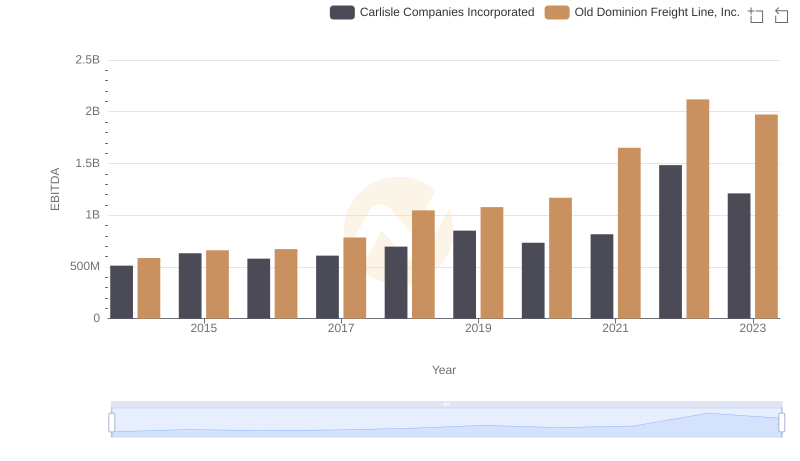

| __timestamp | Old Dominion Freight Line, Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 585590000 | 1109300000 |

| Thursday, January 1, 2015 | 660570000 | 842400000 |

| Friday, January 1, 2016 | 671786000 | 890400000 |

| Sunday, January 1, 2017 | 783749000 | 488600000 |

| Monday, January 1, 2018 | 1046059000 | 552800000 |

| Tuesday, January 1, 2019 | 1078007000 | 513200000 |

| Wednesday, January 1, 2020 | 1168149000 | 527600000 |

| Friday, January 1, 2021 | 1651501000 | 714400000 |

| Saturday, January 1, 2022 | 2118962000 | 830400000 |

| Sunday, January 1, 2023 | 1972689000 | 852000000 |

| Monday, January 1, 2024 | 803800000 |

Data in motion

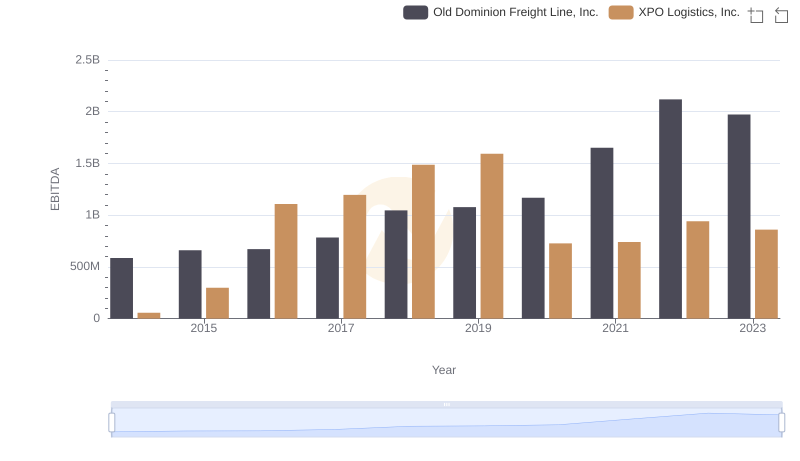

In the competitive landscape of logistics and industrial solutions, Old Dominion Freight Line, Inc. and Pentair plc have showcased distinct EBITDA trajectories over the past decade. From 2014 to 2023, Old Dominion Freight Line, Inc. has demonstrated a robust growth pattern, with its EBITDA surging by approximately 237%, peaking in 2022. This impressive growth underscores the company's strategic prowess in optimizing operational efficiencies and expanding market reach.

Conversely, Pentair plc experienced a more modest EBITDA fluctuation, with a peak in 2014 and a subsequent decline, reflecting a 23% decrease by 2023. This trend highlights the challenges faced by Pentair in maintaining consistent profitability amidst evolving market dynamics.

These contrasting performances offer valuable insights into the strategic maneuvers and market conditions influencing these industry giants, providing a compelling narrative for investors and industry analysts alike.

