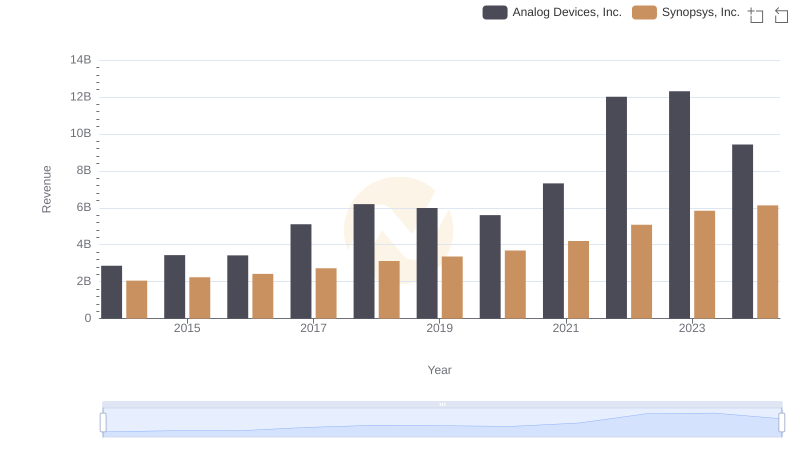

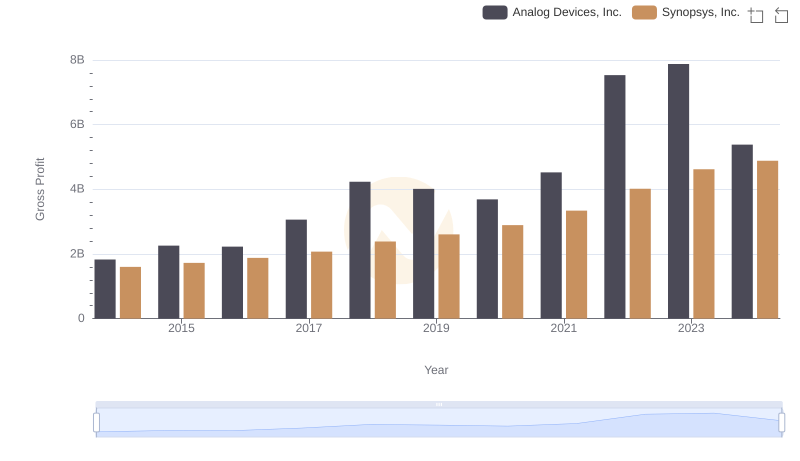

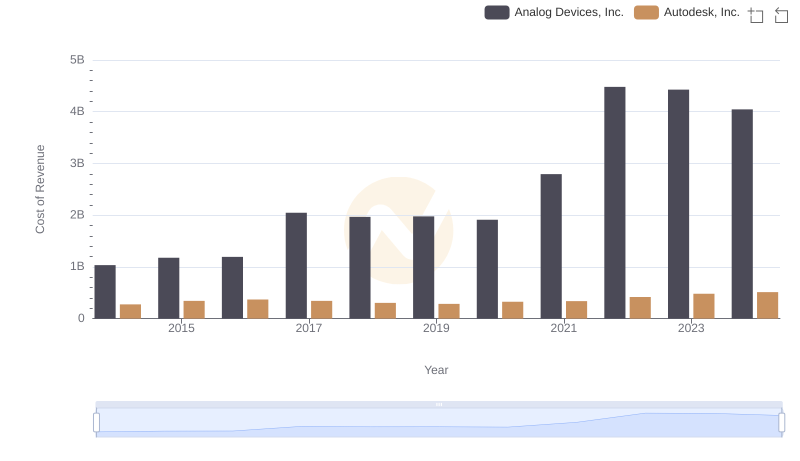

| __timestamp | Analog Devices, Inc. | Synopsys, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1034585000 | 456885000 |

