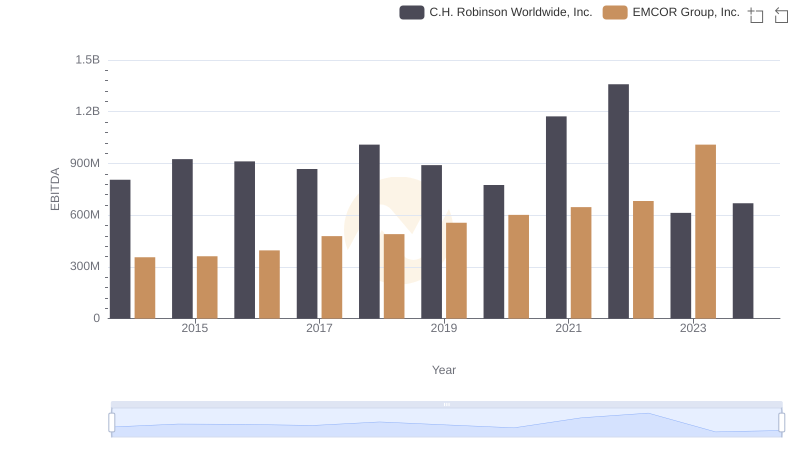

| __timestamp | C.H. Robinson Worldwide, Inc. | EMCOR Group, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 320213000 | 626478000 |

| Thursday, January 1, 2015 | 358760000 | 656573000 |

| Friday, January 1, 2016 | 375061000 | 725538000 |

| Sunday, January 1, 2017 | 413404000 | 757062000 |

| Monday, January 1, 2018 | 449610000 | 799157000 |

| Tuesday, January 1, 2019 | 497806000 | 893453000 |

| Wednesday, January 1, 2020 | 496122000 | 903584000 |

| Friday, January 1, 2021 | 526371000 | 970937000 |

| Saturday, January 1, 2022 | 603415000 | 1038717000 |

| Sunday, January 1, 2023 | 624266000 | 1211233000 |

| Monday, January 1, 2024 | 639624000 |

Unveiling the hidden dimensions of data

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, EMCOR Group, Inc. and C.H. Robinson Worldwide, Inc. have shown distinct trends in their SG&A management. EMCOR's SG&A expenses have surged by approximately 93%, from $626 million in 2014 to $1.21 billion in 2023. In contrast, C.H. Robinson's expenses increased by about 100%, from $320 million to $640 million over the same period. While both companies have seen rising costs, EMCOR's expenses have consistently been higher, reflecting its larger operational scale. However, the data for 2024 is incomplete, leaving room for speculation on future trends. This analysis provides a snapshot of how these industry giants navigate their financial strategies, offering insights into their operational efficiencies.

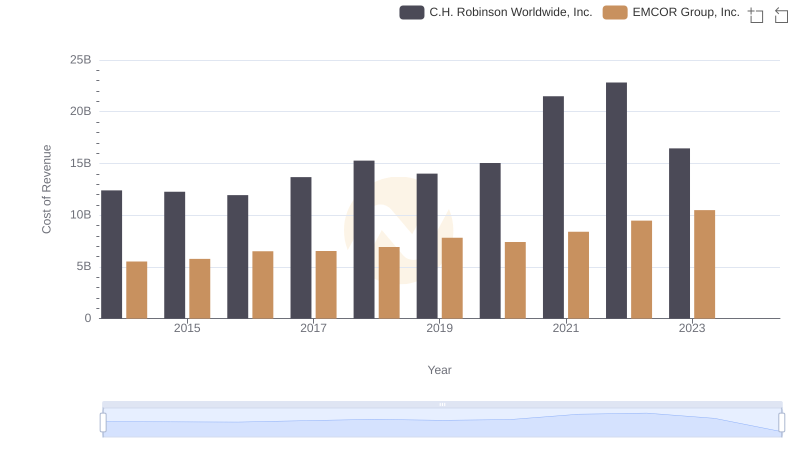

Cost of Revenue Comparison: EMCOR Group, Inc. vs C.H. Robinson Worldwide, Inc.

