| __timestamp | Carlisle Companies Incorporated | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 512300000 | 585590000 |

| Thursday, January 1, 2015 | 631900000 | 660570000 |

| Friday, January 1, 2016 | 580200000 | 671786000 |

| Sunday, January 1, 2017 | 609300000 | 783749000 |

| Monday, January 1, 2018 | 696100000 | 1046059000 |

| Tuesday, January 1, 2019 | 851000000 | 1078007000 |

| Wednesday, January 1, 2020 | 733100000 | 1168149000 |

| Friday, January 1, 2021 | 816100000 | 1651501000 |

| Saturday, January 1, 2022 | 1483400000 | 2118962000 |

| Sunday, January 1, 2023 | 1210700000 | 1972689000 |

| Monday, January 1, 2024 | 1356800000 |

Unveiling the hidden dimensions of data

In the competitive landscape of the transportation and manufacturing sectors, Old Dominion Freight Line, Inc. and Carlisle Companies Incorporated have demonstrated remarkable EBITDA growth over the past decade. From 2014 to 2023, Old Dominion Freight Line's EBITDA surged by approximately 237%, showcasing its robust operational efficiency and market adaptability. In contrast, Carlisle Companies experienced a 136% increase, reflecting steady growth in its diversified industrial products.

This analysis highlights Old Dominion's strategic advantage in the freight industry, while Carlisle's diversified approach continues to yield substantial returns. Investors and industry analysts should watch these trends closely as they indicate potential future performance.

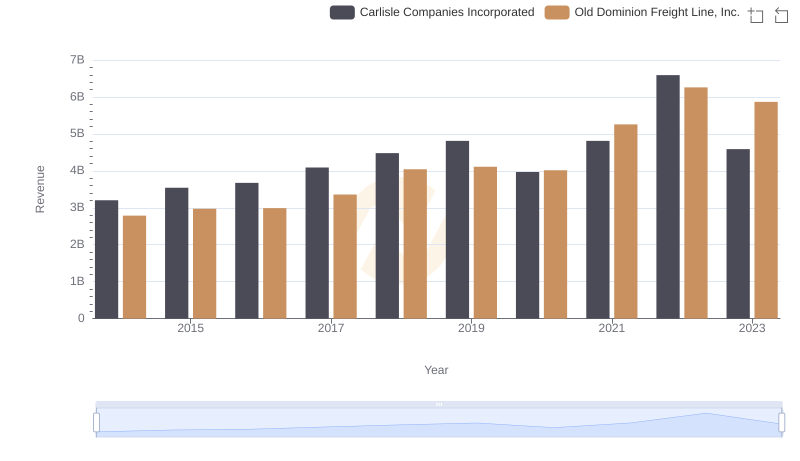

Old Dominion Freight Line, Inc. vs Carlisle Companies Incorporated: Annual Revenue Growth Compared

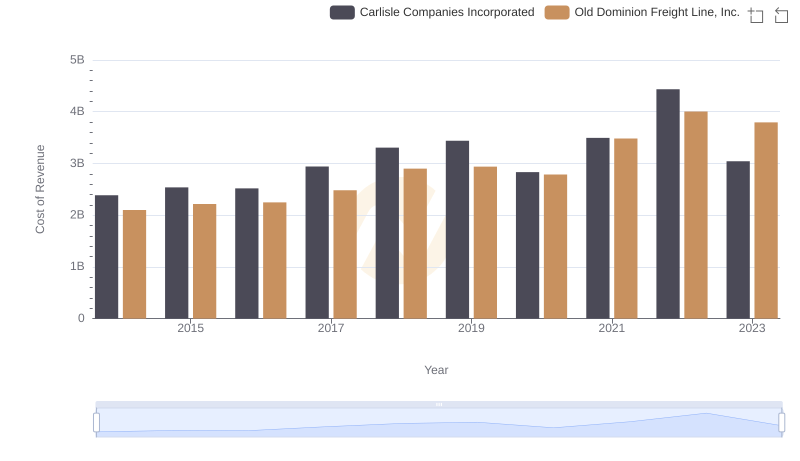

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Carlisle Companies Incorporated

