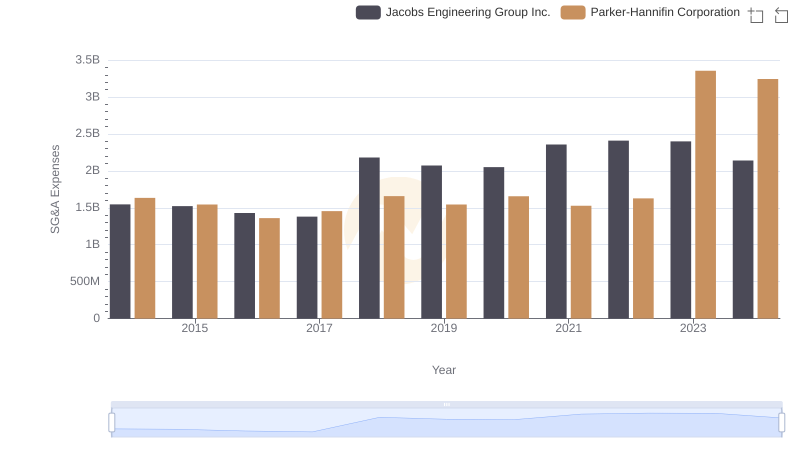

| __timestamp | Booz Allen Hamilton Holding Corporation | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 1633992000 |

| Thursday, January 1, 2015 | 2159439000 | 1544746000 |

| Friday, January 1, 2016 | 2319592000 | 1359360000 |

| Sunday, January 1, 2017 | 2568511000 | 1453935000 |

| Monday, January 1, 2018 | 2719909000 | 1657152000 |

| Tuesday, January 1, 2019 | 2932602000 | 1543939000 |

| Wednesday, January 1, 2020 | 3334378000 | 1656553000 |

| Friday, January 1, 2021 | 3362722000 | 1527302000 |

| Saturday, January 1, 2022 | 3633150000 | 1627116000 |

| Sunday, January 1, 2023 | 4341769000 | 3354103000 |

| Monday, January 1, 2024 | 1281443000 | 3315177000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Booz Allen Hamilton Holding Corporation and Parker-Hannifin Corporation have showcased distinct trajectories in their SG&A expenditures. From 2014 to 2023, Booz Allen Hamilton's SG&A expenses surged by approximately 95%, peaking in 2023. In contrast, Parker-Hannifin experienced a more modest increase of around 105% during the same period, with a notable spike in 2023. This divergence highlights the strategic differences in operational management between a consulting giant and an industrial leader. As we step into 2024, Booz Allen Hamilton's expenses plummeted by 70%, while Parker-Hannifin maintained a steady course. This data not only reflects their financial strategies but also offers insights into their adaptability in a dynamic market environment.

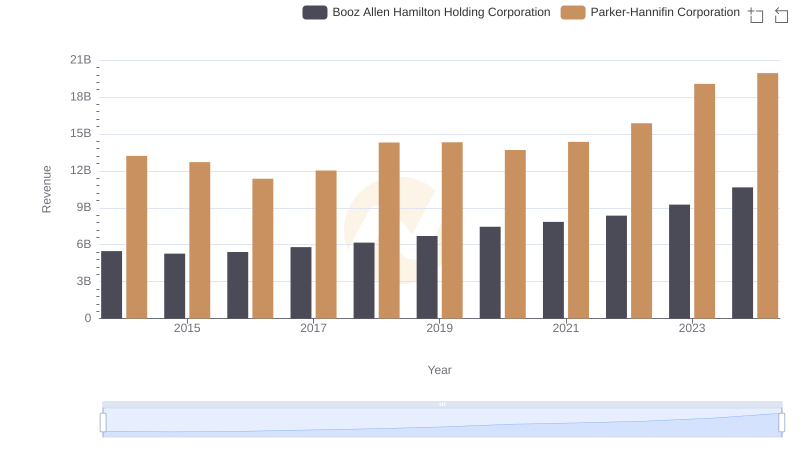

Revenue Showdown: Parker-Hannifin Corporation vs Booz Allen Hamilton Holding Corporation

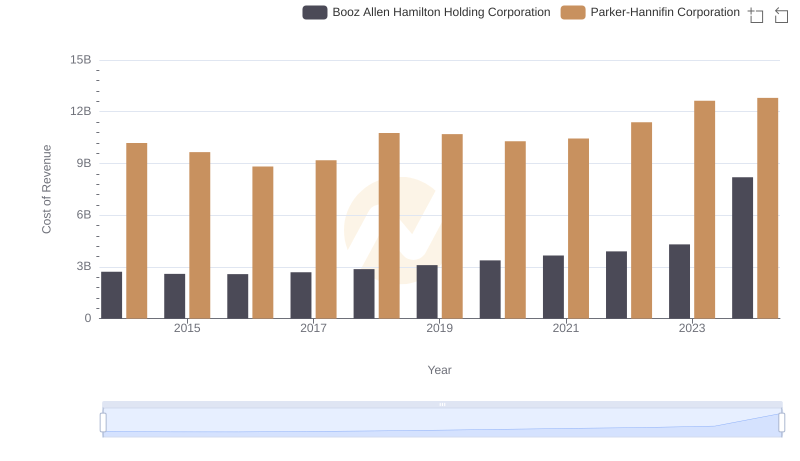

Cost Insights: Breaking Down Parker-Hannifin Corporation and Booz Allen Hamilton Holding Corporation's Expenses

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs Jacobs Engineering Group Inc.

