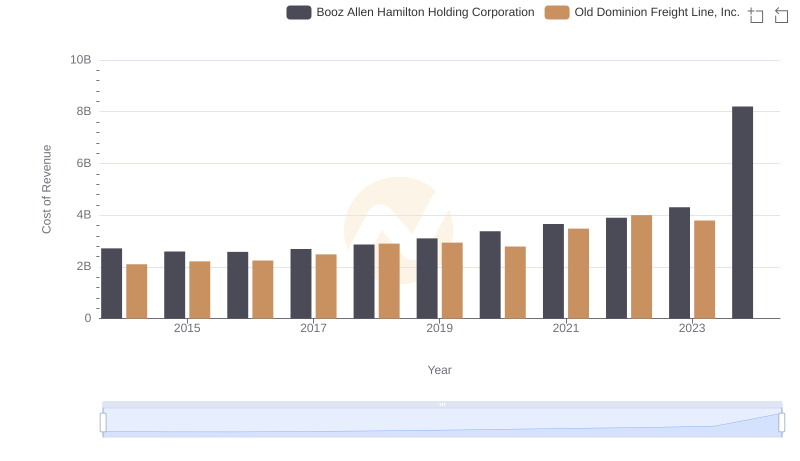

| __timestamp | Booz Allen Hamilton Holding Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 531144000 | 585590000 |

| Thursday, January 1, 2015 | 520410000 | 660570000 |

| Friday, January 1, 2016 | 506120000 | 671786000 |

| Sunday, January 1, 2017 | 561524000 | 783749000 |

| Monday, January 1, 2018 | 577061000 | 1046059000 |

| Tuesday, January 1, 2019 | 663731000 | 1078007000 |

| Wednesday, January 1, 2020 | 745424000 | 1168149000 |

| Friday, January 1, 2021 | 834449000 | 1651501000 |

| Saturday, January 1, 2022 | 826865000 | 2118962000 |

| Sunday, January 1, 2023 | 958150000 | 1972689000 |

| Monday, January 1, 2024 | 1199992000 |

Unleashing insights

In the ever-evolving landscape of American business, Old Dominion Freight Line, Inc. and Booz Allen Hamilton Holding Corporation stand as titans in their respective industries. Over the past decade, Old Dominion has demonstrated a remarkable growth trajectory, with its EBITDA increasing by over 250% from 2014 to 2023. This surge underscores the company's robust operational efficiency and strategic market positioning. In contrast, Booz Allen Hamilton has shown a steady, albeit slower, growth of approximately 80% in the same period, reflecting its stable yet conservative expansion strategy.

The data reveals a fascinating narrative: while Old Dominion's EBITDA peaked in 2022, Booz Allen's financial performance continues to climb, reaching its highest point in 2024. This divergence highlights the distinct business models and market dynamics each company navigates. As we look to the future, these trends offer valuable insights into the competitive strategies shaping the American corporate landscape.

Analyzing Cost of Revenue: Old Dominion Freight Line, Inc. and Booz Allen Hamilton Holding Corporation

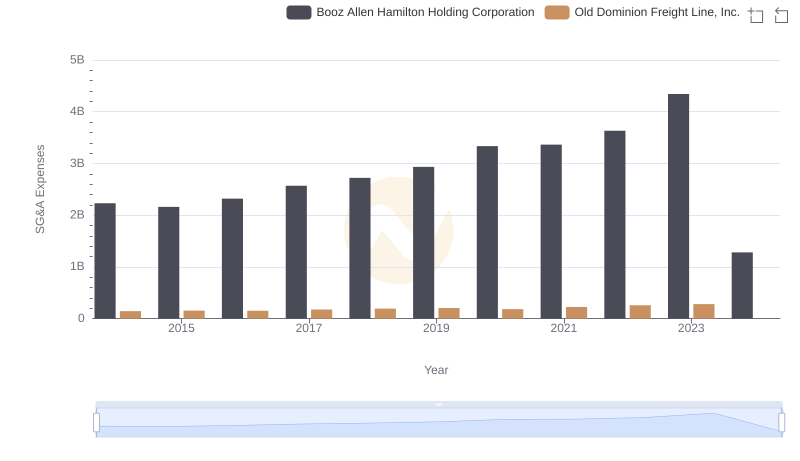

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or Booz Allen Hamilton Holding Corporation

