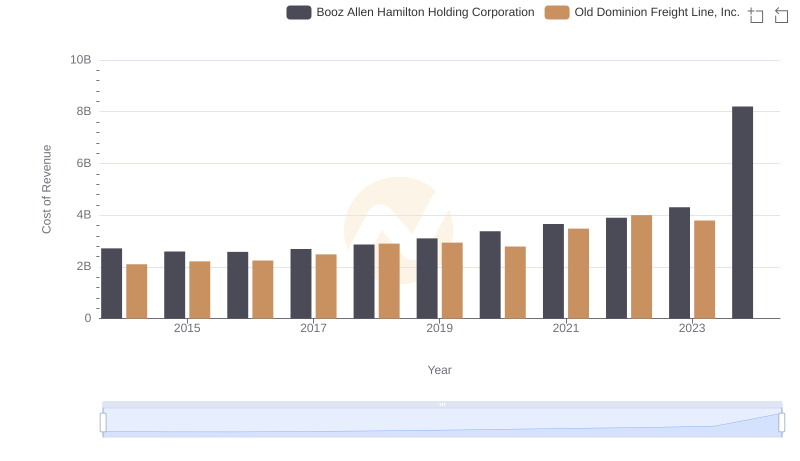

| __timestamp | Booz Allen Hamilton Holding Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 144817000 |

| Thursday, January 1, 2015 | 2159439000 | 153589000 |

| Friday, January 1, 2016 | 2319592000 | 152391000 |

| Sunday, January 1, 2017 | 2568511000 | 177205000 |

| Monday, January 1, 2018 | 2719909000 | 194368000 |

| Tuesday, January 1, 2019 | 2932602000 | 206125000 |

| Wednesday, January 1, 2020 | 3334378000 | 184185000 |

| Friday, January 1, 2021 | 3362722000 | 223757000 |

| Saturday, January 1, 2022 | 3633150000 | 258883000 |

| Sunday, January 1, 2023 | 4341769000 | 281053000 |

| Monday, January 1, 2024 | 1281443000 |

Unleashing insights

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Old Dominion Freight Line, Inc. and Booz Allen Hamilton Holding Corporation, two giants in their respective industries, offer a fascinating study in cost optimization from 2014 to 2023.

Booz Allen Hamilton, a leader in management consulting, saw its SG&A expenses rise by approximately 95% over the decade, peaking in 2023. In contrast, Old Dominion Freight Line, a major player in freight logistics, maintained a more modest increase of around 94% in the same period. This suggests a more controlled approach to cost management.

Interestingly, data for Old Dominion in 2024 is missing, leaving room for speculation on their strategic moves. As businesses navigate economic challenges, these insights into SG&A optimization offer valuable lessons for financial strategists.

Analyzing Cost of Revenue: Old Dominion Freight Line, Inc. and Booz Allen Hamilton Holding Corporation

