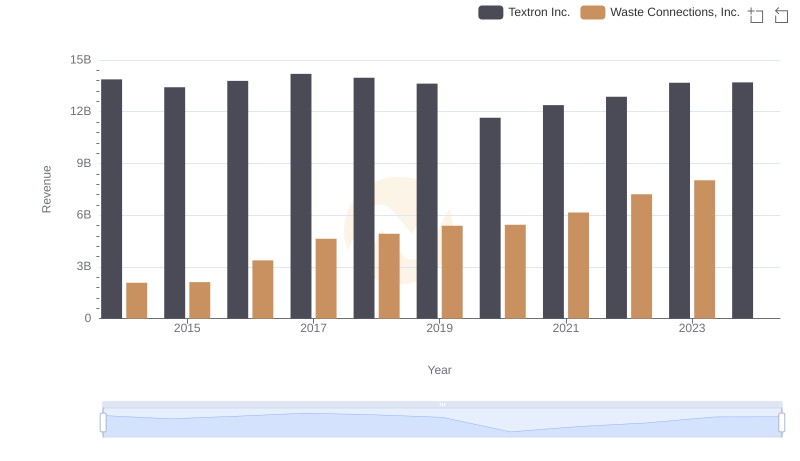

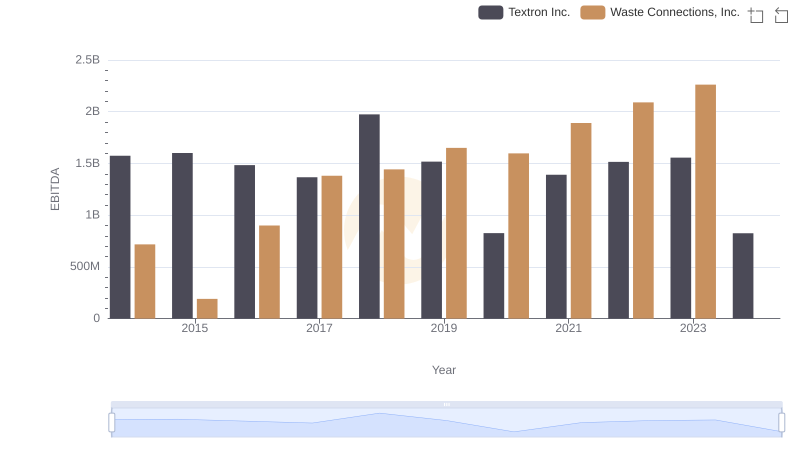

| __timestamp | Textron Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1361000000 | 229474000 |

| Thursday, January 1, 2015 | 1304000000 | 237484000 |

| Friday, January 1, 2016 | 1304000000 | 474263000 |

| Sunday, January 1, 2017 | 1337000000 | 509638000 |

| Monday, January 1, 2018 | 1275000000 | 524388000 |

| Tuesday, January 1, 2019 | 1152000000 | 546278000 |

| Wednesday, January 1, 2020 | 1045000000 | 537632000 |

| Friday, January 1, 2021 | 1221000000 | 612337000 |

| Saturday, January 1, 2022 | 1186000000 | 696467000 |

| Sunday, January 1, 2023 | 1225000000 | 799119000 |

| Monday, January 1, 2024 | 1156000000 | 883445000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Textron Inc. and Waste Connections, Inc. have showcased distinct trajectories in their SG&A expenditures. From 2014 to 2023, Textron Inc. consistently reported higher SG&A expenses, peaking in 2024 with a staggering 10-fold increase compared to previous years. In contrast, Waste Connections, Inc. demonstrated a steady growth, with expenses rising by approximately 250% from 2014 to 2023. This divergence highlights Textron's aggressive expansion strategies, while Waste Connections maintains a more conservative approach. Notably, the data for 2024 is incomplete for Waste Connections, suggesting potential shifts in their financial strategy. As businesses navigate the complexities of operational costs, these insights offer a window into the strategic priorities of two industry giants.

