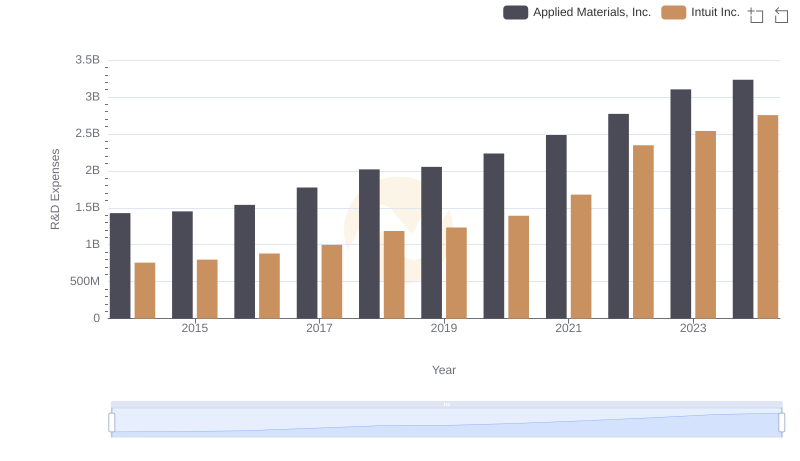

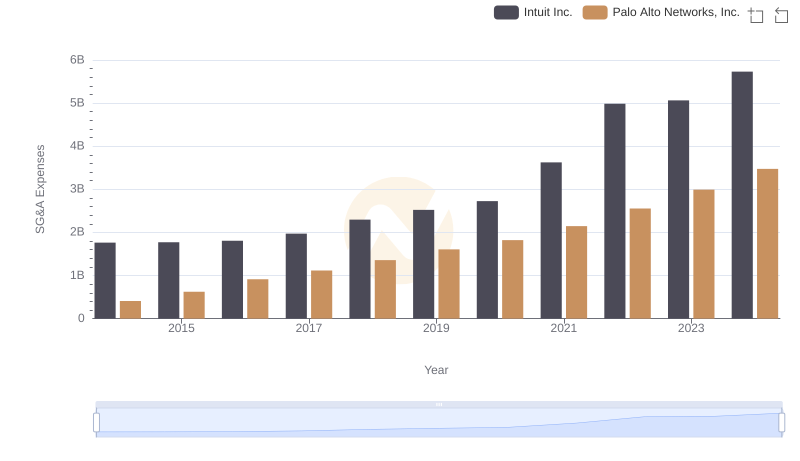

| __timestamp | Intuit Inc. | Palo Alto Networks, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 104813000 |

| Thursday, January 1, 2015 | 798000000 | 185828000 |

| Friday, January 1, 2016 | 881000000 | 284200000 |

| Sunday, January 1, 2017 | 998000000 | 347400000 |

| Monday, January 1, 2018 | 1186000000 | 400700000 |

| Tuesday, January 1, 2019 | 1233000000 | 539500000 |

| Wednesday, January 1, 2020 | 1392000000 | 768100000 |

| Friday, January 1, 2021 | 1678000000 | 1140400000 |

| Saturday, January 1, 2022 | 2347000000 | 1417700000 |

| Sunday, January 1, 2023 | 2539000000 | 1604000000 |

| Monday, January 1, 2024 | 2754000000 | 1809400000 |

Igniting the spark of knowledge

In the ever-evolving tech landscape, innovation is the lifeblood of success. Over the past decade, Intuit Inc. and Palo Alto Networks, Inc. have demonstrated a steadfast commitment to research and development (R&D), as evidenced by their increasing expenditures in this area.

From 2014 to 2024, Intuit Inc. has seen its R&D expenses grow by over 260%, reflecting its dedication to maintaining a competitive edge in financial software. By 2024, Intuit's R&D spending is projected to reach nearly three times its 2014 levels, underscoring its strategic focus on innovation.

Palo Alto Networks, Inc. has also significantly increased its R&D investment, with a remarkable growth of over 1,600% from 2014 to 2024. This surge highlights the company's aggressive approach to enhancing its cybersecurity solutions, ensuring it remains at the forefront of the industry.

Both companies exemplify how strategic R&D investment can drive growth and innovation, setting benchmarks for others in the tech sector.

