| __timestamp | Canadian National Railway Company | U-Haul Holding Company |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 923383000 |

| Thursday, January 1, 2015 | 6424000000 | 1076520000 |

| Friday, January 1, 2016 | 6537000000 | 1255474000 |

| Sunday, January 1, 2017 | 6839000000 | 1195593000 |

| Monday, January 1, 2018 | 7124000000 | 1123974000 |

| Tuesday, January 1, 2019 | 7999000000 | 1200955000 |

| Wednesday, January 1, 2020 | 7652000000 | 1202436000 |

| Friday, January 1, 2021 | 7607000000 | 1627442000 |

| Saturday, January 1, 2022 | 9067000000 | 2337788000 |

| Sunday, January 1, 2023 | 9027000000 | 2183839000 |

| Monday, January 1, 2024 | 1919656000 |

Unveiling the hidden dimensions of data

In the world of transportation and logistics, Canadian National Railway Company (CNR) and U-Haul Holding Company have been pivotal players. Over the past decade, CNR has consistently outperformed U-Haul in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, CNR's EBITDA surged by approximately 59%, peaking in 2022. In contrast, U-Haul's EBITDA, while growing, saw a more modest increase of around 137% over the same period, with a notable spike in 2022. This divergence highlights CNR's dominance in the rail sector, driven by strategic expansions and operational efficiencies. However, U-Haul's growth, particularly in recent years, underscores its resilience and adaptability in the rental and storage market. As we look to the future, the missing data for 2024 suggests potential volatility, making it a year to watch for both companies.

Gross Profit Analysis: Comparing Canadian National Railway Company and U-Haul Holding Company

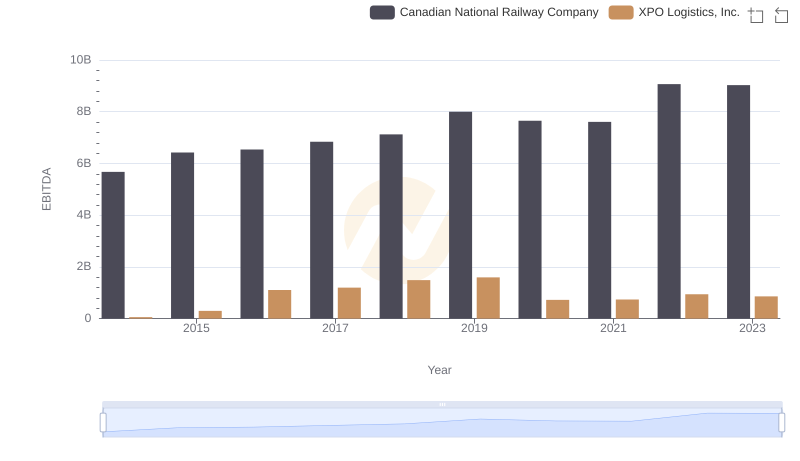

EBITDA Metrics Evaluated: Canadian National Railway Company vs XPO Logistics, Inc.

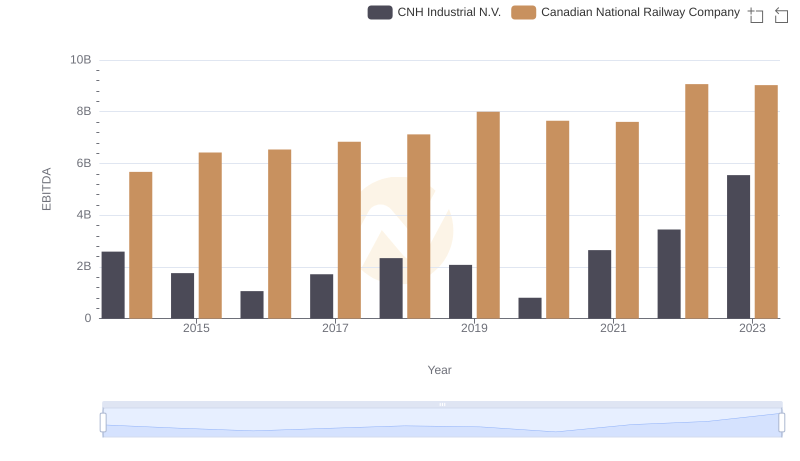

A Professional Review of EBITDA: Canadian National Railway Company Compared to CNH Industrial N.V.

EBITDA Metrics Evaluated: Canadian National Railway Company vs Saia, Inc.

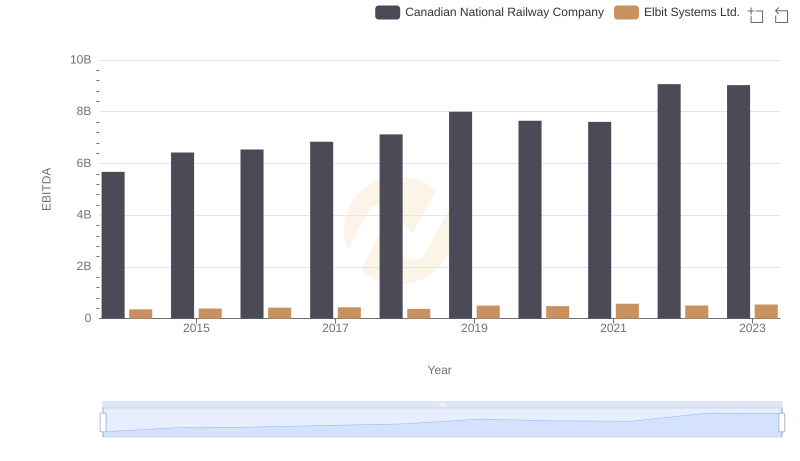

EBITDA Analysis: Evaluating Canadian National Railway Company Against Elbit Systems Ltd.

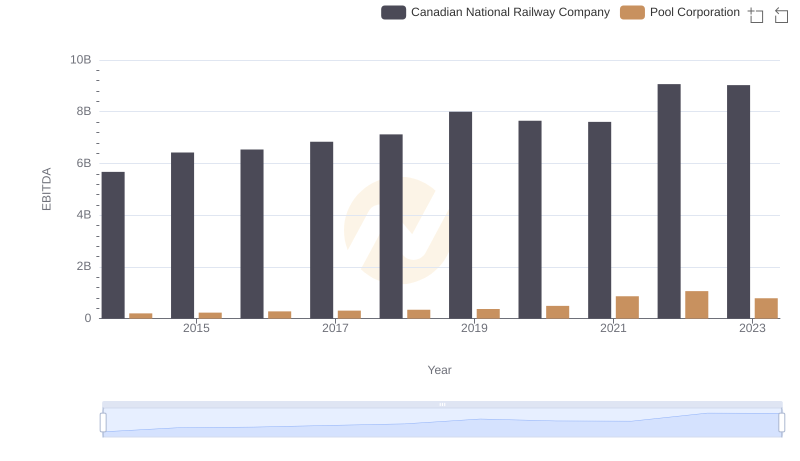

Professional EBITDA Benchmarking: Canadian National Railway Company vs Pool Corporation