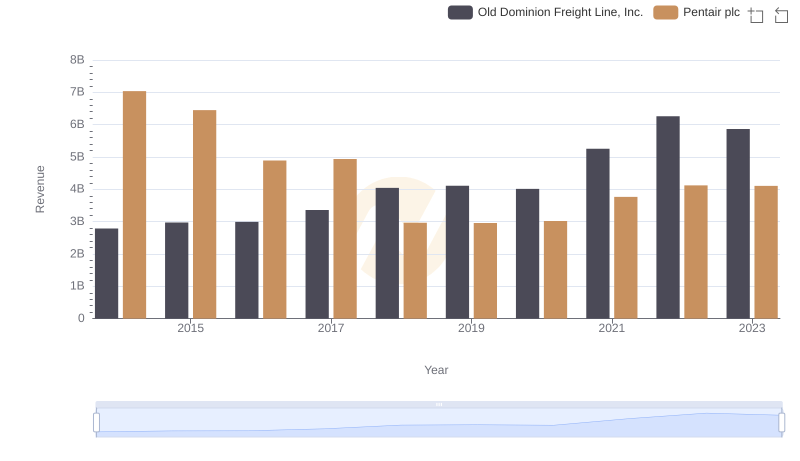

Old Dominion Freight Line, Inc. or Pentair plc: Who Leads in Yearly Revenue?

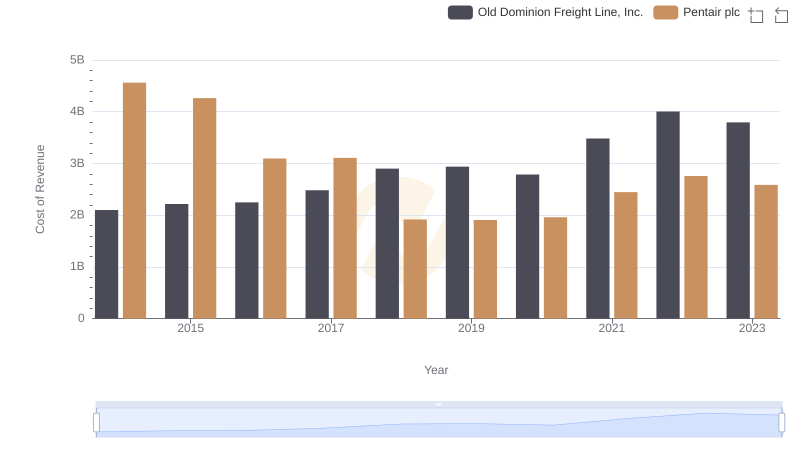

Old Dominion Freight Line, Inc. vs Pentair plc: Efficiency in Cost of Revenue Explored

Old Dominion Freight Line, Inc. and Carlisle Companies Incorporated: A Detailed Examination of EBITDA Performance

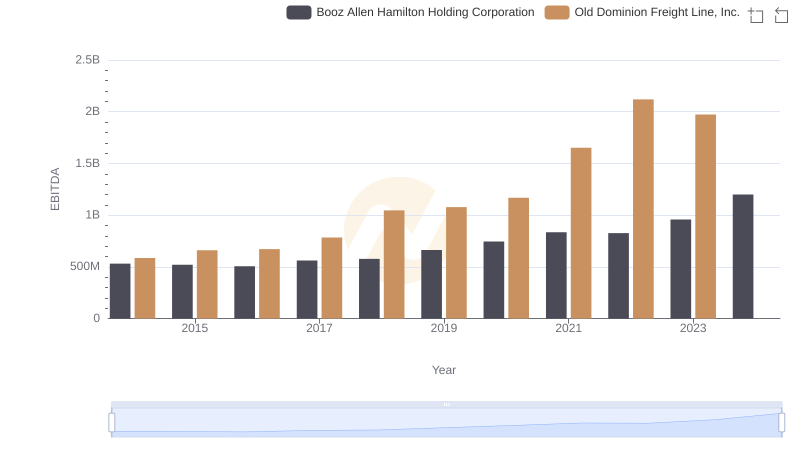

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Booz Allen Hamilton Holding Corporation

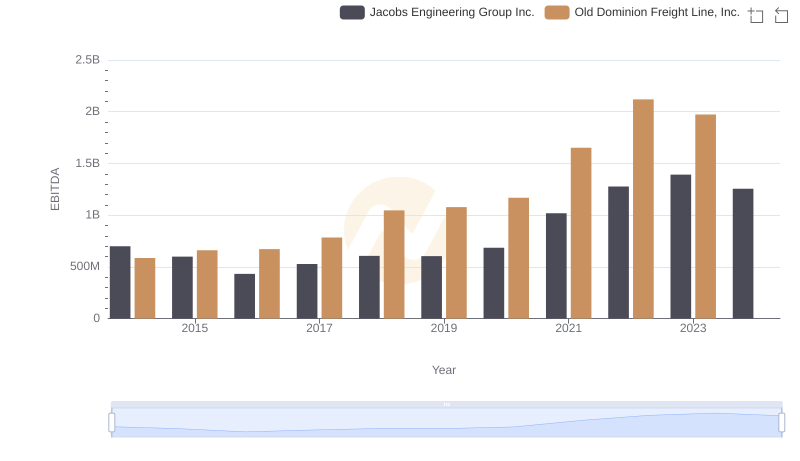

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Jacobs Engineering Group Inc.

