| __timestamp | Electronic Arts Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3575000000 | 92793000000 |

| Thursday, January 1, 2015 | 4515000000 | 81742000000 |

| Friday, January 1, 2016 | 4396000000 | 79920000000 |

| Sunday, January 1, 2017 | 4845000000 | 79139000000 |

| Monday, January 1, 2018 | 5150000000 | 79591000000 |

| Tuesday, January 1, 2019 | 4950000000 | 57714000000 |

| Wednesday, January 1, 2020 | 5537000000 | 55179000000 |

| Friday, January 1, 2021 | 5629000000 | 57351000000 |

| Saturday, January 1, 2022 | 6991000000 | 60530000000 |

| Sunday, January 1, 2023 | 7426000000 | 61860000000 |

| Monday, January 1, 2024 | 7562000000 | 62753000000 |

Cracking the code

In the ever-evolving landscape of technology and entertainment, two giants stand out: International Business Machines Corporation (IBM) and Electronic Arts Inc. (EA). Over the past decade, these companies have showcased contrasting revenue trajectories.

IBM, a stalwart in the tech industry, has seen its annual revenue decline by approximately 32% from 2014 to 2024. This trend reflects the company's strategic shift from traditional hardware to cloud computing and AI services. Despite this, IBM's revenue remains significantly higher than EA's, underscoring its enduring market presence.

Conversely, EA, a leader in digital entertainment, has experienced a robust 111% increase in revenue over the same period. This growth is fueled by the rising popularity of digital gaming and live services. EA's ability to adapt to consumer preferences has positioned it as a formidable player in the entertainment sector.

As these companies navigate their respective industries, their revenue trends offer a glimpse into the broader shifts shaping technology and entertainment today.

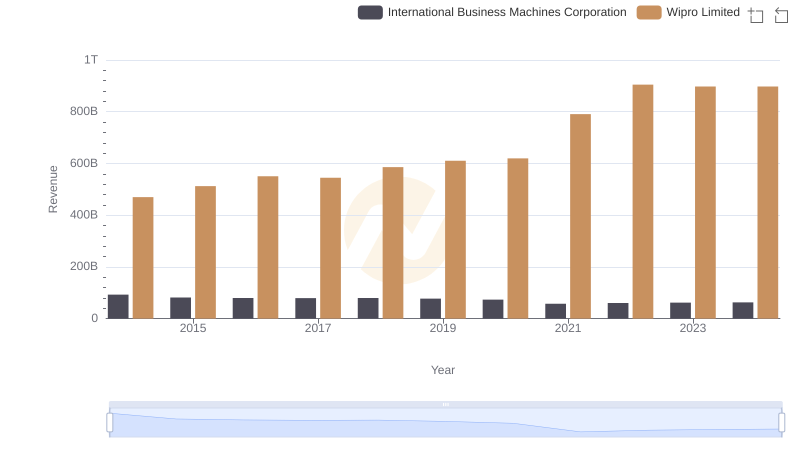

International Business Machines Corporation vs Wipro Limited: Examining Key Revenue Metrics

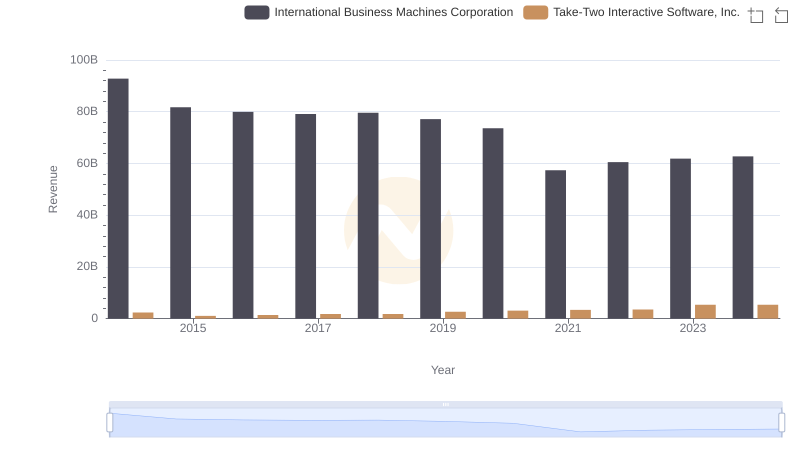

Breaking Down Revenue Trends: International Business Machines Corporation vs Take-Two Interactive Software, Inc.

