| __timestamp | Allegion plc | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2118300000 | 6623500000 |

| Thursday, January 1, 2015 | 2068100000 | 6307900000 |

| Friday, January 1, 2016 | 2238000000 | 5879500000 |

| Sunday, January 1, 2017 | 2408200000 | 6311300000 |

| Monday, January 1, 2018 | 2731700000 | 6666000000 |

| Tuesday, January 1, 2019 | 2854000000 | 6694800000 |

| Wednesday, January 1, 2020 | 2719900000 | 6329800000 |

| Friday, January 1, 2021 | 2867400000 | 6997400000 |

| Saturday, January 1, 2022 | 3271900000 | 7760400000 |

| Sunday, January 1, 2023 | 3650800000 | 9058000000 |

| Monday, January 1, 2024 | 3772200000 | 8264200000 |

Unlocking the unknown

In the competitive landscape of industrial automation and security solutions, Rockwell Automation, Inc. and Allegion plc have been key players. Over the past decade, Rockwell Automation has consistently outperformed Allegion in terms of revenue, boasting a 2023 revenue that is nearly 2.5 times higher than Allegion's. This trend highlights Rockwell's robust market presence and strategic growth initiatives.

From 2014 to 2023, Rockwell Automation's revenue surged by approximately 37%, reaching a peak of $9.06 billion in 2023. In contrast, Allegion's revenue grew by about 72% during the same period, indicating a strong upward trajectory despite its smaller scale. Notably, Allegion's revenue in 2023 was $3.65 billion, marking its highest annual revenue to date.

While Rockwell's 2024 data is missing, its historical performance suggests continued dominance. Allegion, however, is rapidly closing the gap, making this an exciting rivalry to watch.

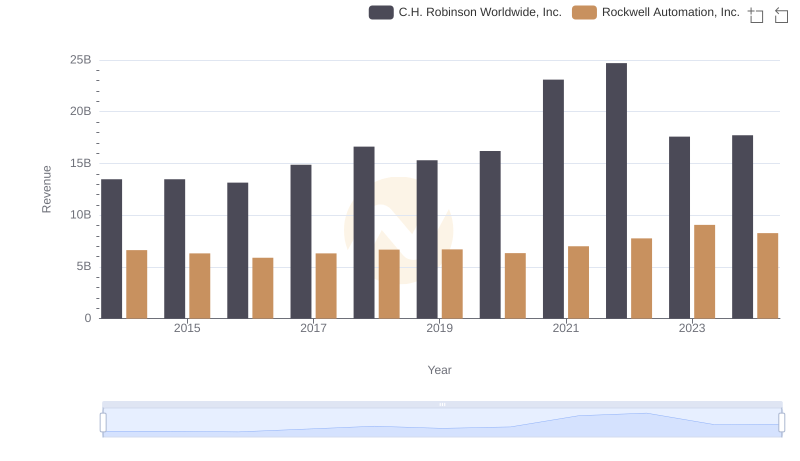

Rockwell Automation, Inc. vs C.H. Robinson Worldwide, Inc.: Annual Revenue Growth Compared

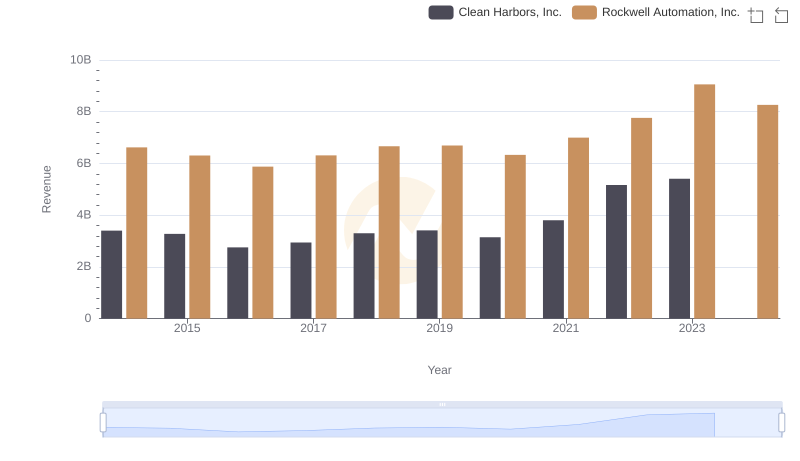

Comparing Revenue Performance: Rockwell Automation, Inc. or Clean Harbors, Inc.?

