| __timestamp | Cintas Corporation | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 4551812000 | 3277700000 |

| Thursday, January 1, 2015 | 4476886000 | 3352800000 |

| Friday, January 1, 2016 | 4905458000 | 3430400000 |

| Sunday, January 1, 2017 | 5323381000 | 3686900000 |

| Monday, January 1, 2018 | 6476632000 | 3740700000 |

| Tuesday, January 1, 2019 | 6892303000 | 3730000000 |

| Wednesday, January 1, 2020 | 7085120000 | 3592500000 |

| Friday, January 1, 2021 | 7116340000 | 4252000000 |

| Saturday, January 1, 2022 | 7854459000 | 4492800000 |

| Sunday, January 1, 2023 | 8815769000 | 5108300000 |

| Monday, January 1, 2024 | 9596615000 | 4707400000 |

Unleashing the power of data

In the ever-evolving landscape of American industry, Cintas Corporation and Snap-on Incorporated stand as paragons of resilience and growth. Over the past decade, Cintas has demonstrated a remarkable revenue growth trajectory, with a staggering 111% increase from 2014 to 2023. This growth is underscored by a consistent upward trend, peaking at an impressive $9.6 billion in 2024. In contrast, Snap-on Incorporated, while experiencing a more modest growth of approximately 56% over the same period, reached its highest revenue of $5.1 billion in 2023. The data reveals a compelling narrative of Cintas's aggressive expansion strategy, outpacing Snap-on's steady yet slower growth. As we look to the future, the absence of data for Snap-on in 2024 leaves room for speculation on its next strategic move. This comparison not only highlights the dynamic nature of these companies but also offers insights into their strategic priorities.

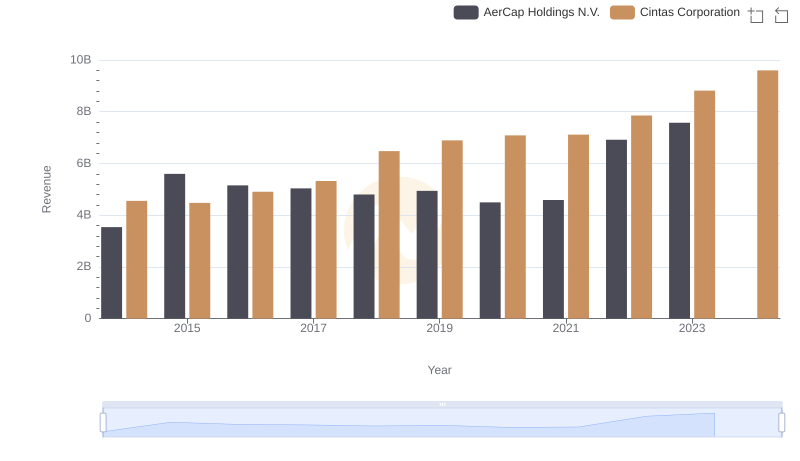

Annual Revenue Comparison: Cintas Corporation vs AerCap Holdings N.V.

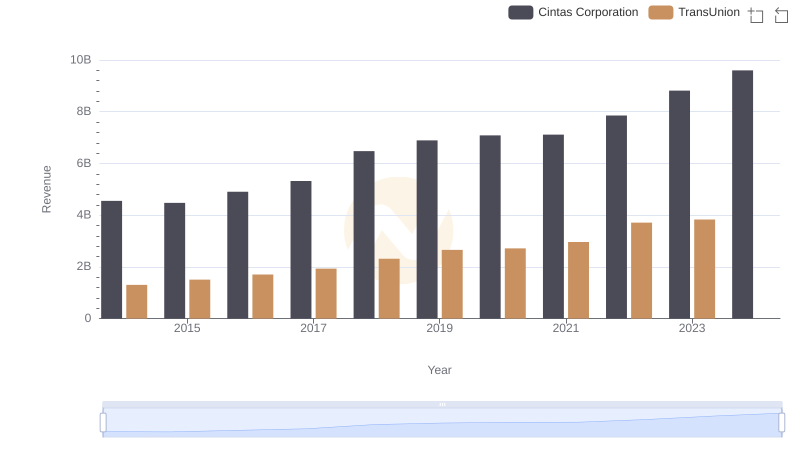

Cintas Corporation or TransUnion: Who Leads in Yearly Revenue?

