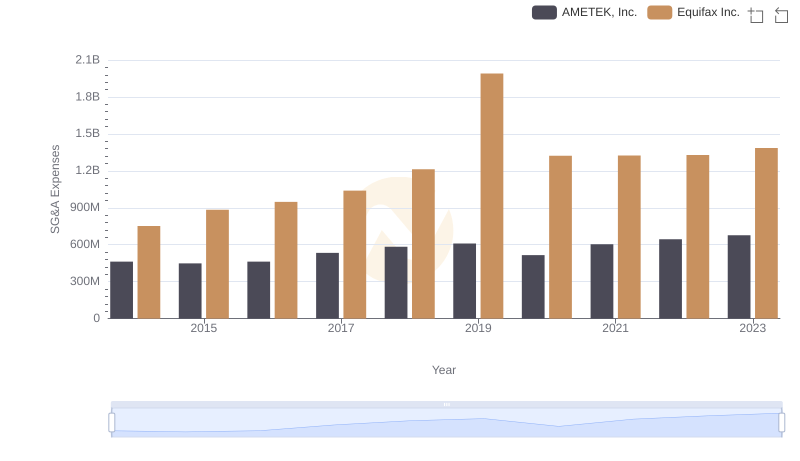

| __timestamp | AMETEK, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1023344000 | 842400000 |

| Thursday, January 1, 2015 | 1093776000 | 914600000 |

| Friday, January 1, 2016 | 1007213000 | 1116900000 |

| Sunday, January 1, 2017 | 1068174000 | 1013900000 |

| Monday, January 1, 2018 | 1269415000 | 770200000 |

| Tuesday, January 1, 2019 | 1411422000 | 29000000 |

| Wednesday, January 1, 2020 | 1283159000 | 1217800000 |

| Friday, January 1, 2021 | 1600782000 | 1575200000 |

| Saturday, January 1, 2022 | 1820119000 | 1672800000 |

| Sunday, January 1, 2023 | 2025843000 | 1579100000 |

| Monday, January 1, 2024 | 1779562000 | 1251200000 |

Unleashing the power of data

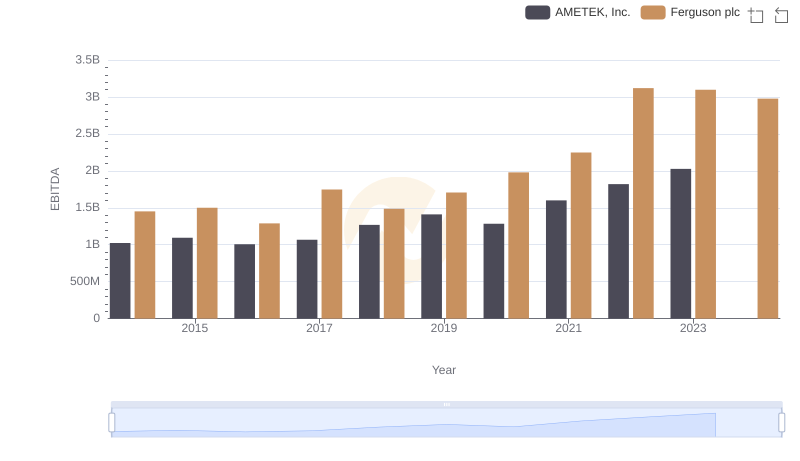

In the ever-evolving landscape of the financial sector, AMETEK, Inc. and Equifax Inc. have demonstrated remarkable resilience and growth over the past decade. From 2014 to 2023, AMETEK's EBITDA surged by approximately 98%, showcasing its robust business model and strategic expansions. In contrast, Equifax experienced a more modest growth of around 87%, reflecting its steady recovery and adaptation post-2017 data breach.

This comparative analysis underscores the dynamic nature of these industry giants, offering valuable insights for investors and stakeholders alike.

