| __timestamp | Axon Enterprise, Inc. | Quanta Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 1233520000 |

| Thursday, January 1, 2015 | 128647000 | 923665000 |

| Friday, January 1, 2016 | 170536000 | 1013800000 |

| Sunday, January 1, 2017 | 207088000 | 1241860000 |

| Monday, January 1, 2018 | 258583000 | 1479964000 |

| Tuesday, January 1, 2019 | 307286000 | 1600252000 |

| Wednesday, January 1, 2020 | 416331000 | 1660847000 |

| Friday, January 1, 2021 | 540910000 | 1953259000 |

| Saturday, January 1, 2022 | 728638000 | 2529155000 |

| Sunday, January 1, 2023 | 955382000 | 2937086000 |

Infusing magic into the data realm

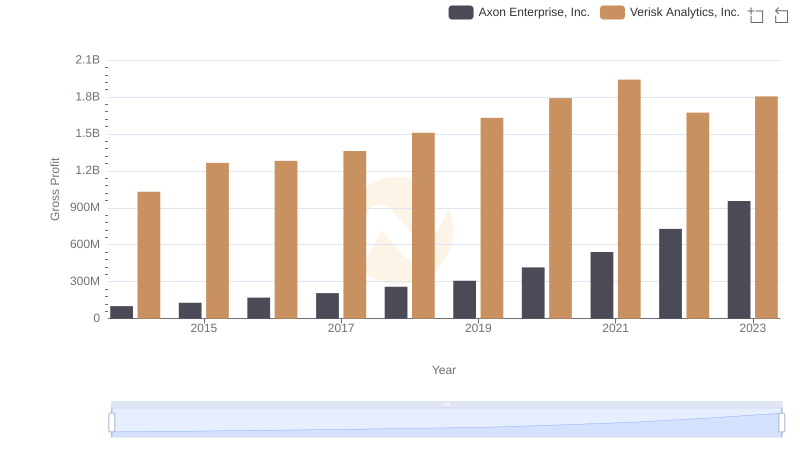

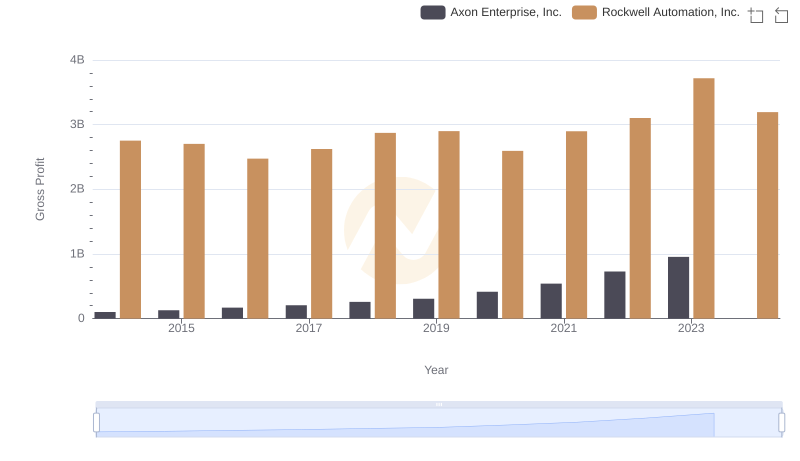

In the dynamic landscape of American business, understanding the financial health of companies is crucial. Over the past decade, Axon Enterprise, Inc. and Quanta Services, Inc. have demonstrated remarkable growth in their gross profits. From 2014 to 2023, Axon Enterprise's gross profit surged by approximately 840%, reflecting its strategic expansion and innovation in public safety technology. Meanwhile, Quanta Services, a leader in infrastructure solutions, saw its gross profit grow by around 140%, underscoring its robust position in the energy and communications sectors.

This analysis highlights the diverse strategies and market conditions influencing these two industry giants.

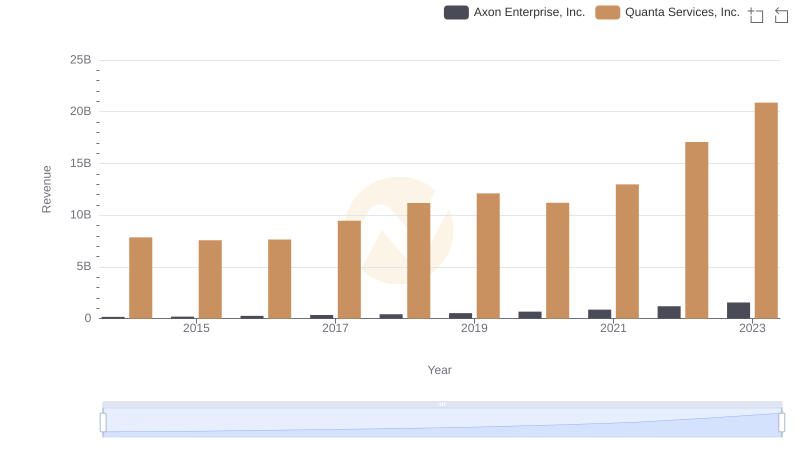

Breaking Down Revenue Trends: Axon Enterprise, Inc. vs Quanta Services, Inc.

