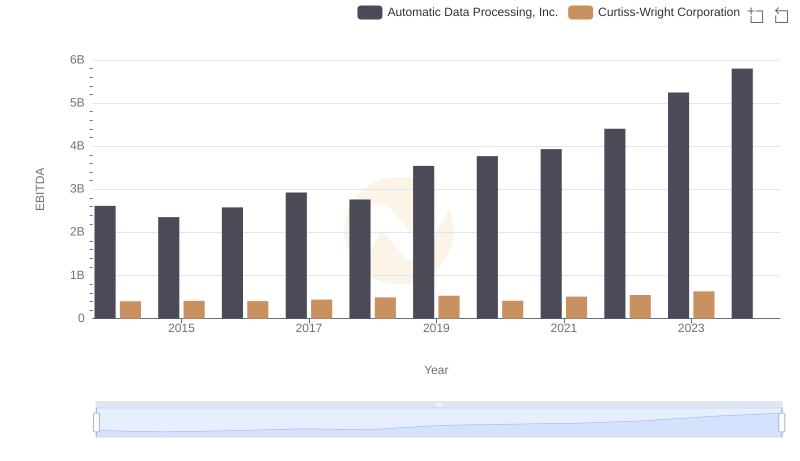

| __timestamp | Automatic Data Processing, Inc. | Nordson Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 427302000 |

| Thursday, January 1, 2015 | 2355100000 | 384160000 |

| Friday, January 1, 2016 | 2579500000 | 460120000 |

| Sunday, January 1, 2017 | 2927200000 | 547746000 |

| Monday, January 1, 2018 | 2762900000 | 606502000 |

| Tuesday, January 1, 2019 | 3544500000 | 588493000 |

| Wednesday, January 1, 2020 | 3769700000 | 446951000 |

| Friday, January 1, 2021 | 3931600000 | 703550000 |

| Saturday, January 1, 2022 | 4405500000 | 771615000 |

| Sunday, January 1, 2023 | 5244600000 | 786742000 |

| Monday, January 1, 2024 | 5800000000 | 674001000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. Over the past decade, Automatic Data Processing, Inc. (ADP) and Nordson Corporation have demonstrated contrasting trajectories in their EBITDA performance.

From 2014 to 2024, ADP's EBITDA has surged by approximately 122%, reflecting its robust business model and strategic growth initiatives. Notably, the company experienced a significant leap in 2023, with a 19% increase from the previous year, underscoring its resilience in a competitive market.

Nordson, while smaller in scale, has shown a commendable 58% growth in EBITDA over the same period. The company's peak performance in 2023, with a 12% rise from 2022, highlights its ability to adapt and thrive amidst industry challenges.

This comparative analysis offers valuable insights into the financial health and strategic direction of these two industry leaders.

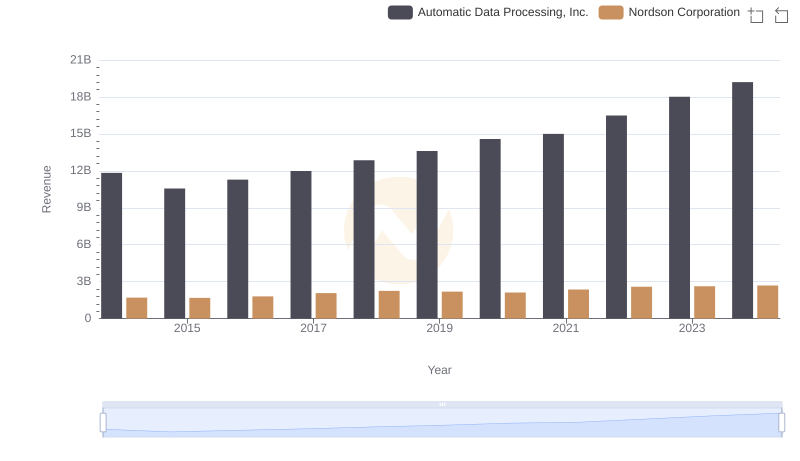

Who Generates More Revenue? Automatic Data Processing, Inc. or Nordson Corporation