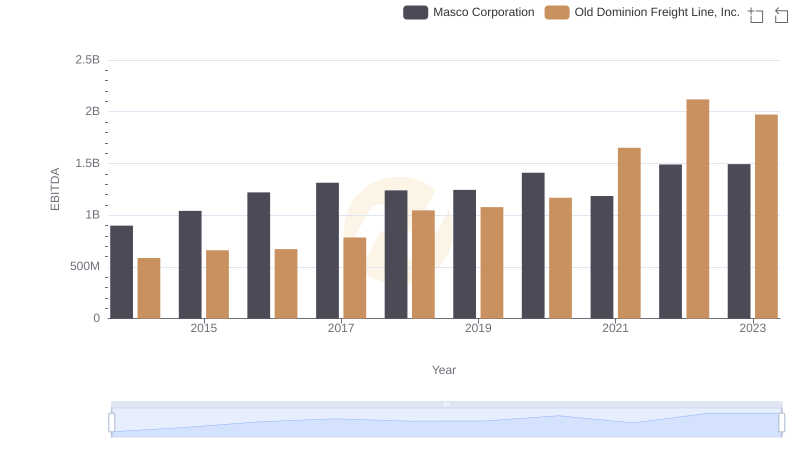

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Masco Corporation

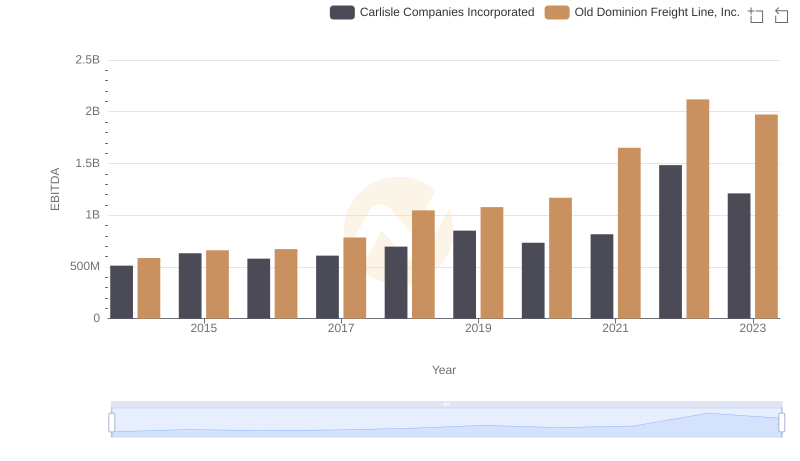

Old Dominion Freight Line, Inc. and Carlisle Companies Incorporated: A Detailed Examination of EBITDA Performance