| Thursday, January 1, 2015 | 1175830000 | 518920000 |

| Friday, January 1, 2016 | 1194236000 | 542962000 |

| Sunday, January 1, 2017 | 2045907000 | 654184000 |

| Monday, January 1, 2018 | 1967640000 | 735898000 |

| Tuesday, January 1, 2019 | 1977315000 | 752946000 |

| Wednesday, January 1, 2020 | 1912578000 | 794690000 |

| Friday, January 1, 2021 | 2793274000 | 861777000 |

| Saturday, January 1, 2022 | 4481479000 | 1063697000 |

| Sunday, January 1, 2023 | 4428321000 | 1222193000 |

| Monday, January 1, 2024 | 4045814000 | 1245289000 |

Infusing magic into the data realm

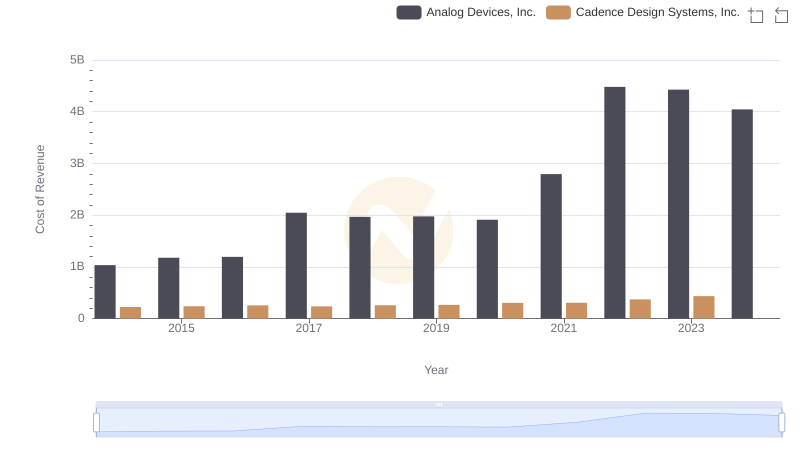

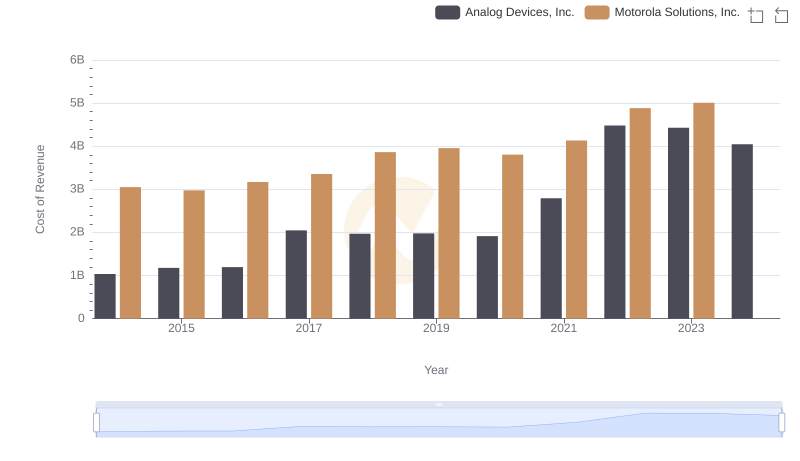

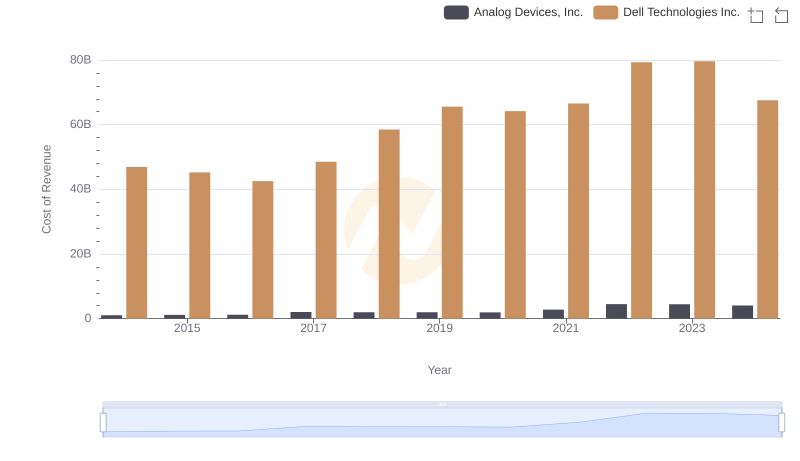

In the ever-evolving landscape of technology, cost efficiency remains a pivotal factor for companies striving for market leadership. This analysis delves into the cost of revenue trends for Analog Devices, Inc. and Synopsys, Inc. from 2014 to 2024. Over this decade, Analog Devices, Inc. has seen a significant increase in its cost of revenue, peaking in 2022 with a 333% rise from 2014. In contrast, Synopsys, Inc. has maintained a more stable trajectory, with a 172% increase over the same period.