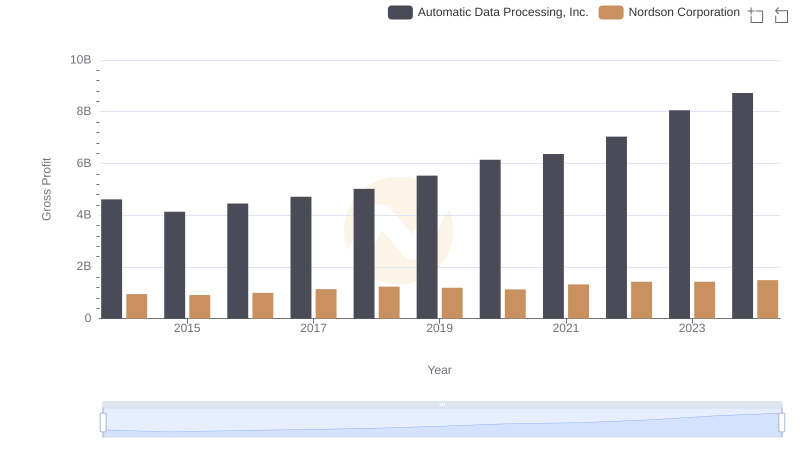

Gross Profit Trends Compared: Automatic Data Processing, Inc. vs Nordson Corporation

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Curtiss-Wright Corporation

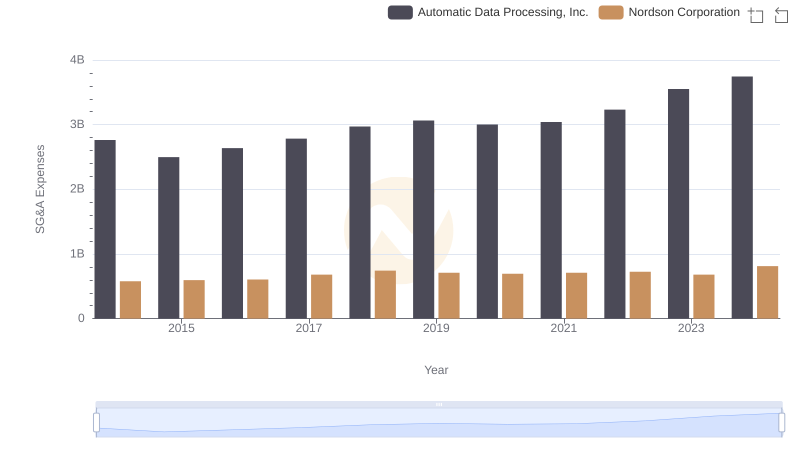

Automatic Data Processing, Inc. vs Nordson Corporation: SG&A Expense Trends

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to U-Haul Holding Company

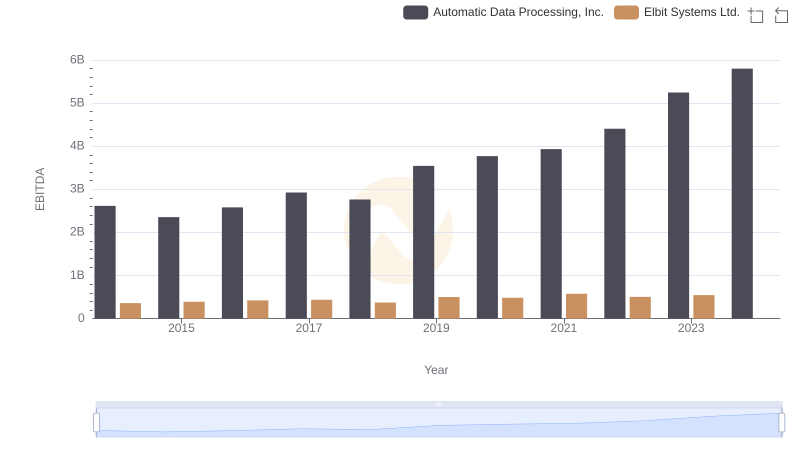

Comprehensive EBITDA Comparison: Automatic Data Processing, Inc. vs Elbit Systems Ltd.

