| __timestamp | Pentair plc | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4563000000 | 3869600000 |

| Thursday, January 1, 2015 | 4263200000 | 3604800000 |

| Friday, January 1, 2016 | 3095900000 | 3404000000 |

| Sunday, January 1, 2017 | 3107400000 | 3687100000 |

| Monday, January 1, 2018 | 1917400000 | 3793800000 |

| Tuesday, January 1, 2019 | 1905700000 | 3794700000 |

| Wednesday, January 1, 2020 | 1960200000 | 3734600000 |

| Friday, January 1, 2021 | 2445600000 | 4099700000 |

| Saturday, January 1, 2022 | 2757200000 | 4658400000 |

| Sunday, January 1, 2023 | 2585300000 | 5341000000 |

| Monday, January 1, 2024 | 2484000000 | 5070800000 |

Infusing magic into the data realm

In the ever-evolving landscape of industrial automation and water solutions, understanding cost dynamics is crucial. From 2014 to 2023, Rockwell Automation, Inc. and Pentair plc have shown distinct trends in their cost of revenue. Rockwell Automation's cost of revenue has seen a steady increase, peaking in 2023 with a 38% rise from 2014. This reflects their strategic investments in automation technologies. In contrast, Pentair plc experienced a significant decline of 43% from 2014 to 2019, likely due to restructuring and divestitures. However, a resurgence is noted post-2020, with a 36% increase by 2022, indicating a recovery in their operational efficiency. The data for 2024 is incomplete, highlighting the need for continuous monitoring. These trends offer valuable insights into the financial strategies and market positioning of these industrial giants.

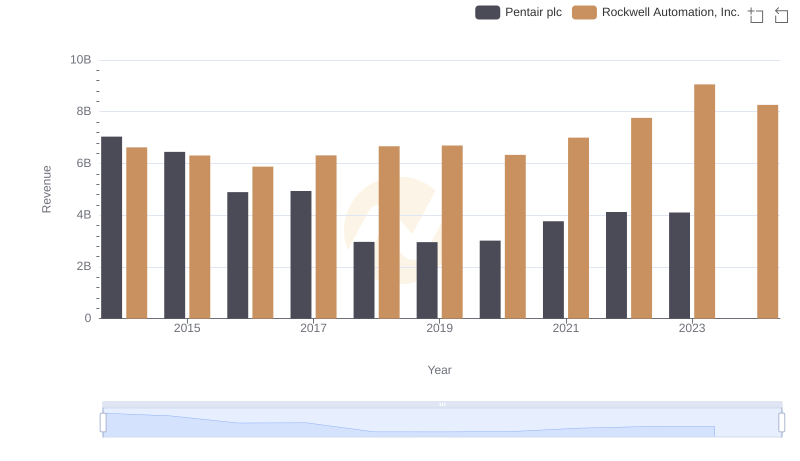

Revenue Insights: Rockwell Automation, Inc. and Pentair plc Performance Compared

Rockwell Automation, Inc. vs Booz Allen Hamilton Holding Corporation: Efficiency in Cost of Revenue Explored

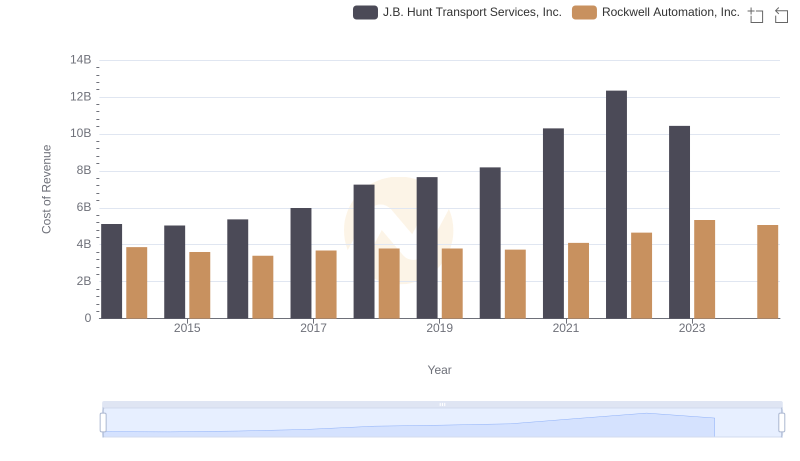

Analyzing Cost of Revenue: Rockwell Automation, Inc. and J.B. Hunt Transport Services, Inc.

