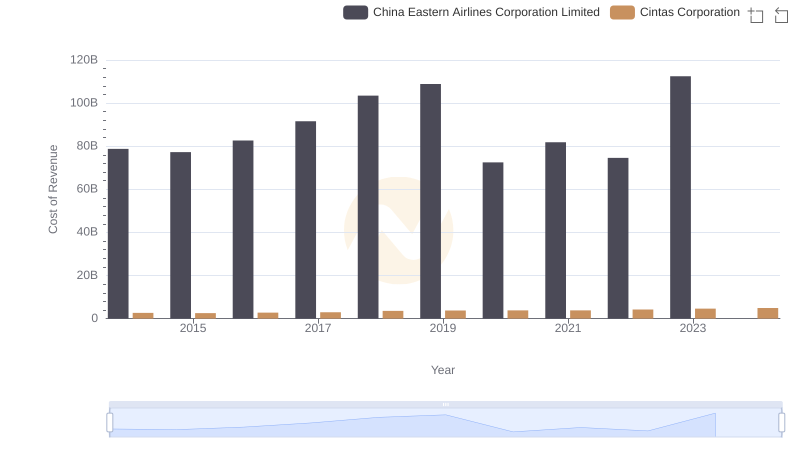

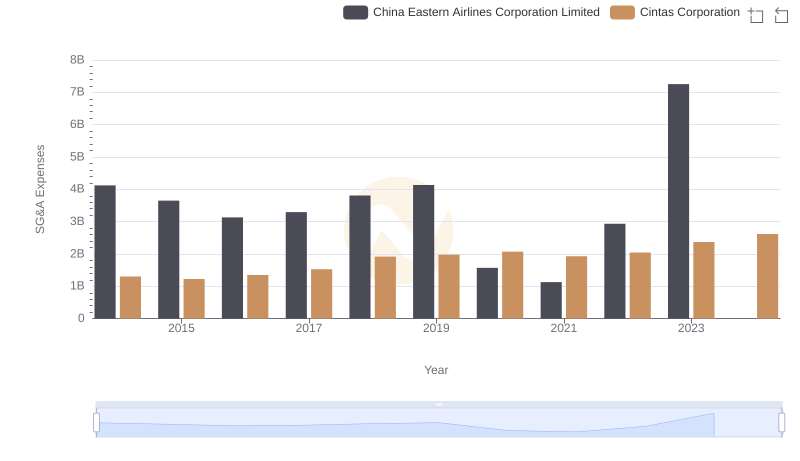

| __timestamp | China Eastern Airlines Corporation Limited | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 90185000000 | 4551812000 |

| Thursday, January 1, 2015 | 93969000000 | 4476886000 |

| Friday, January 1, 2016 | 98904000000 | 4905458000 |

| Sunday, January 1, 2017 | 102475000000 | 5323381000 |

| Monday, January 1, 2018 | 115210000000 | 6476632000 |

| Tuesday, January 1, 2019 | 120796000000 | 6892303000 |

| Wednesday, January 1, 2020 | 58470000000 | 7085120000 |

| Friday, January 1, 2021 | 66887000000 | 7116340000 |

| Saturday, January 1, 2022 | 46111000000 | 7854459000 |

| Sunday, January 1, 2023 | 113741000000 | 8815769000 |

| Monday, January 1, 2024 | 9596615000 |

Igniting the spark of knowledge

In the ever-evolving landscape of global business, Cintas Corporation and China Eastern Airlines stand as titans in their respective industries. From 2014 to 2023, these companies have showcased contrasting revenue trajectories. Cintas, a leader in corporate identity uniforms, has seen a steady climb in revenue, growing by approximately 94% over the decade. In contrast, China Eastern Airlines, a major player in the aviation sector, experienced a more volatile journey. Despite a dip in 2020, likely due to the global pandemic, the airline rebounded with a 146% increase in revenue by 2023 compared to its lowest point in 2020. This comparison highlights the resilience and adaptability of these companies amidst global challenges. As we look to the future, the missing data for 2024 leaves us anticipating how these giants will continue to navigate the economic skies.

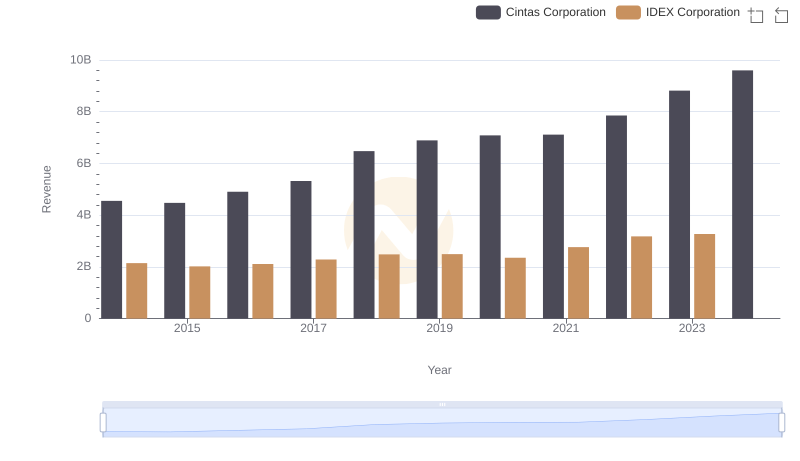

Comparing Revenue Performance: Cintas Corporation or IDEX Corporation?