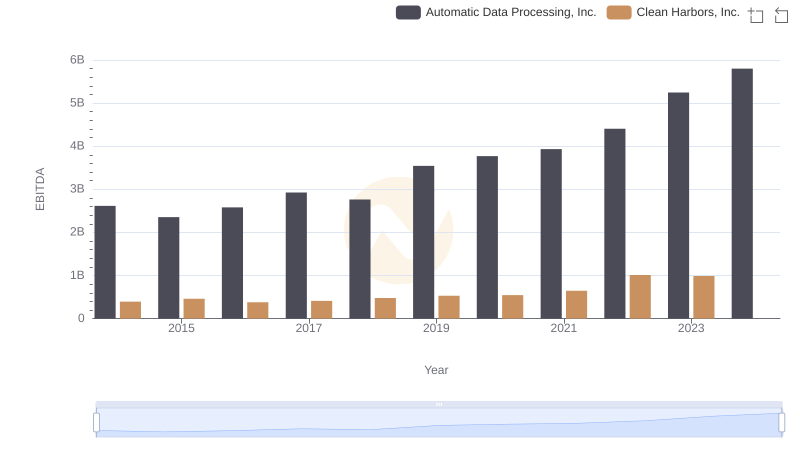

EBITDA Performance Review: Automatic Data Processing, Inc. vs Clean Harbors, Inc.

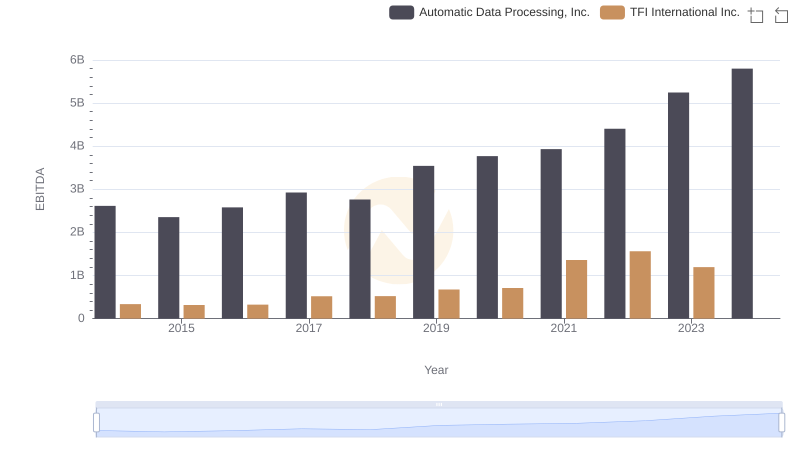

Automatic Data Processing, Inc. vs TFI International Inc.: In-Depth EBITDA Performance Comparison

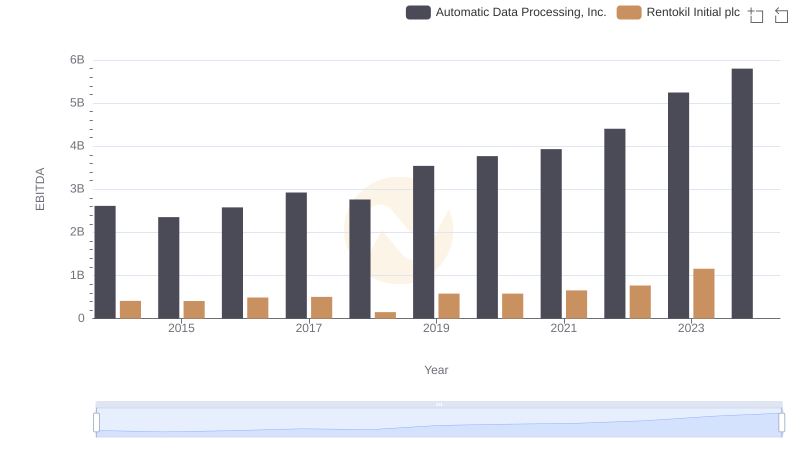

A Side-by-Side Analysis of EBITDA: Automatic Data Processing, Inc. and Rentokil Initial plc