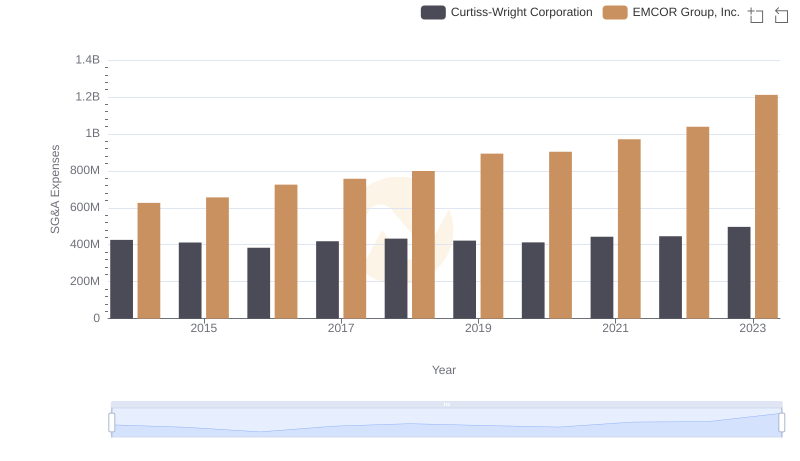

EMCOR Group, Inc. vs Curtiss-Wright Corporation: SG&A Expense Trends

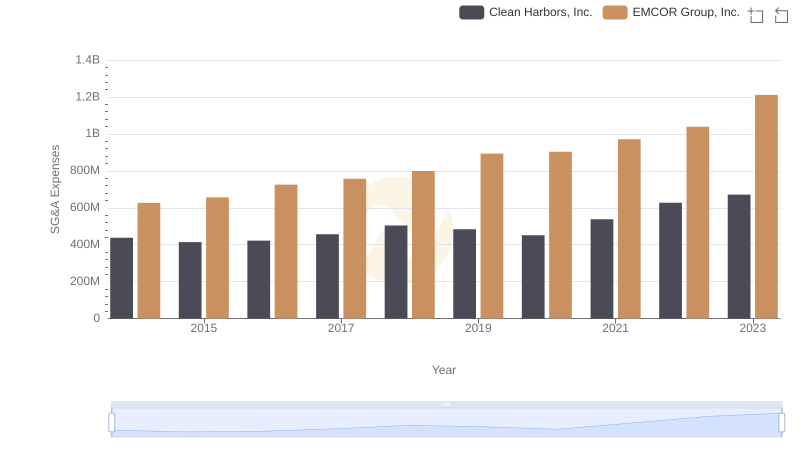

EMCOR Group, Inc. and Clean Harbors, Inc.: SG&A Spending Patterns Compared

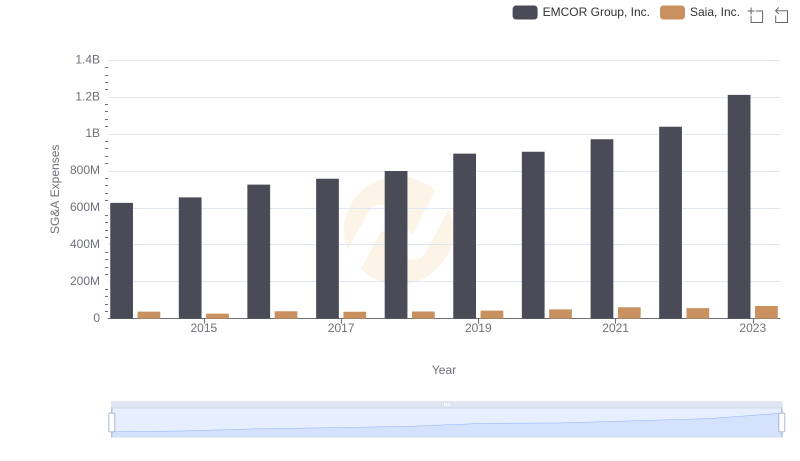

SG&A Efficiency Analysis: Comparing EMCOR Group, Inc. and Saia, Inc.

