| __timestamp | AerCap Holdings N.V. | Automatic Data Processing, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3535797000 | 11832800000 |

| Thursday, January 1, 2015 | 5598662000 | 10560800000 |

| Friday, January 1, 2016 | 5152131000 | 11290500000 |

| Sunday, January 1, 2017 | 5037493000 | 11982400000 |

| Monday, January 1, 2018 | 4799980000 | 12859300000 |

| Tuesday, January 1, 2019 | 4937340000 | 13613300000 |

| Wednesday, January 1, 2020 | 4493629000 | 14589800000 |

| Friday, January 1, 2021 | 4588930000 | 15005400000 |

| Saturday, January 1, 2022 | 6914985000 | 16498300000 |

| Sunday, January 1, 2023 | 7574664000 | 18012200000 |

| Monday, January 1, 2024 | 19202600000 |

In pursuit of knowledge

In the dynamic world of finance, Automatic Data Processing, Inc. (ADP) and AerCap Holdings N.V. have been key players, each carving out a significant niche. Over the past decade, ADP has consistently outperformed AerCap in terms of revenue, showcasing a robust growth trajectory. From 2014 to 2023, ADP's revenue surged by approximately 52%, reaching a peak of $18 billion in 2023. In contrast, AerCap's revenue, while showing a commendable 114% increase, reached $7.6 billion in the same year.

ADP's steady climb can be attributed to its strategic expansions and innovations in human capital management solutions. Meanwhile, AerCap, a leader in aircraft leasing, has shown resilience, especially in the post-pandemic recovery phase. Notably, 2022 marked a significant leap for AerCap, with a 50% revenue increase from the previous year, highlighting its recovery momentum. However, data for 2024 remains incomplete, leaving room for speculation on future trends.

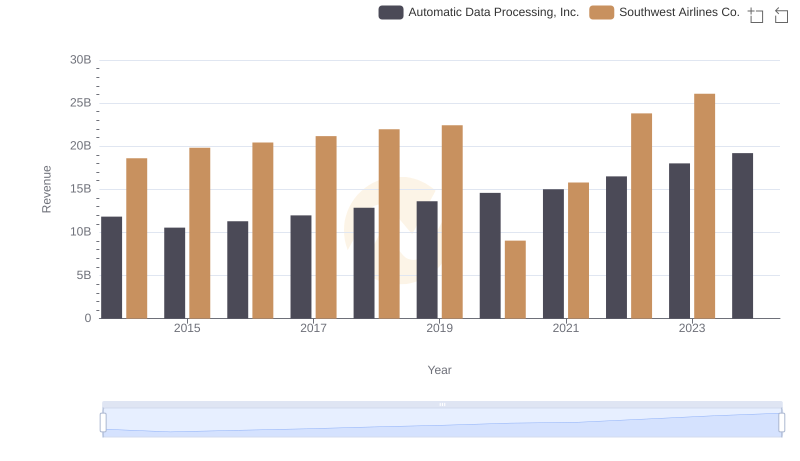

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Examining Key Revenue Metrics

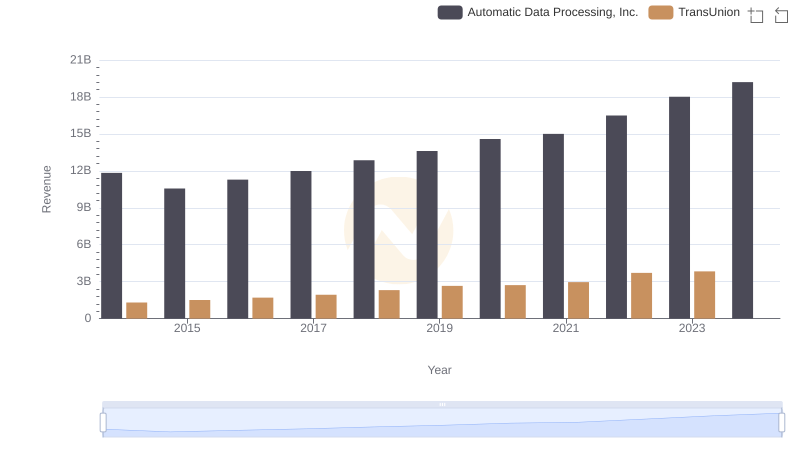

Comparing Revenue Performance: Automatic Data Processing, Inc. or TransUnion?

