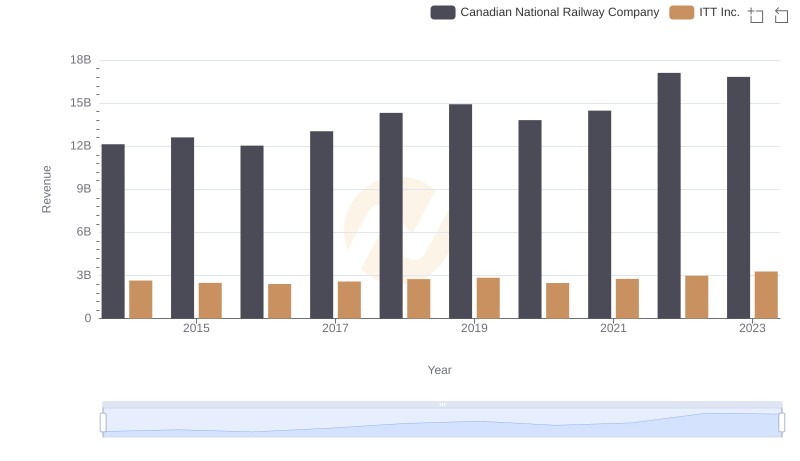

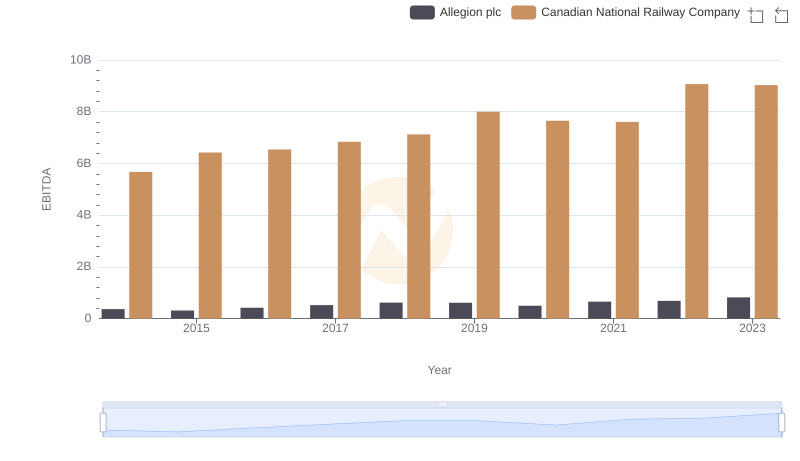

| __timestamp | Canadian National Railway Company | ITT Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 5674000000 | 386700000 |

