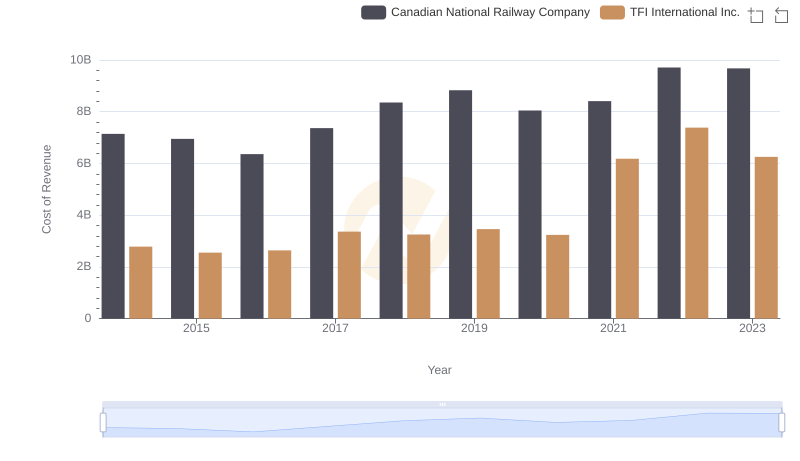

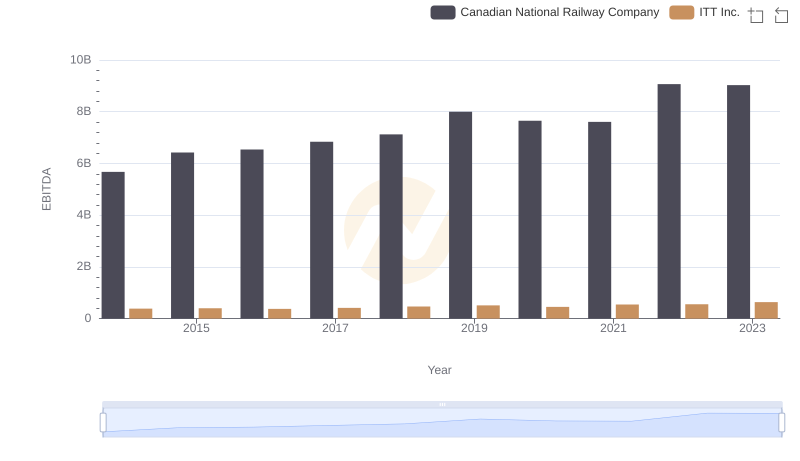

| __timestamp | Canadian National Railway Company | TFI International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 334908602 |

| Thursday, January 1, 2015 | 6424000000 | 314924803 |

| Friday, January 1, 2016 | 6537000000 | 325584405 |

| Sunday, January 1, 2017 | 6839000000 | 517899005 |

| Monday, January 1, 2018 | 7124000000 | 521265317 |

| Tuesday, January 1, 2019 | 7999000000 | 674440000 |

| Wednesday, January 1, 2020 | 7652000000 | 709296000 |

| Friday, January 1, 2021 | 7607000000 | 1358717000 |

| Saturday, January 1, 2022 | 9067000000 | 1561728000 |

| Sunday, January 1, 2023 | 9027000000 | 1194213000 |

Unleashing insights

In the ever-evolving landscape of North American transportation, Canadian National Railway Company (CNR) and TFI International Inc. have emerged as key players. Over the past decade, CNR has consistently outperformed TFI in terms of EBITDA, showcasing its robust operational efficiency. From 2014 to 2023, CNR's EBITDA surged by approximately 59%, peaking in 2022. In contrast, TFI International, while experiencing a remarkable 390% growth, still trails behind CNR in absolute terms.

This comparison highlights the dynamic nature of the transportation sector, where strategic foresight and adaptability are key to sustained growth.

