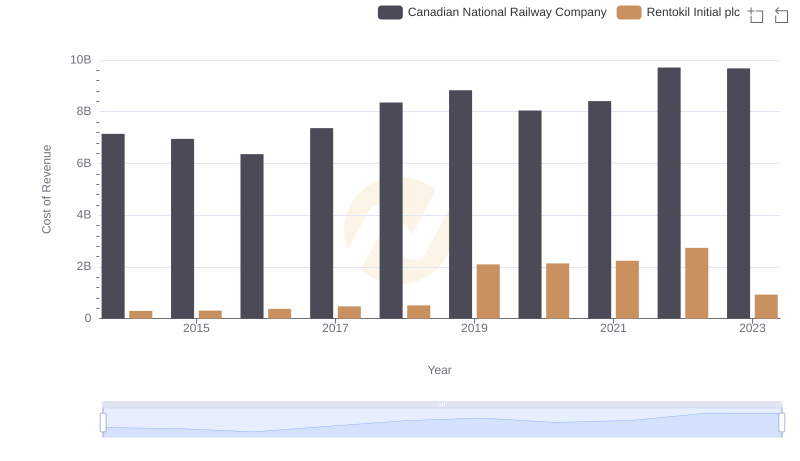

| __timestamp | Canadian National Railway Company | Rentokil Initial plc |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 410400000 |

| Thursday, January 1, 2015 | 6424000000 | 408700000 |

| Friday, January 1, 2016 | 6537000000 | 489000000 |

| Sunday, January 1, 2017 | 6839000000 | 503200000 |

| Monday, January 1, 2018 | 7124000000 | 149800000 |

| Tuesday, January 1, 2019 | 7999000000 | 580600000 |

| Wednesday, January 1, 2020 | 7652000000 | 581000000 |

| Friday, January 1, 2021 | 7607000000 | 656000000 |

| Saturday, January 1, 2022 | 9067000000 | 767000000 |

| Sunday, January 1, 2023 | 9027000000 | 1157000000 |

Infusing magic into the data realm

In the world of finance, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) serves as a crucial indicator of a company's operational performance. This analysis delves into the EBITDA trends of two industry giants: Canadian National Railway Company and Rentokil Initial plc, from 2014 to 2023.

Canadian National Railway has consistently outperformed Rentokil Initial, with its EBITDA growing by approximately 59% over the decade. In 2023, Canadian National Railway's EBITDA reached a peak, nearly doubling that of Rentokil Initial. Meanwhile, Rentokil Initial showed a steady increase, with a notable 183% rise from 2014 to 2023.

This comparison highlights the robust growth trajectory of Canadian National Railway, driven by strategic expansions and operational efficiencies, while Rentokil Initial's steady climb reflects its resilience and adaptability in a competitive market.

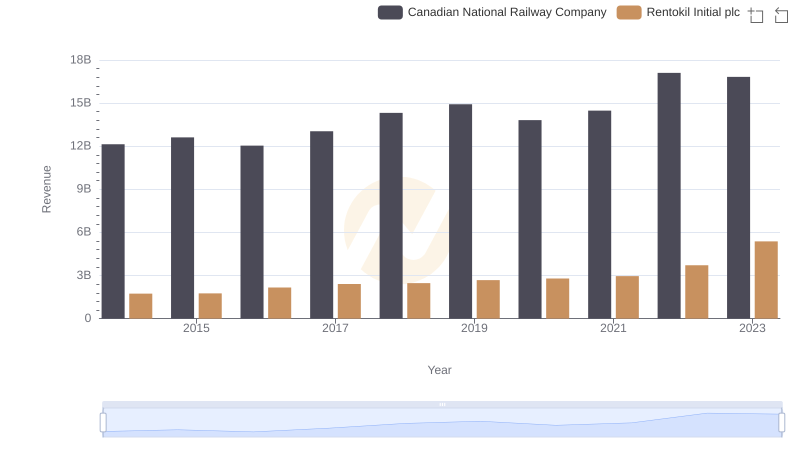

Revenue Insights: Canadian National Railway Company and Rentokil Initial plc Performance Compared

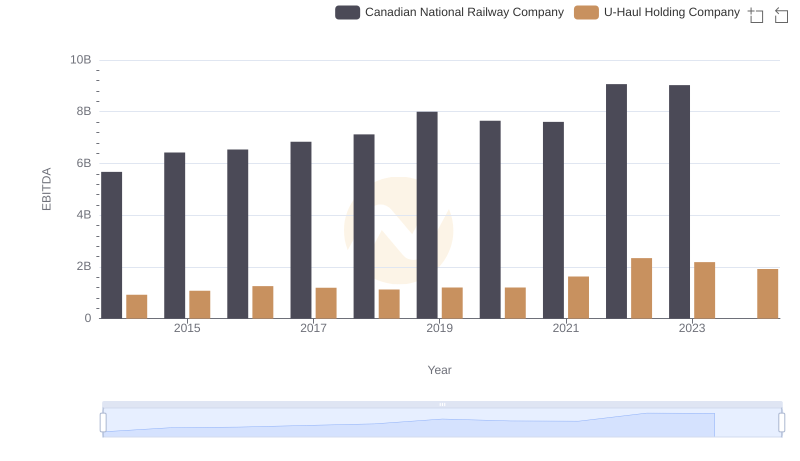

EBITDA Analysis: Evaluating Canadian National Railway Company Against U-Haul Holding Company

