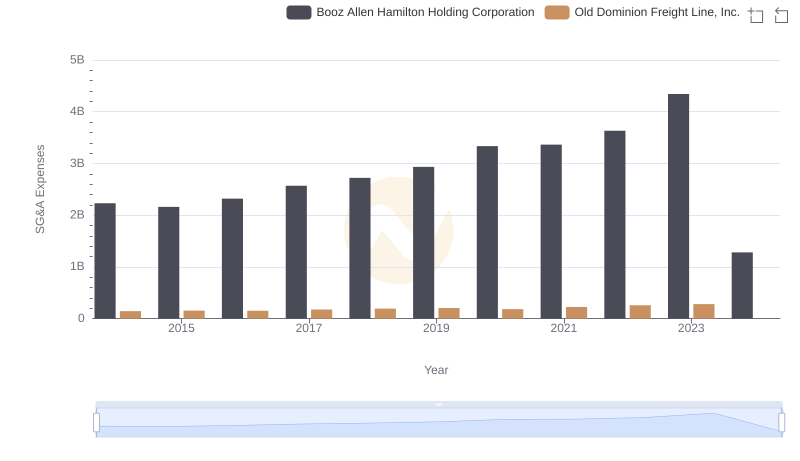

| __timestamp | Booz Allen Hamilton Holding Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2716113000 | 2100409000 |

| Thursday, January 1, 2015 | 2593849000 | 2214943000 |

| Friday, January 1, 2016 | 2580026000 | 2246890000 |

| Sunday, January 1, 2017 | 2691982000 | 2482732000 |

| Monday, January 1, 2018 | 2867103000 | 2899452000 |

| Tuesday, January 1, 2019 | 3100466000 | 2938895000 |

| Wednesday, January 1, 2020 | 3379180000 | 2786531000 |

| Friday, January 1, 2021 | 3657530000 | 3481268000 |

| Saturday, January 1, 2022 | 3899622000 | 4003951000 |

| Sunday, January 1, 2023 | 4304810000 | 3793953000 |

| Monday, January 1, 2024 | 8202847000 |

Data in motion

In the ever-evolving landscape of American business, understanding the cost of revenue is crucial for evaluating a company's financial health. This analysis focuses on two industry giants: Old Dominion Freight Line, Inc., a leader in freight transportation, and Booz Allen Hamilton Holding Corporation, a renowned consulting firm. From 2014 to 2023, Booz Allen Hamilton's cost of revenue increased by approximately 58%, peaking in 2024 with a significant jump. Meanwhile, Old Dominion Freight Line saw a steady rise, with a notable 90% increase from 2014 to 2022. However, data for 2024 is missing, leaving room for speculation. These trends highlight the dynamic nature of operational costs in different sectors, offering valuable insights for investors and analysts alike. As businesses navigate economic challenges, understanding these financial metrics becomes essential for strategic decision-making.

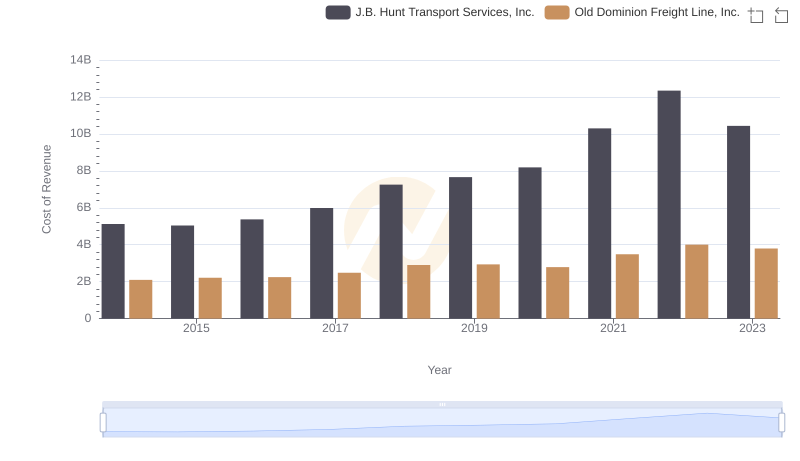

Analyzing Cost of Revenue: Old Dominion Freight Line, Inc. and J.B. Hunt Transport Services, Inc.