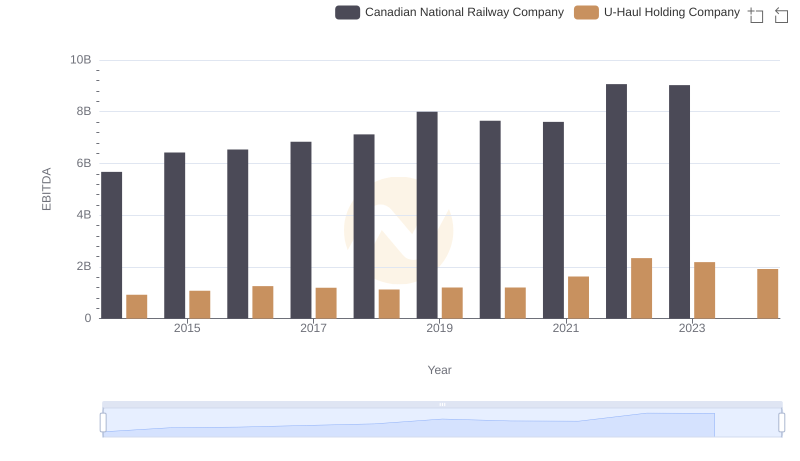

EBITDA Analysis: Evaluating Canadian National Railway Company Against U-Haul Holding Company

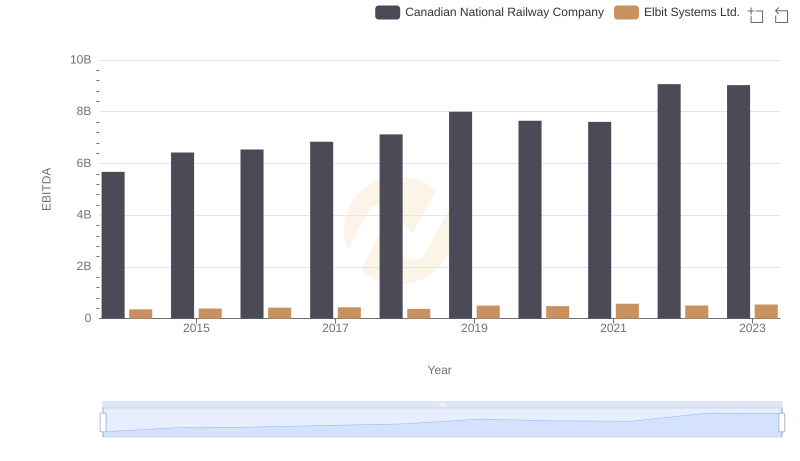

EBITDA Analysis: Evaluating Canadian National Railway Company Against Elbit Systems Ltd.

Comparing Cost of Revenue Efficiency: Canadian National Railway Company vs TFI International Inc.

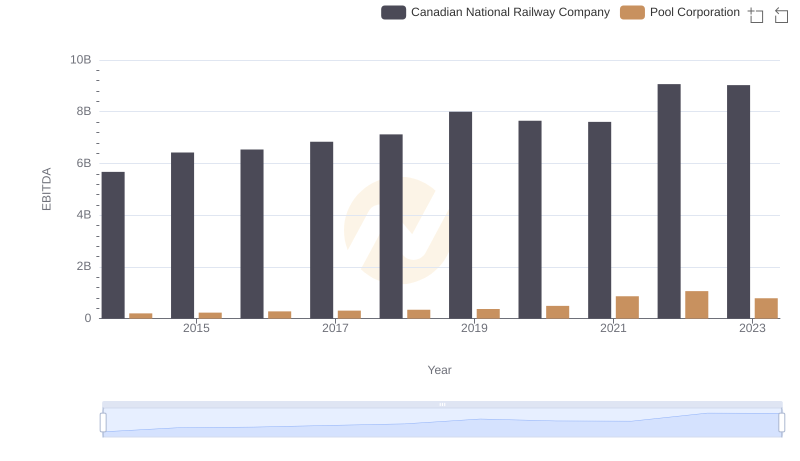

Professional EBITDA Benchmarking: Canadian National Railway Company vs Pool Corporation

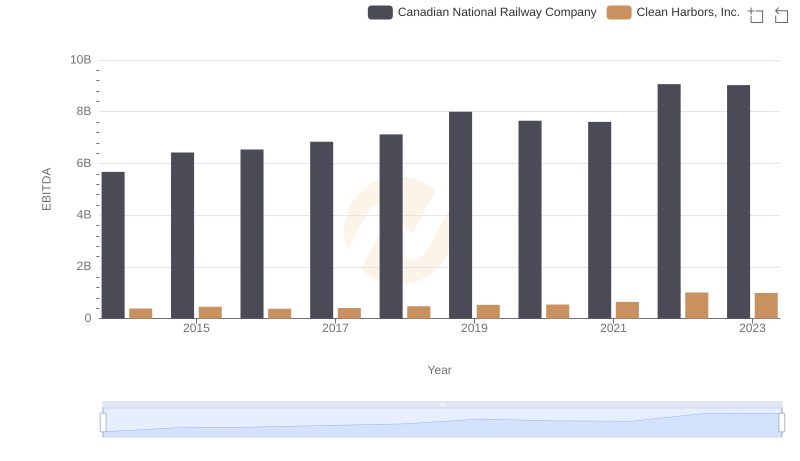

A Professional Review of EBITDA: Canadian National Railway Company Compared to Clean Harbors, Inc.