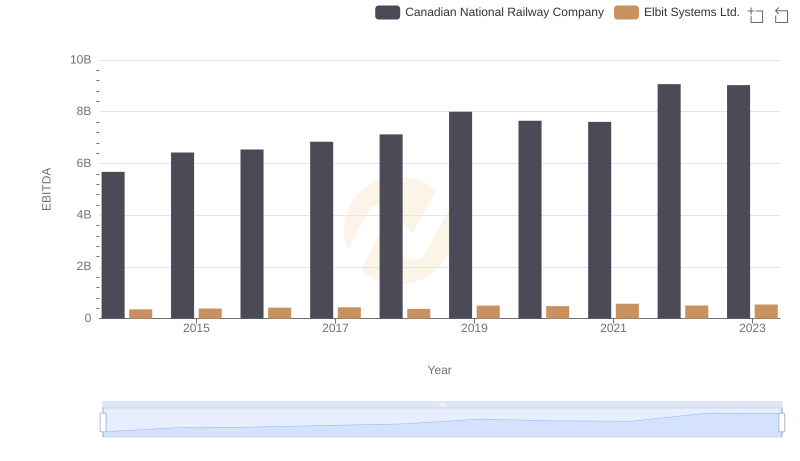

EBITDA Analysis: Evaluating Canadian National Railway Company Against Elbit Systems Ltd.

Canadian National Railway Company vs Rentokil Initial plc: Efficiency in Cost of Revenue Explored

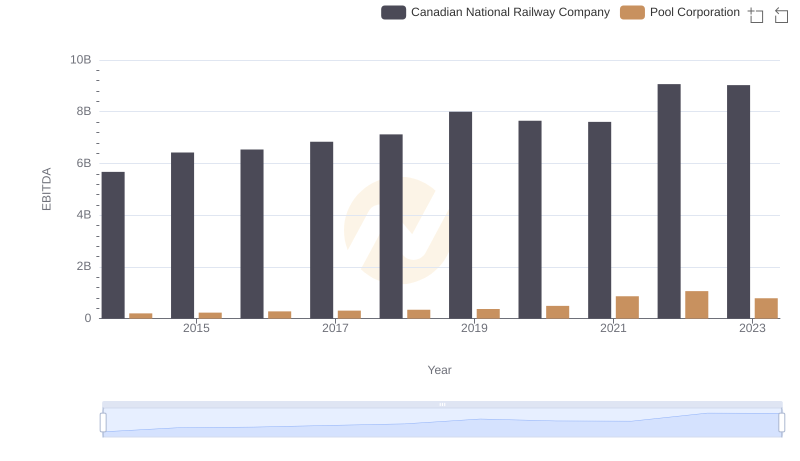

Professional EBITDA Benchmarking: Canadian National Railway Company vs Pool Corporation

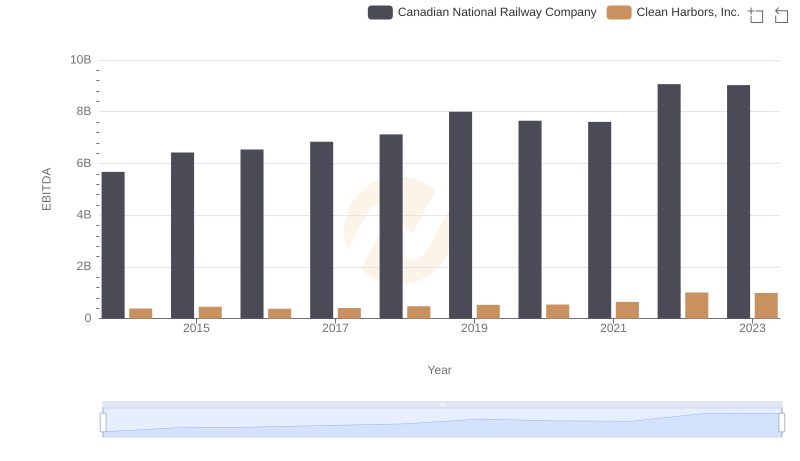

A Professional Review of EBITDA: Canadian National Railway Company Compared to Clean Harbors, Inc.

