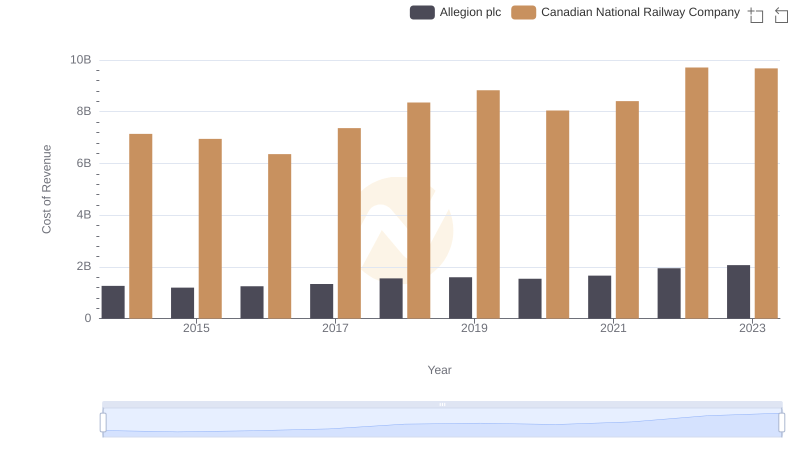

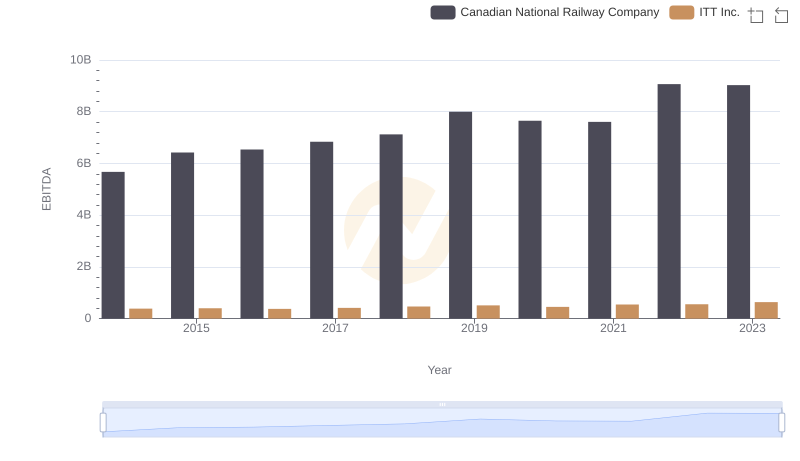

| __timestamp | Allegion plc | Canadian National Railway Company |

|---|---|---|

| Wednesday, January 1, 2014 | 365700000 | 5674000000 |

| Thursday, January 1, 2015 | 315400000 | 6424000000 |

| Friday, January 1, 2016 | 422600000 | 6537000000 |

| Sunday, January 1, 2017 | 523300000 | 6839000000 |

| Monday, January 1, 2018 | 617600000 | 7124000000 |

| Tuesday, January 1, 2019 | 614300000 | 7999000000 |

| Wednesday, January 1, 2020 | 497700000 | 7652000000 |

| Friday, January 1, 2021 | 657300000 | 7607000000 |

| Saturday, January 1, 2022 | 688300000 | 9067000000 |

| Sunday, January 1, 2023 | 819300000 | 9027000000 |

| Monday, January 1, 2024 | 919800000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, the financial health of companies is a key indicator of their success and resilience. This analysis delves into the EBITDA performance of two industry giants: Canadian National Railway Company and Allegion plc, from 2014 to 2023.

Canadian National Railway, a leader in the transportation sector, has consistently demonstrated robust financial growth. Over the past decade, its EBITDA has surged by approximately 60%, peaking in 2022. This growth underscores the company's strategic investments and operational efficiency.

Conversely, Allegion plc, a prominent player in the security solutions industry, has shown a remarkable 160% increase in EBITDA during the same period. This impressive growth trajectory highlights Allegion's adaptability and innovation in a competitive market.

This side-by-side analysis offers a fascinating glimpse into how these companies have navigated economic challenges and capitalized on opportunities to enhance their financial performance.

