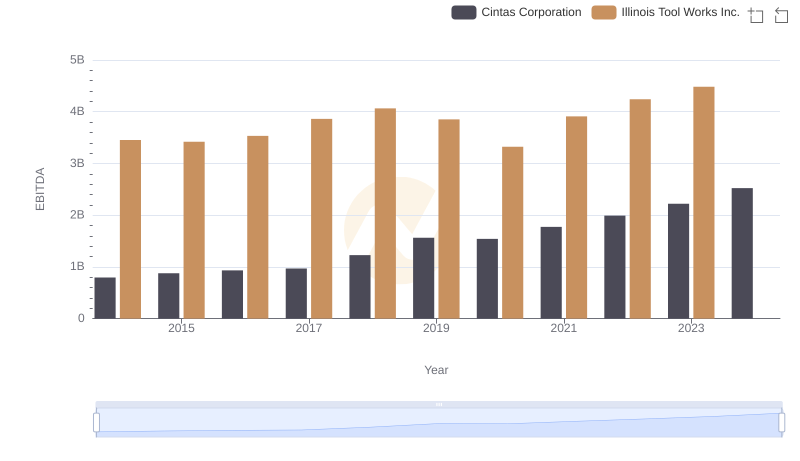

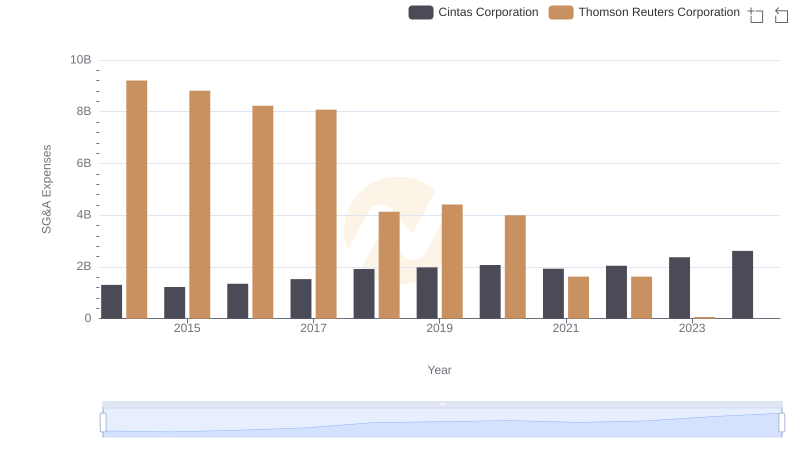

| __timestamp | Cintas Corporation | Thomson Reuters Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 4289000000 |

| Thursday, January 1, 2015 | 877761000 | 3151000000 |

| Friday, January 1, 2016 | 933728000 | 2999000000 |

| Sunday, January 1, 2017 | 968293000 | 1495930891 |

| Monday, January 1, 2018 | 1227852000 | 1345686008 |

| Tuesday, January 1, 2019 | 1564228000 | 1913474675 |

| Wednesday, January 1, 2020 | 1542737000 | 2757000000 |

| Friday, January 1, 2021 | 1773591000 | 1994296441 |

| Saturday, January 1, 2022 | 1990046000 | 3010000000 |

| Sunday, January 1, 2023 | 2221676000 | 2950000000 |

| Monday, January 1, 2024 | 2523857000 |

Cracking the code

In the ever-evolving landscape of corporate finance, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a crucial metric for evaluating a company's operational performance. This analysis delves into the EBITDA trends of Cintas Corporation and Thomson Reuters Corporation from 2014 to 2023.

Cintas Corporation has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 218% over the decade. Starting at around $794 million in 2014, it reached a peak of $2.52 billion in 2023. In contrast, Thomson Reuters experienced a more fluctuating pattern, with its EBITDA peaking at $4.29 billion in 2014 and then stabilizing around $2.95 billion by 2023.

This comparison highlights Cintas's consistent upward momentum, while Thomson Reuters faced more variability, reflecting differing strategic and market dynamics.