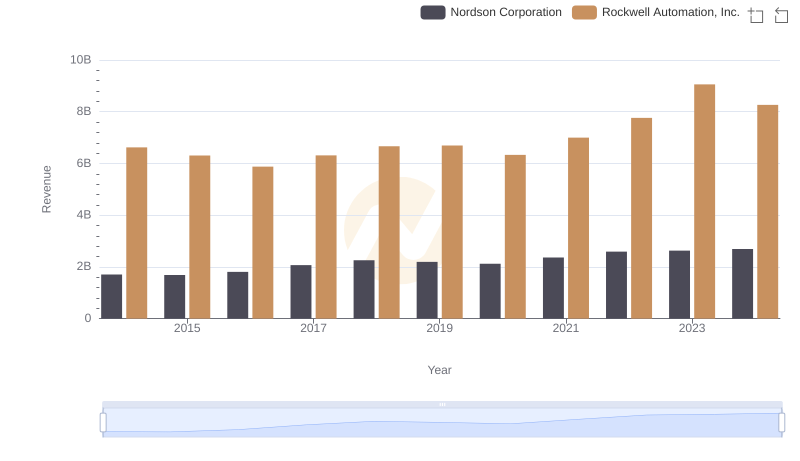

Annual Revenue Comparison: Rockwell Automation, Inc. vs Nordson Corporation

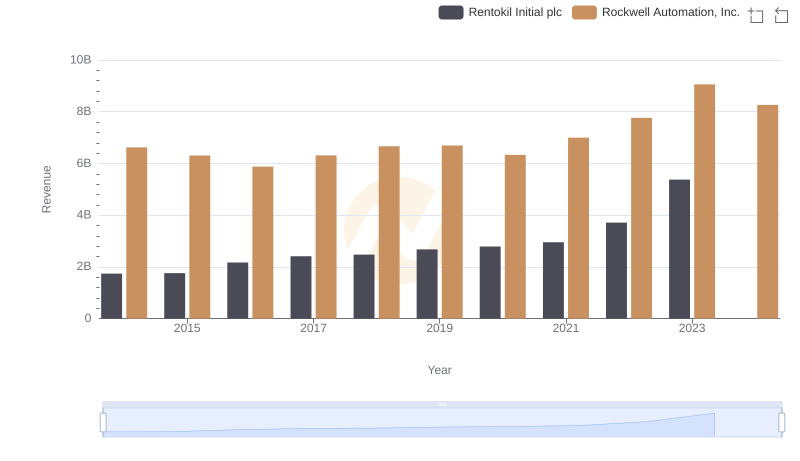

Rockwell Automation, Inc. vs Rentokil Initial plc: Examining Key Revenue Metrics

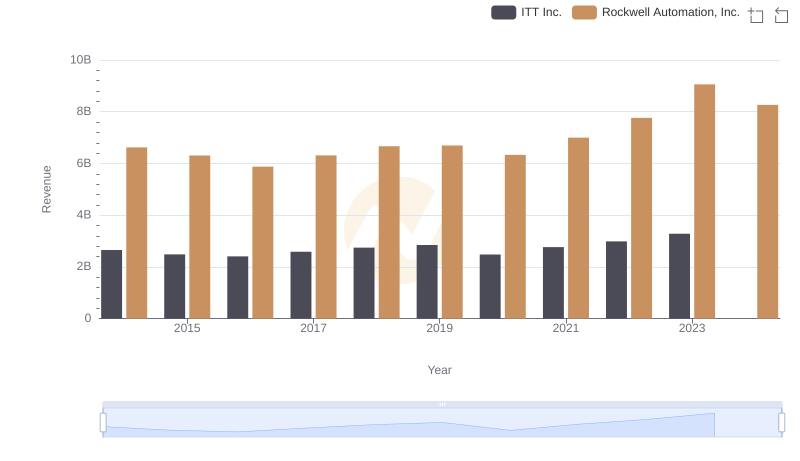

Comparing Revenue Performance: Rockwell Automation, Inc. or ITT Inc.?

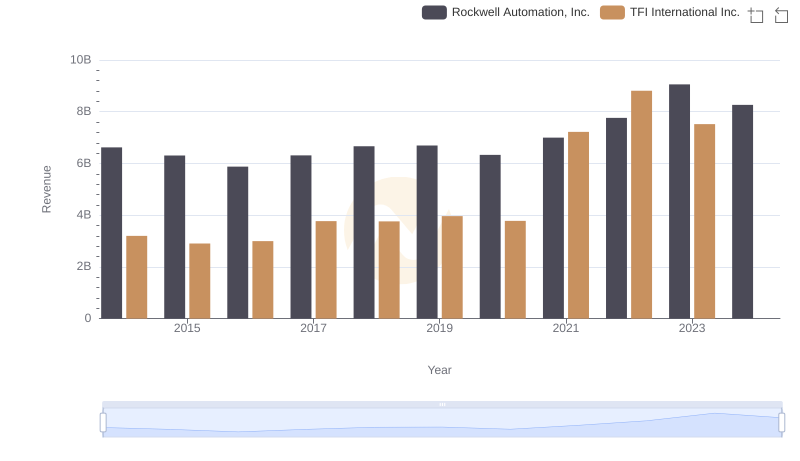

Breaking Down Revenue Trends: Rockwell Automation, Inc. vs TFI International Inc.