Understanding these trends provides valuable insights into each company's operational strategies and market positioning.

Annual Revenue Comparison: Analog Devices, Inc. vs Synopsys, Inc.

Analog Devices, Inc. vs Cadence Design Systems, Inc.: Efficiency in Cost of Revenue Explored

Cost of Revenue Comparison: Analog Devices, Inc. vs Motorola Solutions, Inc.

Cost of Revenue: Key Insights for Analog Devices, Inc. and Dell Technologies Inc.

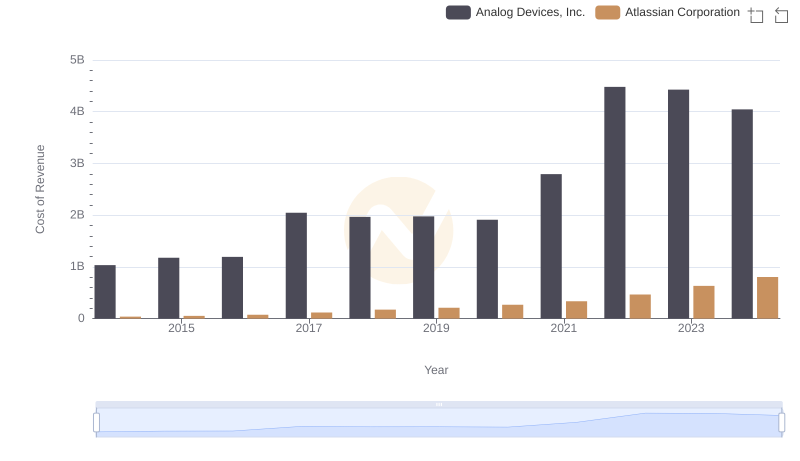

Cost Insights: Breaking Down Analog Devices, Inc. and Atlassian Corporation's Expenses

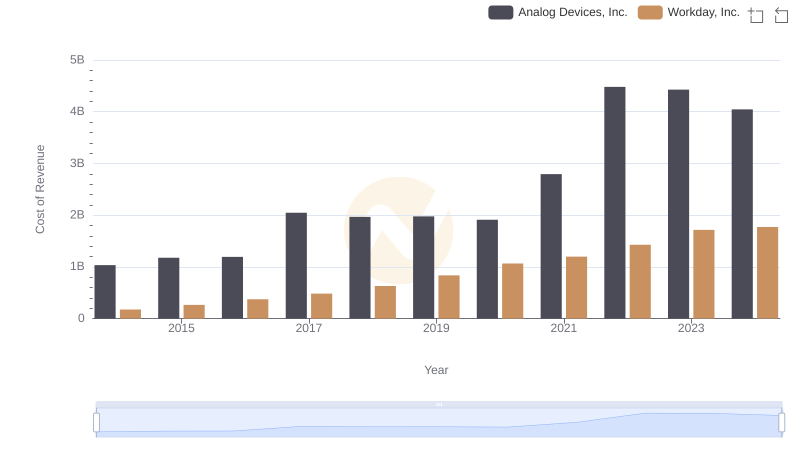

Comparing Cost of Revenue Efficiency: Analog Devices, Inc. vs Workday, Inc.

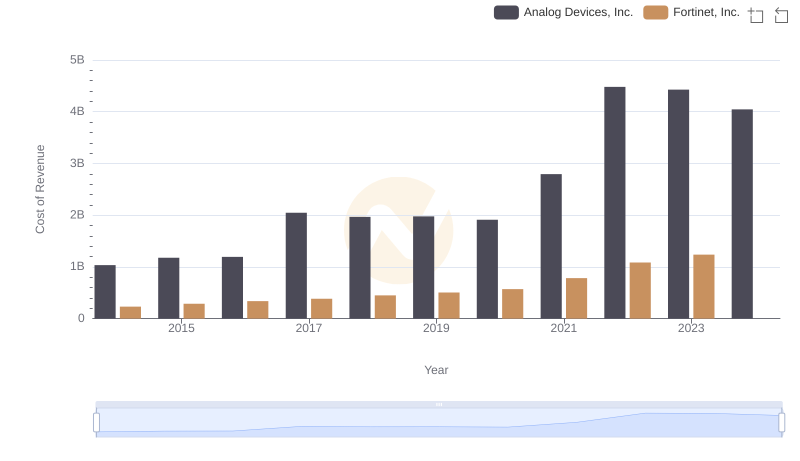

Cost of Revenue: Key Insights for Analog Devices, Inc. and Fortinet, Inc.