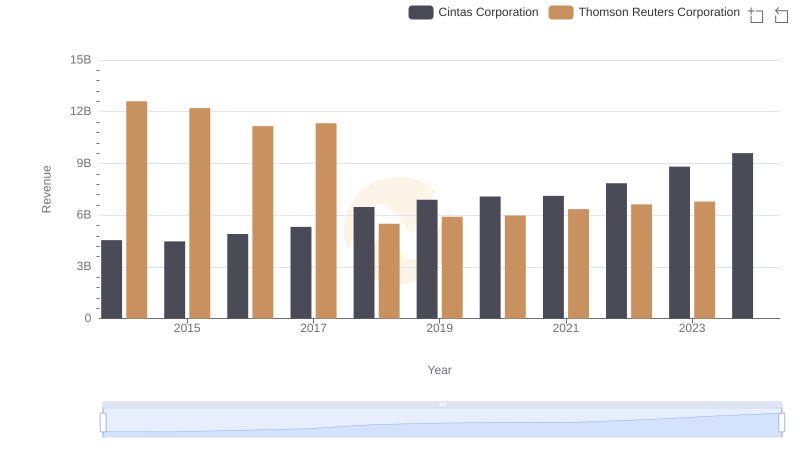

Breaking Down Revenue Trends: Cintas Corporation vs Thomson Reuters Corporation

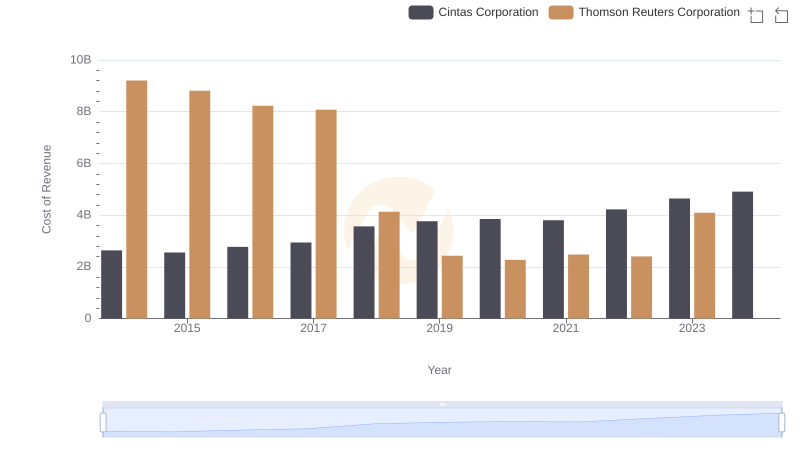

Cost Insights: Breaking Down Cintas Corporation and Thomson Reuters Corporation's Expenses

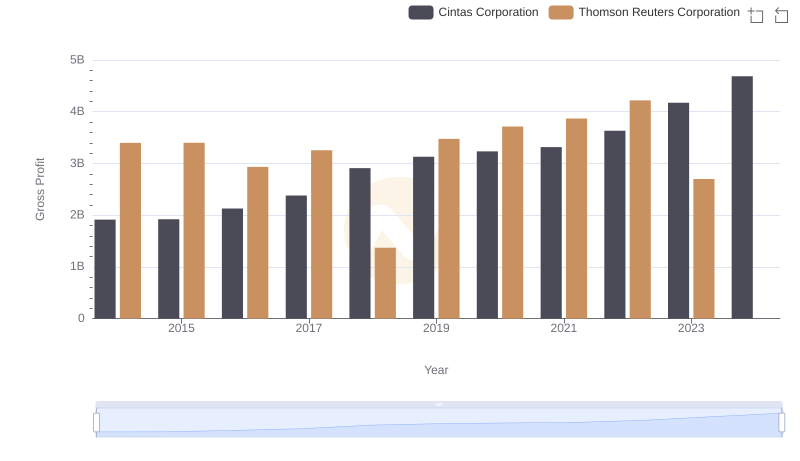

Cintas Corporation and Thomson Reuters Corporation: A Detailed Gross Profit Analysis

Cintas Corporation vs Illinois Tool Works Inc.: In-Depth EBITDA Performance Comparison