| Thursday, January 1, 2015 | 6424000000 | 402700000 |

| Friday, January 1, 2016 | 6537000000 | 378000000 |

| Sunday, January 1, 2017 | 6839000000 | 415000000 |

| Monday, January 1, 2018 | 7124000000 | 469000000 |

| Tuesday, January 1, 2019 | 7999000000 | 513900000 |

| Wednesday, January 1, 2020 | 7652000000 | 455000000 |

| Friday, January 1, 2021 | 7607000000 | 545600000 |

| Saturday, January 1, 2022 | 9067000000 | 554500000 |

| Sunday, January 1, 2023 | 9027000000 | 639100000 |

| Monday, January 1, 2024 | 821500000 |

Unleashing the power of data

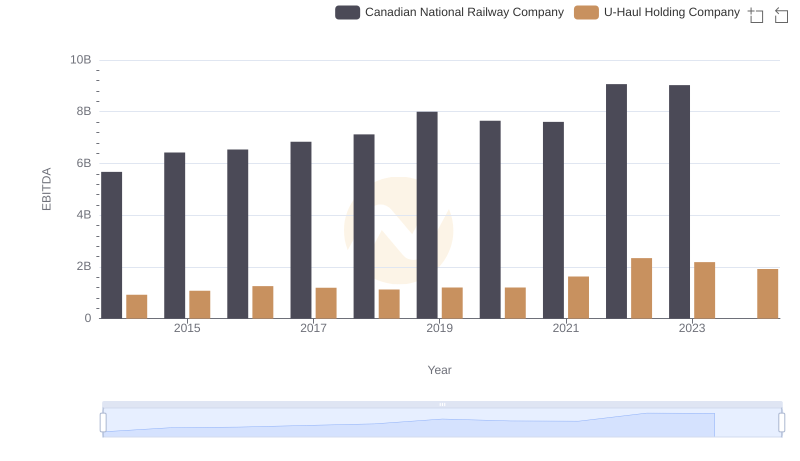

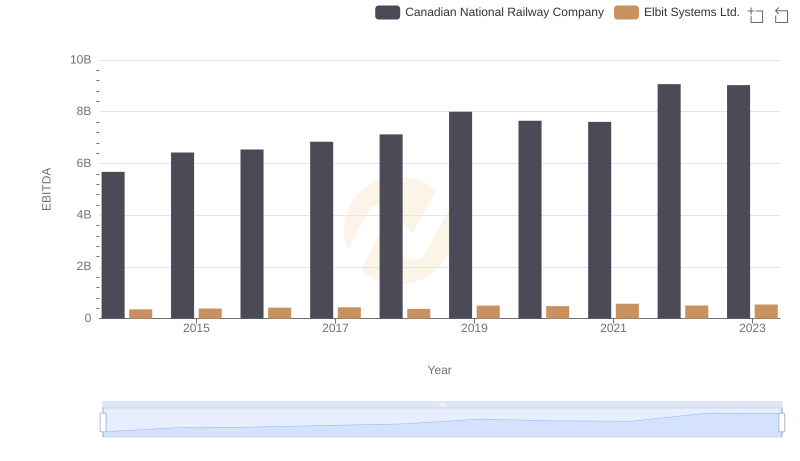

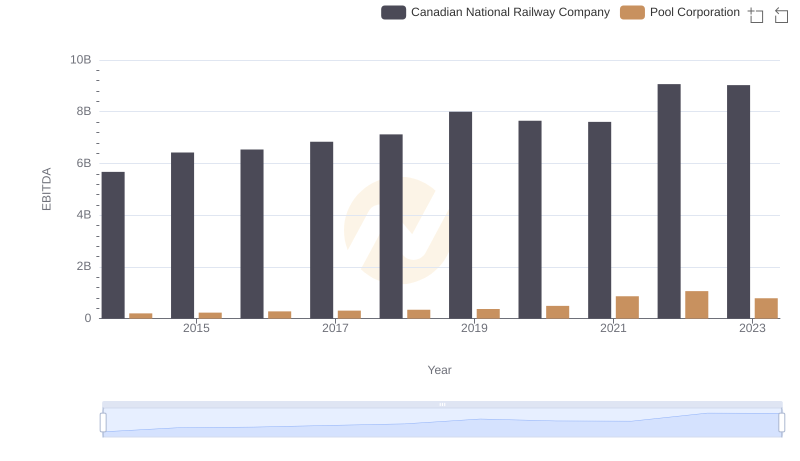

In the world of transportation and engineering, Canadian National Railway Company (CNR) and ITT Inc. stand as titans. Over the past decade, CNR has consistently outperformed ITT Inc. in terms of EBITDA, showcasing its robust financial health. From 2014 to 2023, CNR's EBITDA grew by approximately 59%, peaking in 2022 with a remarkable 9.07 billion. In contrast, ITT Inc. experienced a more modest growth of around 65%, reaching its highest EBITDA of 639 million in 2023.

CNR's strategic investments and operational efficiencies have propelled its EBITDA from 5.67 billion in 2014 to over 9 billion in recent years. Meanwhile, ITT Inc. has steadily increased its EBITDA from 387 million in 2014, reflecting its resilience and adaptability in a competitive market. This comparison highlights the diverse strategies and market dynamics influencing these industry leaders.

Canadian National Railway Company vs ITT Inc.: Annual Revenue Growth Compared

EBITDA Analysis: Evaluating Canadian National Railway Company Against U-Haul Holding Company

EBITDA Analysis: Evaluating Canadian National Railway Company Against Elbit Systems Ltd.

Professional EBITDA Benchmarking: Canadian National Railway Company vs Pool Corporation

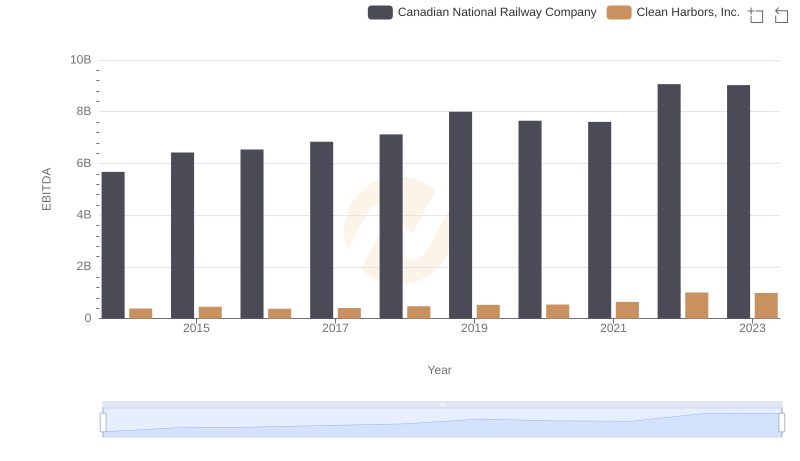

A Professional Review of EBITDA: Canadian National Railway Company Compared to Clean Harbors, Inc.

