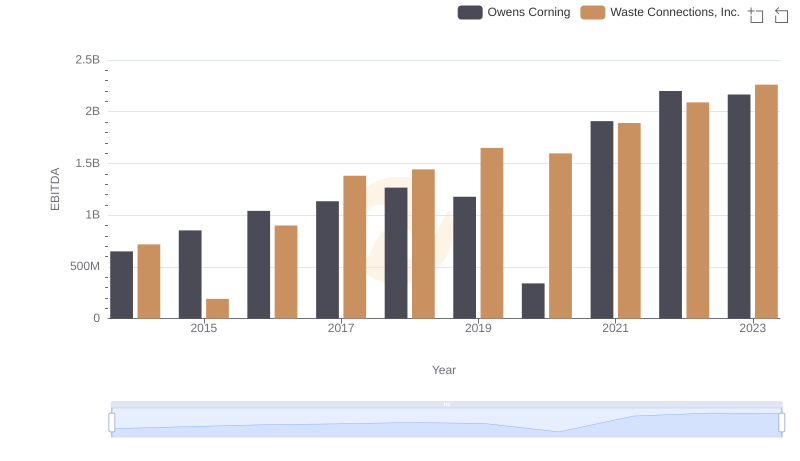

| __timestamp | Owens Corning | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 487000000 | 229474000 |

| Thursday, January 1, 2015 | 525000000 | 237484000 |

| Friday, January 1, 2016 | 584000000 | 474263000 |

| Sunday, January 1, 2017 | 620000000 | 509638000 |

| Monday, January 1, 2018 | 700000000 | 524388000 |

| Tuesday, January 1, 2019 | 698000000 | 546278000 |

| Wednesday, January 1, 2020 | 664000000 | 537632000 |

| Friday, January 1, 2021 | 757000000 | 612337000 |

| Saturday, January 1, 2022 | 803000000 | 696467000 |

| Sunday, January 1, 2023 | 831000000 | 799119000 |

| Monday, January 1, 2024 | 883445000 |

Infusing magic into the data realm

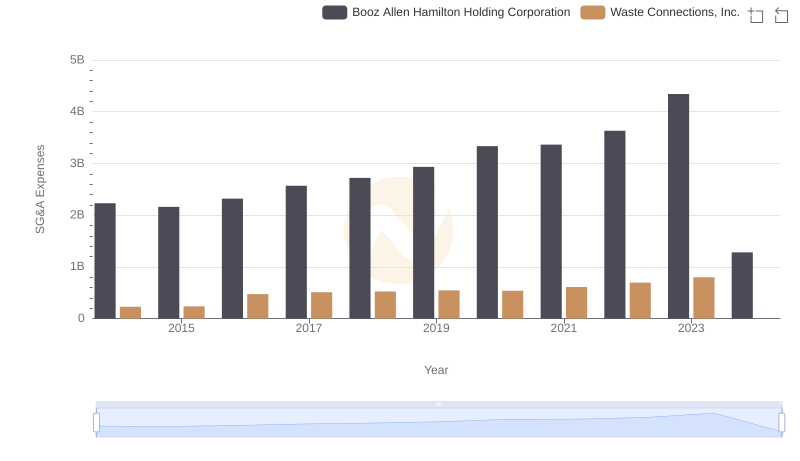

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Waste Connections, Inc. and Owens Corning, two industry giants, have shown distinct strategies in optimizing these costs over the past decade. From 2014 to 2023, Owens Corning's SG&A expenses grew by approximately 71%, while Waste Connections, Inc. saw a staggering 248% increase. This suggests that Owens Corning has maintained a more consistent approach, with expenses rising at a steadier pace. In contrast, Waste Connections, Inc. experienced a sharper increase, particularly noticeable from 2016 onwards. This divergence highlights the different operational strategies and market conditions each company faces. As businesses navigate economic fluctuations, understanding these trends provides valuable insights into corporate efficiency and strategic planning.

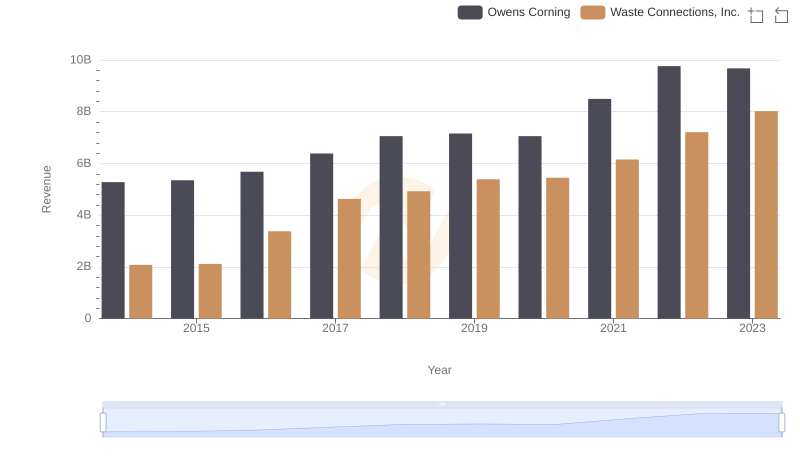

Comparing Revenue Performance: Waste Connections, Inc. or Owens Corning?

