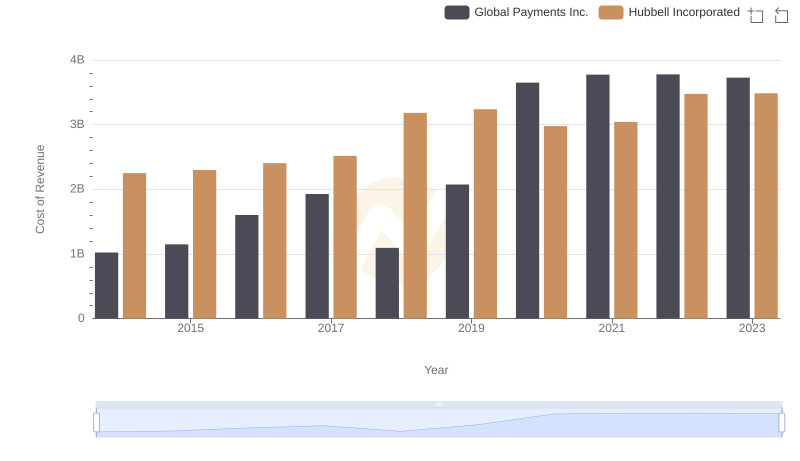

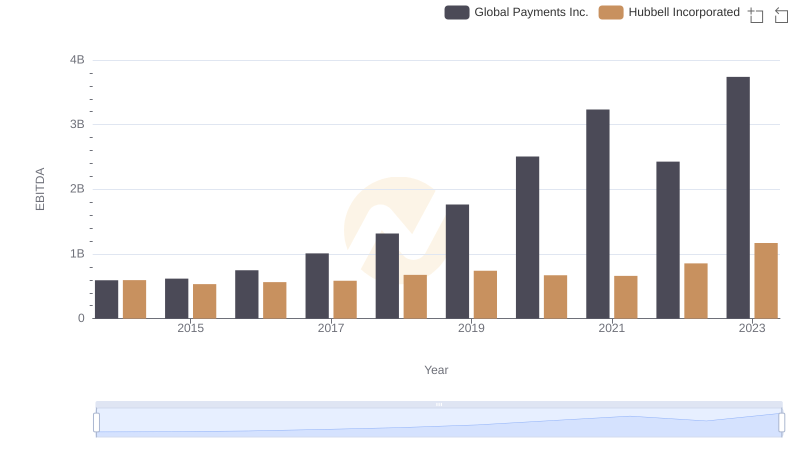

| __timestamp | Global Payments Inc. | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 591600000 |

