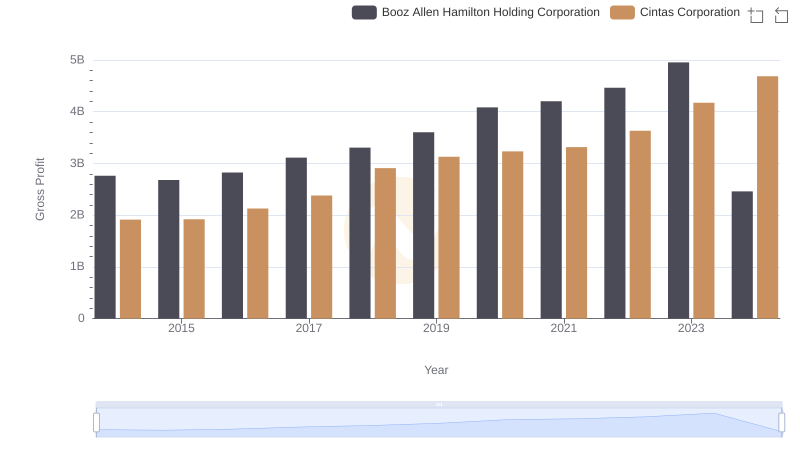

| __timestamp | Booz Allen Hamilton Holding Corporation | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 5478693000 | 4551812000 |

| Thursday, January 1, 2015 | 5274770000 | 4476886000 |

| Friday, January 1, 2016 | 5405738000 | 4905458000 |

| Sunday, January 1, 2017 | 5804284000 | 5323381000 |

| Monday, January 1, 2018 | 6171853000 | 6476632000 |

| Tuesday, January 1, 2019 | 6704037000 | 6892303000 |

| Wednesday, January 1, 2020 | 7463841000 | 7085120000 |

| Friday, January 1, 2021 | 7858938000 | 7116340000 |

| Saturday, January 1, 2022 | 8363700000 | 7854459000 |

| Sunday, January 1, 2023 | 9258911000 | 8815769000 |

| Monday, January 1, 2024 | 10661896000 | 9596615000 |

In pursuit of knowledge

In the competitive landscape of corporate America, Cintas Corporation and Booz Allen Hamilton Holding Corporation have demonstrated remarkable revenue growth over the past decade. From 2014 to 2024, Booz Allen Hamilton's revenue surged by approximately 95%, while Cintas Corporation saw an impressive increase of around 111%. This growth trajectory highlights the resilience and strategic prowess of both companies in navigating market challenges.

These figures underscore the dynamic nature of the U.S. stock market and the potential for growth in diverse sectors.

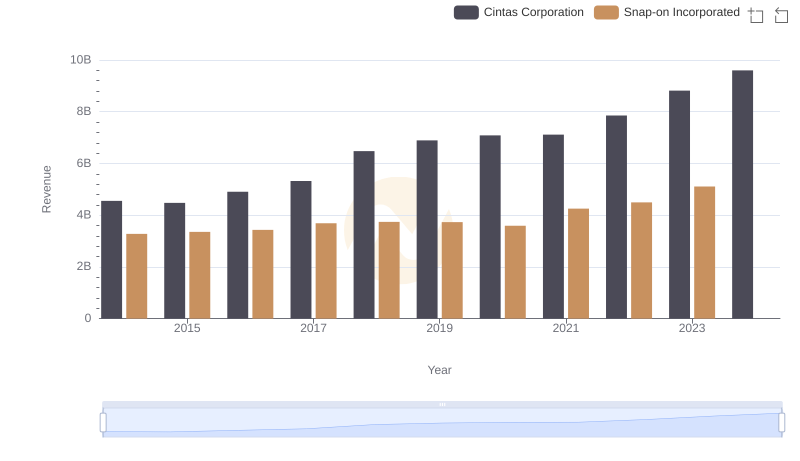

Comparing Revenue Performance: Cintas Corporation or Snap-on Incorporated?

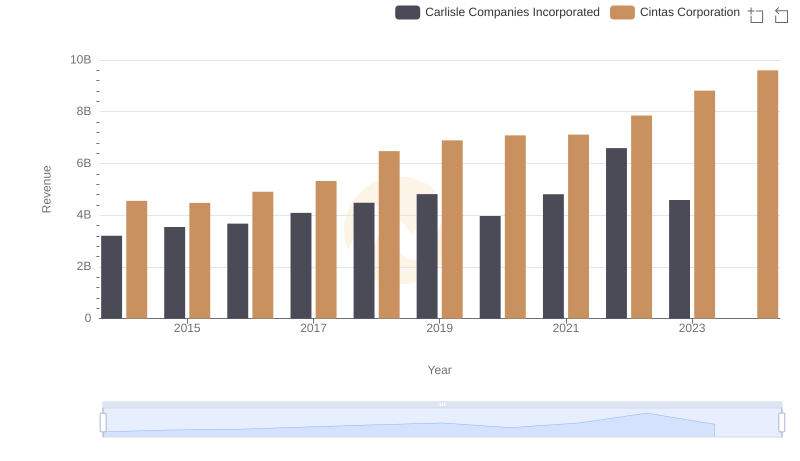

Cintas Corporation vs Carlisle Companies Incorporated: Annual Revenue Growth Compared