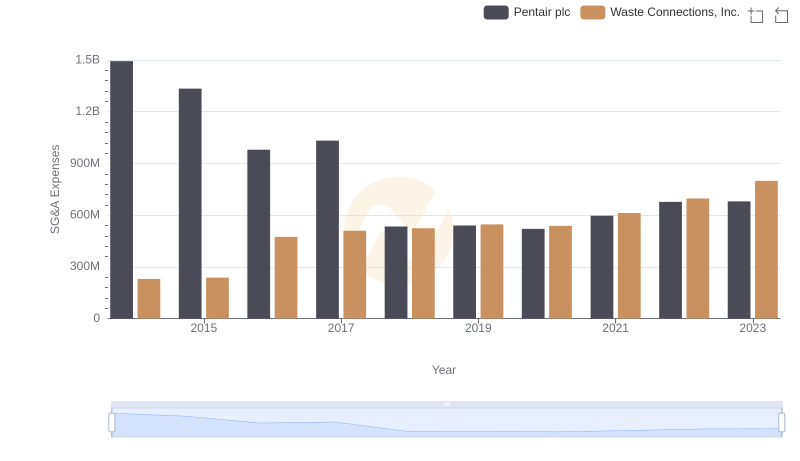

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Pentair plc

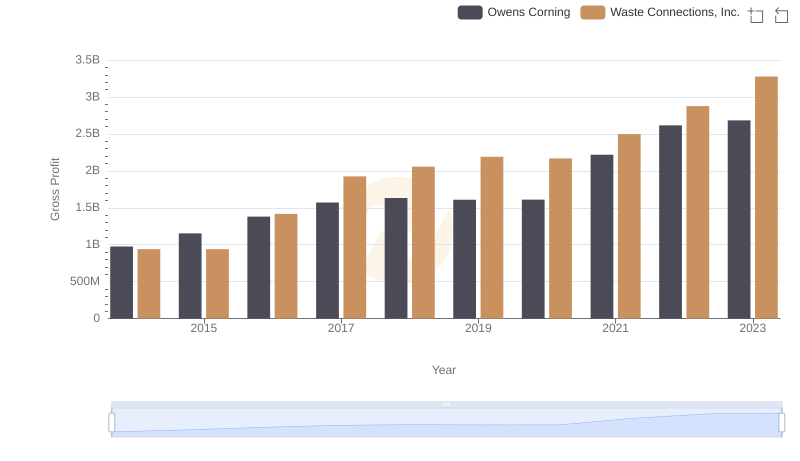

Who Generates Higher Gross Profit? Waste Connections, Inc. or Owens Corning

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Booz Allen Hamilton Holding Corporation

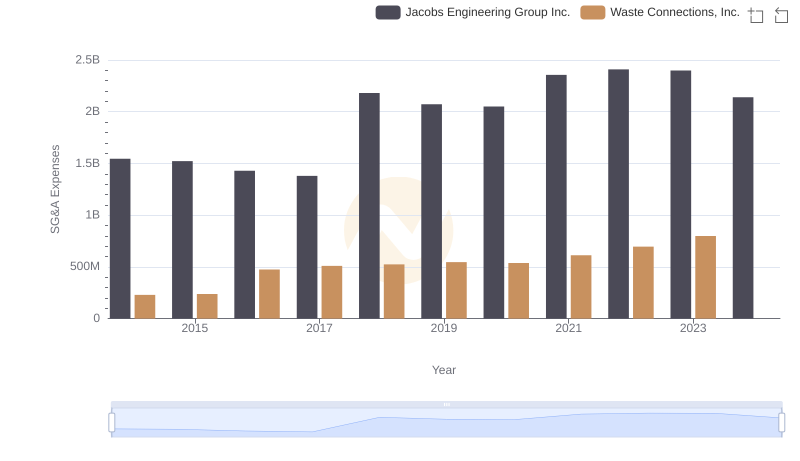

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Jacobs Engineering Group Inc.