Cost Management Insights: SG&A Expenses for Cintas Corporation and Thomson Reuters Corporation

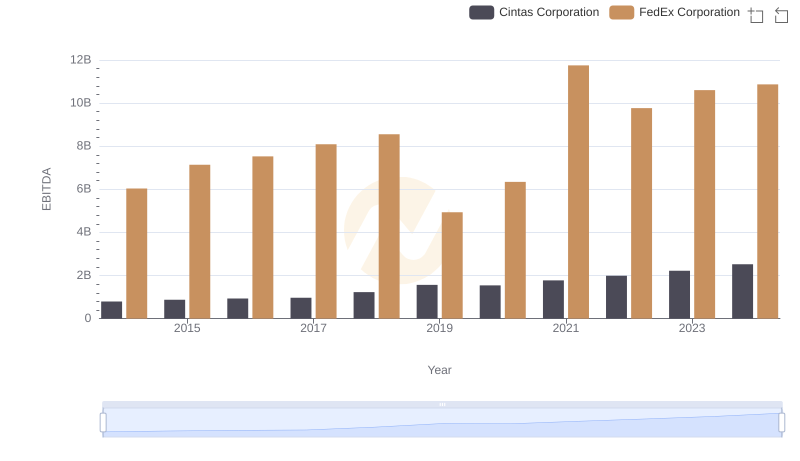

Professional EBITDA Benchmarking: Cintas Corporation vs FedEx Corporation

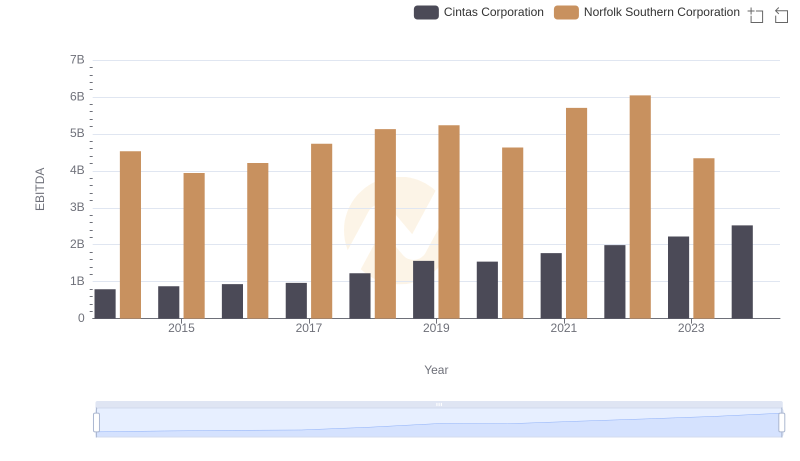

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Norfolk Southern Corporation

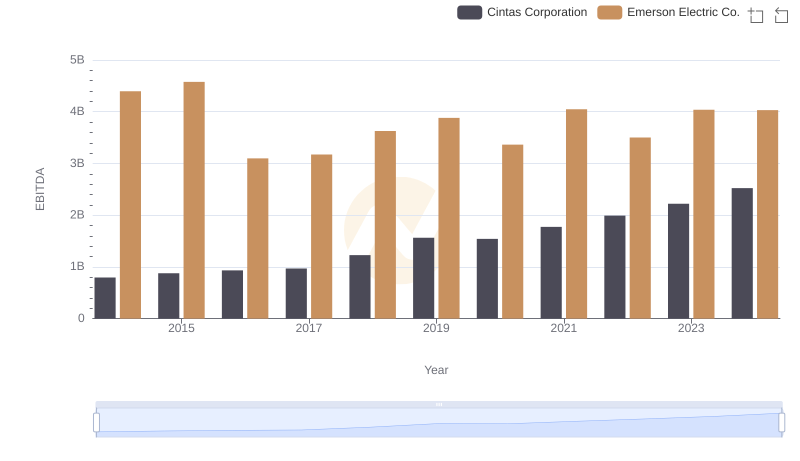

Comparative EBITDA Analysis: Cintas Corporation vs Emerson Electric Co.