Key Insights on Gross Profit: Analog Devices, Inc. vs Synopsys, Inc.

Analyzing Cost of Revenue: Analog Devices, Inc. and Autodesk, Inc.

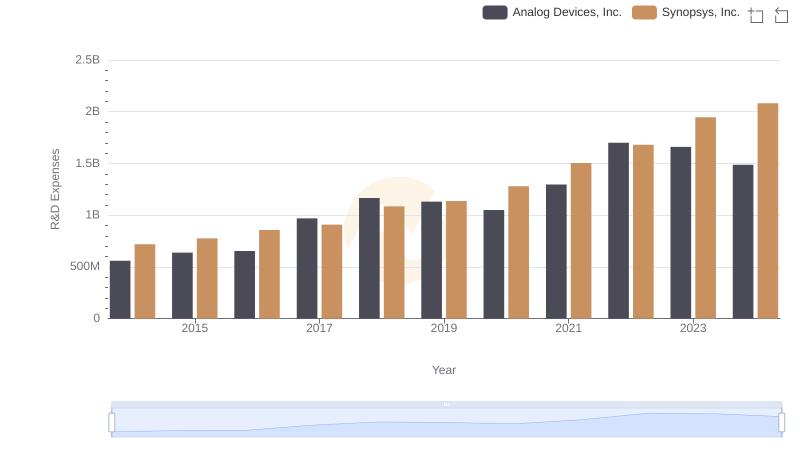

Research and Development Investment: Analog Devices, Inc. vs Synopsys, Inc.

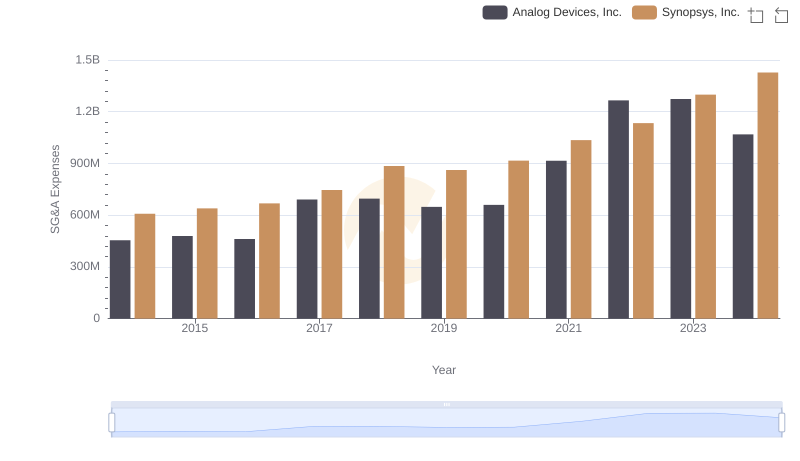

Analog Devices, Inc. vs Synopsys, Inc.: SG&A Expense Trends

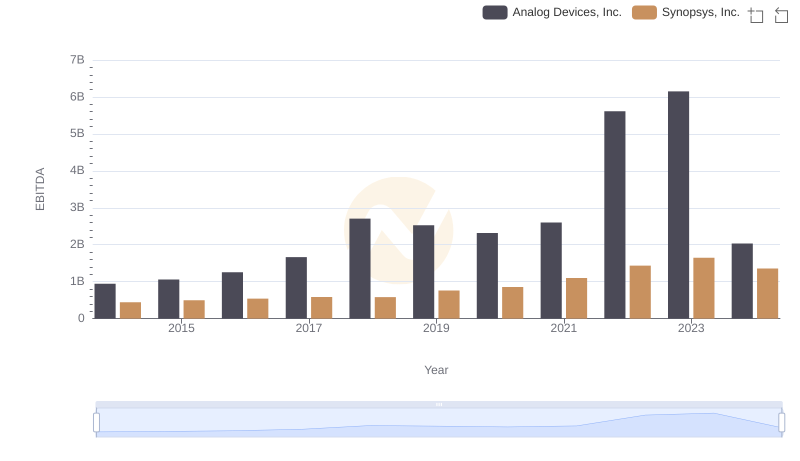

A Professional Review of EBITDA: Analog Devices, Inc. Compared to Synopsys, Inc.