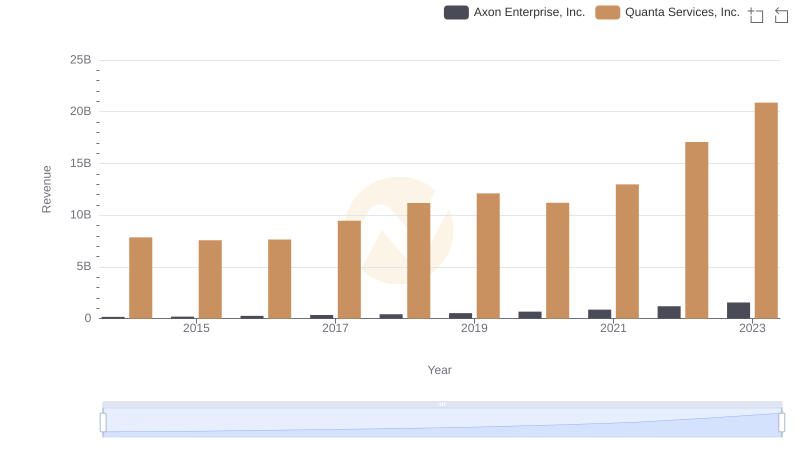

| __timestamp | Axon Enterprise, Inc. | Quanta Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 62977000 | 6617730000 |

| Thursday, January 1, 2015 | 69245000 | 6648771000 |

| Friday, January 1, 2016 | 97709000 | 6637519000 |

| Sunday, January 1, 2017 | 136710000 | 8224618000 |

| Monday, January 1, 2018 | 161485000 | 9691459000 |

| Tuesday, January 1, 2019 | 223574000 | 10511901000 |

| Wednesday, January 1, 2020 | 264672000 | 9541825000 |

| Friday, January 1, 2021 | 322471000 | 11026954000 |

| Saturday, January 1, 2022 | 461297000 | 14544748000 |

| Sunday, January 1, 2023 | 608009000 | 17945120000 |

Unleashing insights

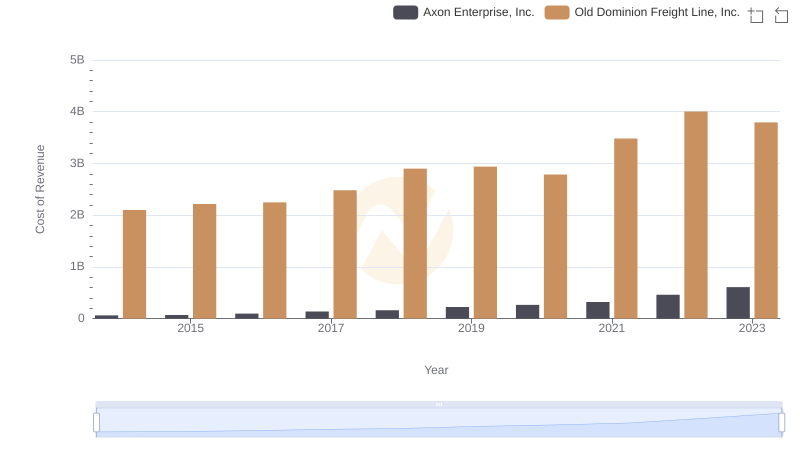

In the ever-evolving landscape of corporate efficiency, understanding cost dynamics is crucial. This analysis delves into the cost of revenue trends for Axon Enterprise, Inc. and Quanta Services, Inc. from 2014 to 2023. Over this period, Axon Enterprise, Inc. has seen a nearly tenfold increase in its cost of revenue, reflecting a strategic expansion and investment in its operational capabilities. In contrast, Quanta Services, Inc. has maintained a more stable growth trajectory, with its cost of revenue increasing by approximately 170%.

The data reveals that while Axon Enterprise, Inc. is rapidly scaling, Quanta Services, Inc. is optimizing its cost structure, potentially indicating a more mature market position. This comparison offers valuable insights into how different companies manage their growth and operational efficiency, providing a window into their strategic priorities and market positioning.

Breaking Down Revenue Trends: Axon Enterprise, Inc. vs Quanta Services, Inc.

Cost Insights: Breaking Down Axon Enterprise, Inc. and Fastenal Company's Expenses

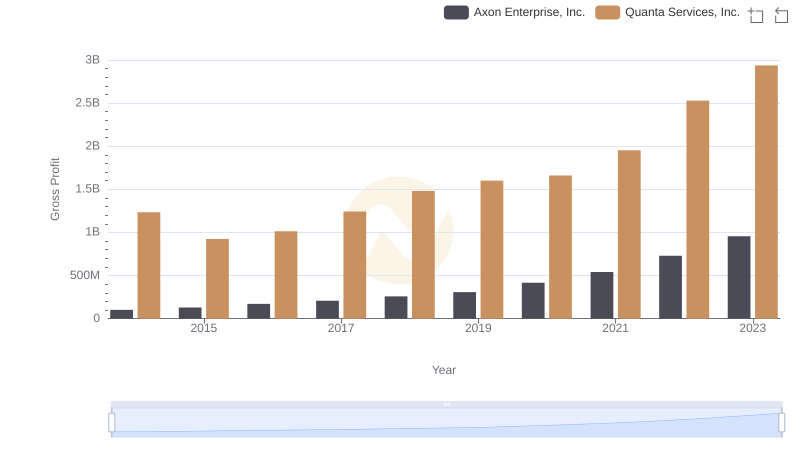

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Quanta Services, Inc.