Waste Connections, Inc. and Textron Inc.: A Comprehensive Revenue Analysis

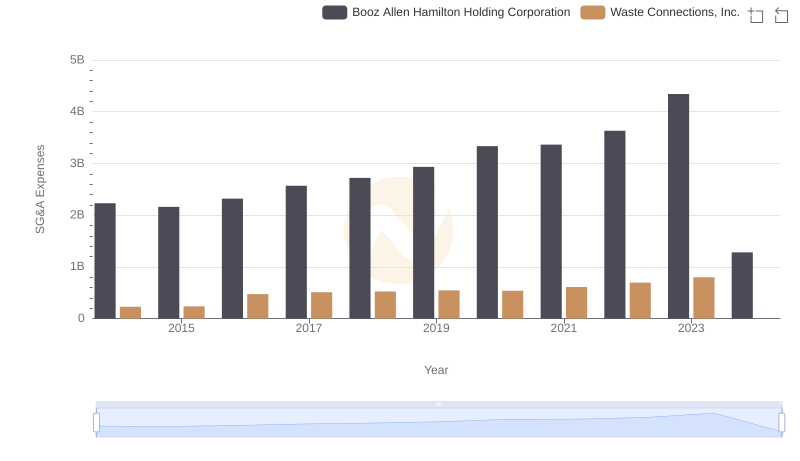

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Booz Allen Hamilton Holding Corporation

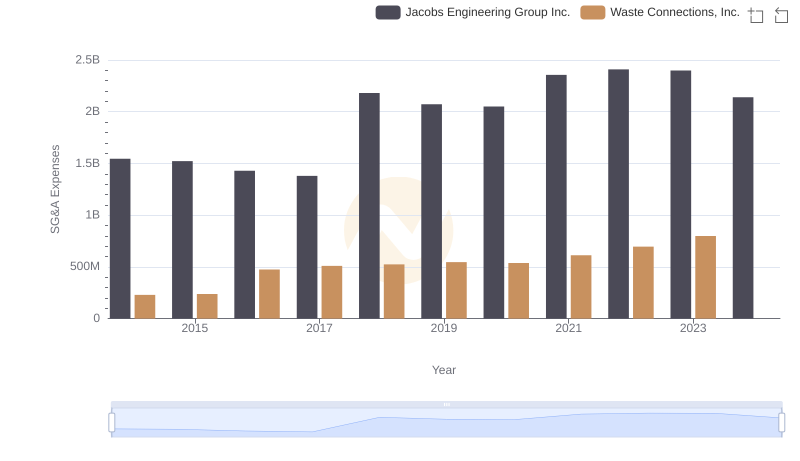

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Jacobs Engineering Group Inc.

