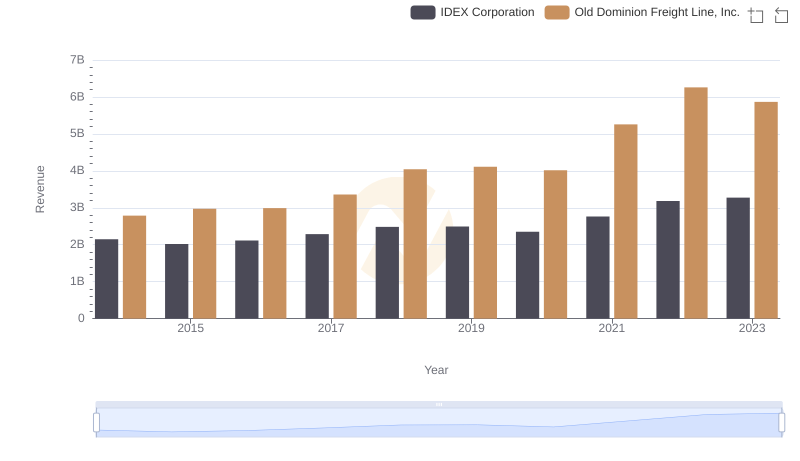

| __timestamp | IDEX Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 504019000 | 585590000 |

| Thursday, January 1, 2015 | 505071000 | 660570000 |

| Friday, January 1, 2016 | 507871000 | 671786000 |

| Sunday, January 1, 2017 | 591033000 | 783749000 |

| Monday, January 1, 2018 | 657092000 | 1046059000 |

| Tuesday, January 1, 2019 | 647793000 | 1078007000 |

| Wednesday, January 1, 2020 | 604602000 | 1168149000 |

| Friday, January 1, 2021 | 720500000 | 1651501000 |

| Saturday, January 1, 2022 | 909800000 | 2118962000 |

| Sunday, January 1, 2023 | 964100000 | 1972689000 |

| Monday, January 1, 2024 | 677200000 |

Cracking the code

In the ever-evolving landscape of the transportation and industrial sectors, Old Dominion Freight Line, Inc. and IDEX Corporation have demonstrated remarkable financial resilience. Over the past decade, from 2014 to 2023, both companies have shown significant growth in their EBITDA, a key indicator of financial health.

Old Dominion has seen its EBITDA surge by over 230%, peaking in 2022. This growth reflects the company's strategic expansion and operational efficiency in the freight industry.

IDEX, a leader in fluid and metering technologies, has also experienced a robust EBITDA increase of approximately 91% over the same period. This growth underscores IDEX's innovation and adaptability in the industrial sector.

As we look to the future, both companies are well-positioned to continue their upward trajectory, driven by strong market demand and strategic initiatives.

Old Dominion Freight Line, Inc. vs IDEX Corporation: Annual Revenue Growth Compared

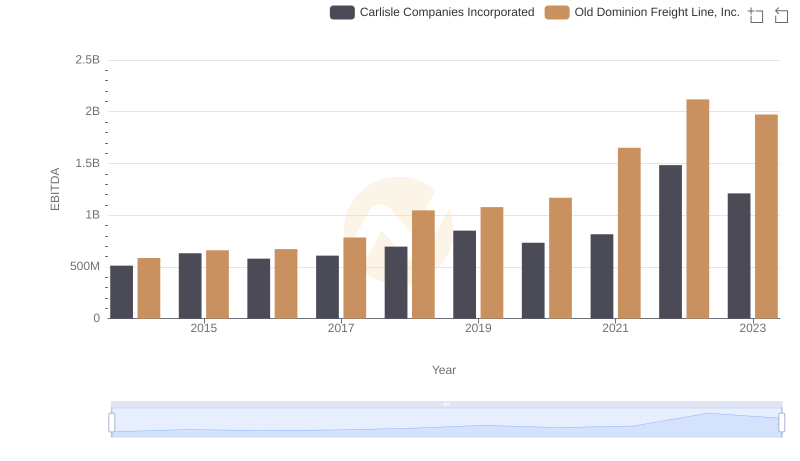

Old Dominion Freight Line, Inc. and Carlisle Companies Incorporated: A Detailed Examination of EBITDA Performance