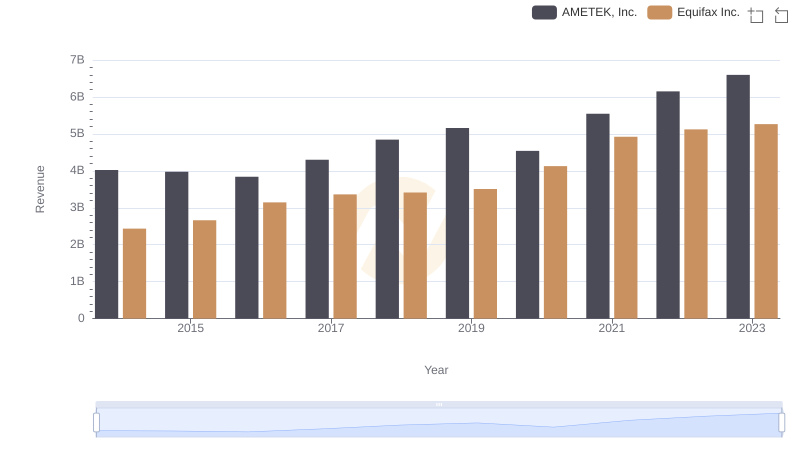

AMETEK, Inc. or Equifax Inc.: Who Leads in Yearly Revenue?

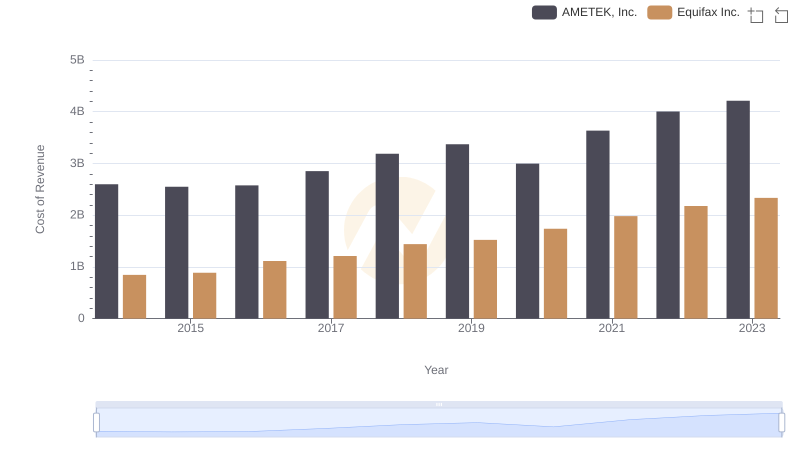

AMETEK, Inc. vs Equifax Inc.: Efficiency in Cost of Revenue Explored

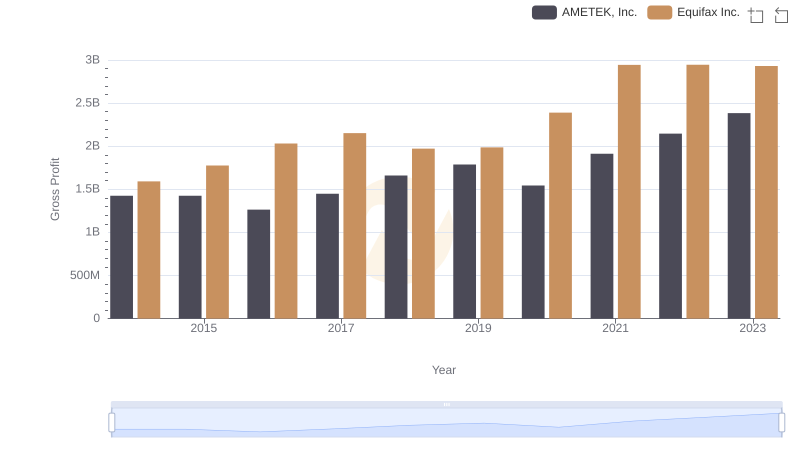

Gross Profit Trends Compared: AMETEK, Inc. vs Equifax Inc.

A Side-by-Side Analysis of EBITDA: AMETEK, Inc. and Ferguson plc

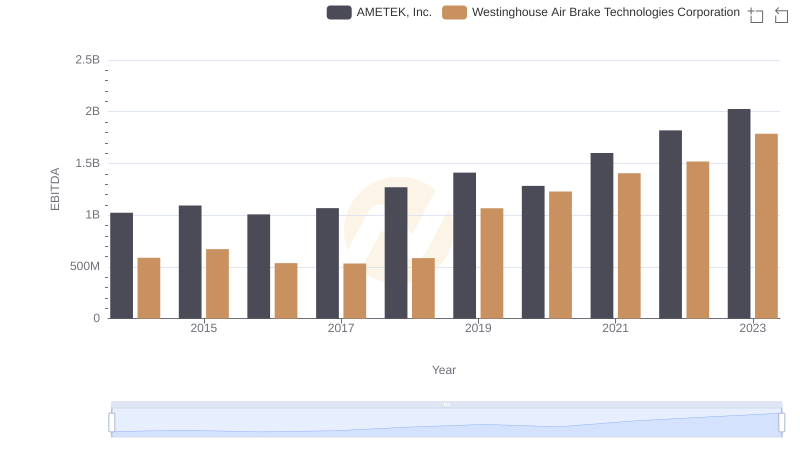

A Professional Review of EBITDA: AMETEK, Inc. Compared to Westinghouse Air Brake Technologies Corporation