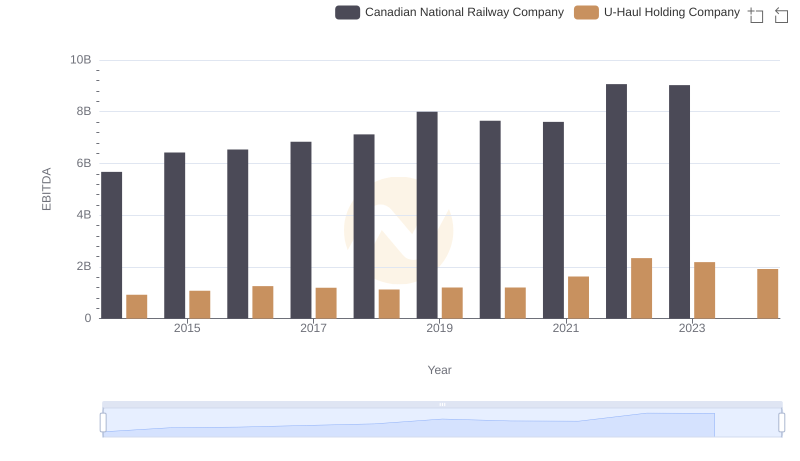

EBITDA Analysis: Evaluating Canadian National Railway Company Against U-Haul Holding Company

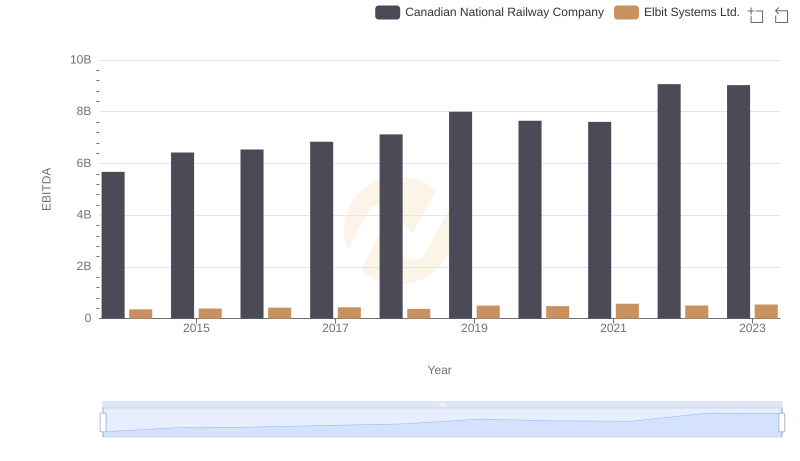

EBITDA Analysis: Evaluating Canadian National Railway Company Against Elbit Systems Ltd.

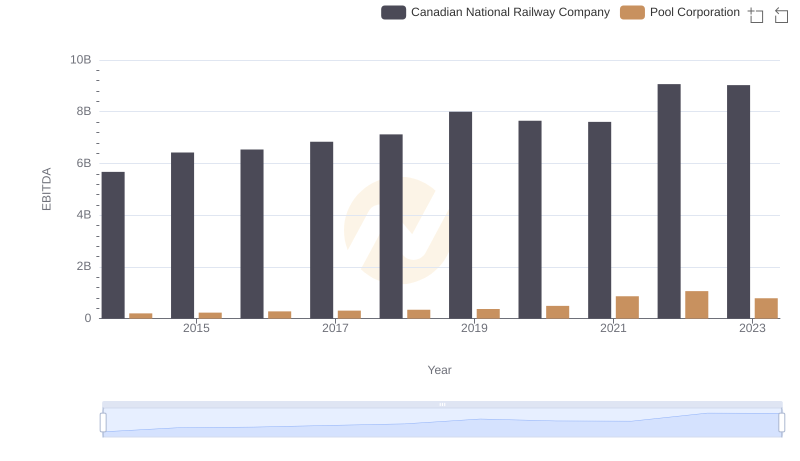

Professional EBITDA Benchmarking: Canadian National Railway Company vs Pool Corporation

Cost of Revenue: Key Insights for Canadian National Railway Company and Allegion plc

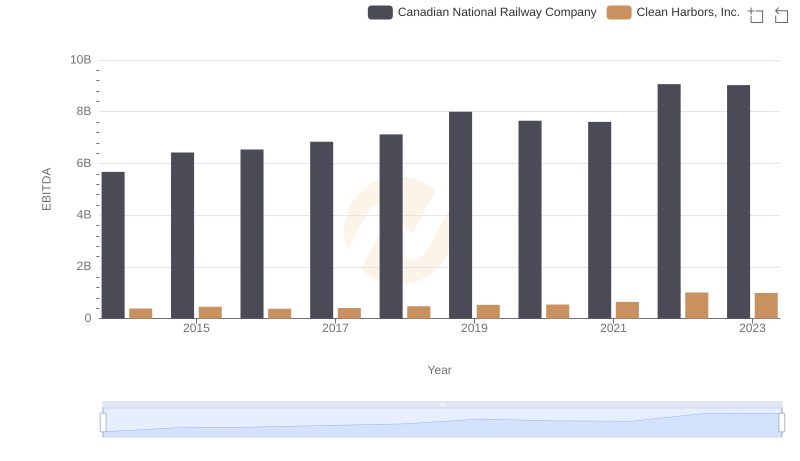

A Professional Review of EBITDA: Canadian National Railway Company Compared to Clean Harbors, Inc.