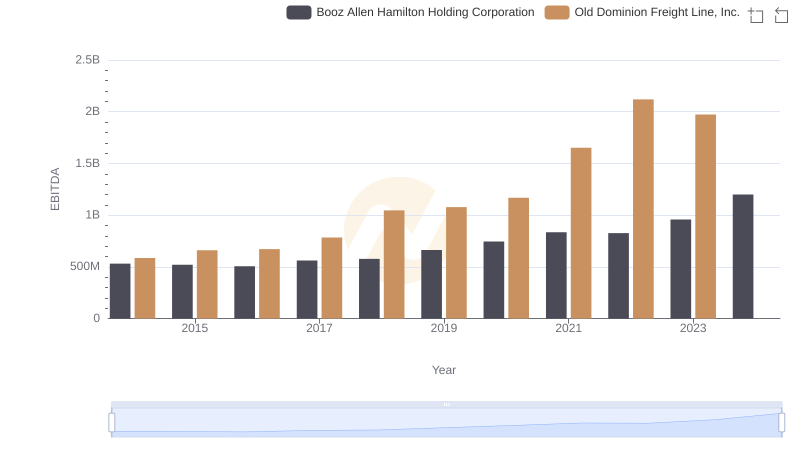

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Booz Allen Hamilton Holding Corporation

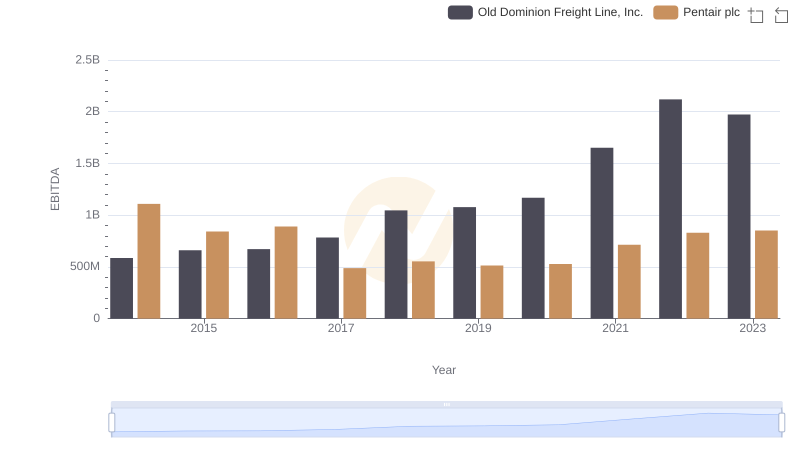

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Pentair plc

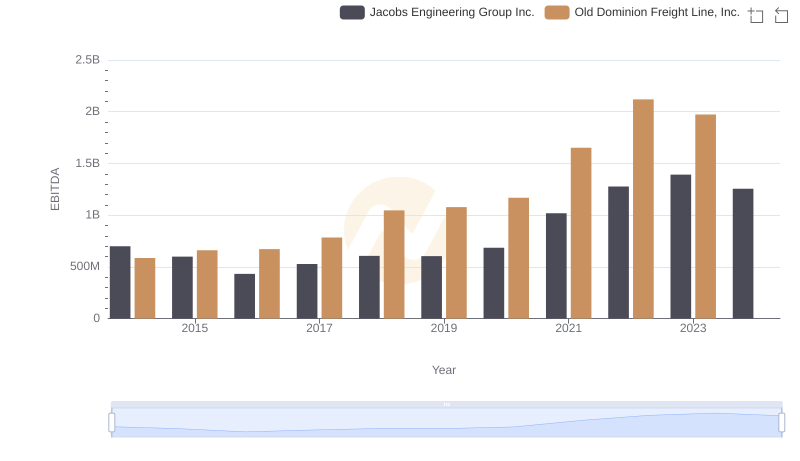

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Jacobs Engineering Group Inc.

