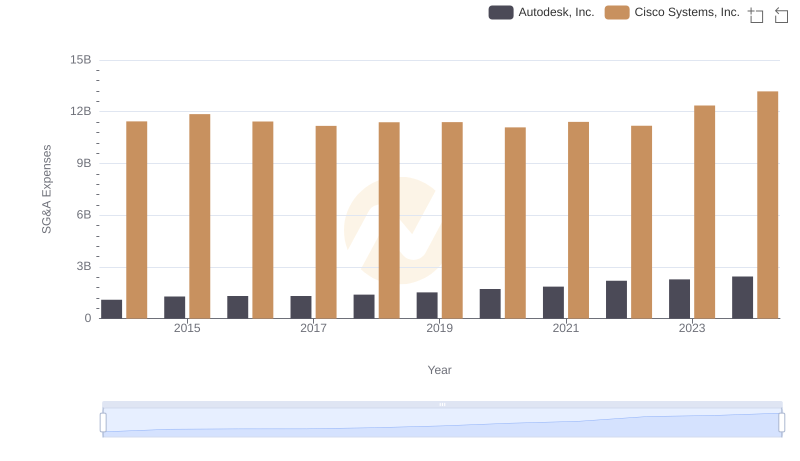

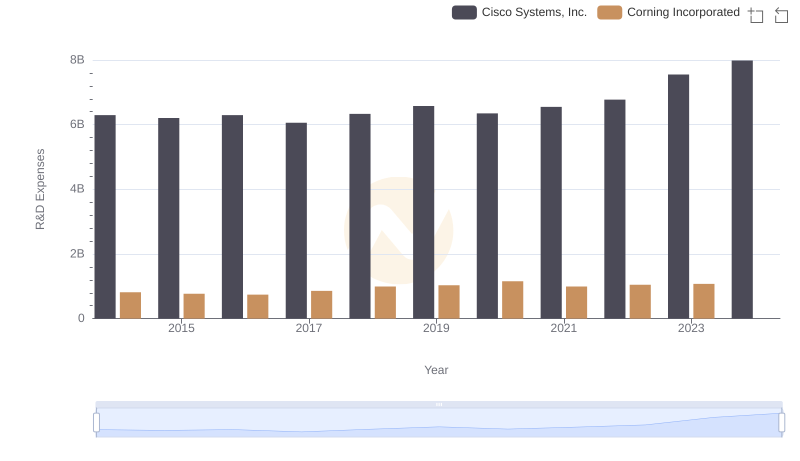

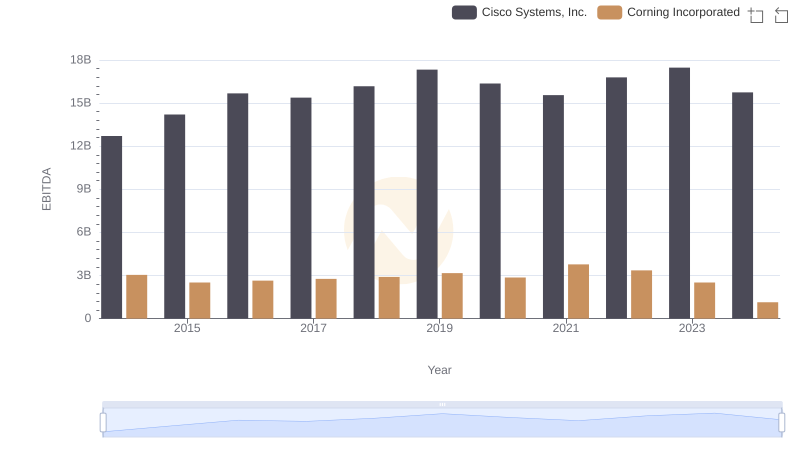

| __timestamp | Cisco Systems, Inc. | Corning Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 11437000000 | 1211000000 |

| Thursday, January 1, 2015 | 11861000000 | 1523000000 |

| Friday, January 1, 2016 | 11433000000 | 1472000000 |

| Sunday, January 1, 2017 | 11177000000 | 1467000000 |

| Monday, January 1, 2018 | 11386000000 | 1799000000 |

| Tuesday, January 1, 2019 | 11398000000 | 1585000000 |

| Wednesday, January 1, 2020 | 11094000000 | 1747000000 |

| Friday, January 1, 2021 | 11411000000 | 1827000000 |

| Saturday, January 1, 2022 | 11186000000 | 1898000000 |

| Sunday, January 1, 2023 | 12358000000 | 1843000000 |

| Monday, January 1, 2024 | 13177000000 | 1931000000 |

Cracking the code

In the competitive landscape of technology and manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Cisco Systems, Inc. and Corning Incorporated have shown distinct strategies in handling these costs. From 2014 to 2024, Cisco's SG&A expenses have seen a steady increase, peaking at approximately $13.2 billion in 2024, reflecting a 15% rise from 2014. In contrast, Corning's expenses have grown more modestly, reaching around $1.9 billion in 2024, marking a 60% increase from 2014. This suggests that while Cisco's absolute expenses are higher, Corning's relative growth in SG&A costs is more pronounced. Understanding these trends can provide insights into each company's operational efficiency and strategic priorities. As businesses navigate economic challenges, effective cost management remains a key differentiator in sustaining growth and competitiveness.