| Thursday, January 1, 2015 | 1325567000 | 617200000 |

| Friday, January 1, 2016 | 1411096000 | 622900000 |

| Sunday, January 1, 2017 | 1488258000 | 648200000 |

| Monday, January 1, 2018 | 1534297000 | 743500000 |

| Tuesday, January 1, 2019 | 2046672000 | 756100000 |

| Wednesday, January 1, 2020 | 2878878000 | 676300000 |

| Friday, January 1, 2021 | 3391161000 | 619200000 |

| Saturday, January 1, 2022 | 3524578000 | 762500000 |

| Sunday, January 1, 2023 | 4073768000 | 848600000 |

| Monday, January 1, 2024 | 4285307000 | 812500000 |

Unleashing the power of data

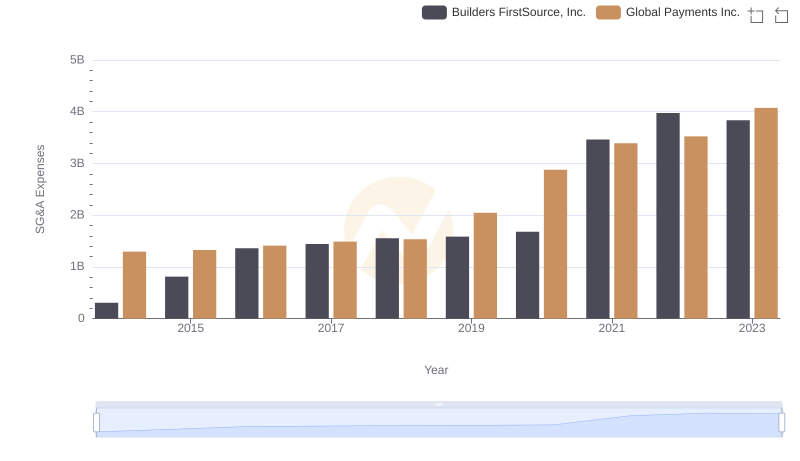

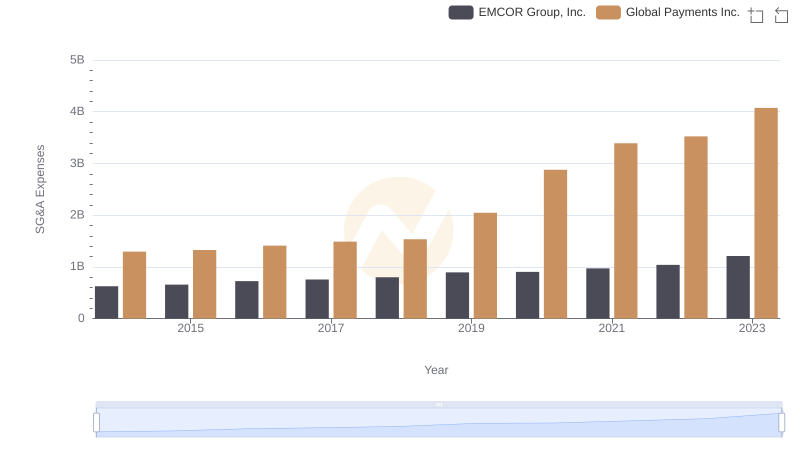

In the ever-evolving landscape of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Global Payments Inc. and Hubbell Incorporated have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Global Payments Inc. has seen a remarkable increase in SG&A expenses, growing by over 200%. This upward trend reflects the company's aggressive expansion and investment in operational capabilities. By 2023, their SG&A expenses reached a peak, highlighting a strategic focus on scaling operations.

In contrast, Hubbell Incorporated maintained a more stable SG&A expense pattern, with a modest increase of around 43% over the same period. This consistency suggests a disciplined approach to cost management, aligning with their steady growth strategy.

These insights offer a window into the strategic priorities of these industry players, providing valuable lessons for investors and analysts alike.

Cost Insights: Breaking Down Global Payments Inc. and Hubbell Incorporated's Expenses

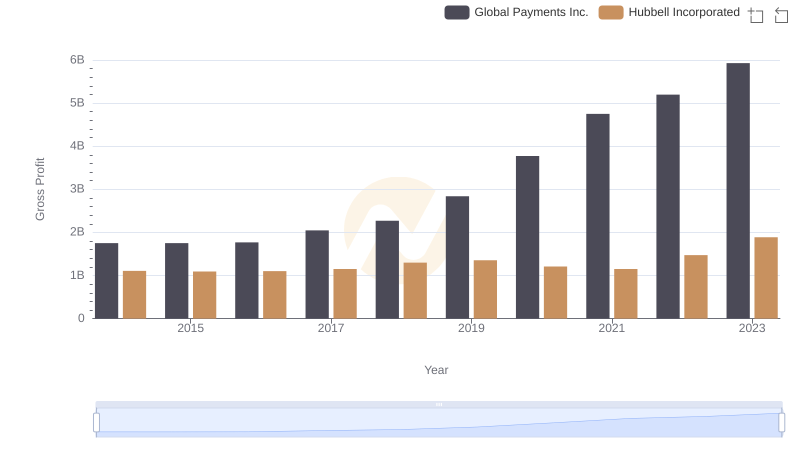

Gross Profit Comparison: Global Payments Inc. and Hubbell Incorporated Trends

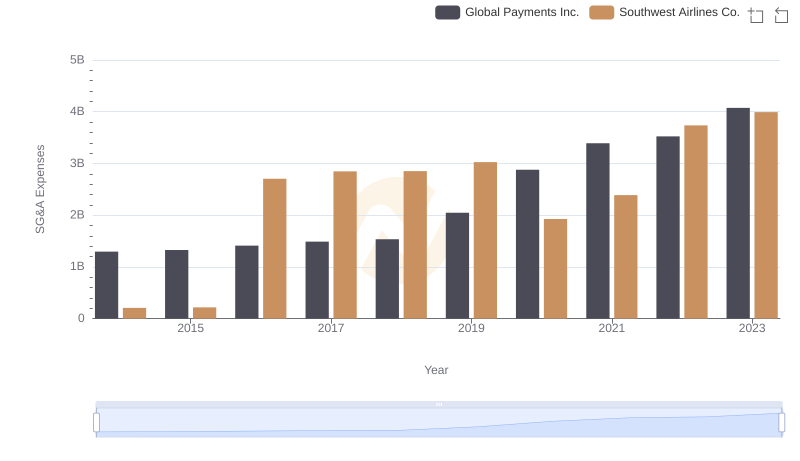

Comparing SG&A Expenses: Global Payments Inc. vs Southwest Airlines Co. Trends and Insights

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Builders FirstSource, Inc.

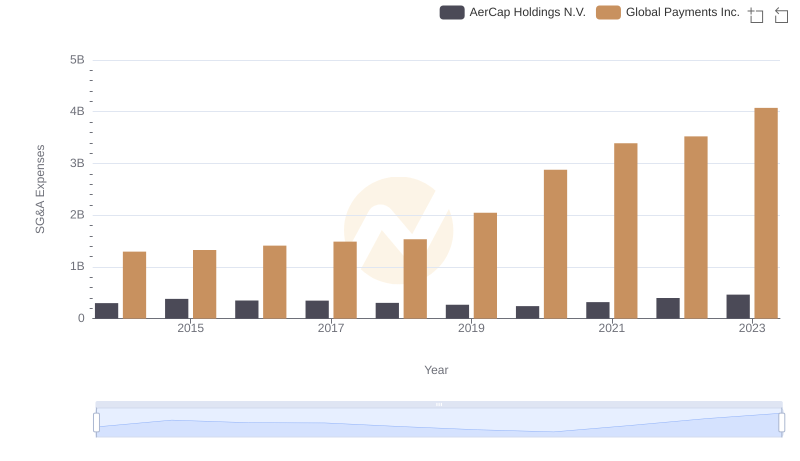

Cost Management Insights: SG&A Expenses for Global Payments Inc. and AerCap Holdings N.V.