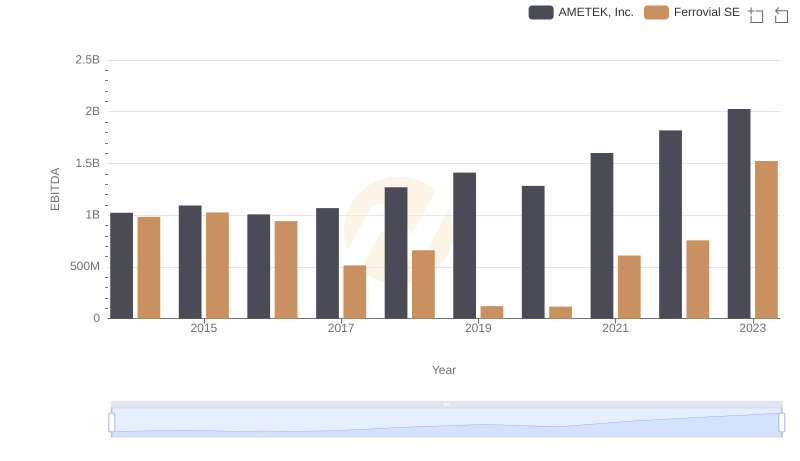

A Side-by-Side Analysis of EBITDA: AMETEK, Inc. and Ferrovial SE

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Equifax Inc.

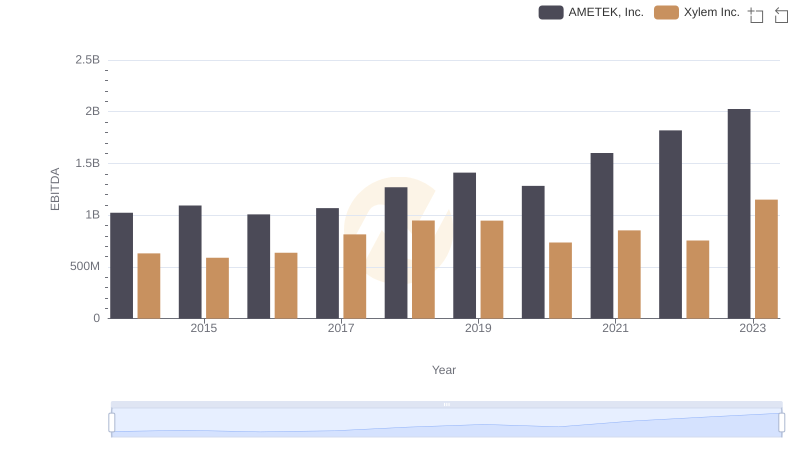

Professional EBITDA Benchmarking: AMETEK, Inc. vs Xylem Inc.

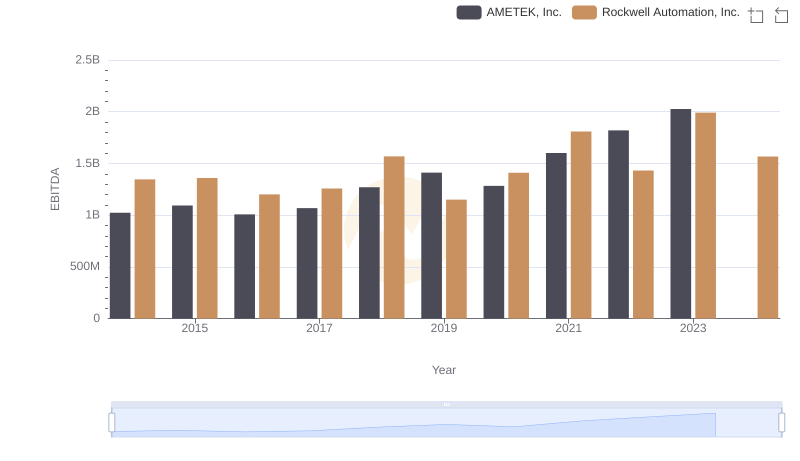

Professional EBITDA Benchmarking: AMETEK, Inc. vs Rockwell Automation, Inc.

