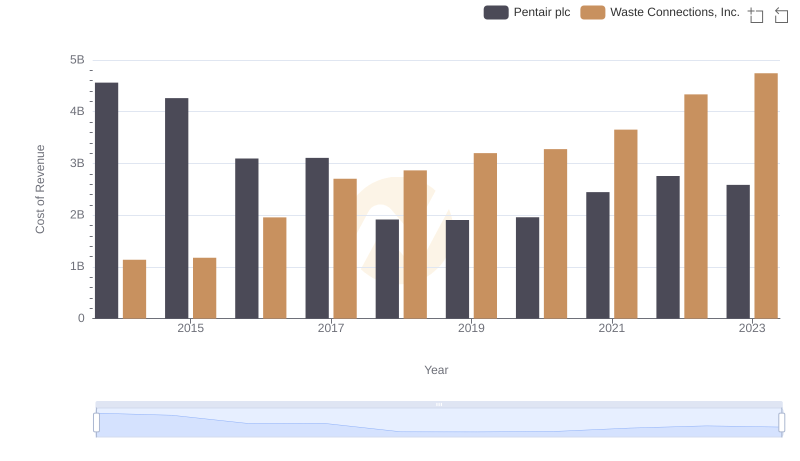

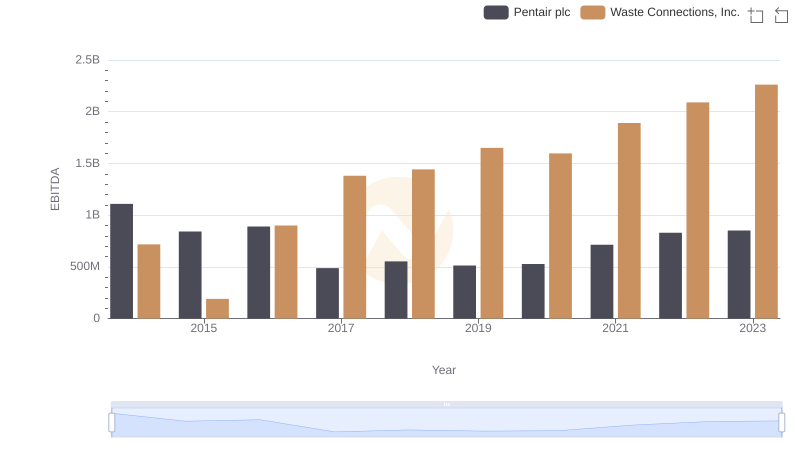

| __timestamp | Pentair plc | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1493800000 | 229474000 |

