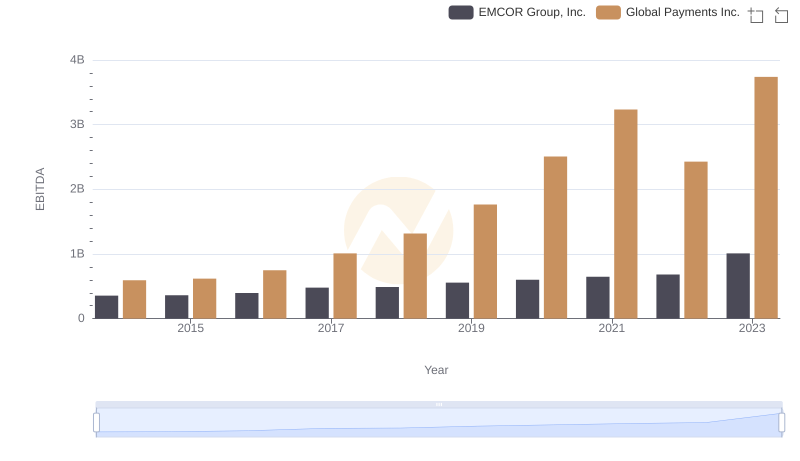

| __timestamp | EMCOR Group, Inc. | Global Payments Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 1295014000 |

| Thursday, January 1, 2015 | 656573000 | 1325567000 |

| Friday, January 1, 2016 | 725538000 | 1411096000 |

| Sunday, January 1, 2017 | 757062000 | 1488258000 |

| Monday, January 1, 2018 | 799157000 | 1534297000 |

| Tuesday, January 1, 2019 | 893453000 | 2046672000 |

| Wednesday, January 1, 2020 | 903584000 | 2878878000 |

| Friday, January 1, 2021 | 970937000 | 3391161000 |

| Saturday, January 1, 2022 | 1038717000 | 3524578000 |

| Sunday, January 1, 2023 | 1211233000 | 4073768000 |

| Monday, January 1, 2024 | 4285307000 |

Unveiling the hidden dimensions of data

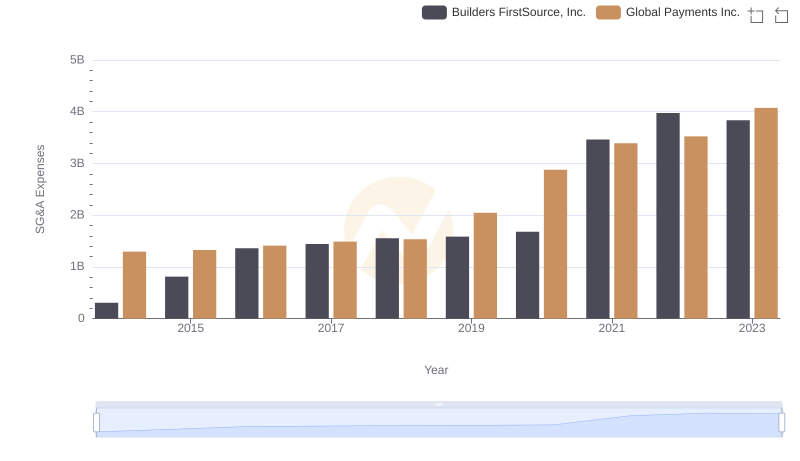

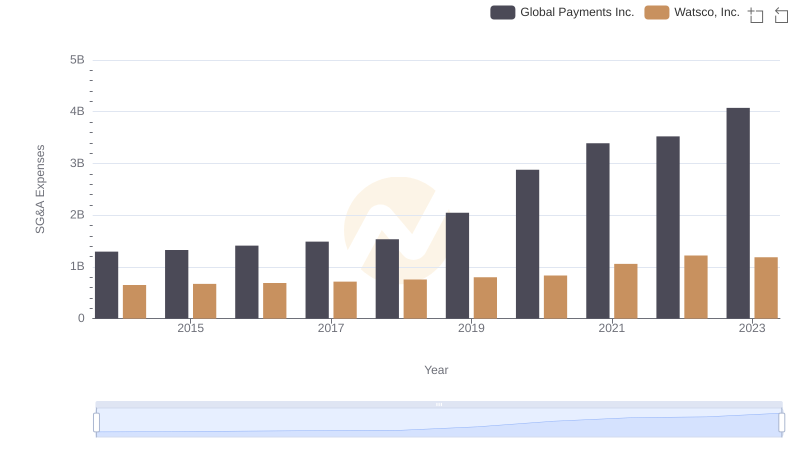

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. This analysis juxtaposes the SG&A trends of Global Payments Inc. and EMCOR Group, Inc. over the past decade, from 2014 to 2023.

Global Payments Inc. has seen a staggering 214% increase in SG&A expenses, rising from approximately $1.3 billion in 2014 to over $4 billion in 2023. This growth reflects the company's aggressive expansion and investment strategies. In contrast, EMCOR Group, Inc. experienced a more modest 93% increase, from around $626 million to $1.2 billion, indicating a steady yet controlled growth approach.