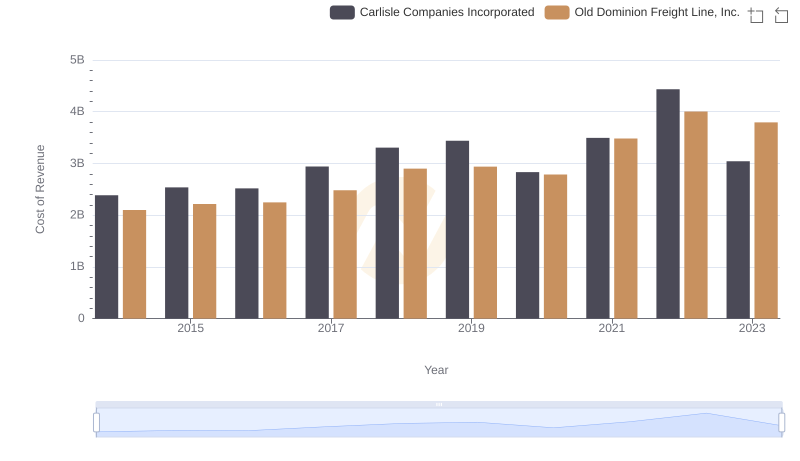

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Carlisle Companies Incorporated

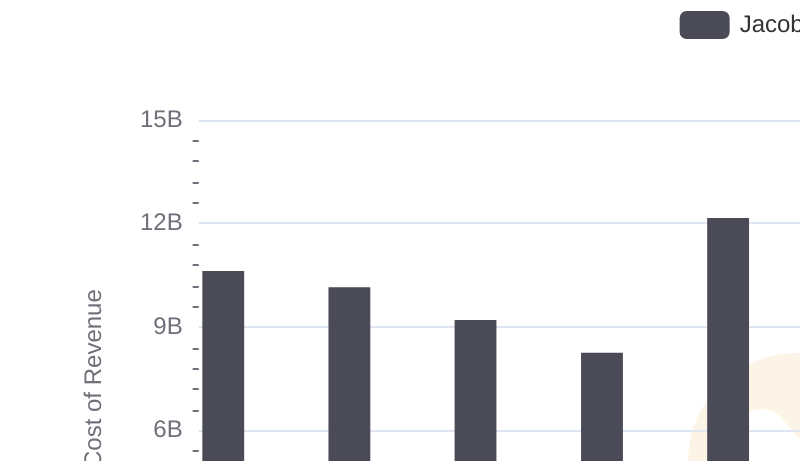

Cost of Revenue Comparison: Old Dominion Freight Line, Inc. vs Jacobs Engineering Group Inc.

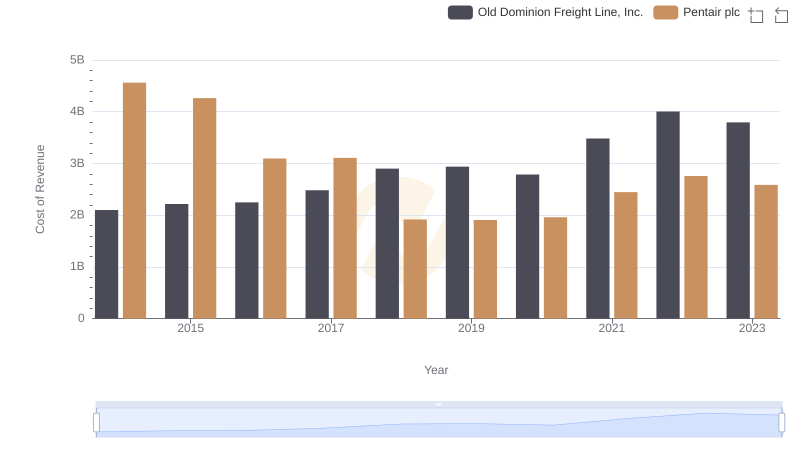

Old Dominion Freight Line, Inc. vs Pentair plc: Efficiency in Cost of Revenue Explored

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or Booz Allen Hamilton Holding Corporation

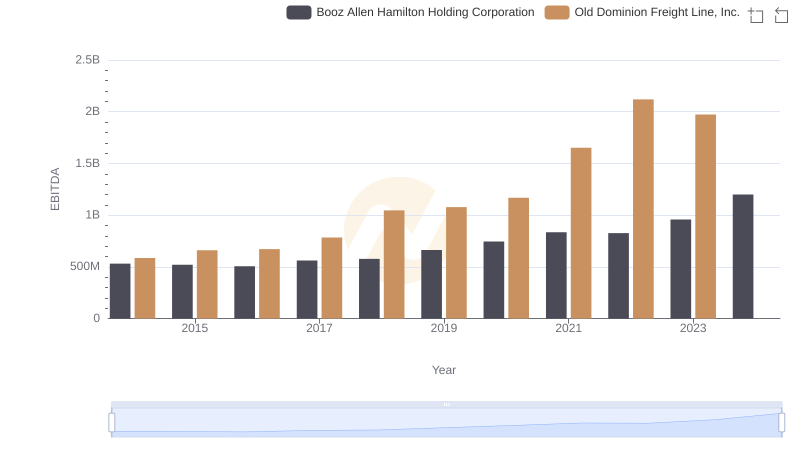

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Booz Allen Hamilton Holding Corporation