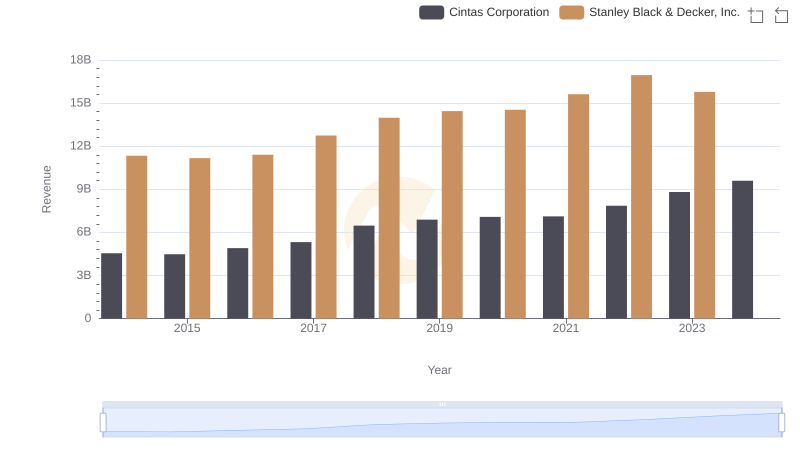

Cintas Corporation or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

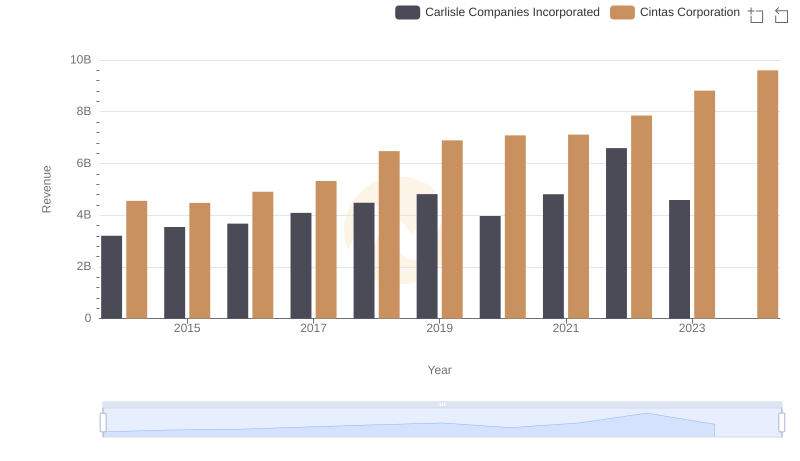

Cintas Corporation vs Carlisle Companies Incorporated: Annual Revenue Growth Compared