Cost of Revenue Trends: Axon Enterprise, Inc. vs Old Dominion Freight Line, Inc.

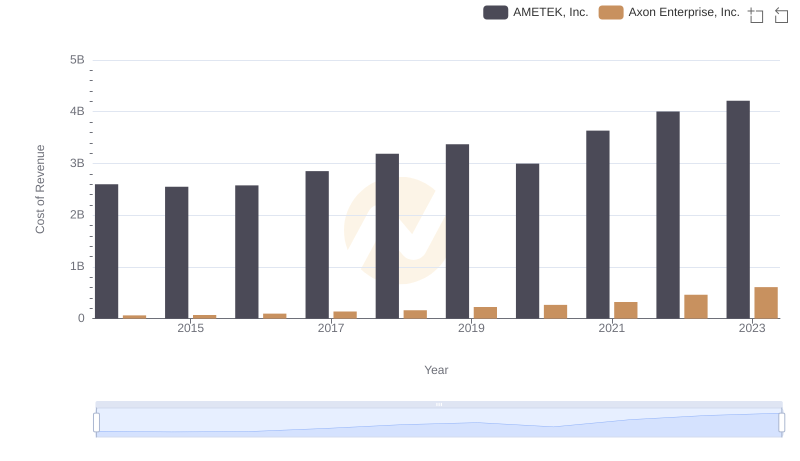

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and AMETEK, Inc.

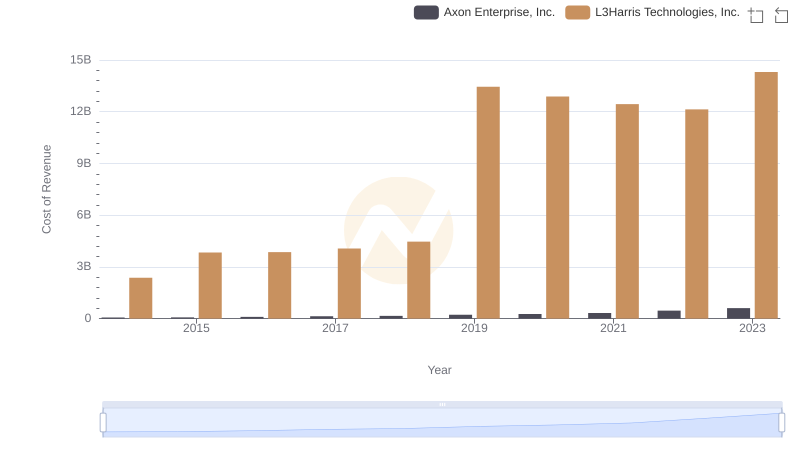

Axon Enterprise, Inc. vs L3Harris Technologies, Inc.: Efficiency in Cost of Revenue Explored

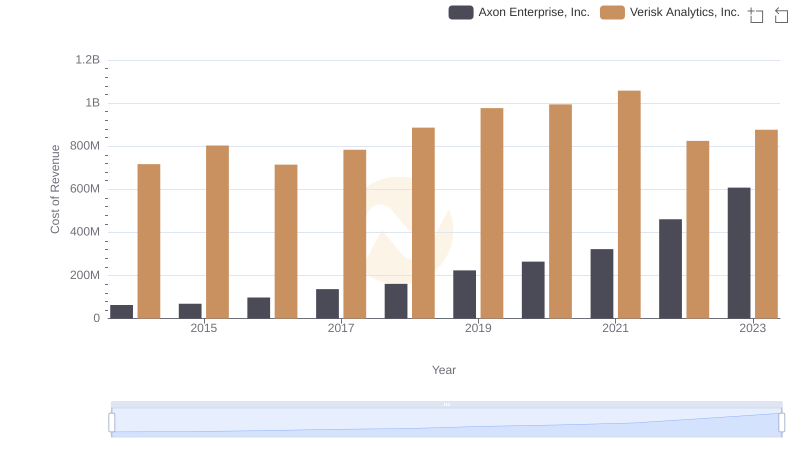

Comparing Cost of Revenue Efficiency: Axon Enterprise, Inc. vs Verisk Analytics, Inc.

Cost of Revenue Trends: Axon Enterprise, Inc. vs Ferguson plc

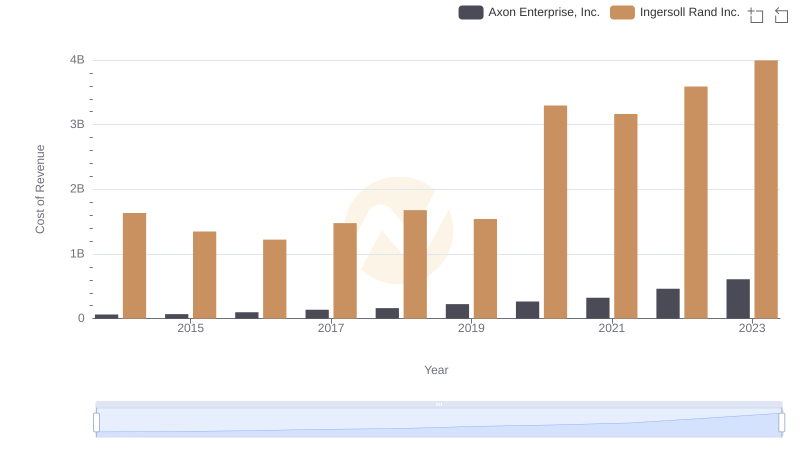

Analyzing Cost of Revenue: Axon Enterprise, Inc. and Ingersoll Rand Inc.