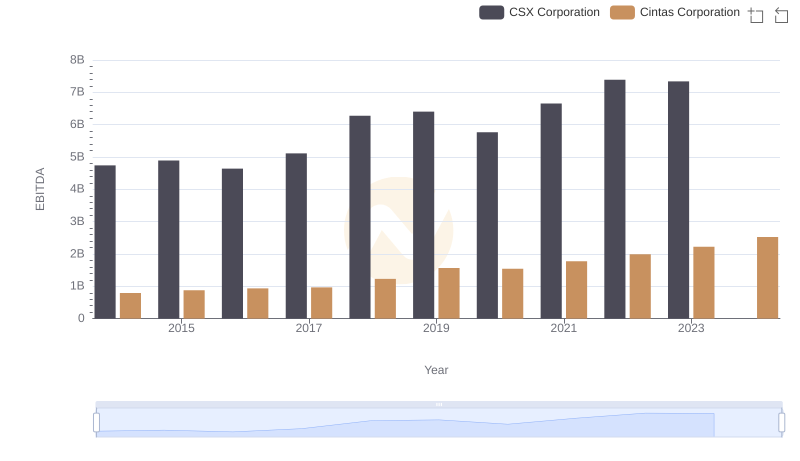

A Side-by-Side Analysis of EBITDA: Cintas Corporation and CSX Corporation

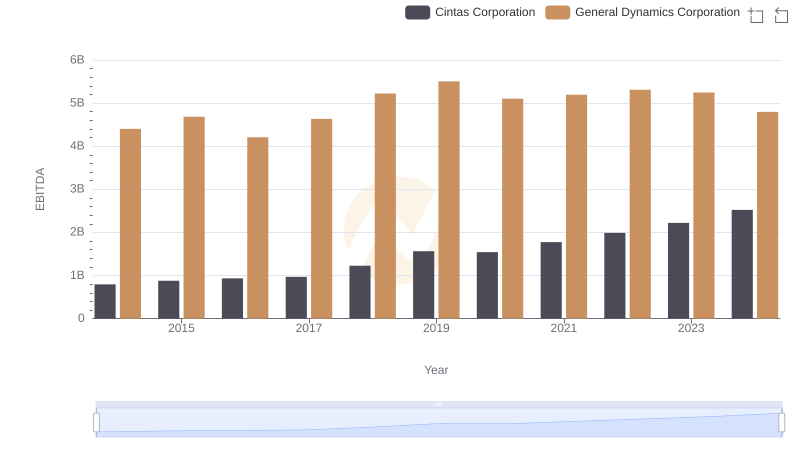

Comparative EBITDA Analysis: Cintas Corporation vs General Dynamics Corporation

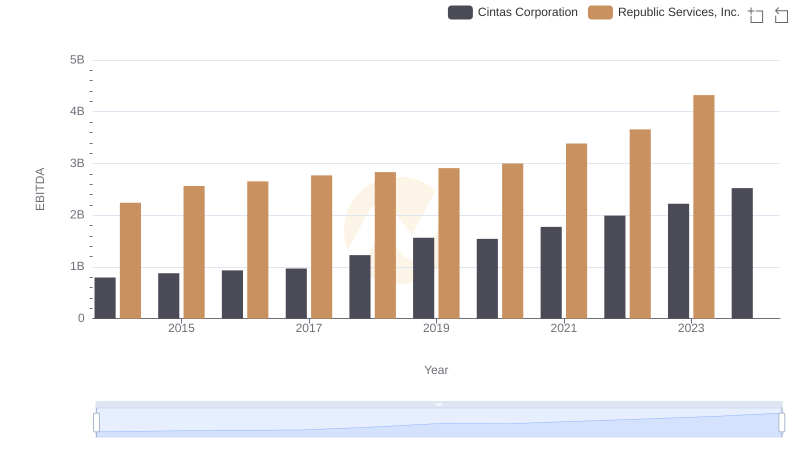

Cintas Corporation and Republic Services, Inc.: A Detailed Examination of EBITDA Performance