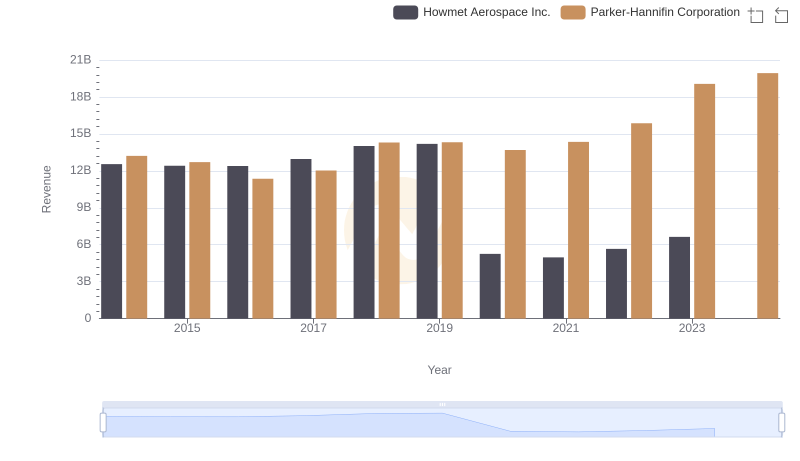

| __timestamp | Howmet Aerospace Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 10349000000 | 10188227000 |

| Thursday, January 1, 2015 | 10104000000 | 9655245000 |

| Friday, January 1, 2016 | 9806000000 | 8823384000 |

| Sunday, January 1, 2017 | 10357000000 | 9188962000 |

| Monday, January 1, 2018 | 11397000000 | 10762841000 |

| Tuesday, January 1, 2019 | 11227000000 | 10703484000 |

| Wednesday, January 1, 2020 | 3878000000 | 10286518000 |

| Friday, January 1, 2021 | 3596000000 | 10449680000 |

| Saturday, January 1, 2022 | 4103000000 | 11387267000 |

| Sunday, January 1, 2023 | 4773000000 | 12635892000 |

| Monday, January 1, 2024 | 5119000000 | 12801816000 |

In pursuit of knowledge

In the ever-evolving landscape of industrial manufacturing, Parker-Hannifin Corporation and Howmet Aerospace Inc. stand as titans. From 2014 to 2023, these companies have showcased distinct trajectories in their cost of revenue. Parker-Hannifin, a leader in motion and control technologies, has seen a steady increase, peaking in 2023 with a 24% rise from 2014. Meanwhile, Howmet Aerospace, renowned for its advanced engineering solutions, experienced a significant dip in 2020, with costs plummeting by over 60% compared to 2019, before gradually recovering. This divergence highlights the resilience and adaptability of these corporations amidst global challenges. Notably, Parker-Hannifin's consistent growth underscores its robust market strategies, while Howmet's recovery post-2020 reflects its strategic pivots in response to industry demands. As we look to 2024, Parker-Hannifin's data remains promising, though Howmet's figures are yet to be revealed.

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs Howmet Aerospace Inc.

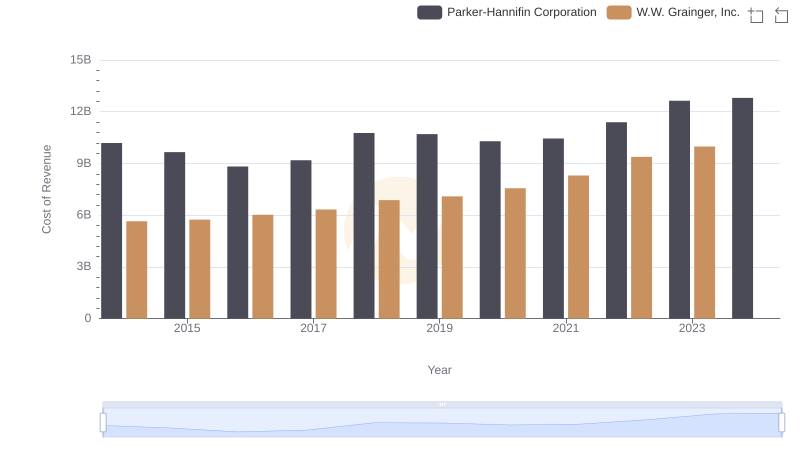

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs W.W. Grainger, Inc.