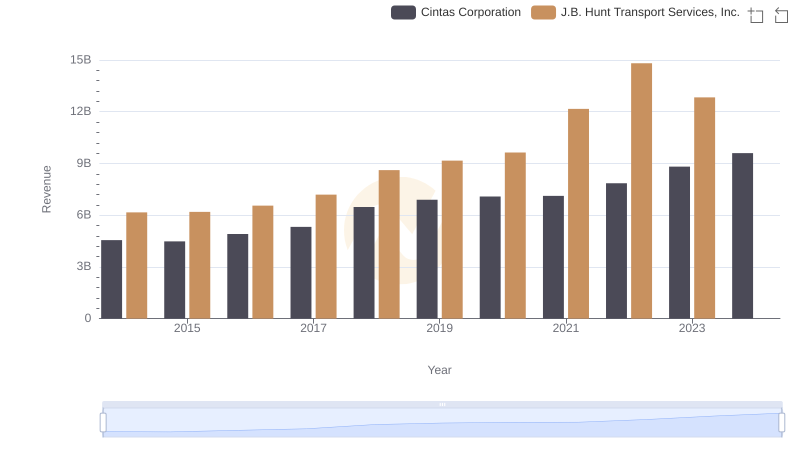

Cintas Corporation and J.B. Hunt Transport Services, Inc.: A Comprehensive Revenue Analysis

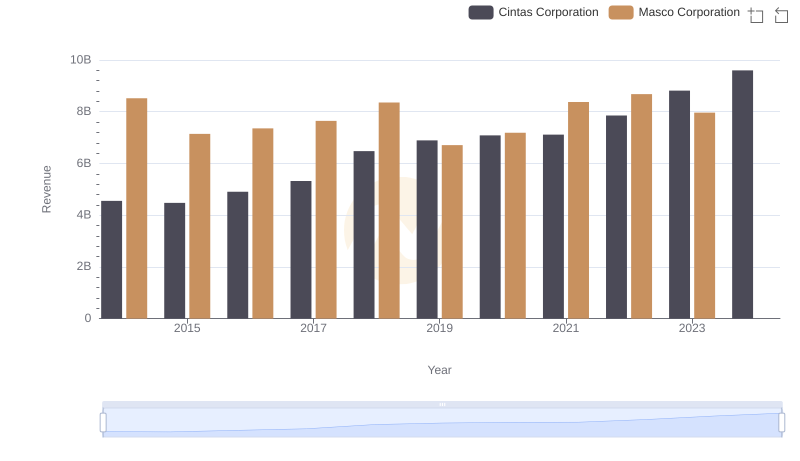

Who Generates More Revenue? Cintas Corporation or Masco Corporation

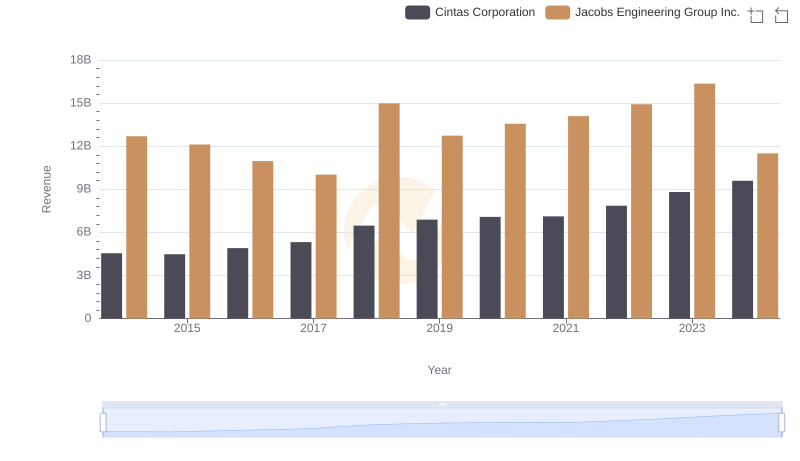

Comparing Revenue Performance: Cintas Corporation or Jacobs Engineering Group Inc.?