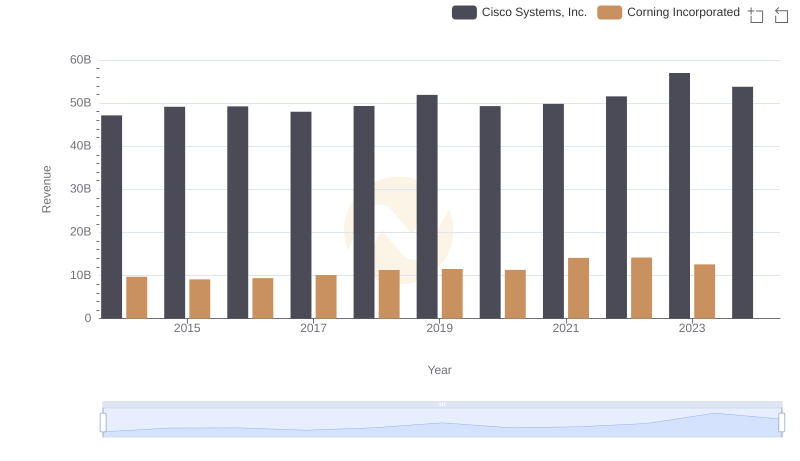

Annual Revenue Comparison: Cisco Systems, Inc. vs Corning Incorporated

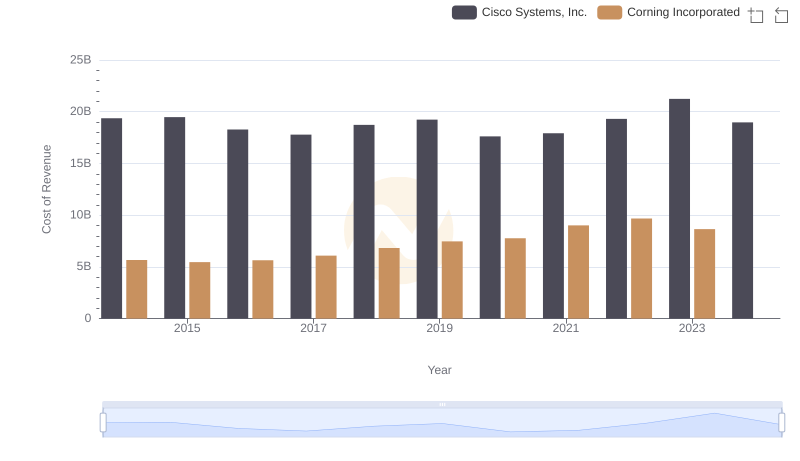

Cost of Revenue Trends: Cisco Systems, Inc. vs Corning Incorporated

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs Autodesk, Inc.

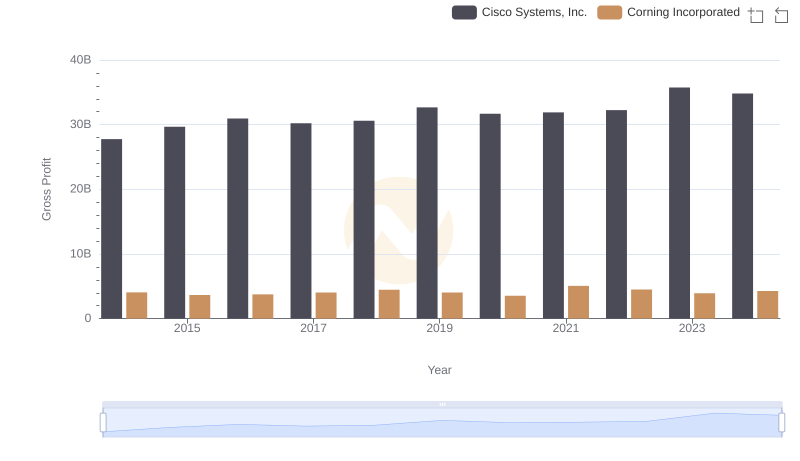

Who Generates Higher Gross Profit? Cisco Systems, Inc. or Corning Incorporated

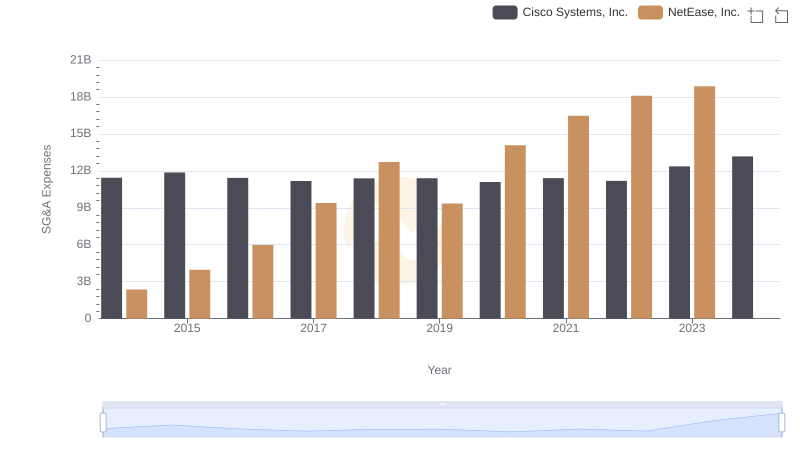

Selling, General, and Administrative Costs: Cisco Systems, Inc. vs NetEase, Inc.