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Snap-on Incorporated

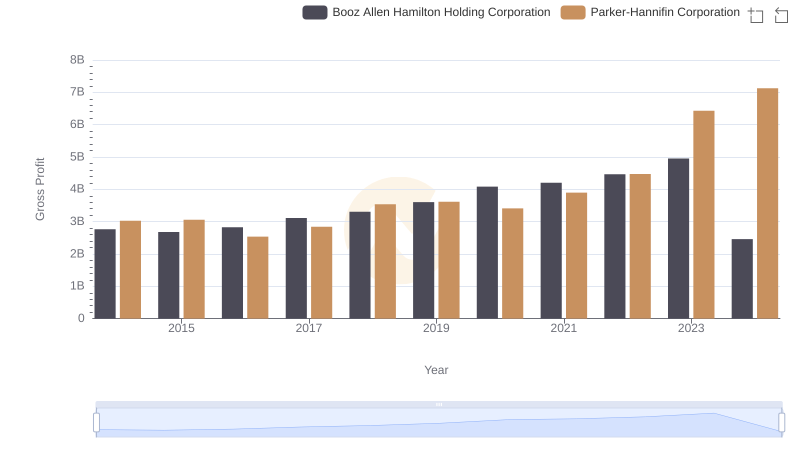

Key Insights on Gross Profit: Parker-Hannifin Corporation vs Booz Allen Hamilton Holding Corporation

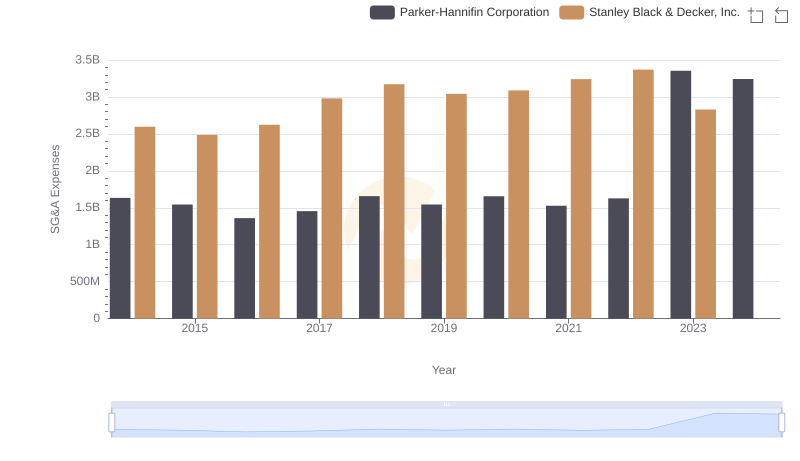

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and Stanley Black & Decker, Inc.

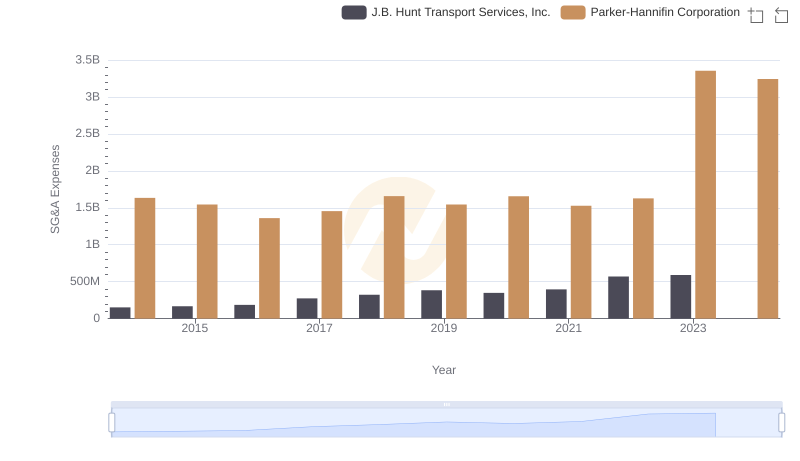

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs J.B. Hunt Transport Services, Inc.

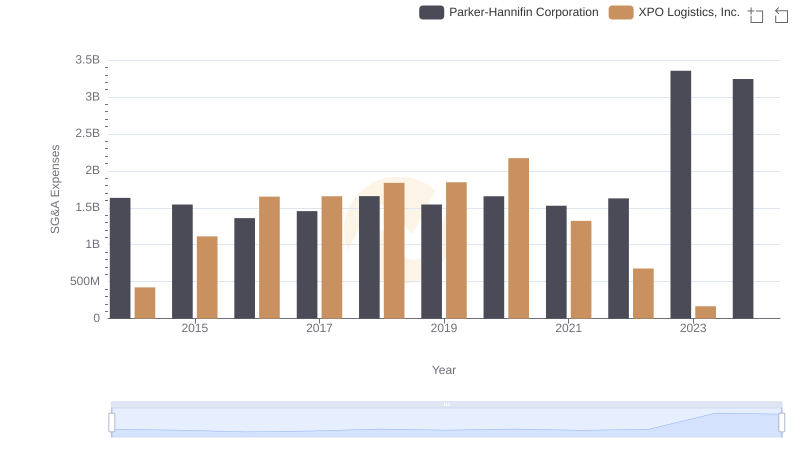

Parker-Hannifin Corporation vs XPO Logistics, Inc.: SG&A Expense Trends