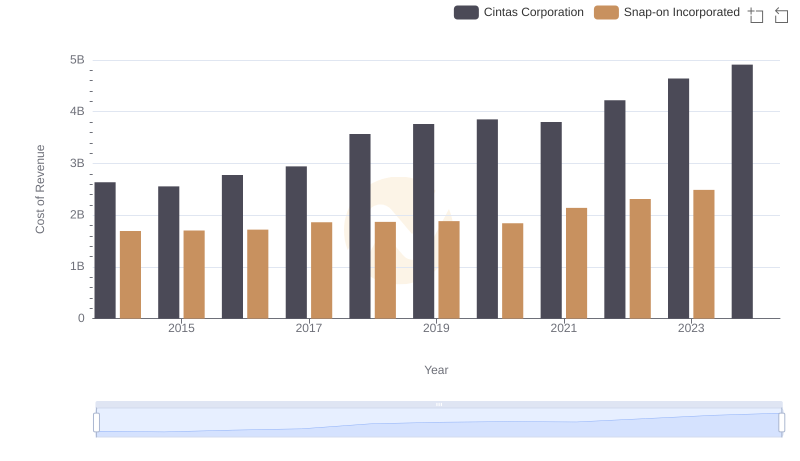

Analyzing Cost of Revenue: Cintas Corporation and Snap-on Incorporated

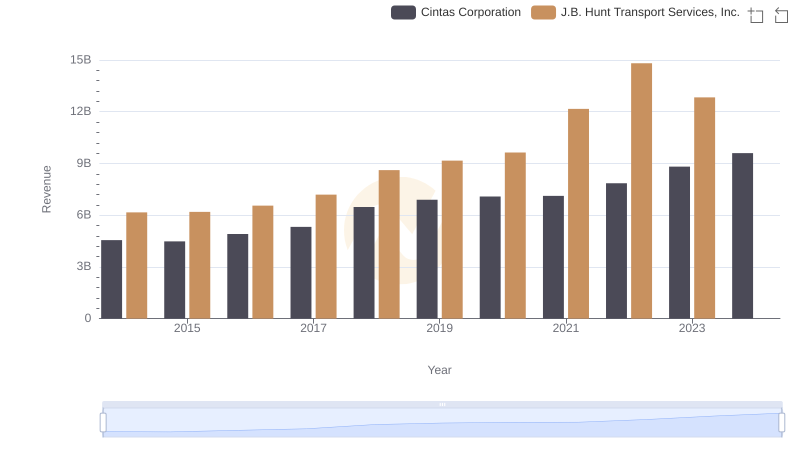

Cintas Corporation and J.B. Hunt Transport Services, Inc.: A Comprehensive Revenue Analysis

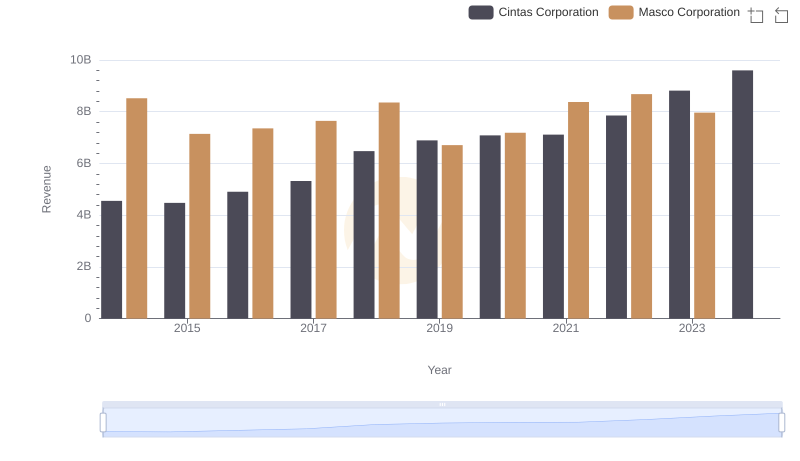

Who Generates More Revenue? Cintas Corporation or Masco Corporation

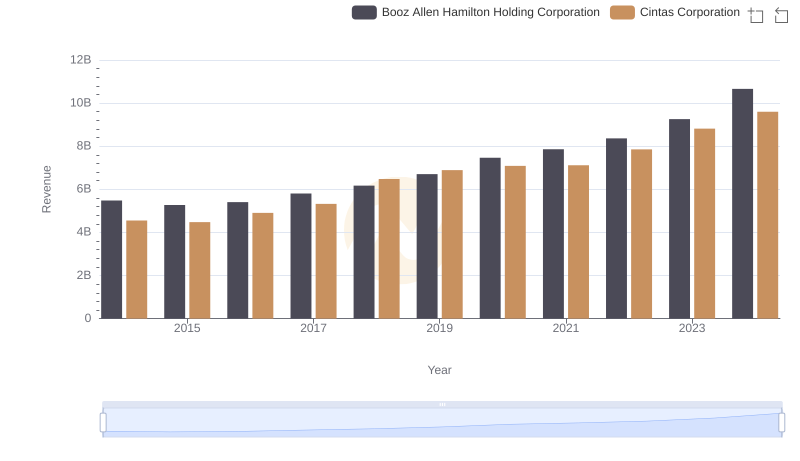

Cintas Corporation vs Booz Allen Hamilton Holding Corporation: Examining Key Revenue Metrics

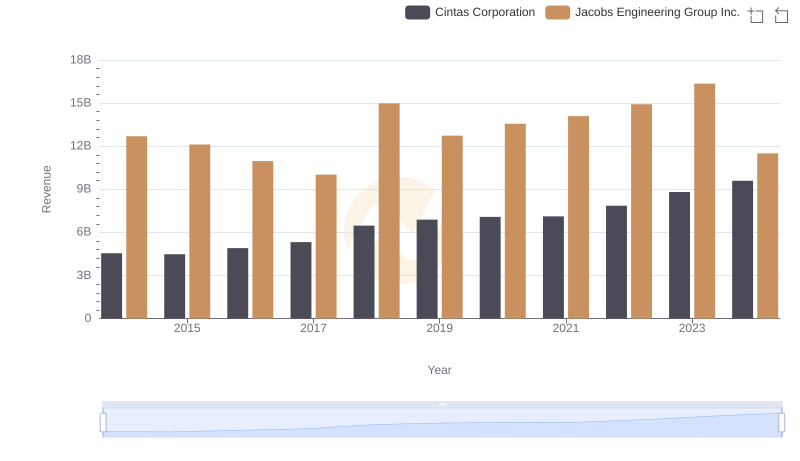

Comparing Revenue Performance: Cintas Corporation or Jacobs Engineering Group Inc.?