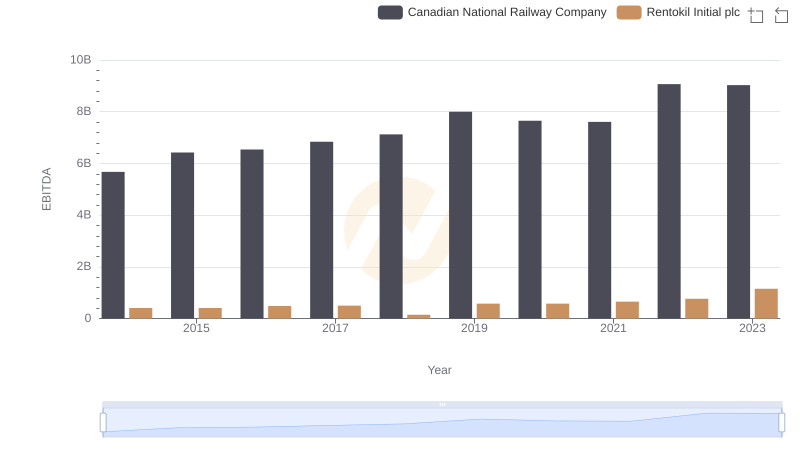

A Professional Review of EBITDA: Canadian National Railway Company Compared to Rentokil Initial plc

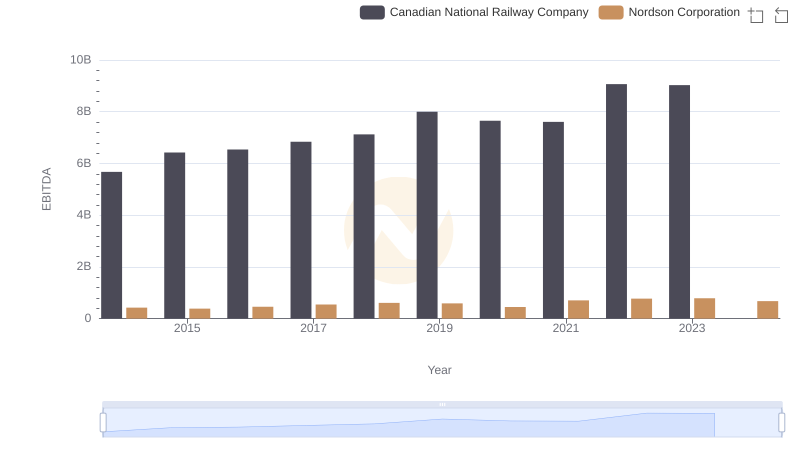

EBITDA Analysis: Evaluating Canadian National Railway Company Against Nordson Corporation

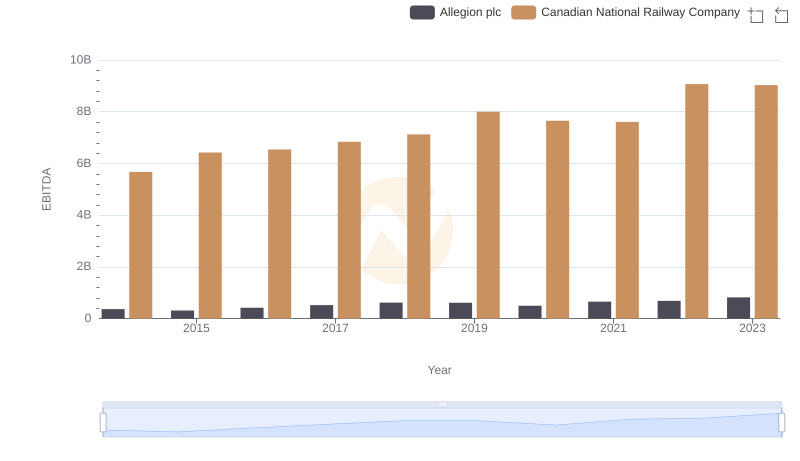

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and Allegion plc

Professional EBITDA Benchmarking: Canadian National Railway Company vs ITT Inc.