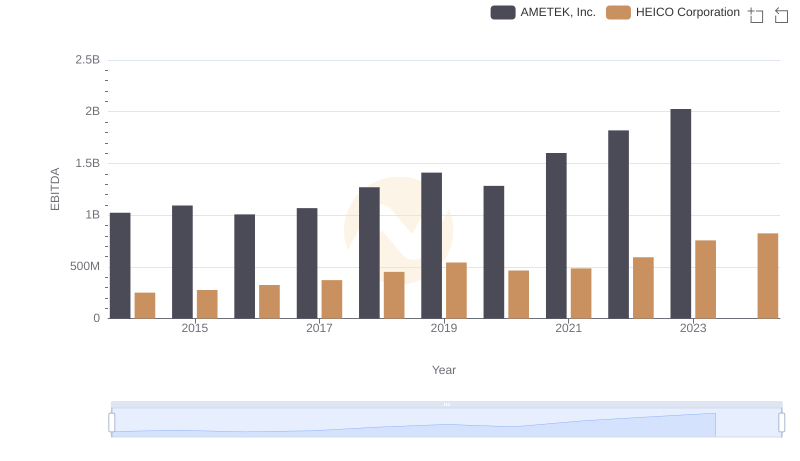

AMETEK, Inc. and HEICO Corporation: A Detailed Examination of EBITDA Performance

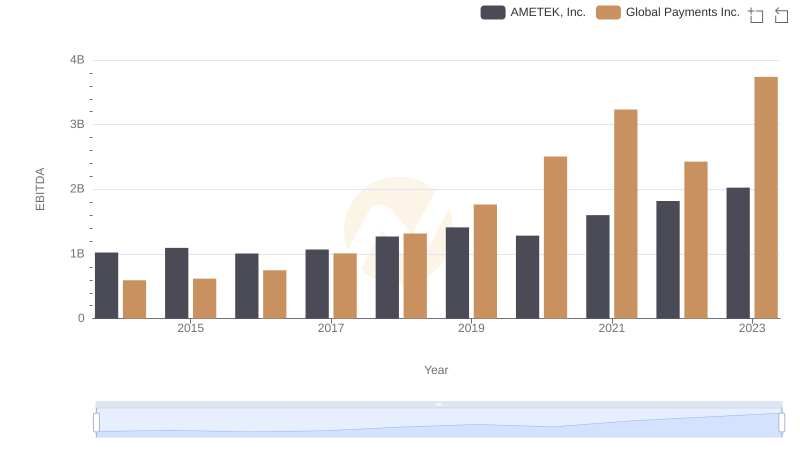

A Side-by-Side Analysis of EBITDA: AMETEK, Inc. and Global Payments Inc.

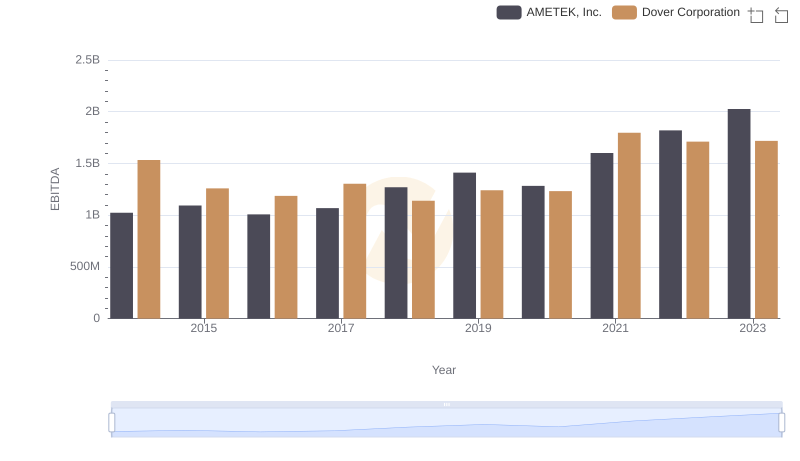

A Professional Review of EBITDA: AMETEK, Inc. Compared to Dover Corporation