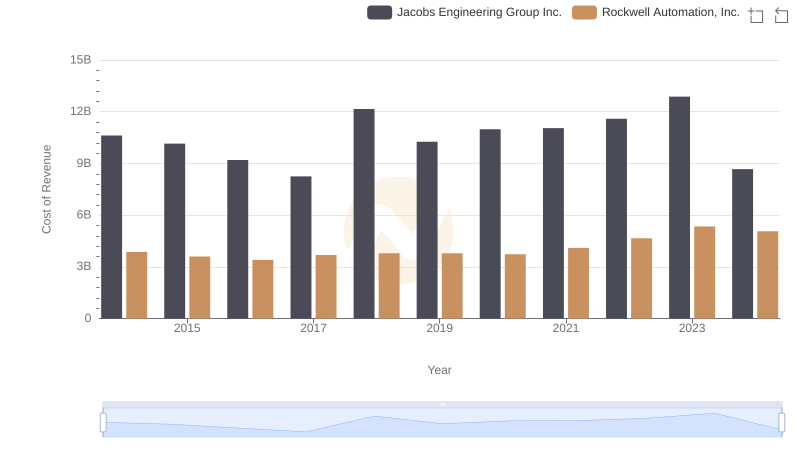

Cost of Revenue: Key Insights for Rockwell Automation, Inc. and Jacobs Engineering Group Inc.

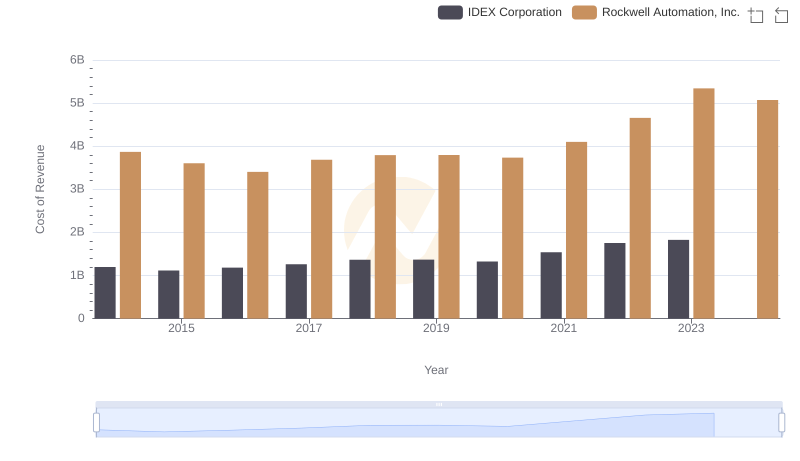

Cost Insights: Breaking Down Rockwell Automation, Inc. and IDEX Corporation's Expenses

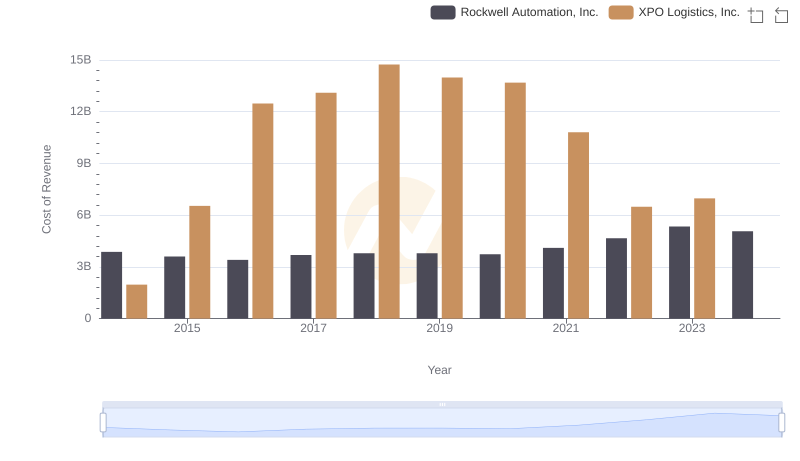

Cost of Revenue: Key Insights for Rockwell Automation, Inc. and XPO Logistics, Inc.