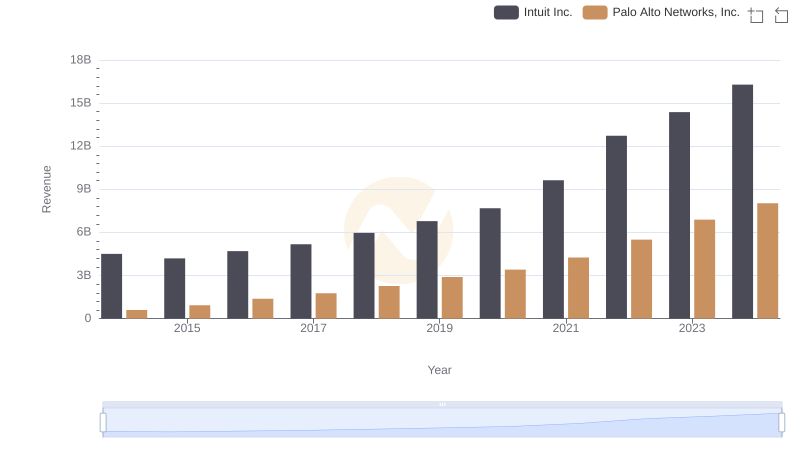

Breaking Down Revenue Trends: Intuit Inc. vs Palo Alto Networks, Inc.

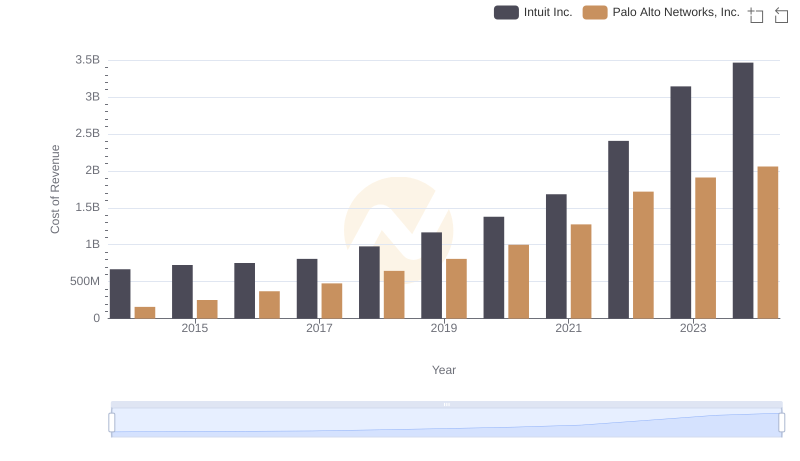

Cost Insights: Breaking Down Intuit Inc. and Palo Alto Networks, Inc.'s Expenses

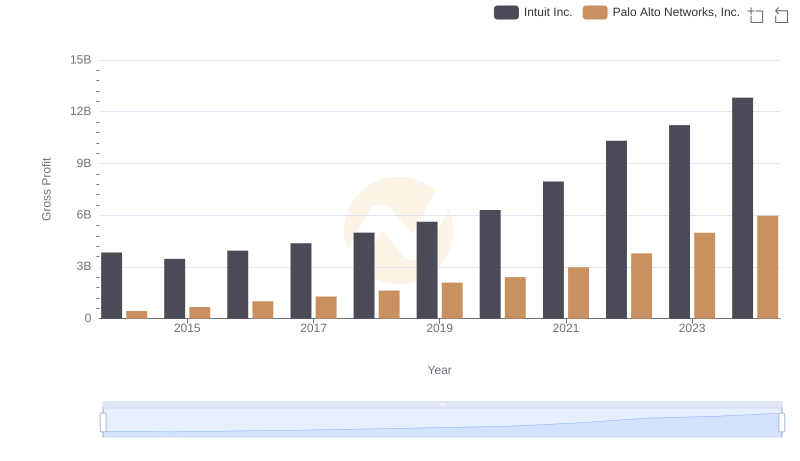

Who Generates Higher Gross Profit? Intuit Inc. or Palo Alto Networks, Inc.

Research and Development Expenses Breakdown: Intuit Inc. vs Applied Materials, Inc.