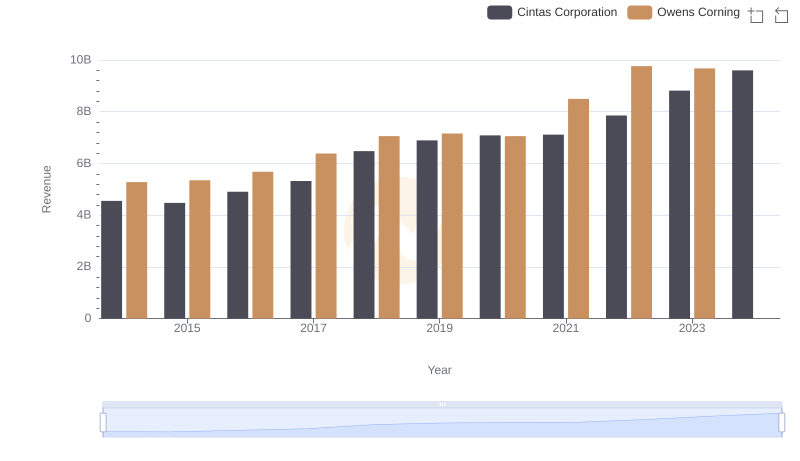

Cintas Corporation and Owens Corning: A Comprehensive Revenue Analysis

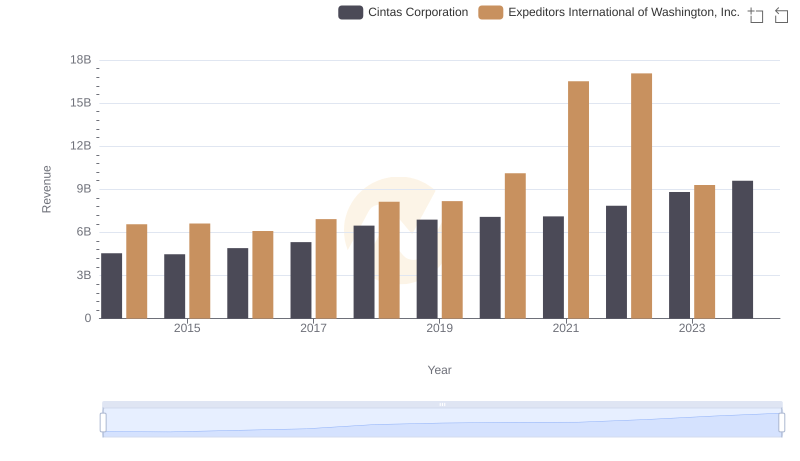

Cintas Corporation or Expeditors International of Washington, Inc.: Who Leads in Yearly Revenue?

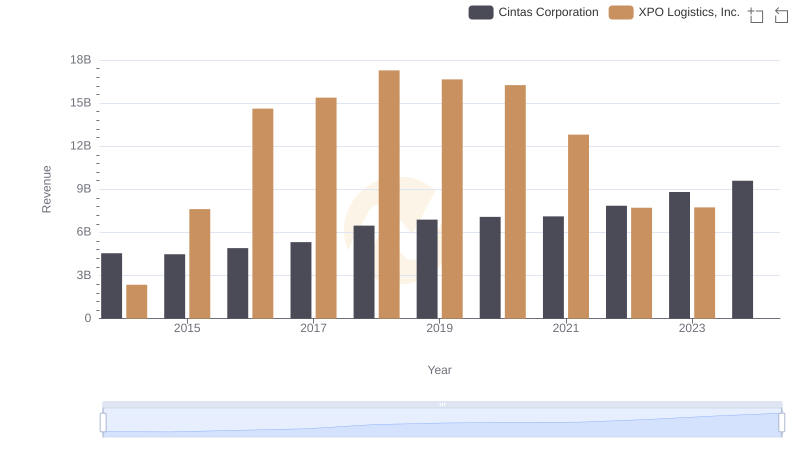

Breaking Down Revenue Trends: Cintas Corporation vs XPO Logistics, Inc.