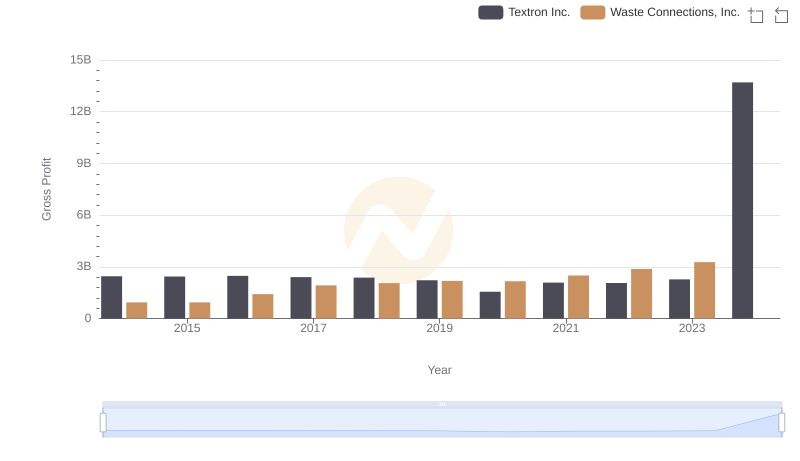

Gross Profit Comparison: Waste Connections, Inc. and Textron Inc. Trends

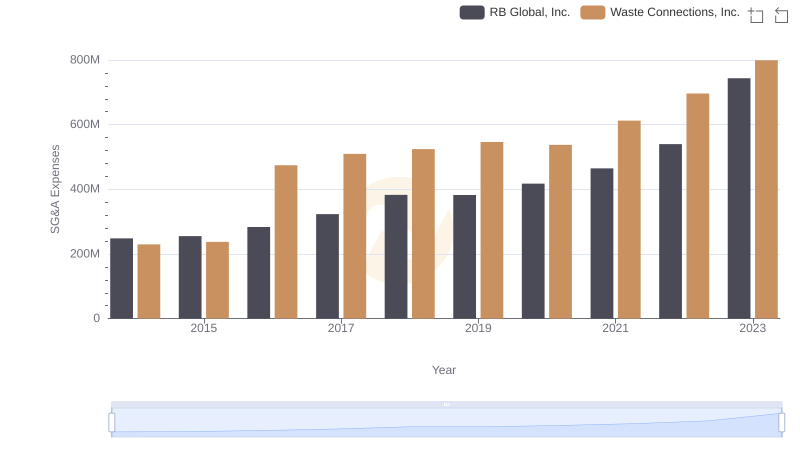

Waste Connections, Inc. vs RB Global, Inc.: SG&A Expense Trends

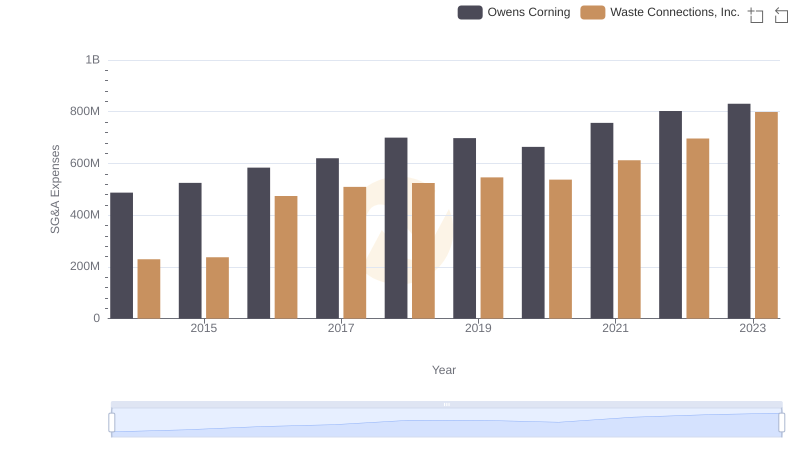

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Owens Corning

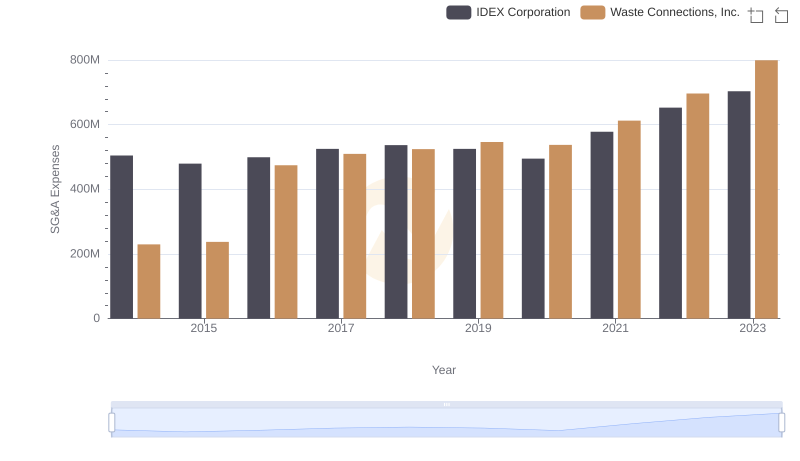

Waste Connections, Inc. and IDEX Corporation: SG&A Spending Patterns Compared

Waste Connections, Inc. and Textron Inc.: A Detailed Examination of EBITDA Performance