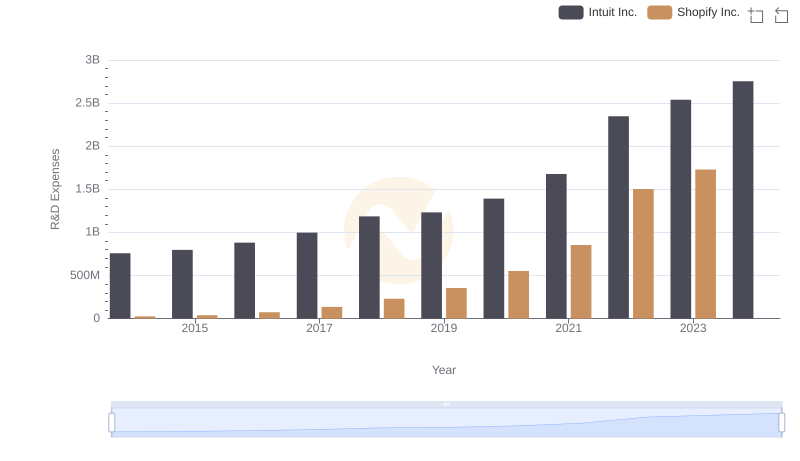

Research and Development: Comparing Key Metrics for Intuit Inc. and Shopify Inc.

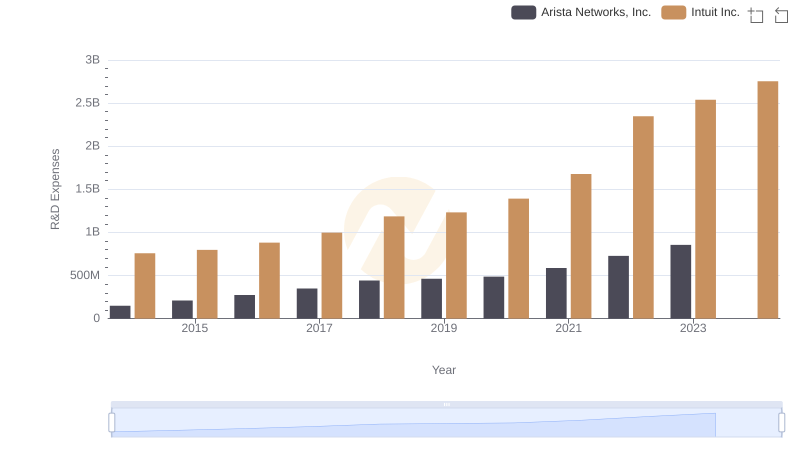

Intuit Inc. or Arista Networks, Inc.: Who Invests More in Innovation?

Comparing SG&A Expenses: Intuit Inc. vs Palo Alto Networks, Inc. Trends and Insights

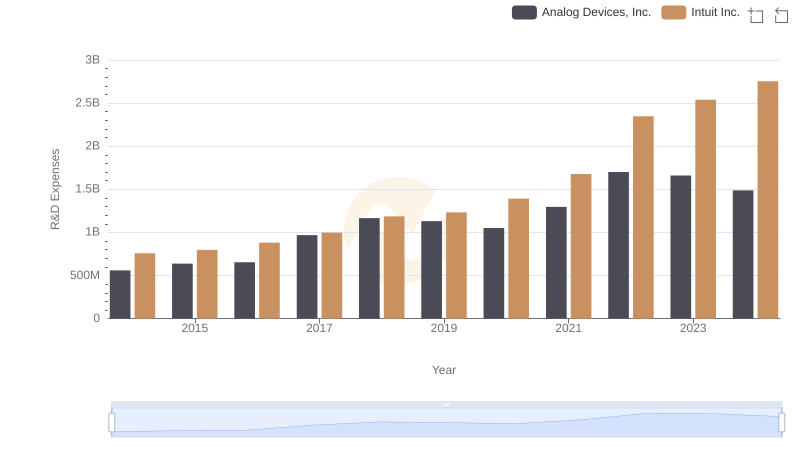

Research and Development Investment: Intuit Inc. vs Analog Devices, Inc.

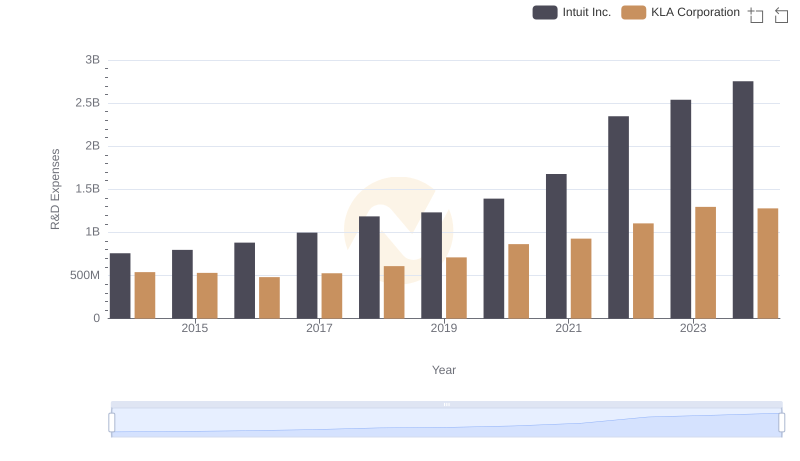

Research and Development: Comparing Key Metrics for Intuit Inc. and KLA Corporation