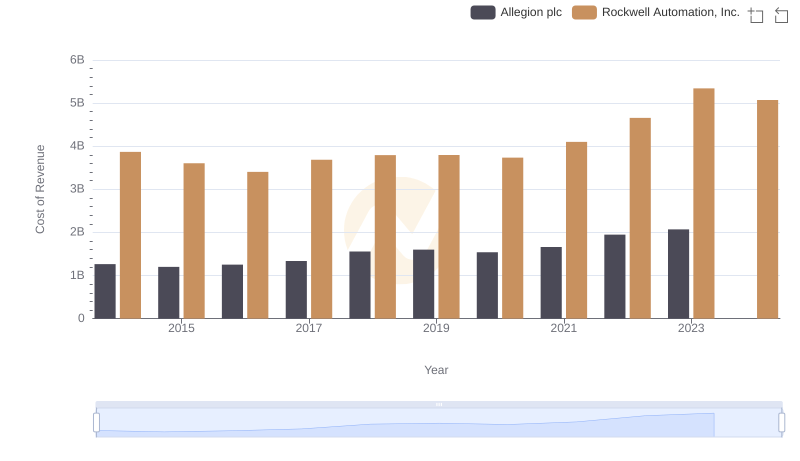

Cost of Revenue Comparison: Rockwell Automation, Inc. vs Allegion plc

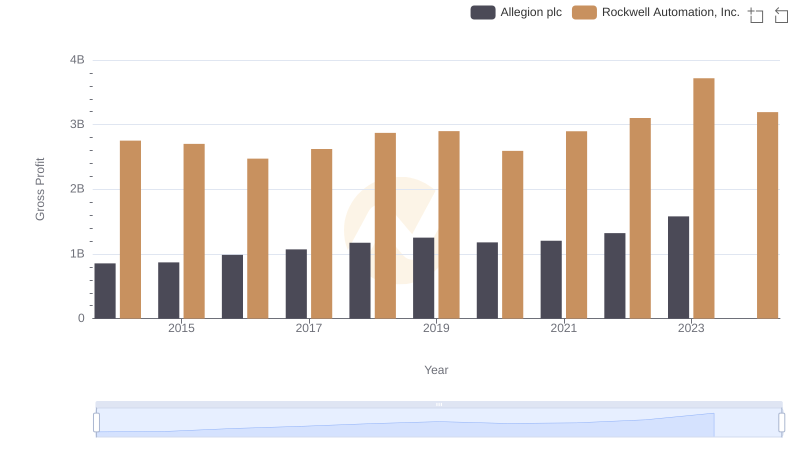

Rockwell Automation, Inc. and Allegion plc: A Detailed Gross Profit Analysis

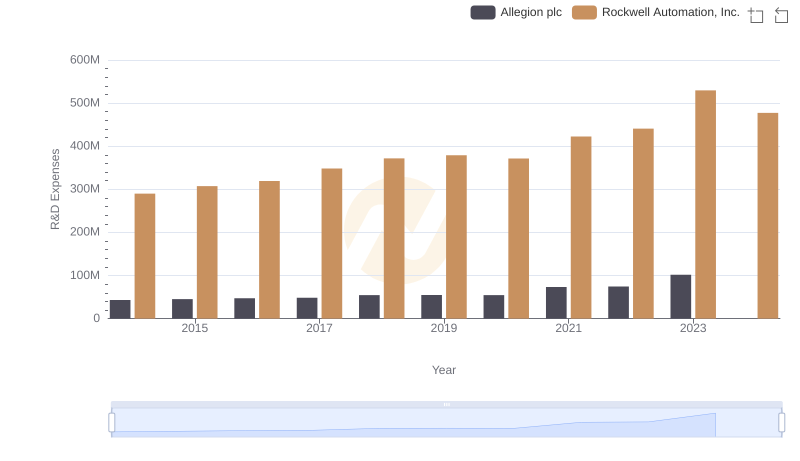

R&D Spending Showdown: Rockwell Automation, Inc. vs Allegion plc

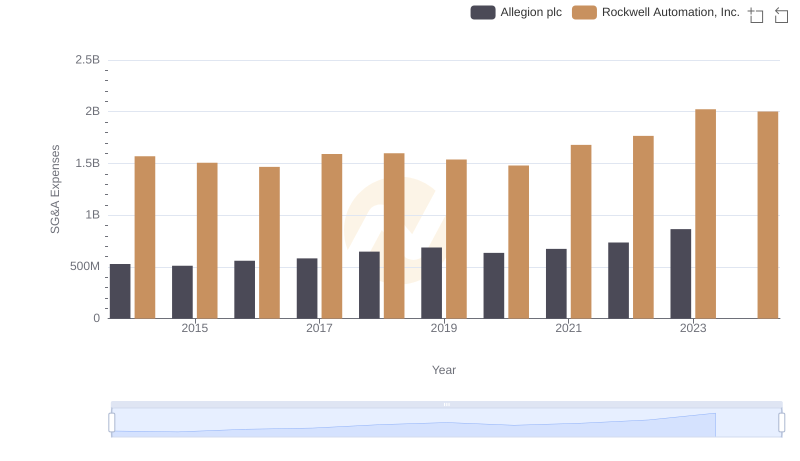

Breaking Down SG&A Expenses: Rockwell Automation, Inc. vs Allegion plc

Rockwell Automation, Inc. vs Allegion plc: In-Depth EBITDA Performance Comparison