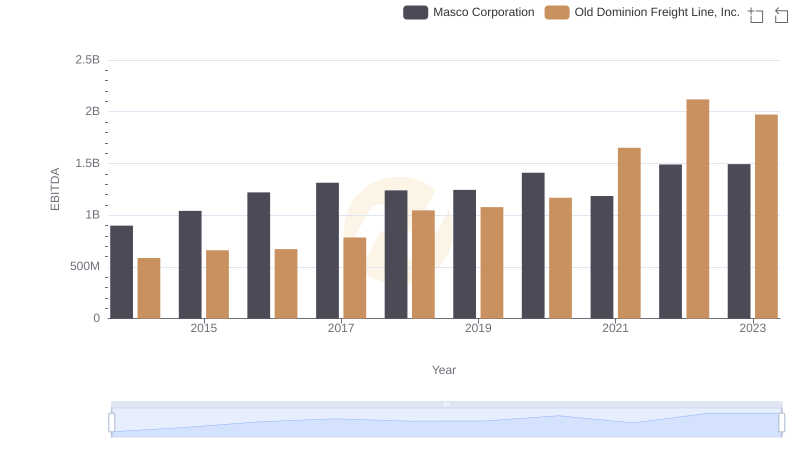

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Masco Corporation

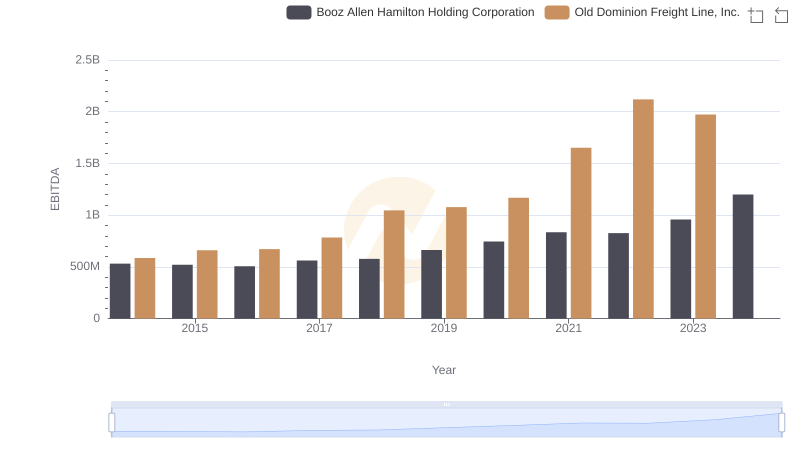

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Booz Allen Hamilton Holding Corporation