These trends highlight the contrasting strategies of these two industry giants, offering valuable insights into their financial health and strategic priorities. As businesses navigate the complexities of the modern economy, understanding SG&A dynamics becomes crucial for investors and stakeholders alike.

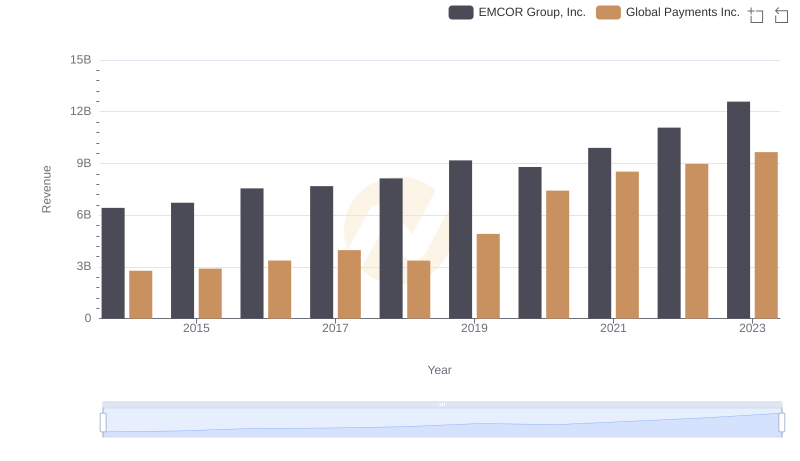

Comparing Revenue Performance: Global Payments Inc. or EMCOR Group, Inc.?

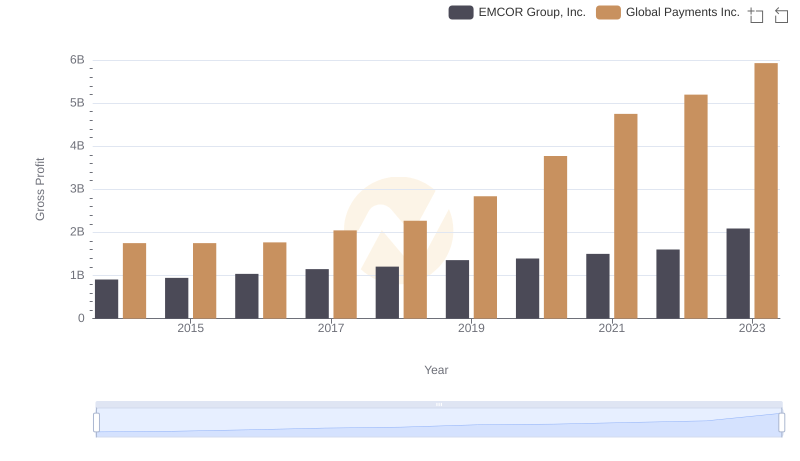

Global Payments Inc. vs EMCOR Group, Inc.: Efficiency in Cost of Revenue Explored

Key Insights on Gross Profit: Global Payments Inc. vs EMCOR Group, Inc.

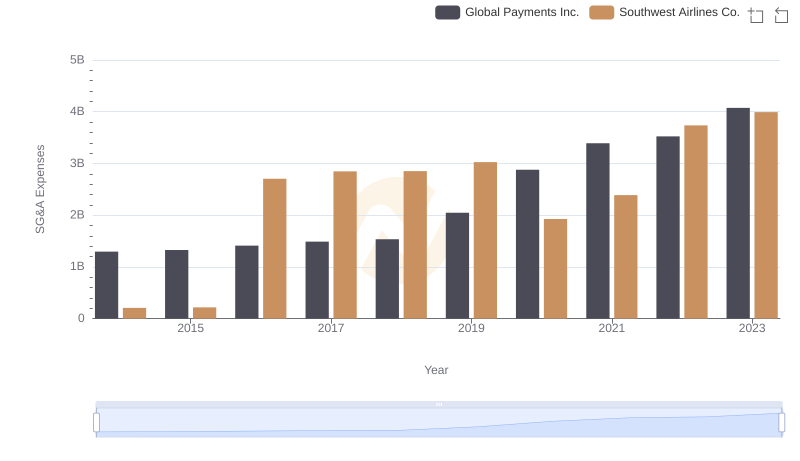

Comparing SG&A Expenses: Global Payments Inc. vs Southwest Airlines Co. Trends and Insights

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Builders FirstSource, Inc.