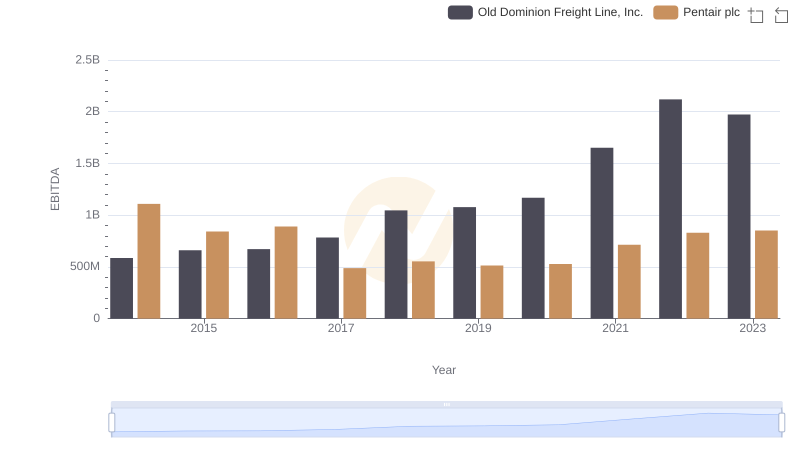

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Pentair plc

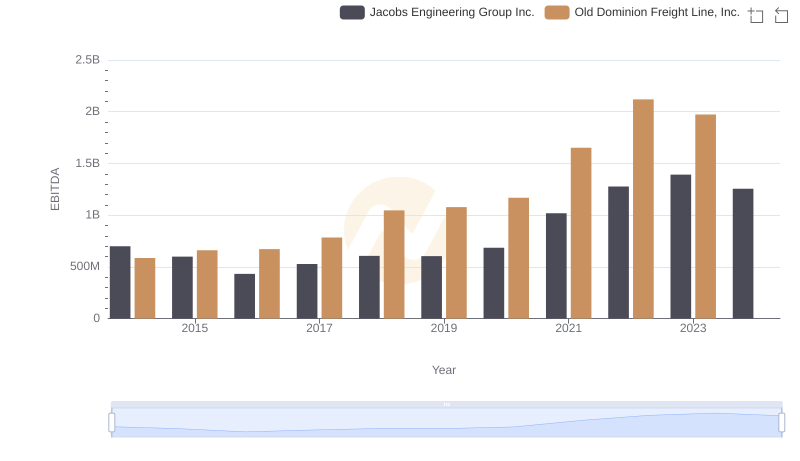

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Jacobs Engineering Group Inc.

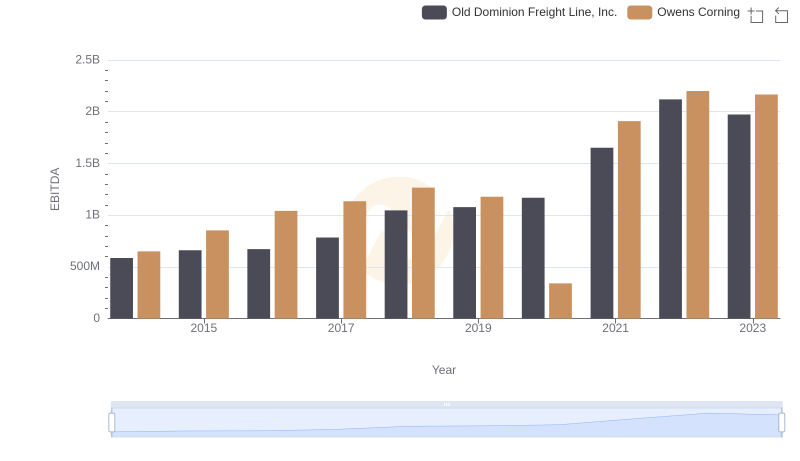

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Owens Corning

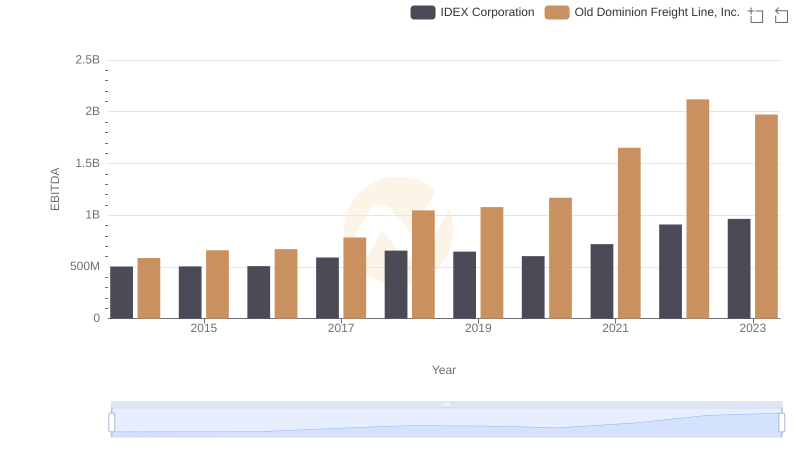

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and IDEX Corporation