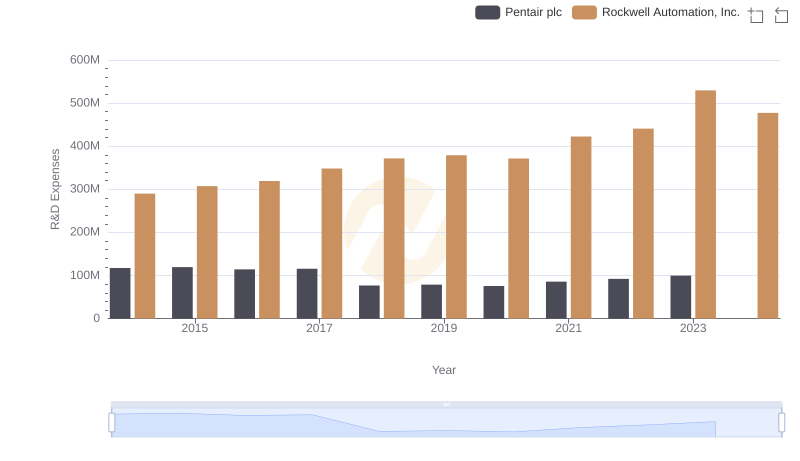

Research and Development: Comparing Key Metrics for Rockwell Automation, Inc. and Pentair plc

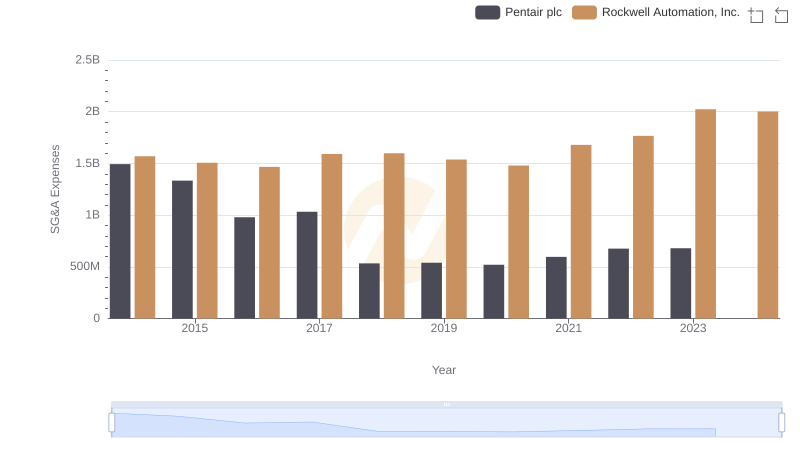

Rockwell Automation, Inc. vs Pentair plc: SG&A Expense Trends

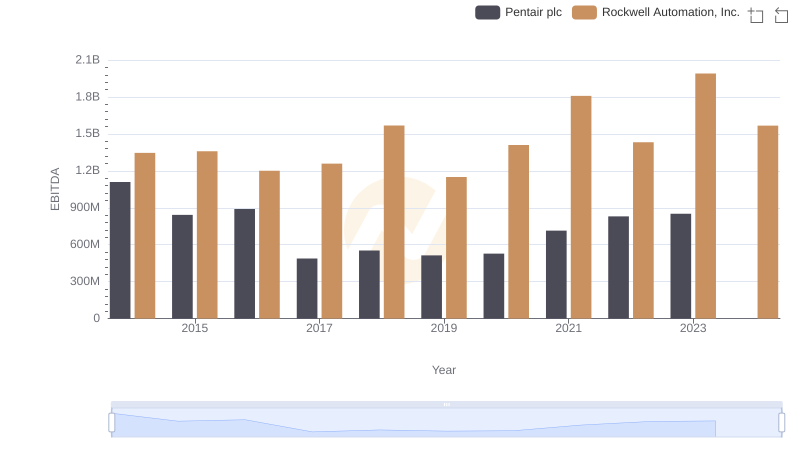

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs Pentair plc