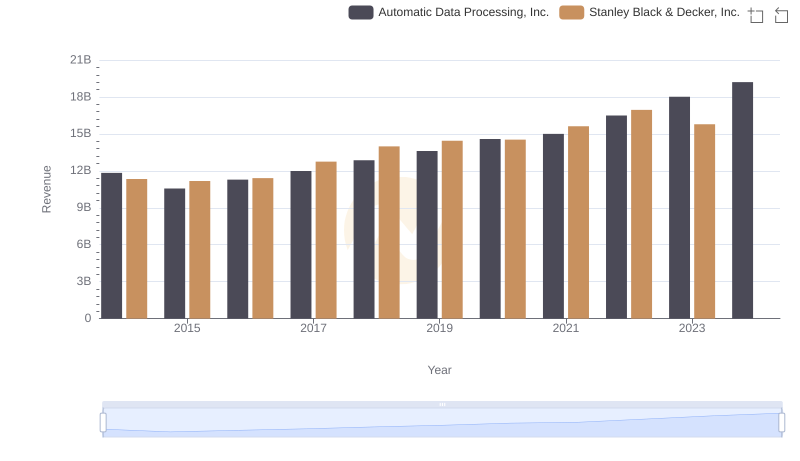

Revenue Insights: Automatic Data Processing, Inc. and Stanley Black & Decker, Inc. Performance Compared

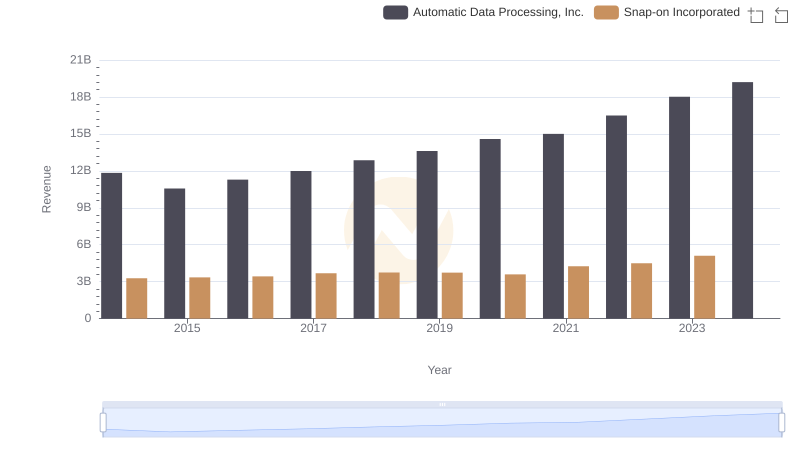

Breaking Down Revenue Trends: Automatic Data Processing, Inc. vs Snap-on Incorporated

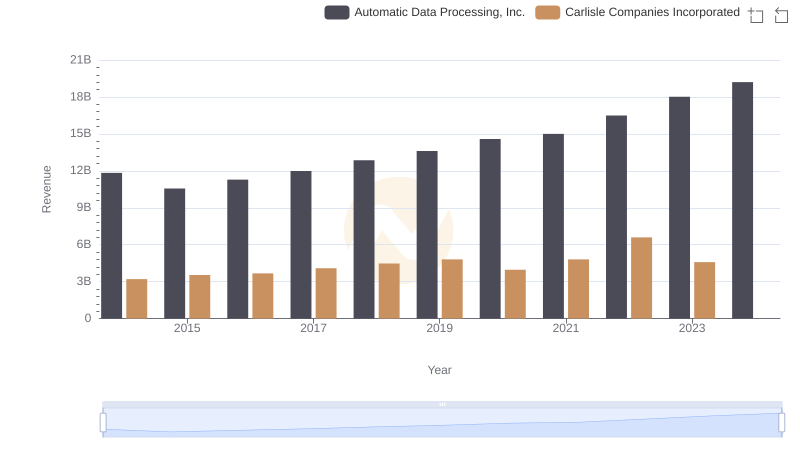

Automatic Data Processing, Inc. vs Carlisle Companies Incorporated: Examining Key Revenue Metrics