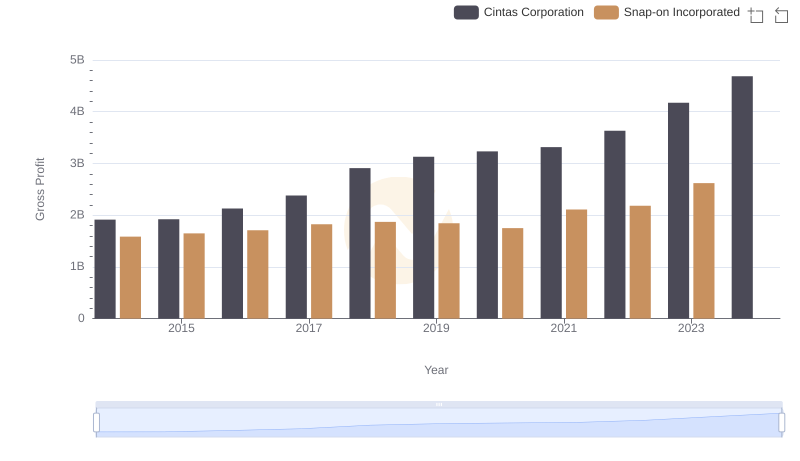

Gross Profit Trends Compared: Cintas Corporation vs Snap-on Incorporated

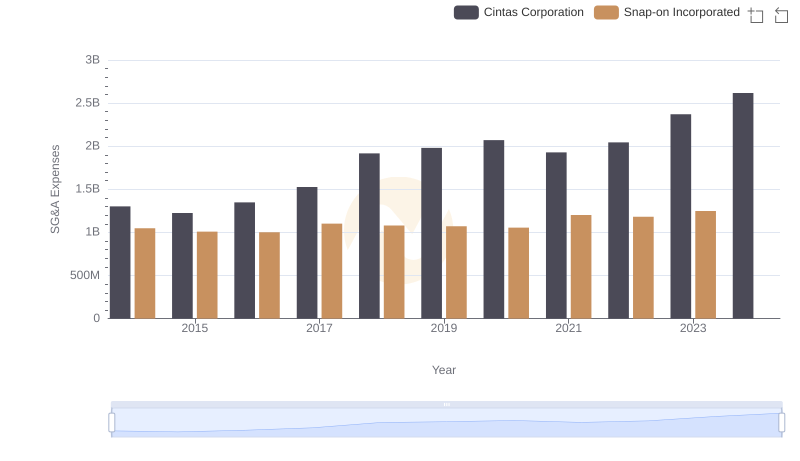

Selling, General, and Administrative Costs: Cintas Corporation vs Snap-on Incorporated

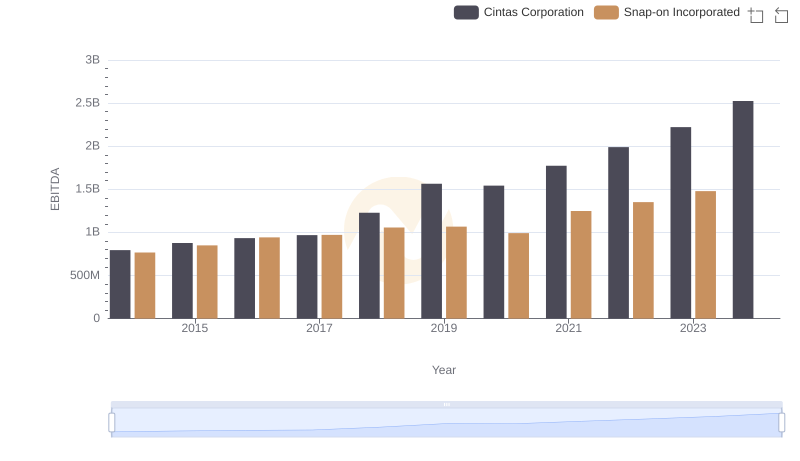

EBITDA Metrics Evaluated: Cintas Corporation vs Snap-on Incorporated