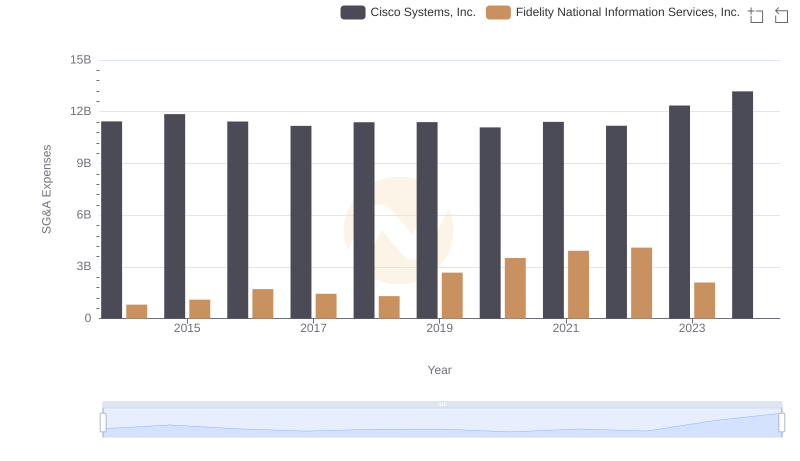

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs Fidelity National Information Services, Inc.

Cisco Systems, Inc. or NXP Semiconductors N.V.: Who Manages SG&A Costs Better?

Research and Development Expenses Breakdown: Cisco Systems, Inc. vs Corning Incorporated

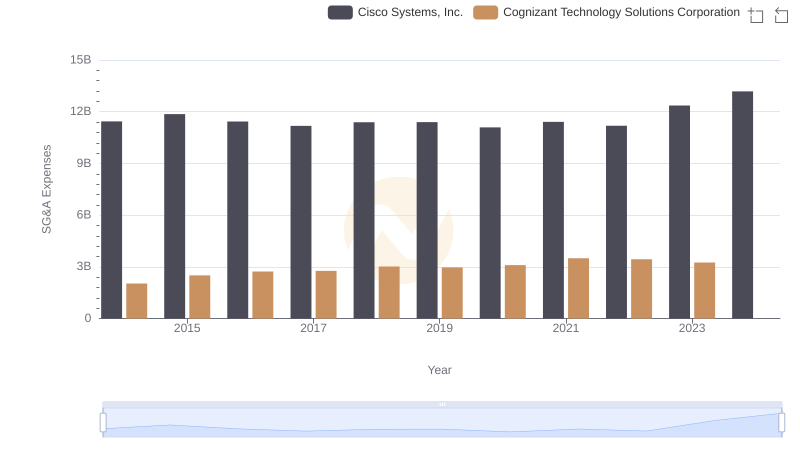

Cisco Systems, Inc. and Cognizant Technology Solutions Corporation: SG&A Spending Patterns Compared

Operational Costs Compared: SG&A Analysis of Cisco Systems, Inc. and Gartner, Inc.

Cisco Systems, Inc. vs Corning Incorporated: In-Depth EBITDA Performance Comparison

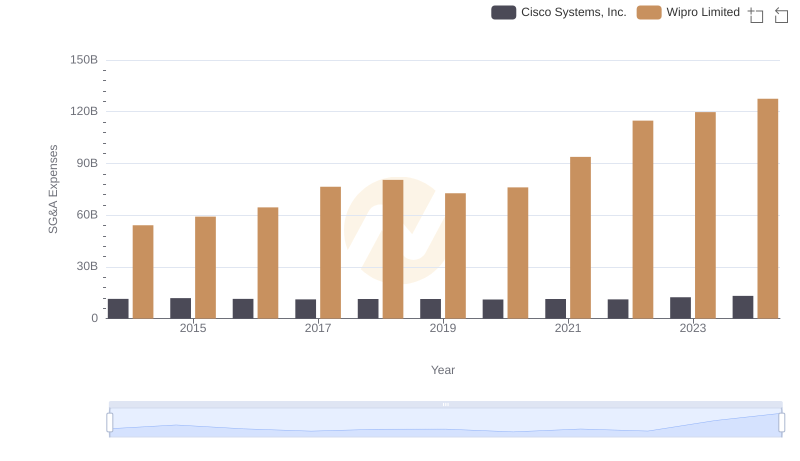

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs Wipro Limited