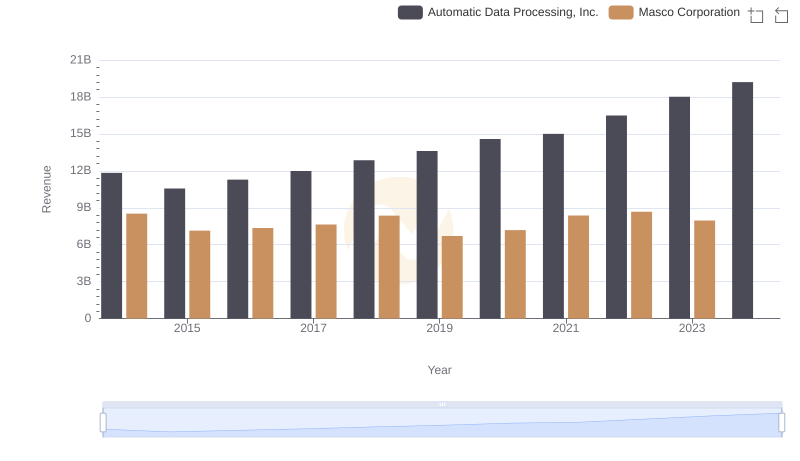

Automatic Data Processing, Inc. vs Masco Corporation: Examining Key Revenue Metrics

Automatic Data Processing, Inc. or J.B. Hunt Transport Services, Inc.: Who Leads in Yearly Revenue?

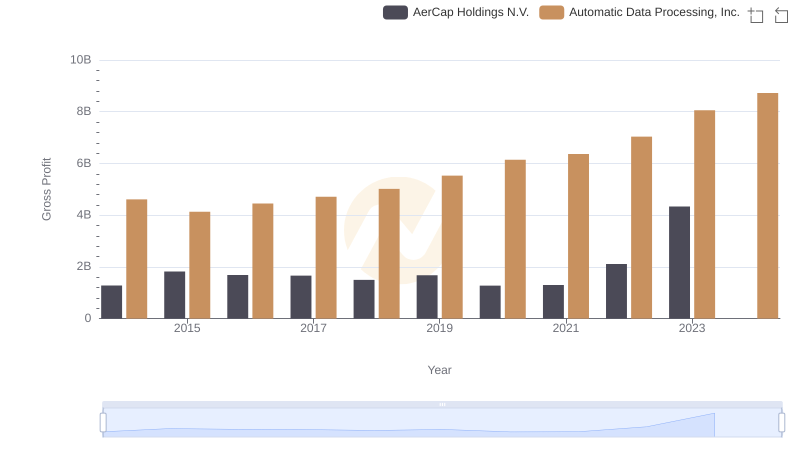

Key Insights on Gross Profit: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

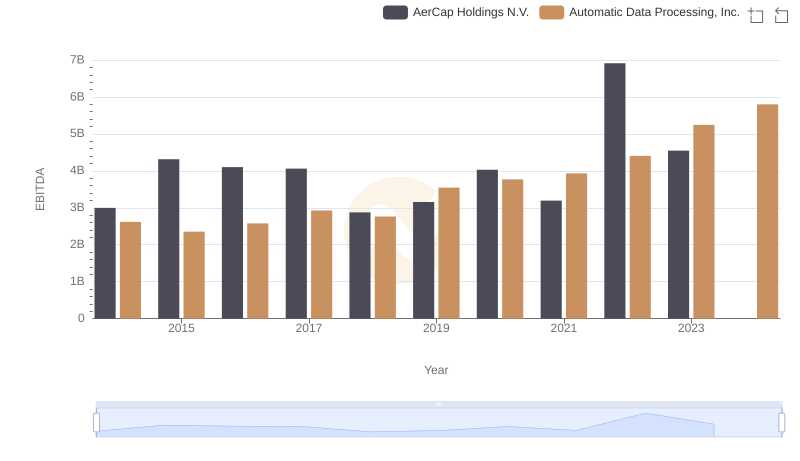

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs AerCap Holdings N.V.