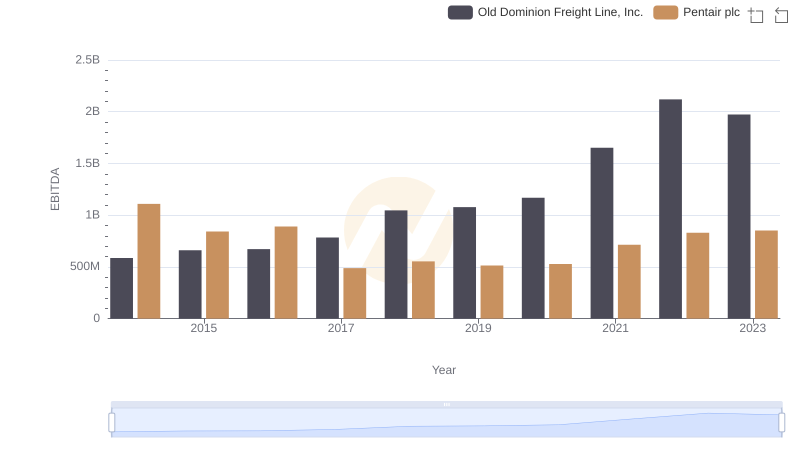

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Pentair plc

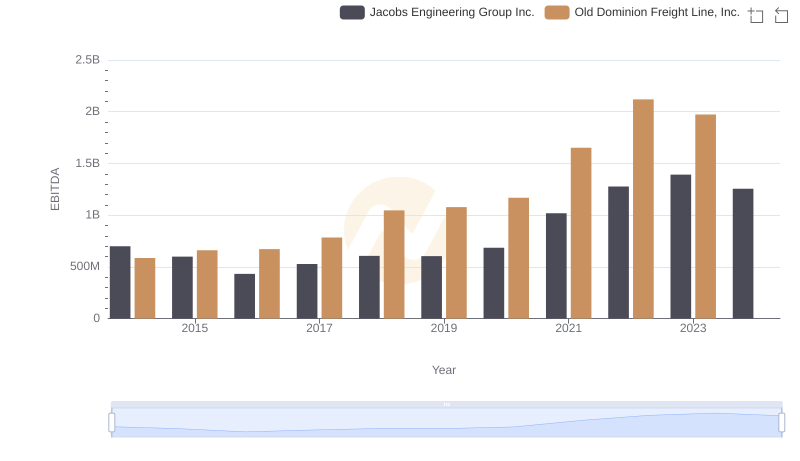

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Jacobs Engineering Group Inc.

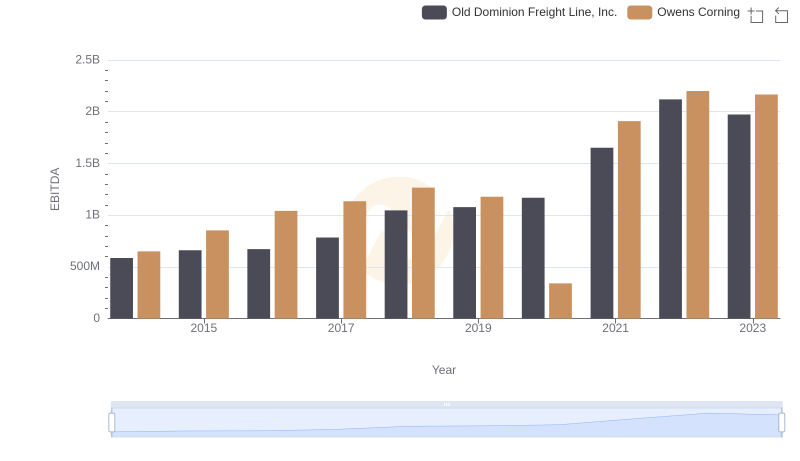

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Owens Corning

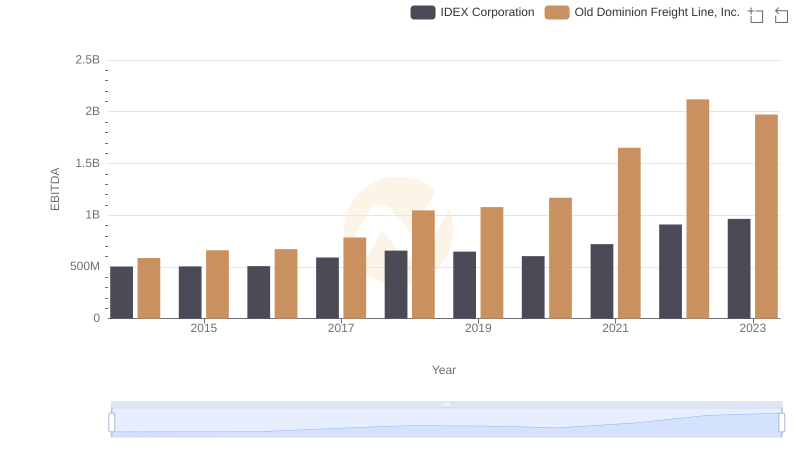

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and IDEX Corporation