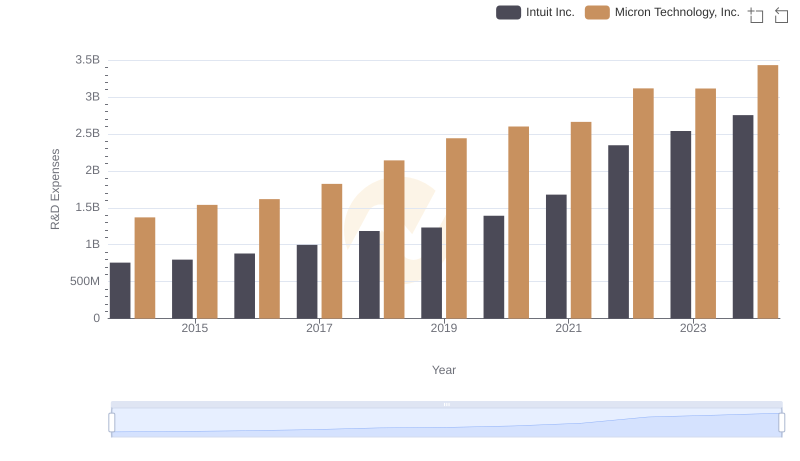

Who Prioritizes Innovation? R&D Spending Compared for Intuit Inc. and Micron Technology, Inc.

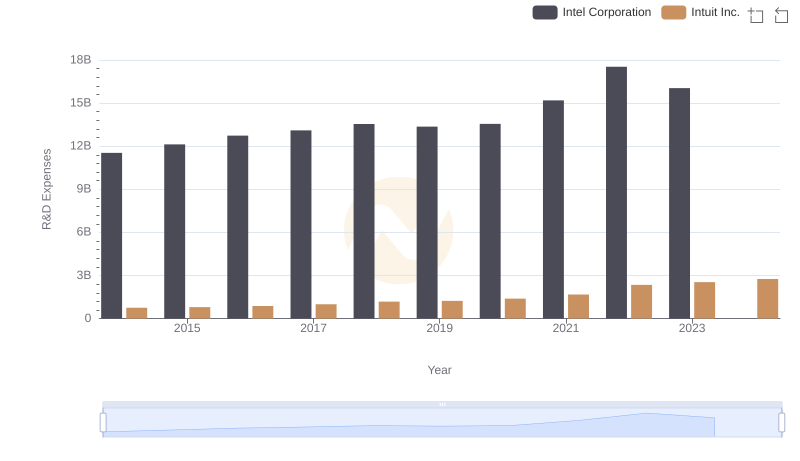

R&D Insights: How Intuit Inc. and Intel Corporation Allocate Funds

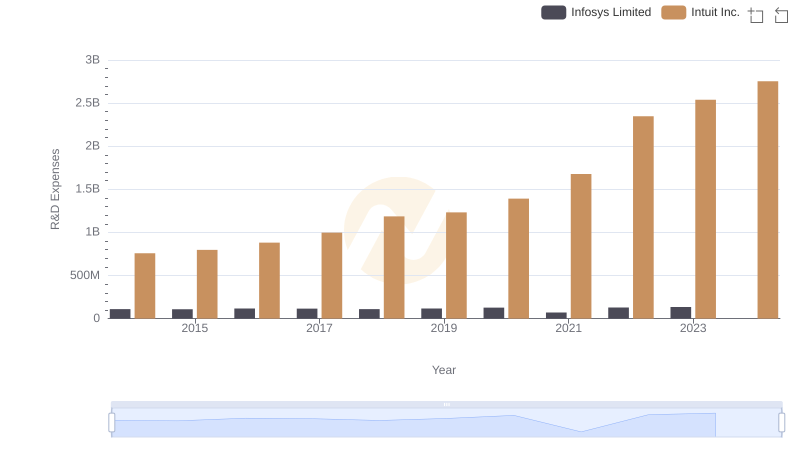

Research and Development Investment: Intuit Inc. vs Infosys Limited