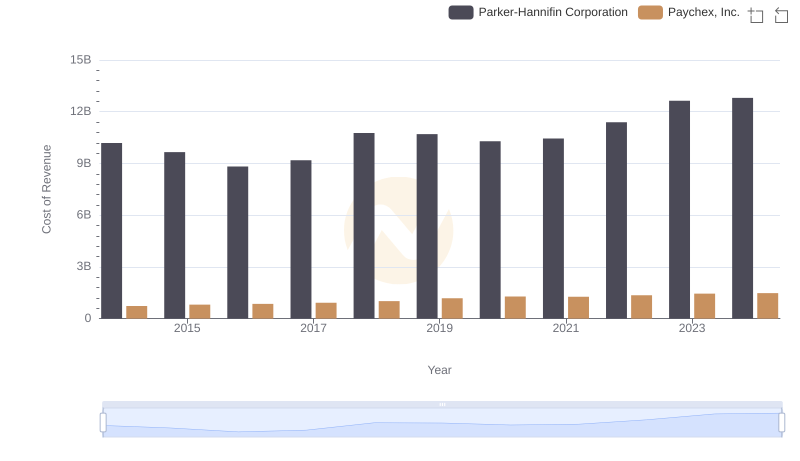

Comparing Cost of Revenue Efficiency: Parker-Hannifin Corporation vs Paychex, Inc.

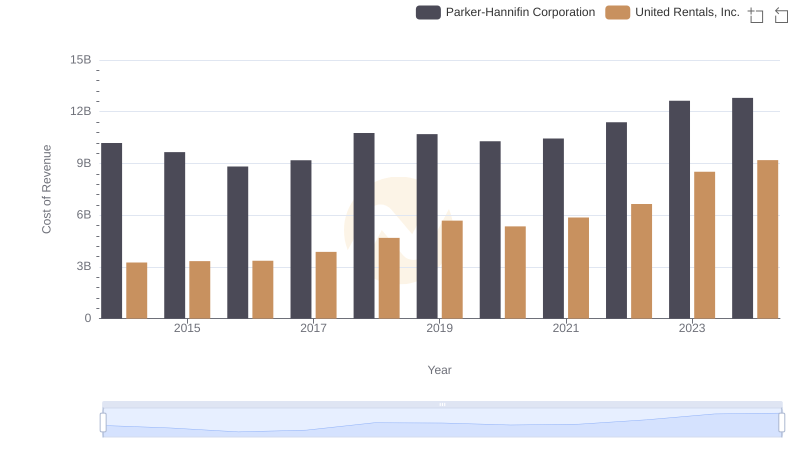

Analyzing Cost of Revenue: Parker-Hannifin Corporation and United Rentals, Inc.

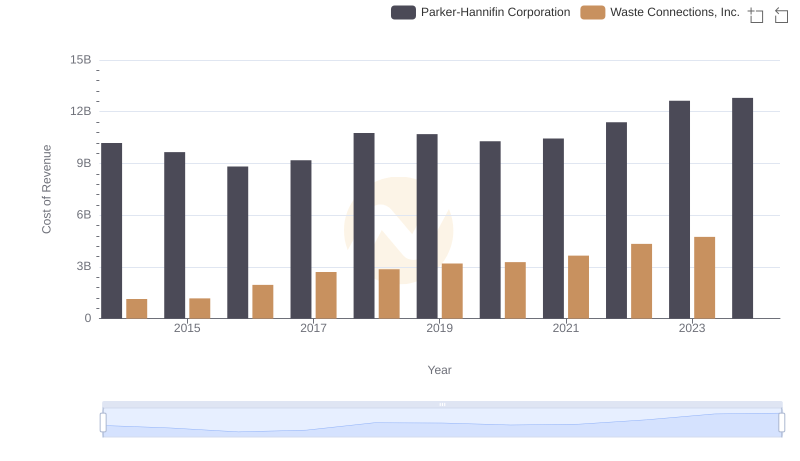

Cost Insights: Breaking Down Parker-Hannifin Corporation and Waste Connections, Inc.'s Expenses

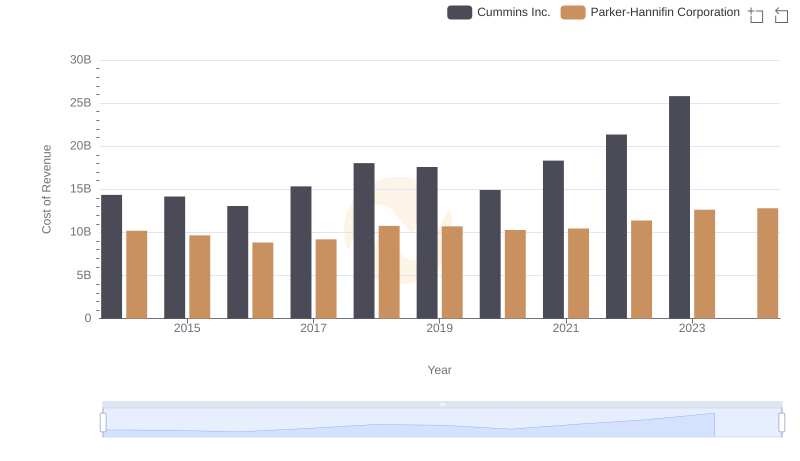

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Cummins Inc.