Gross Profit Trends Compared: Canadian National Railway Company vs Allegion plc

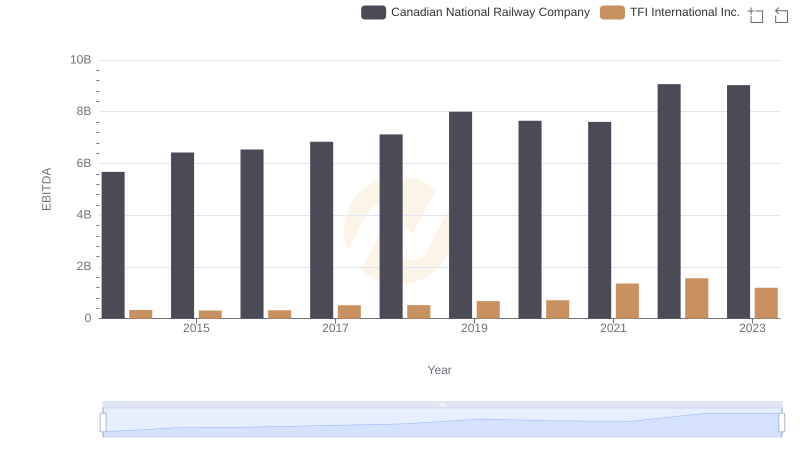

Comprehensive EBITDA Comparison: Canadian National Railway Company vs TFI International Inc.

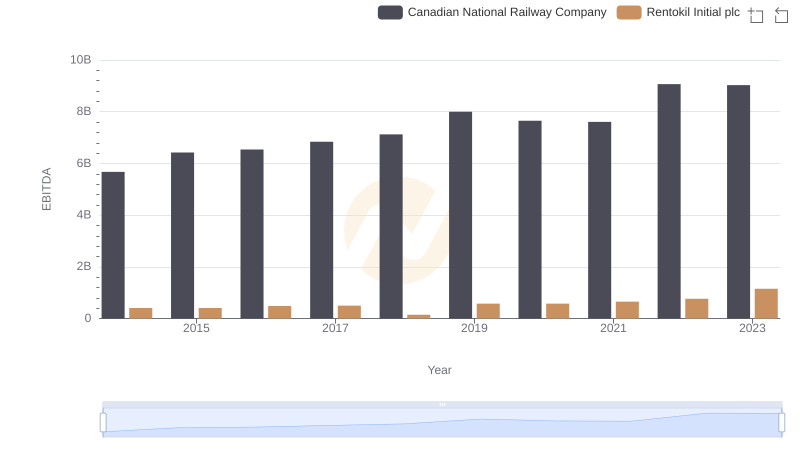

A Professional Review of EBITDA: Canadian National Railway Company Compared to Rentokil Initial plc

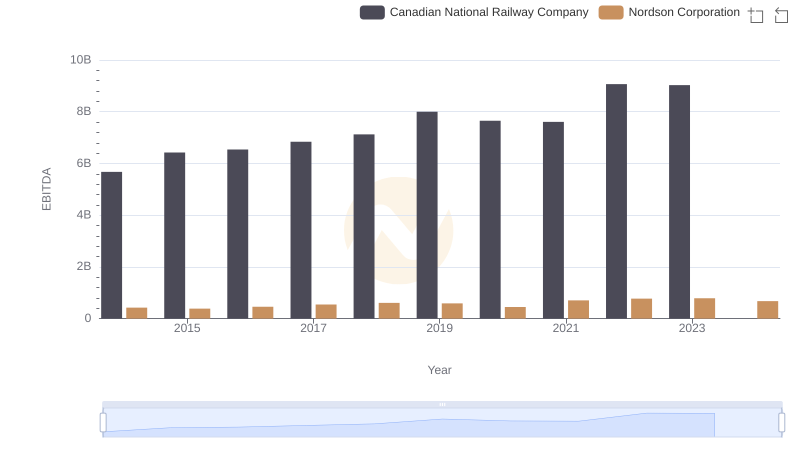

EBITDA Analysis: Evaluating Canadian National Railway Company Against Nordson Corporation

Professional EBITDA Benchmarking: Canadian National Railway Company vs ITT Inc.