| __timestamp | Masco Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6134000000 | 3869600000 |

| Thursday, January 1, 2015 | 4889000000 | 3604800000 |

| Friday, January 1, 2016 | 4901000000 | 3404000000 |

| Sunday, January 1, 2017 | 5033000000 | 3687100000 |

| Monday, January 1, 2018 | 5670000000 | 3793800000 |

| Tuesday, January 1, 2019 | 4336000000 | 3794700000 |

| Wednesday, January 1, 2020 | 4601000000 | 3734600000 |

| Friday, January 1, 2021 | 5512000000 | 4099700000 |

| Saturday, January 1, 2022 | 5967000000 | 4658400000 |

| Sunday, January 1, 2023 | 5131000000 | 5341000000 |

| Monday, January 1, 2024 | 4997000000 | 5070800000 |

Igniting the spark of knowledge

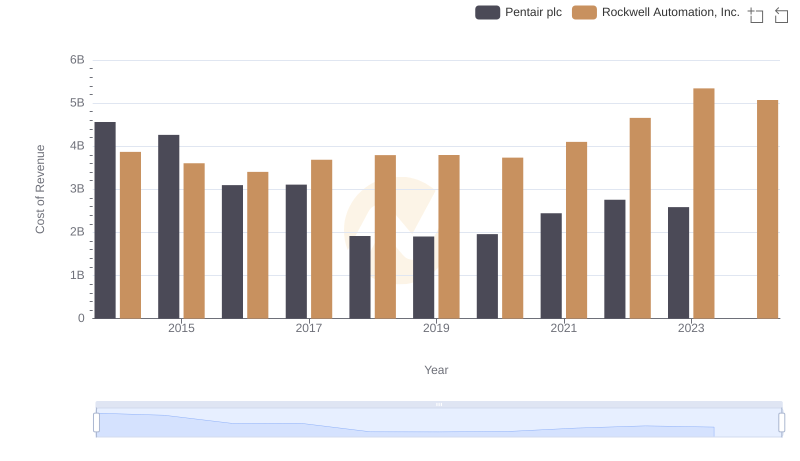

In the ever-evolving landscape of industrial automation and home improvement, Rockwell Automation, Inc. and Masco Corporation stand as titans. From 2014 to 2023, these companies have navigated the complexities of cost management with varying strategies. Masco Corporation, a leader in home improvement, saw its cost of revenue peak in 2014, only to experience a 20% decline by 2019. However, a resurgence in 2022 marked a 38% increase from its lowest point, reflecting strategic adjustments in its operations. Meanwhile, Rockwell Automation, Inc., a pioneer in industrial automation, demonstrated a steady climb, with a notable 38% increase in cost of revenue from 2014 to 2023. This growth underscores its commitment to innovation and expansion. Interestingly, 2024 data for Masco is missing, leaving room for speculation on its future trajectory. As these giants continue to evolve, their financial strategies offer valuable insights into industry trends.

Who Generates More Revenue? Rockwell Automation, Inc. or Masco Corporation

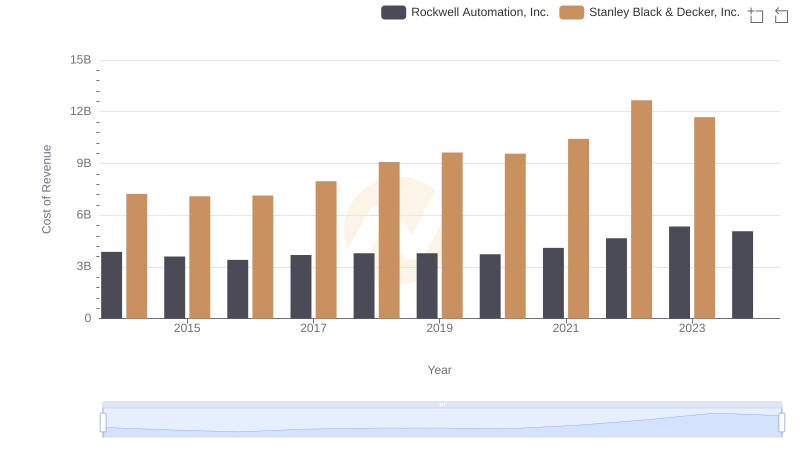

Comparing Cost of Revenue Efficiency: Rockwell Automation, Inc. vs Stanley Black & Decker, Inc.

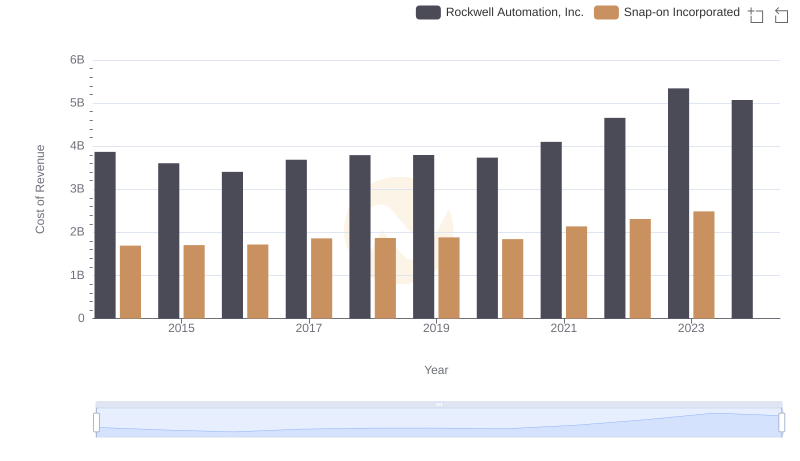

Cost Insights: Breaking Down Rockwell Automation, Inc. and Snap-on Incorporated's Expenses