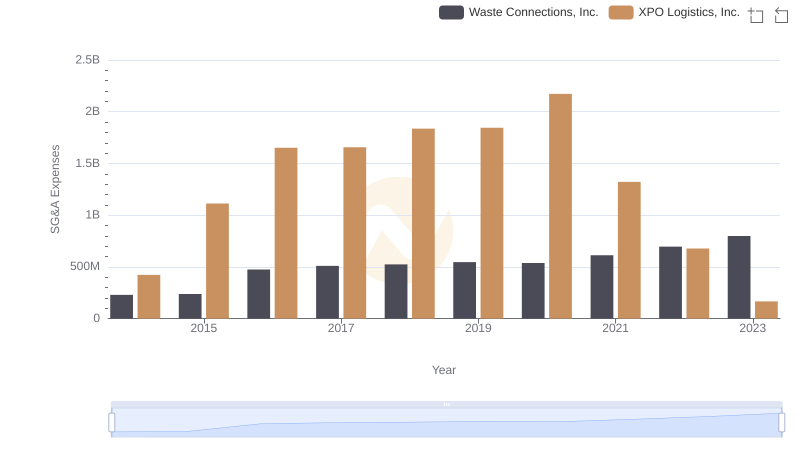

Breaking Down SG&A Expenses: Waste Connections, Inc. vs XPO Logistics, Inc.

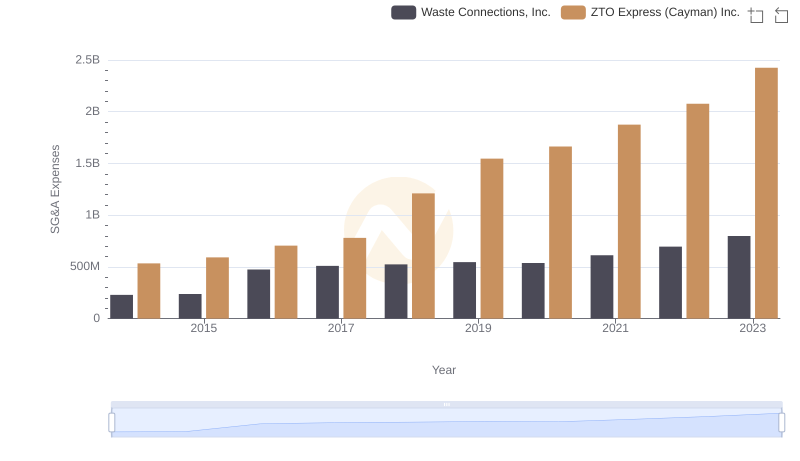

Waste Connections, Inc. vs ZTO Express (Cayman) Inc.: SG&A Expense Trends

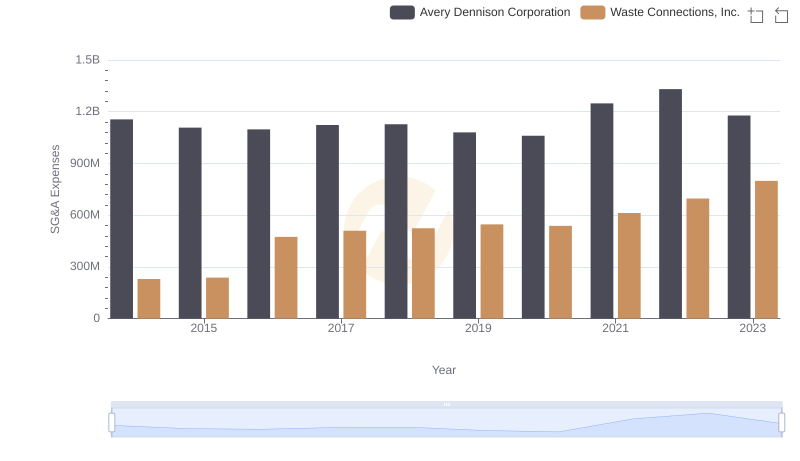

Breaking Down SG&A Expenses: Waste Connections, Inc. vs Avery Dennison Corporation