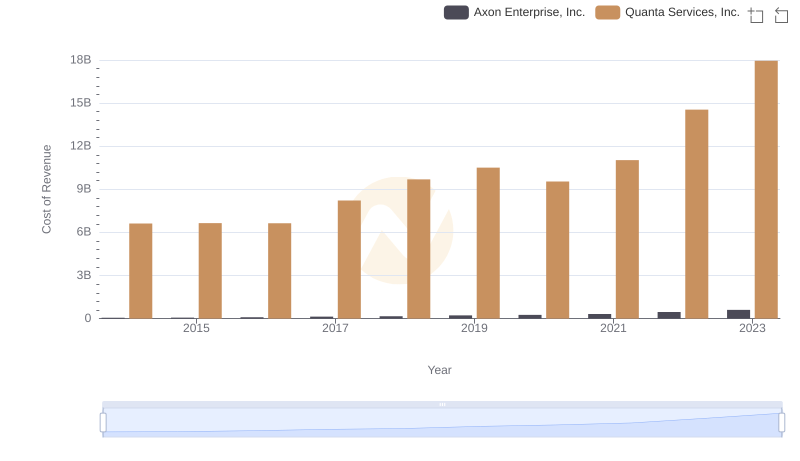

Axon Enterprise, Inc. vs Quanta Services, Inc.: Efficiency in Cost of Revenue Explored

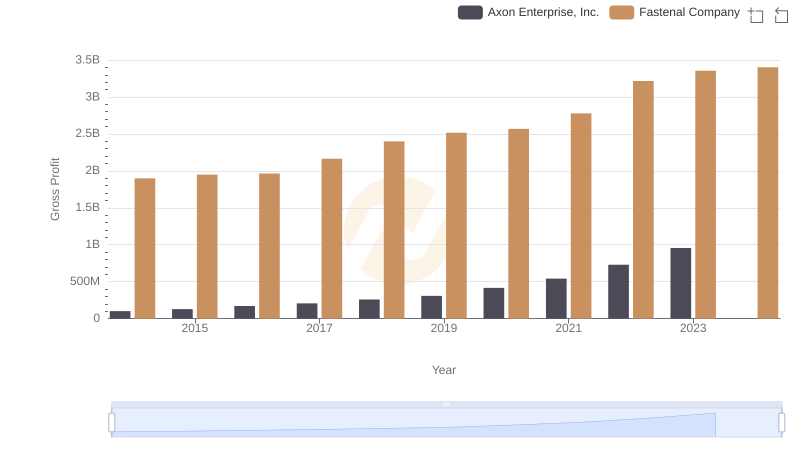

Axon Enterprise, Inc. and Fastenal Company: A Detailed Gross Profit Analysis

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Verisk Analytics, Inc.

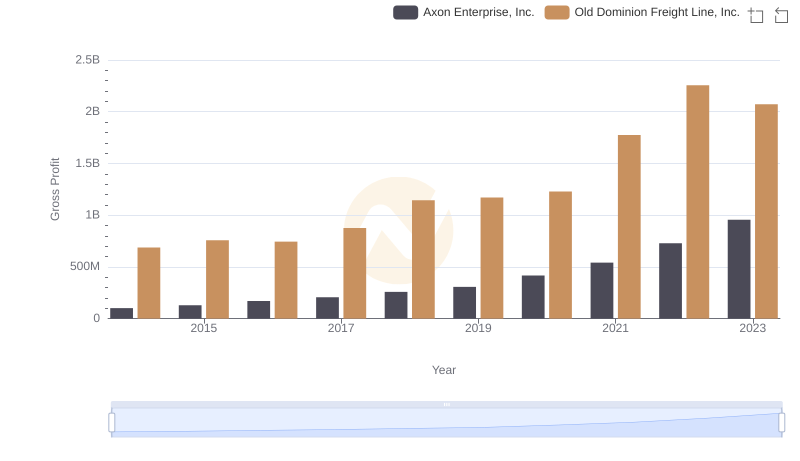

Axon Enterprise, Inc. vs Old Dominion Freight Line, Inc.: A Gross Profit Performance Breakdown