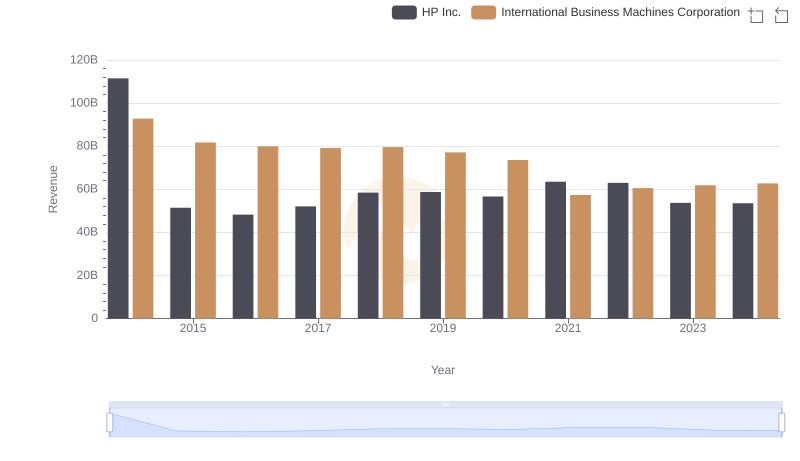

International Business Machines Corporation and HP Inc.: A Comprehensive Revenue Analysis

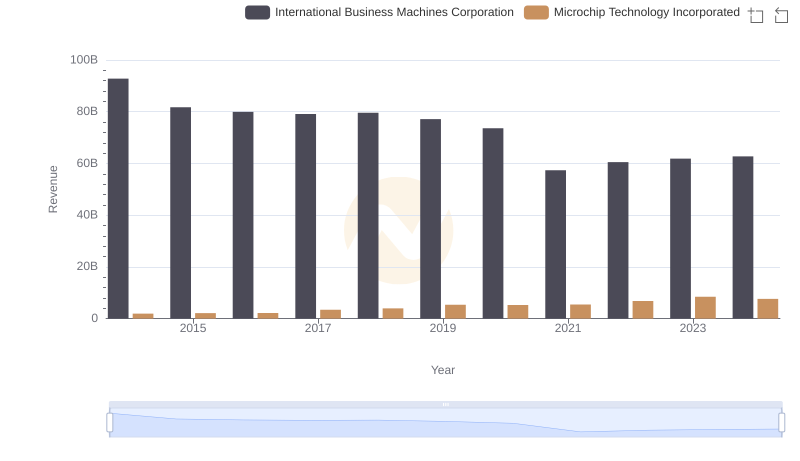

Annual Revenue Comparison: International Business Machines Corporation vs Microchip Technology Incorporated

Breaking Down Revenue Trends: International Business Machines Corporation vs II-VI Incorporated

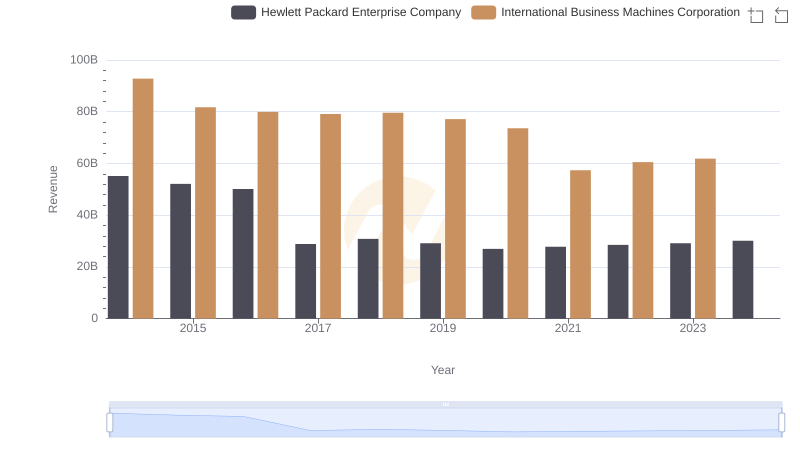

Who Generates More Revenue? International Business Machines Corporation or Hewlett Packard Enterprise Company