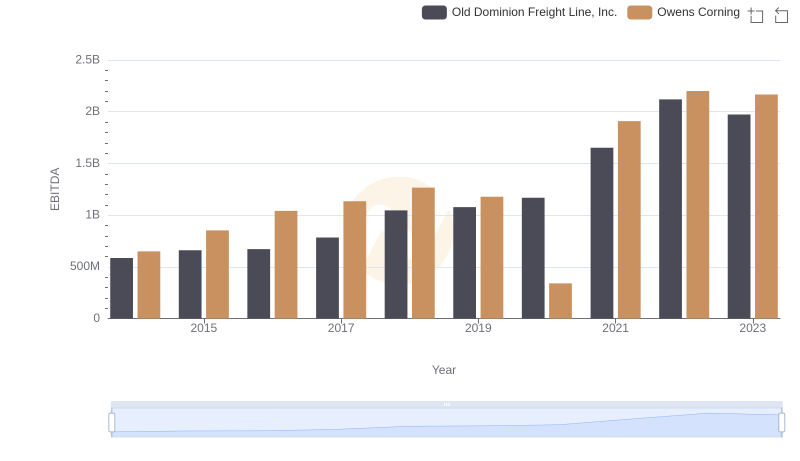

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Owens Corning

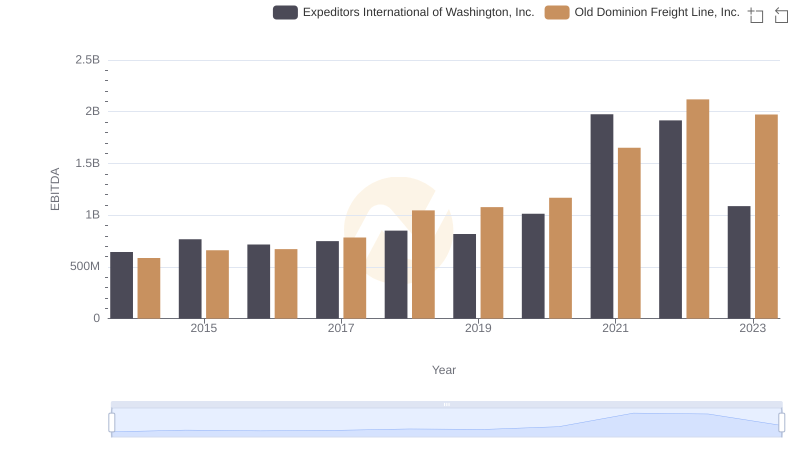

EBITDA Metrics Evaluated: Old Dominion Freight Line, Inc. vs Expeditors International of Washington, Inc.

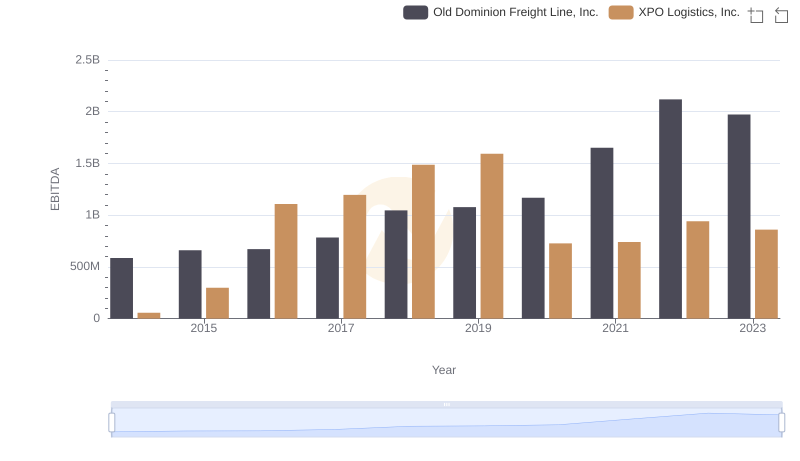

Old Dominion Freight Line, Inc. and XPO Logistics, Inc.: A Detailed Examination of EBITDA Performance

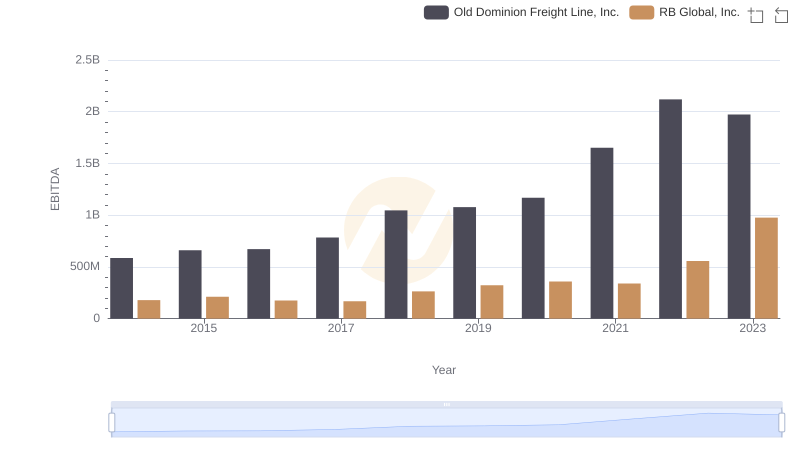

EBITDA Analysis: Evaluating Old Dominion Freight Line, Inc. Against RB Global, Inc.