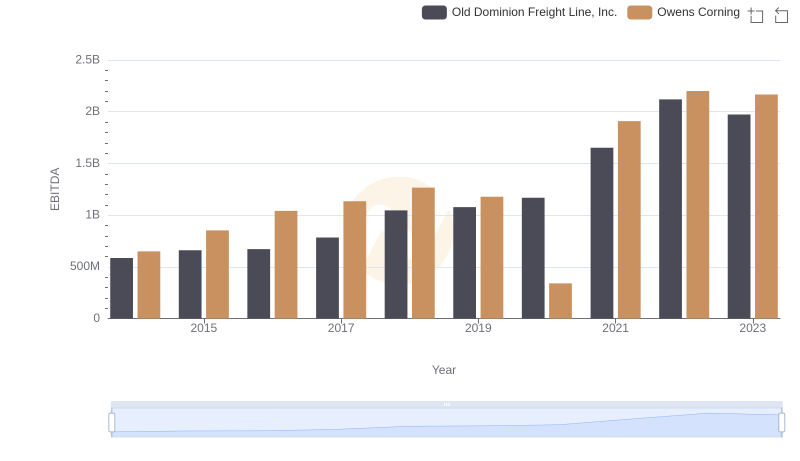

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Owens Corning

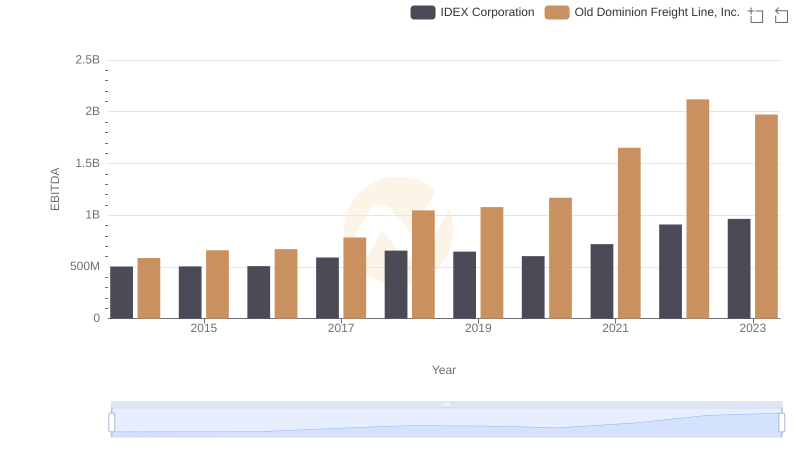

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and IDEX Corporation

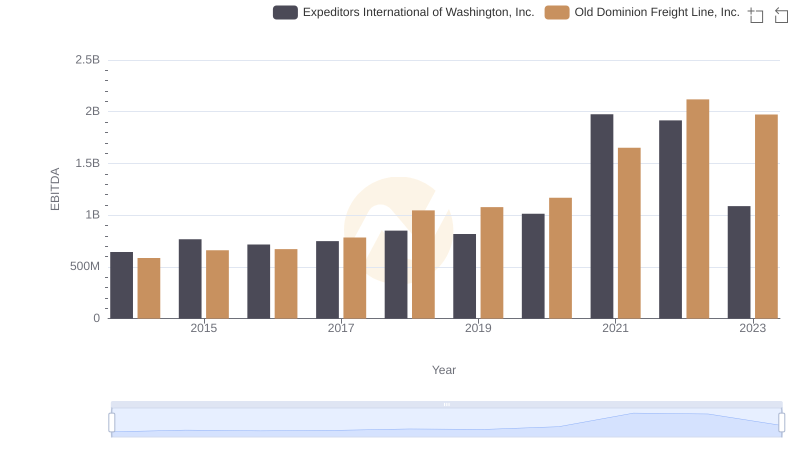

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Expeditors International of Washington, Inc.

Old Dominion Freight Line, Inc. and XPO Logistics, Inc.: A Detailed Examination of EBITDA Performance