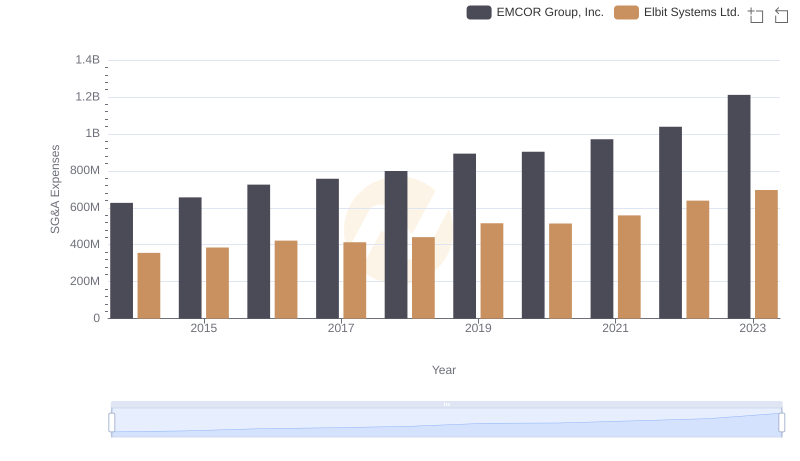

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Elbit Systems Ltd.

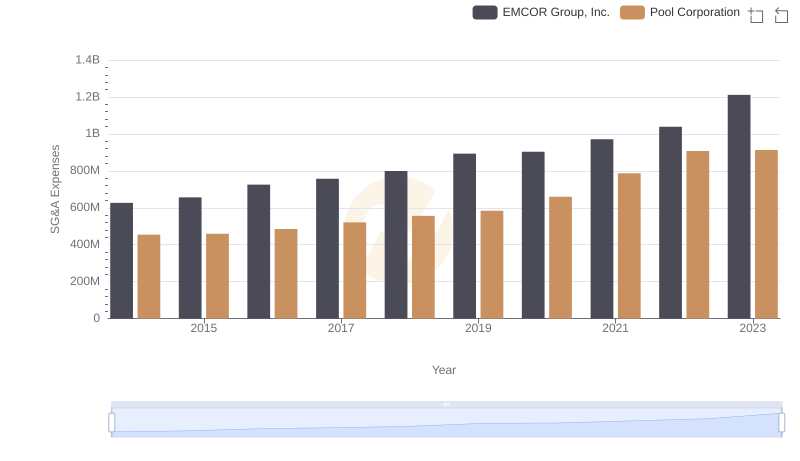

EMCOR Group, Inc. vs Pool Corporation: SG&A Expense Trends

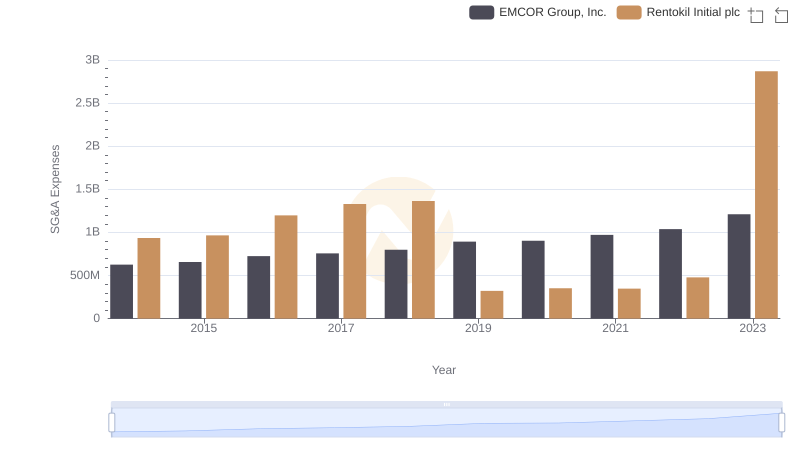

EMCOR Group, Inc. and Rentokil Initial plc: SG&A Spending Patterns Compared

Comparative EBITDA Analysis: EMCOR Group, Inc. vs C.H. Robinson Worldwide, Inc.