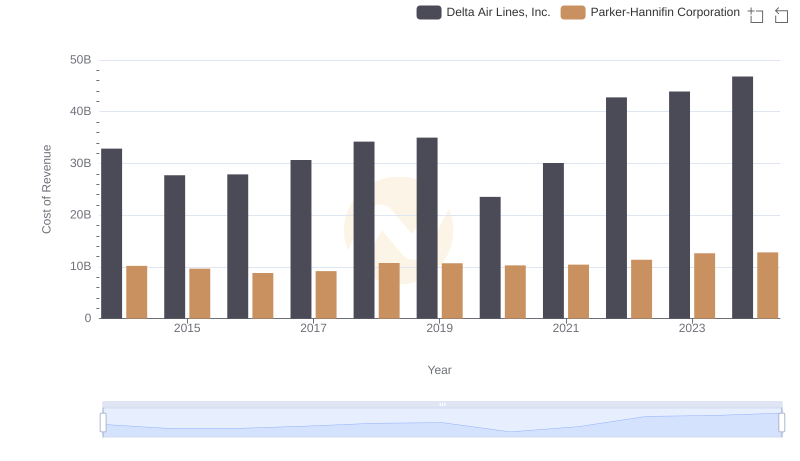

Cost of Revenue Trends: Parker-Hannifin Corporation vs Delta Air Lines, Inc.

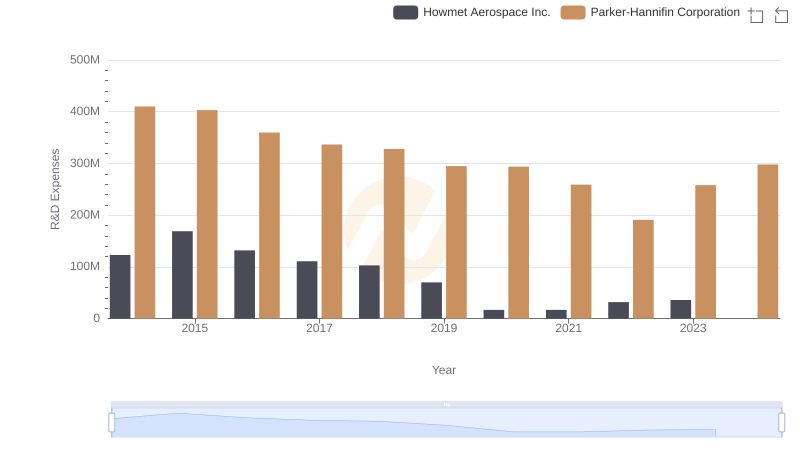

Analyzing R&D Budgets: Parker-Hannifin Corporation vs Howmet Aerospace Inc.

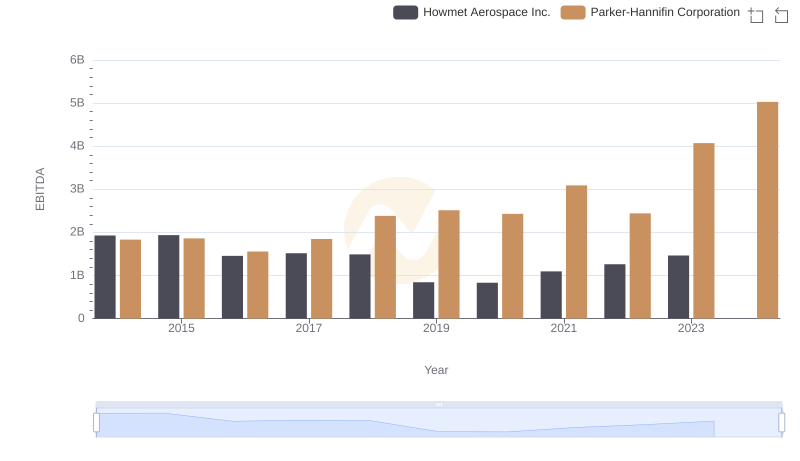

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and Howmet Aerospace Inc.