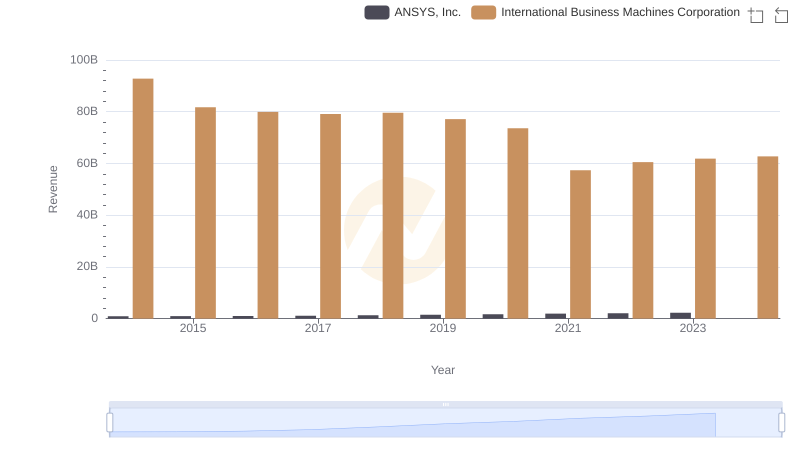

International Business Machines Corporation and ANSYS, Inc.: A Comprehensive Revenue Analysis

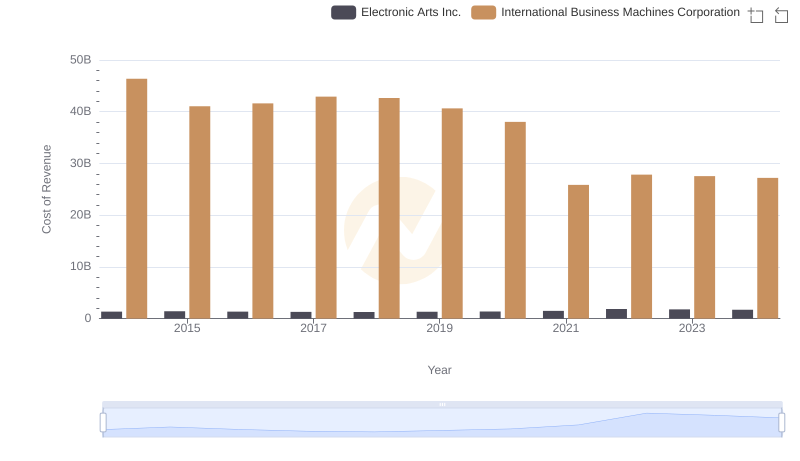

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Electronic Arts Inc.

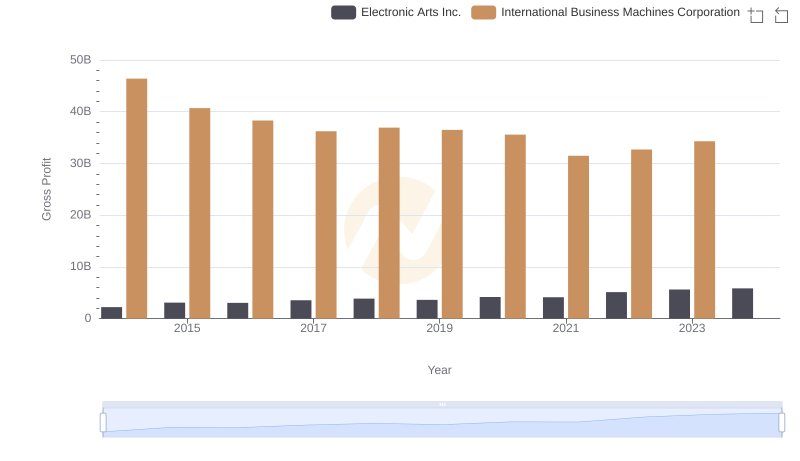

International Business Machines Corporation vs Electronic Arts Inc.: A Gross Profit Performance Breakdown