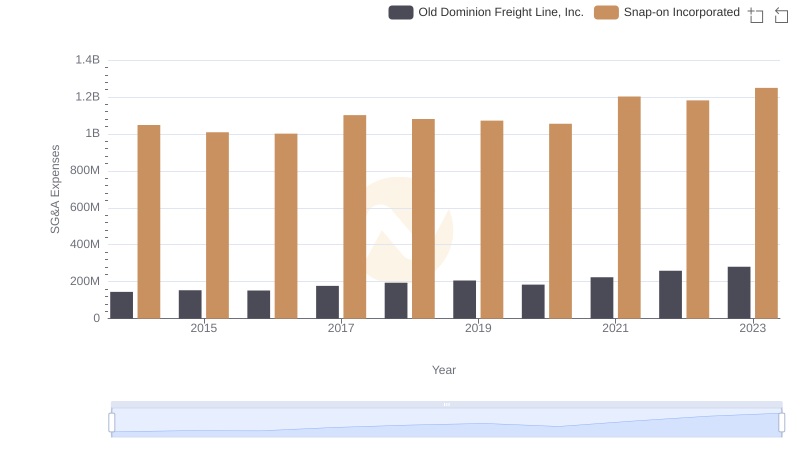

Old Dominion Freight Line, Inc. vs Snap-on Incorporated: SG&A Expense Trends

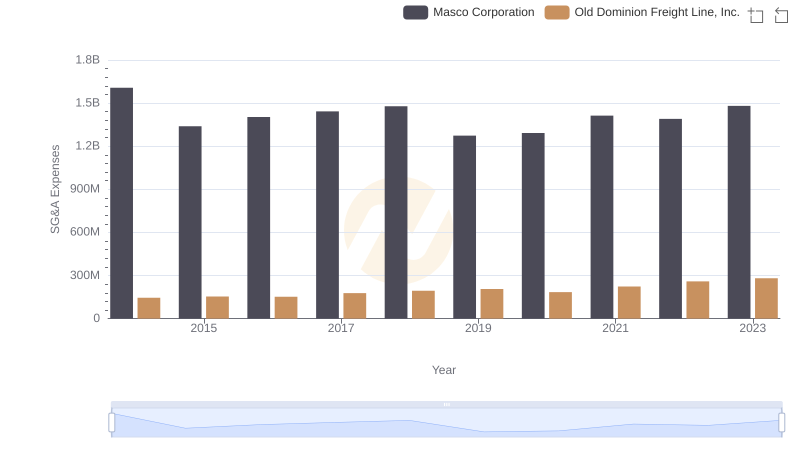

Old Dominion Freight Line, Inc. vs Masco Corporation: SG&A Expense Trends

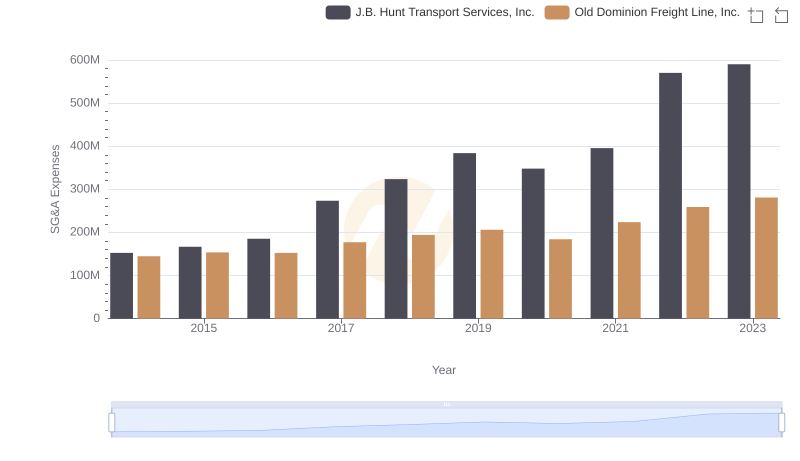

Old Dominion Freight Line, Inc. or J.B. Hunt Transport Services, Inc.: Who Manages SG&A Costs Better?

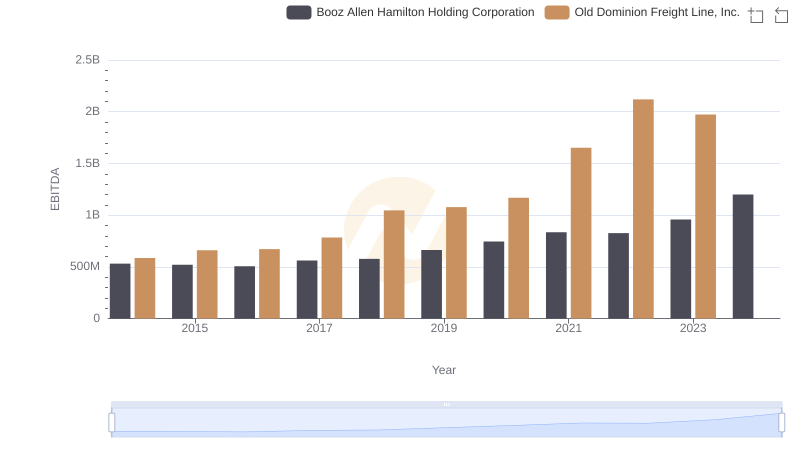

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Booz Allen Hamilton Holding Corporation