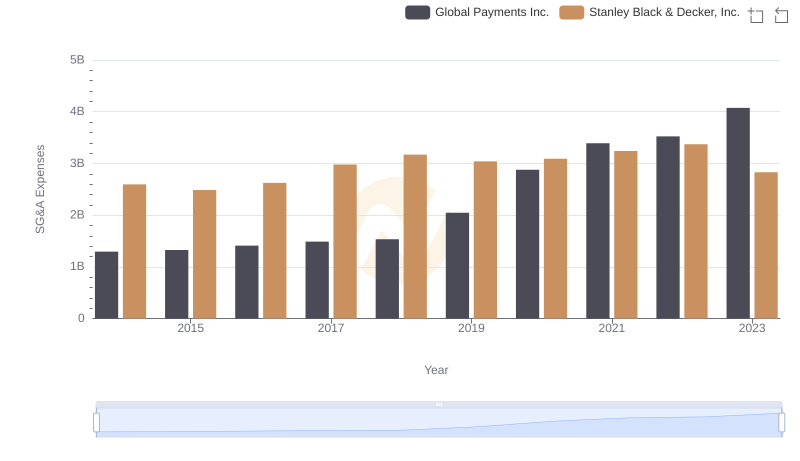

Breaking Down SG&A Expenses: Global Payments Inc. vs Stanley Black & Decker, Inc.

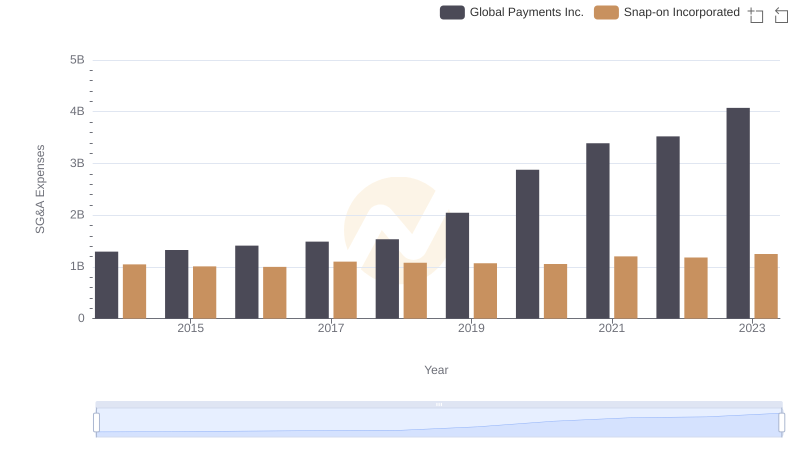

Operational Costs Compared: SG&A Analysis of Global Payments Inc. and Snap-on Incorporated

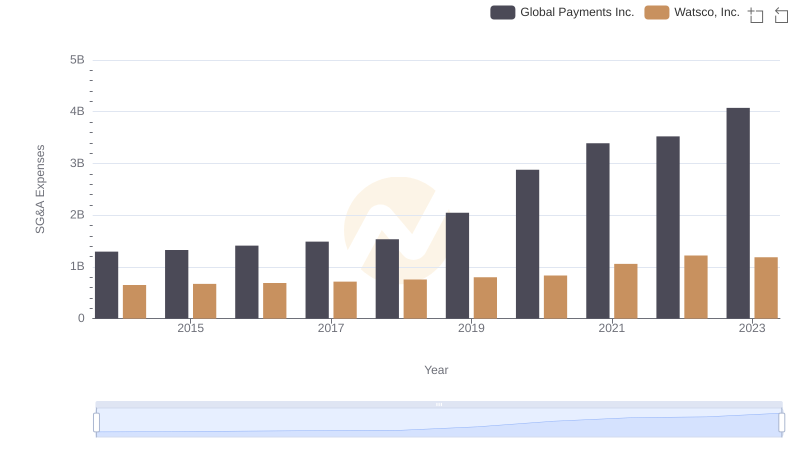

Global Payments Inc. vs Watsco, Inc.: SG&A Expense Trends

Comparing SG&A Expenses: Global Payments Inc. vs EMCOR Group, Inc. Trends and Insights

Selling, General, and Administrative Costs: Global Payments Inc. vs TransUnion

Comparative EBITDA Analysis: Global Payments Inc. vs Hubbell Incorporated