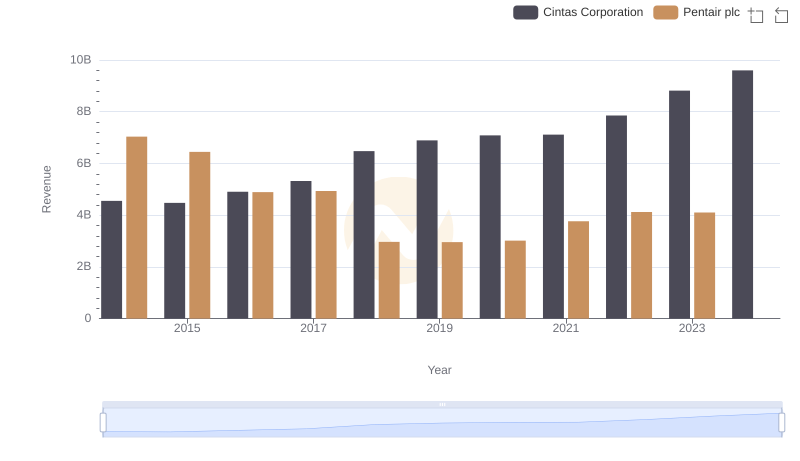

Annual Revenue Comparison: Cintas Corporation vs Pentair plc

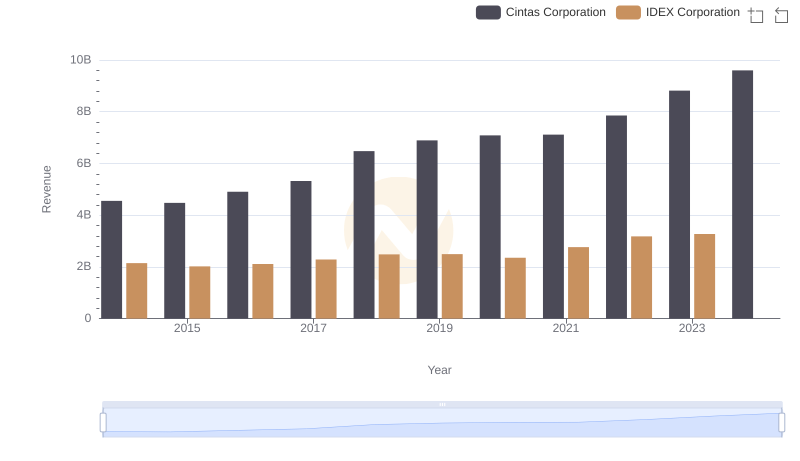

Comparing Revenue Performance: Cintas Corporation or IDEX Corporation?

Cintas Corporation and Booz Allen Hamilton Holding Corporation: A Detailed Gross Profit Analysis

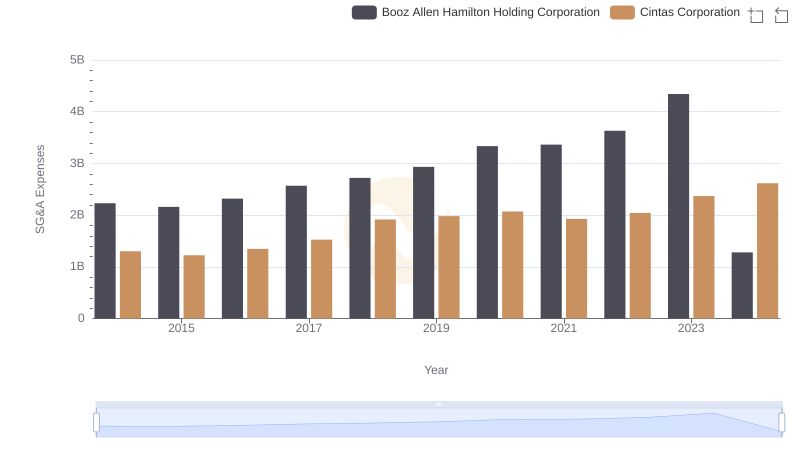

Cintas Corporation and Booz Allen Hamilton Holding Corporation: SG&A Spending Patterns Compared

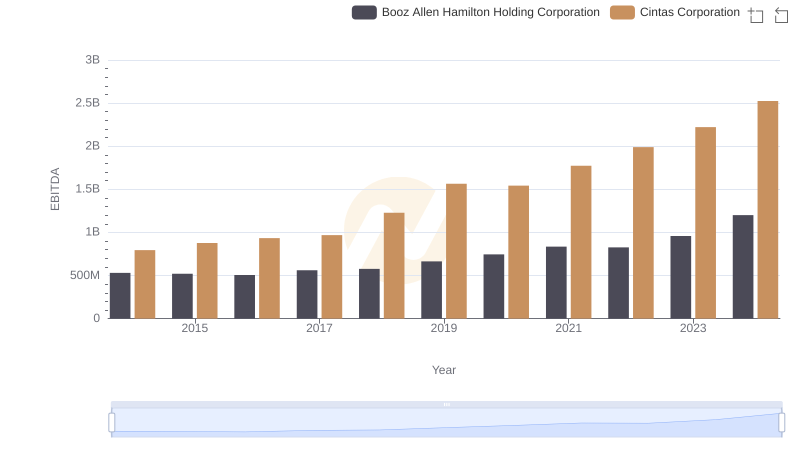

Cintas Corporation and Booz Allen Hamilton Holding Corporation: A Detailed Examination of EBITDA Performance