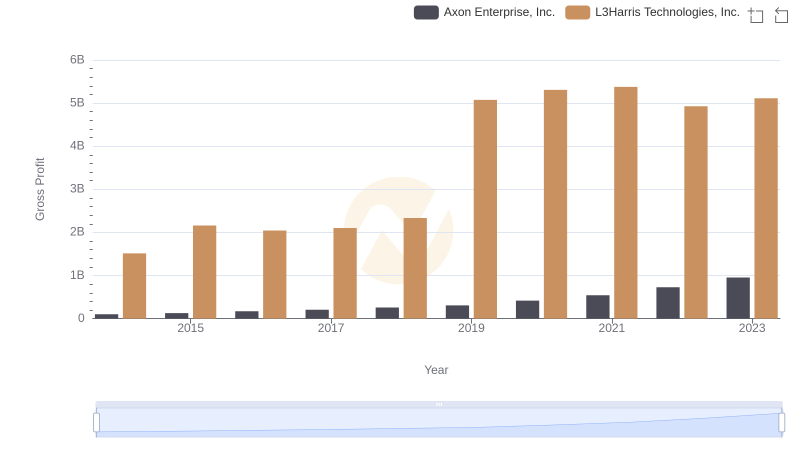

Axon Enterprise, Inc. vs L3Harris Technologies, Inc.: A Gross Profit Performance Breakdown

Gross Profit Trends Compared: Axon Enterprise, Inc. vs AMETEK, Inc.

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Ferguson plc

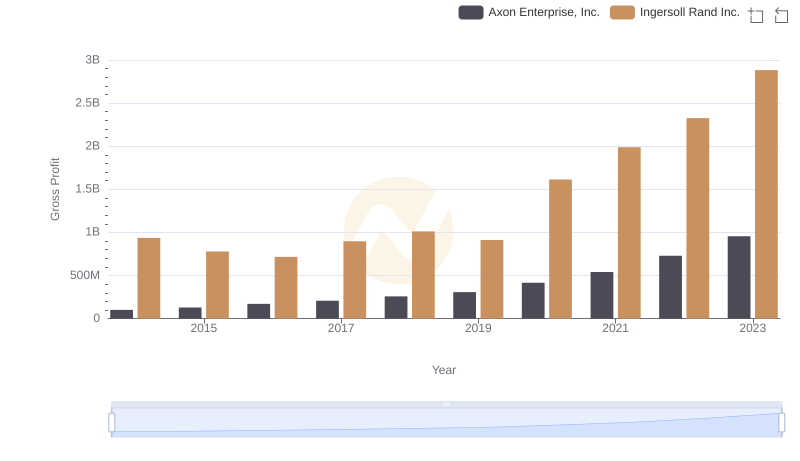

Axon Enterprise, Inc. and Ingersoll Rand Inc.: A Detailed Gross Profit Analysis

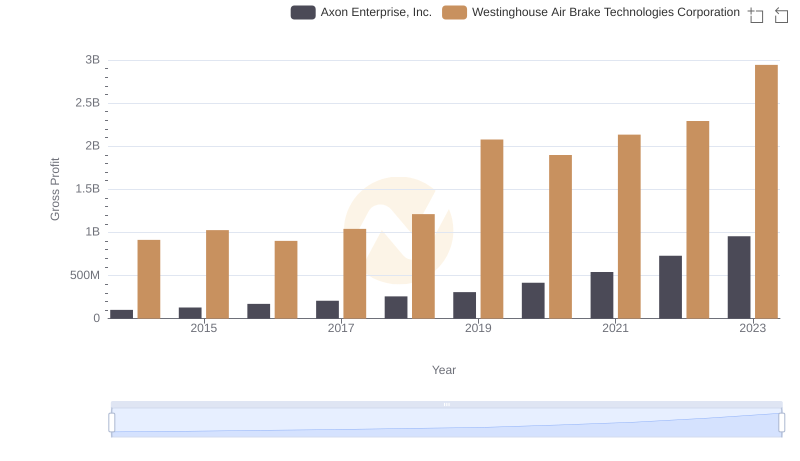

Key Insights on Gross Profit: Axon Enterprise, Inc. vs Westinghouse Air Brake Technologies Corporation

Axon Enterprise, Inc. and Rockwell Automation, Inc.: A Detailed Gross Profit Analysis