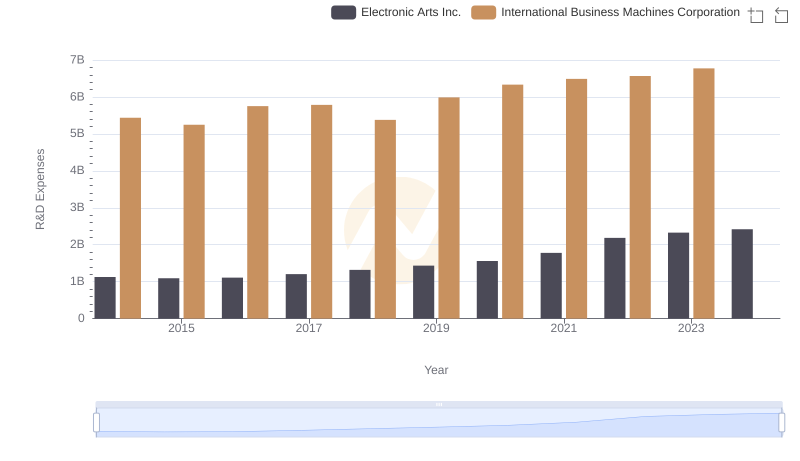

Analyzing R&D Budgets: International Business Machines Corporation vs Electronic Arts Inc.

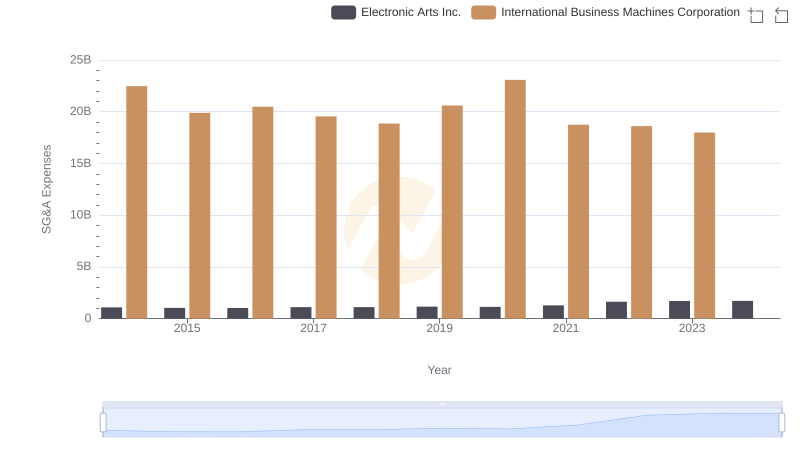

International Business Machines Corporation or Electronic Arts Inc.: Who Manages SG&A Costs Better?

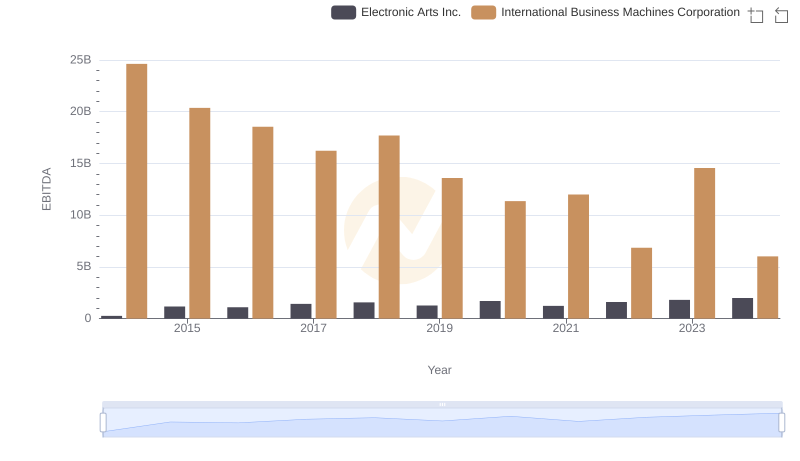

EBITDA Performance Review: International Business Machines Corporation vs Electronic Arts Inc.