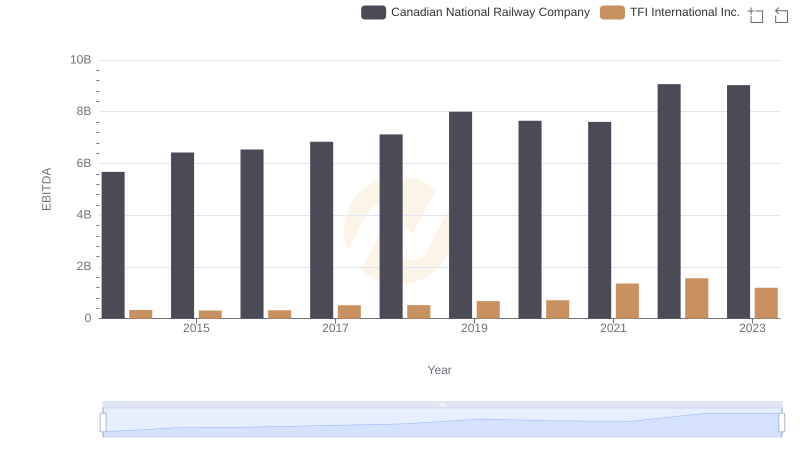

Comprehensive EBITDA Comparison: Canadian National Railway Company vs TFI International Inc.

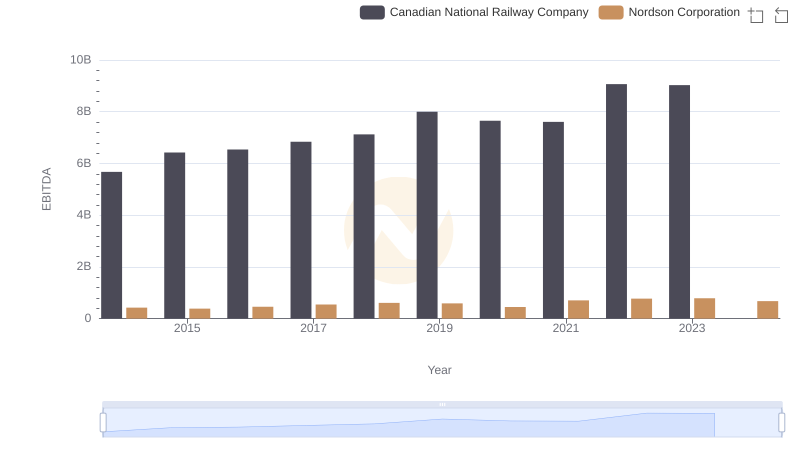

EBITDA Analysis: Evaluating Canadian National Railway Company Against Nordson Corporation

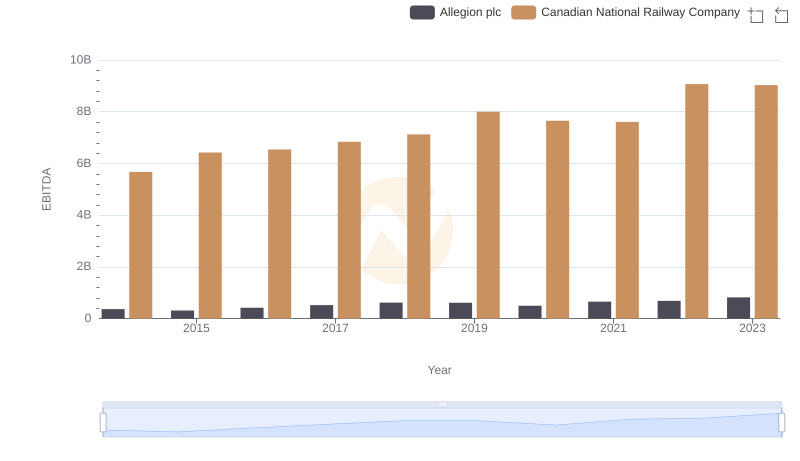

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and Allegion plc

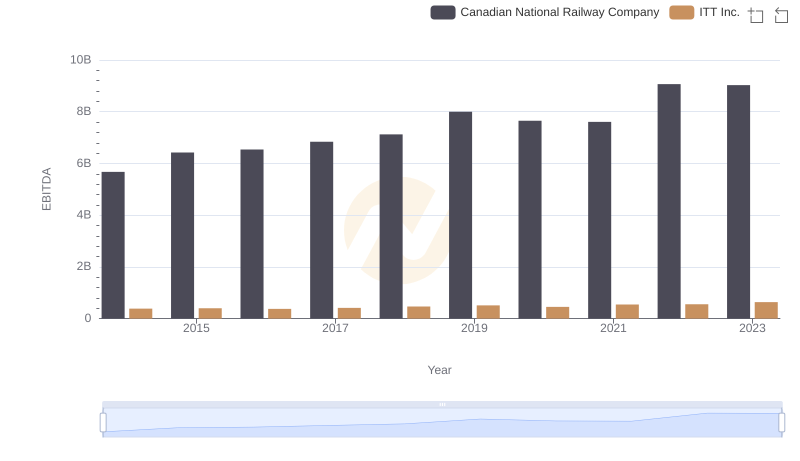

Professional EBITDA Benchmarking: Canadian National Railway Company vs ITT Inc.