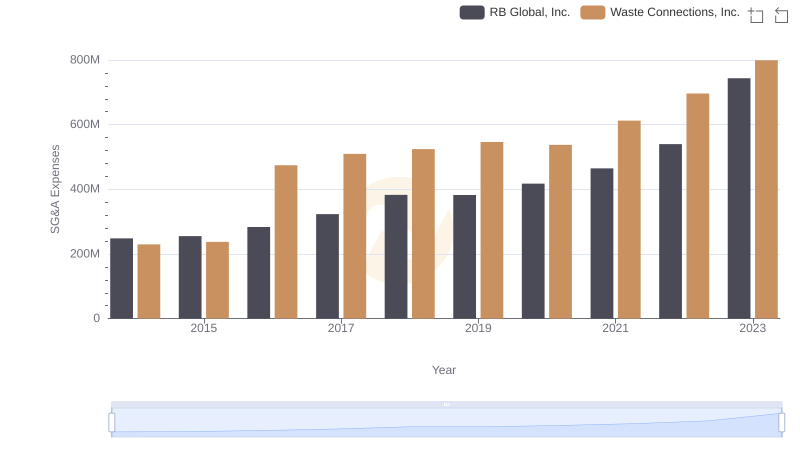

Waste Connections, Inc. vs RB Global, Inc.: SG&A Expense Trends

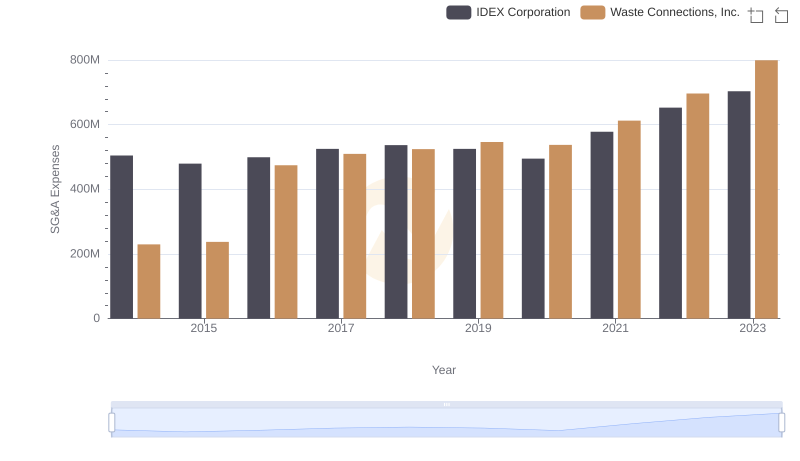

Waste Connections, Inc. and IDEX Corporation: SG&A Spending Patterns Compared

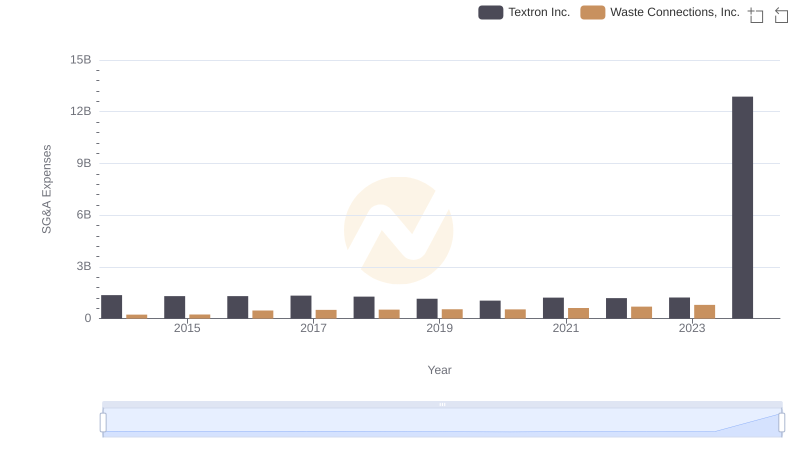

Breaking Down SG&A Expenses: Waste Connections, Inc. vs Textron Inc.

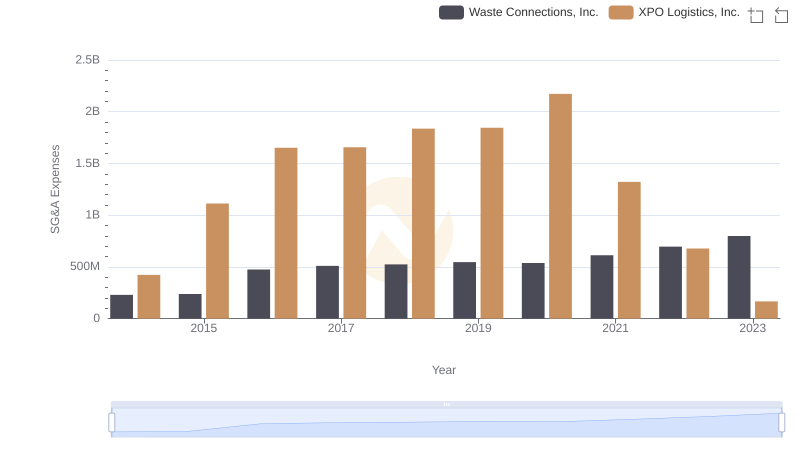

Breaking Down SG&A Expenses: Waste Connections, Inc. vs XPO Logistics, Inc.

EBITDA Metrics Evaluated: Waste Connections, Inc. vs Owens Corning