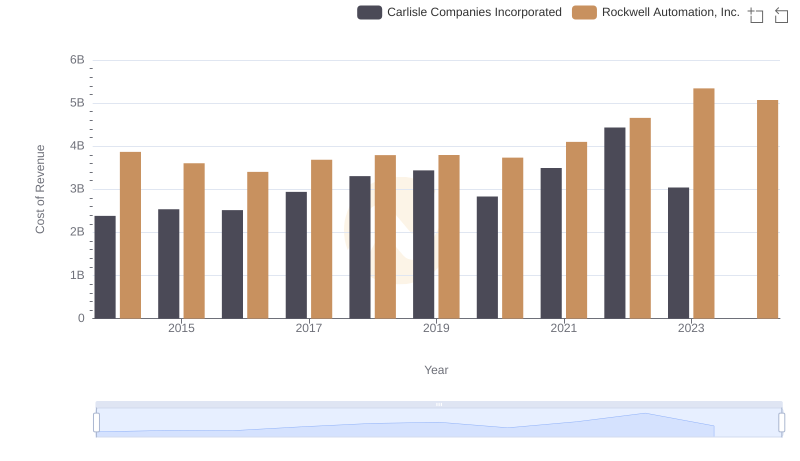

Cost of Revenue Trends: Rockwell Automation, Inc. vs Carlisle Companies Incorporated

Rockwell Automation, Inc. vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

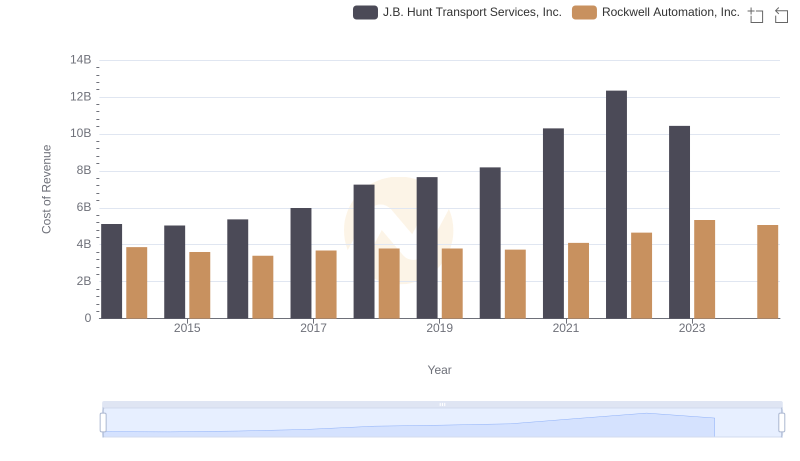

Analyzing Cost of Revenue: Rockwell Automation, Inc. and J.B. Hunt Transport Services, Inc.

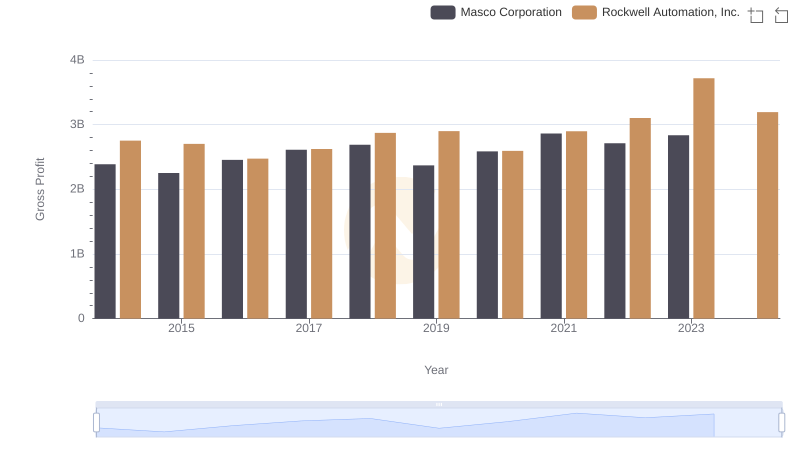

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Masco Corporation

Cost of Revenue Trends: Rockwell Automation, Inc. vs Pentair plc

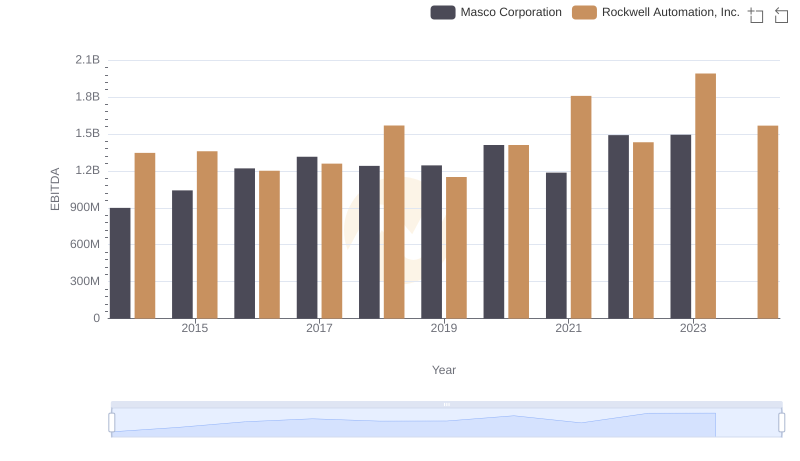

Professional EBITDA Benchmarking: Rockwell Automation, Inc. vs Masco Corporation