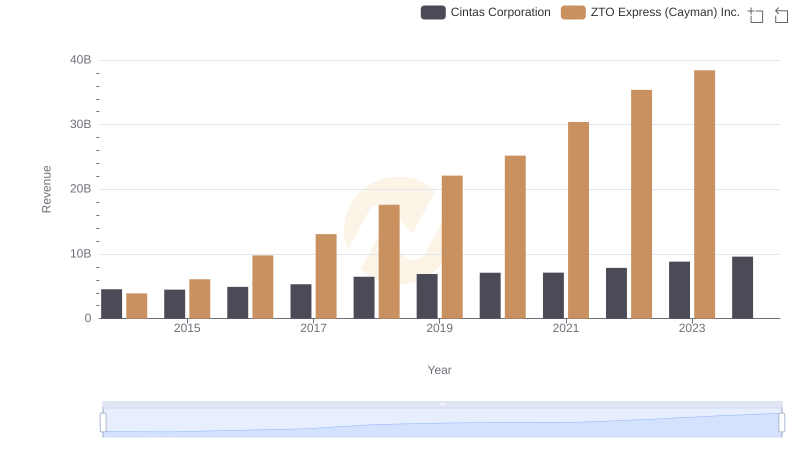

Annual Revenue Comparison: Cintas Corporation vs ZTO Express (Cayman) Inc.

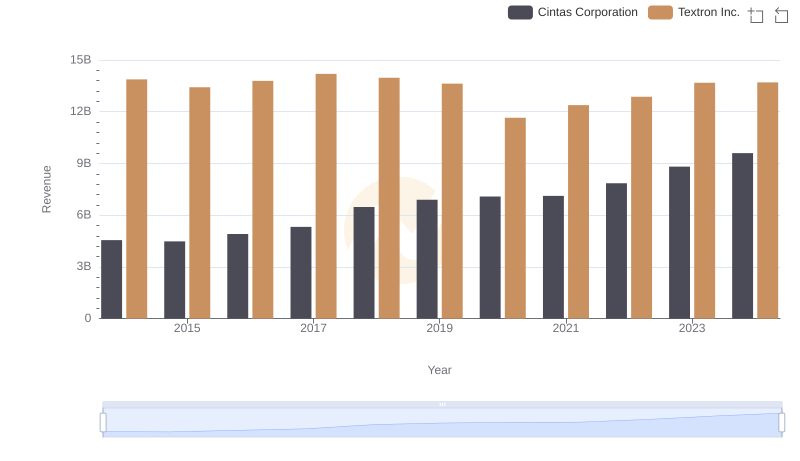

Cintas Corporation vs Textron Inc.: Annual Revenue Growth Compared

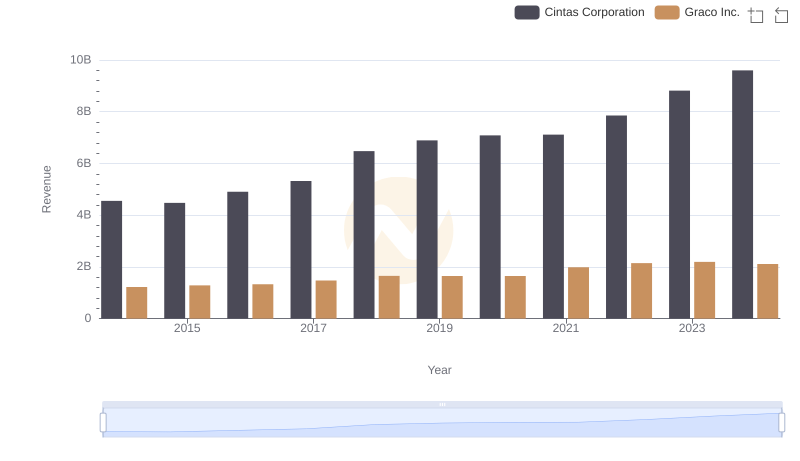

Cintas Corporation and Graco Inc.: A Comprehensive Revenue Analysis

Analyzing Cost of Revenue: Cintas Corporation and China Eastern Airlines Corporation Limited

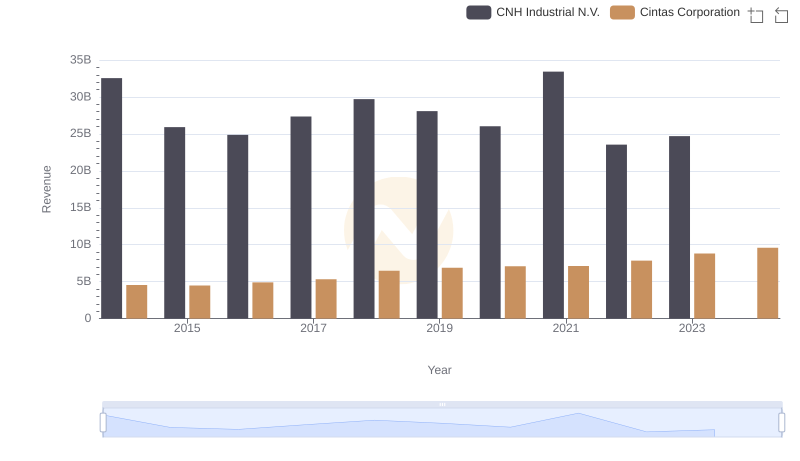

Cintas Corporation and CNH Industrial N.V.: A Comprehensive Revenue Analysis

Cintas Corporation and China Eastern Airlines Corporation Limited: SG&A Spending Patterns Compared