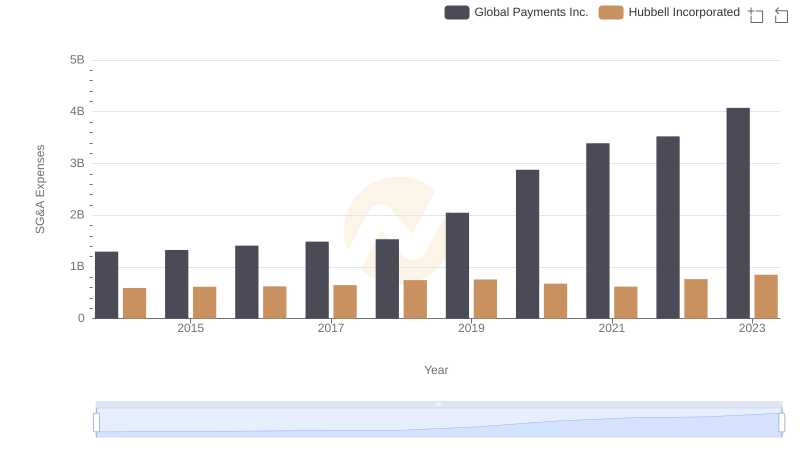

Comparing SG&A Expenses: Global Payments Inc. vs Hubbell Incorporated Trends and Insights

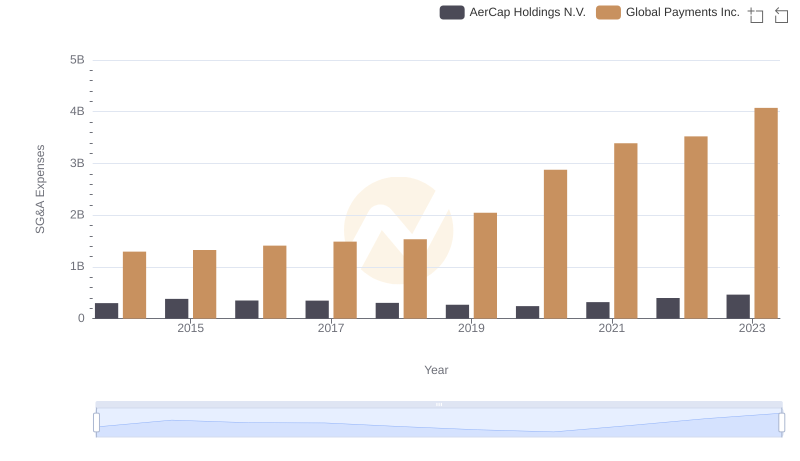

Cost Management Insights: SG&A Expenses for Global Payments Inc. and AerCap Holdings N.V.

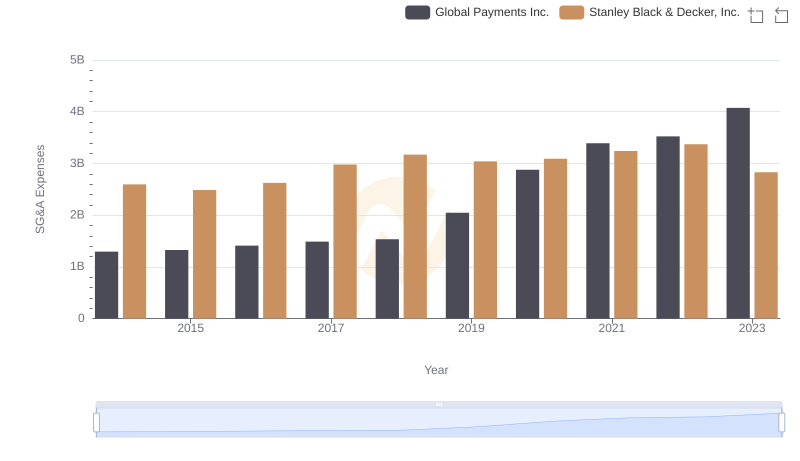

Breaking Down SG&A Expenses: Global Payments Inc. vs Stanley Black & Decker, Inc.

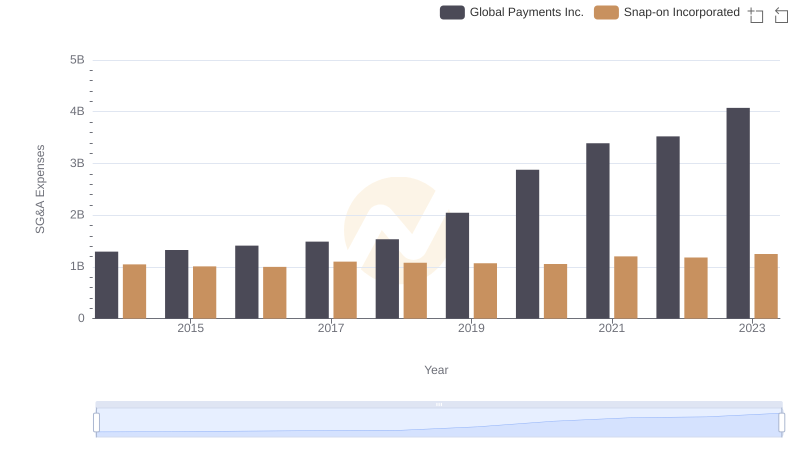

Operational Costs Compared: SG&A Analysis of Global Payments Inc. and Snap-on Incorporated

Global Payments Inc. vs Watsco, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Global Payments Inc. vs TransUnion

A Side-by-Side Analysis of EBITDA: Global Payments Inc. and EMCOR Group, Inc.