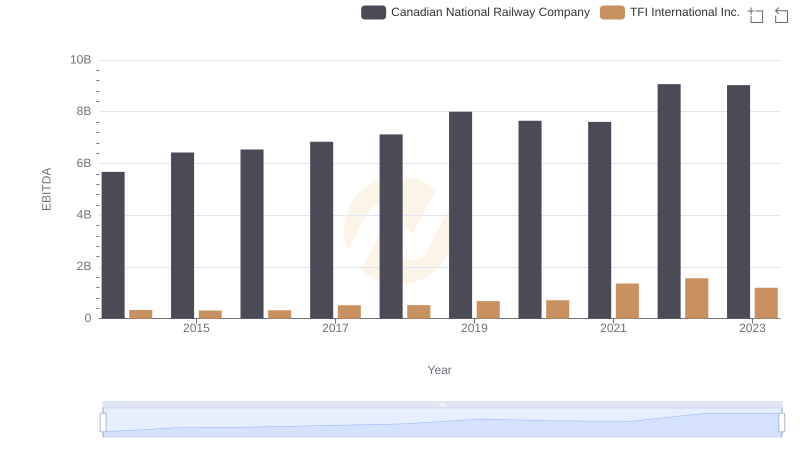

Comprehensive EBITDA Comparison: Canadian National Railway Company vs TFI International Inc.

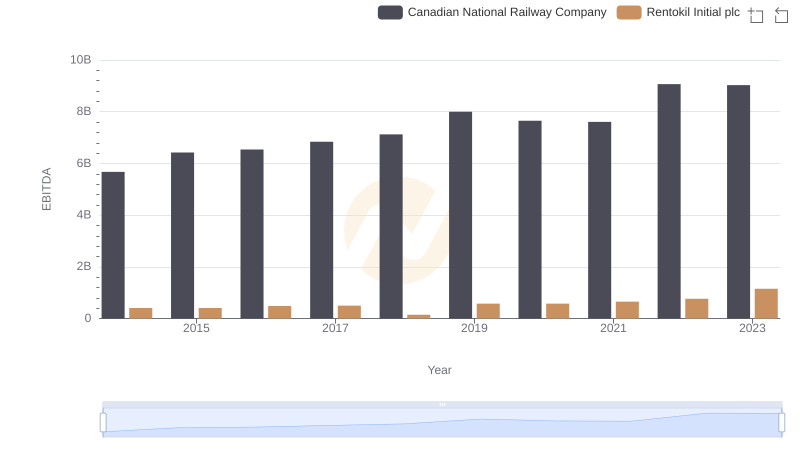

A Professional Review of EBITDA: Canadian National Railway Company Compared to Rentokil Initial plc

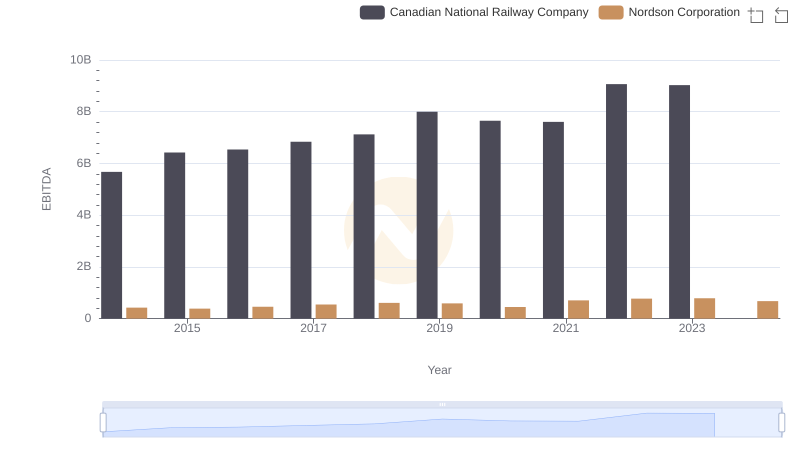

EBITDA Analysis: Evaluating Canadian National Railway Company Against Nordson Corporation

A Side-by-Side Analysis of EBITDA: Canadian National Railway Company and Allegion plc