| Thursday, January 1, 2015 | 1334300000 | 237484000 |

| Friday, January 1, 2016 | 979300000 | 474263000 |

| Sunday, January 1, 2017 | 1032500000 | 509638000 |

| Monday, January 1, 2018 | 534300000 | 524388000 |

| Tuesday, January 1, 2019 | 540100000 | 546278000 |

| Wednesday, January 1, 2020 | 520500000 | 537632000 |

| Friday, January 1, 2021 | 596400000 | 612337000 |

| Saturday, January 1, 2022 | 677100000 | 696467000 |

| Sunday, January 1, 2023 | 680200000 | 799119000 |

| Monday, January 1, 2024 | 701400000 | 883445000 |

Infusing magic into the data realm

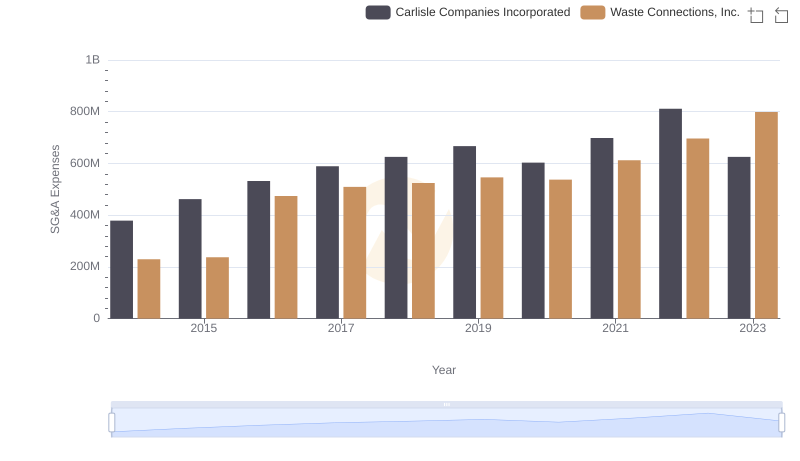

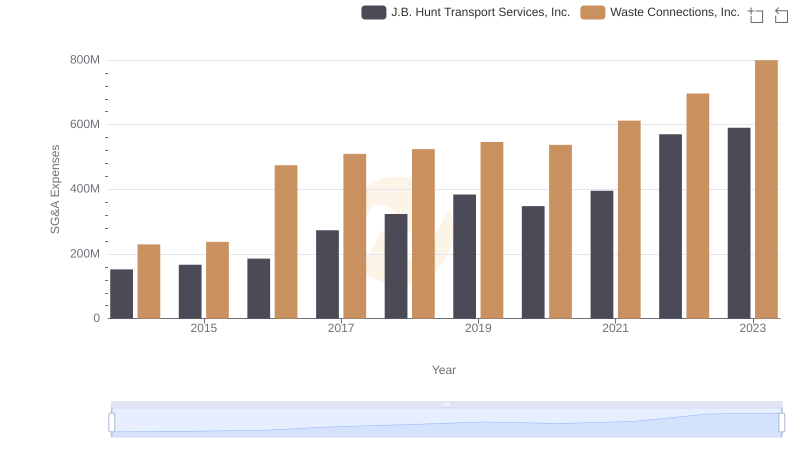

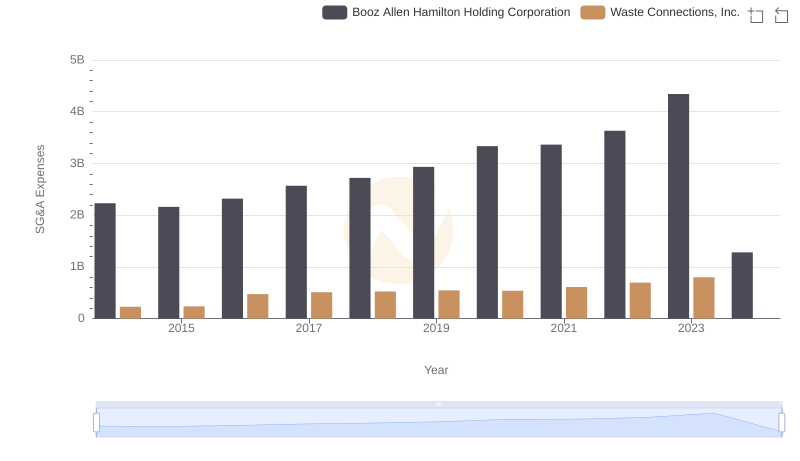

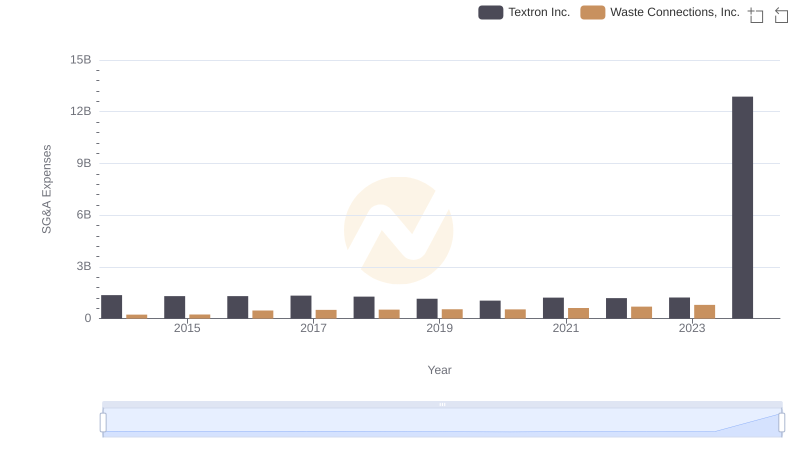

In the competitive landscape of corporate America, the efficiency of Selling, General, and Administrative (SG&A) expenses can be a decisive factor in a company's success. Over the past decade, Waste Connections, Inc. and Pentair plc have showcased contrasting trends in their SG&A expenditures. From 2014 to 2023, Pentair plc's SG&A expenses decreased by approximately 54%, reflecting a strategic shift towards cost efficiency. In contrast, Waste Connections, Inc. saw a 248% increase, indicating a potential expansion or investment in administrative capabilities.

In 2014, Pentair's SG&A expenses were nearly seven times higher than Waste Connections. However, by 2023, Waste Connections had surpassed Pentair, highlighting a significant shift in their financial strategies. This data provides a fascinating insight into how two companies can navigate their financial landscapes differently, offering valuable lessons for investors and industry analysts alike.

Cost of Revenue Comparison: Waste Connections, Inc. vs Pentair plc

Selling, General, and Administrative Costs: Waste Connections, Inc. vs Carlisle Companies Incorporated

Cost Management Insights: SG&A Expenses for Waste Connections, Inc. and J.B. Hunt Transport Services, Inc.

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Booz Allen Hamilton Holding Corporation

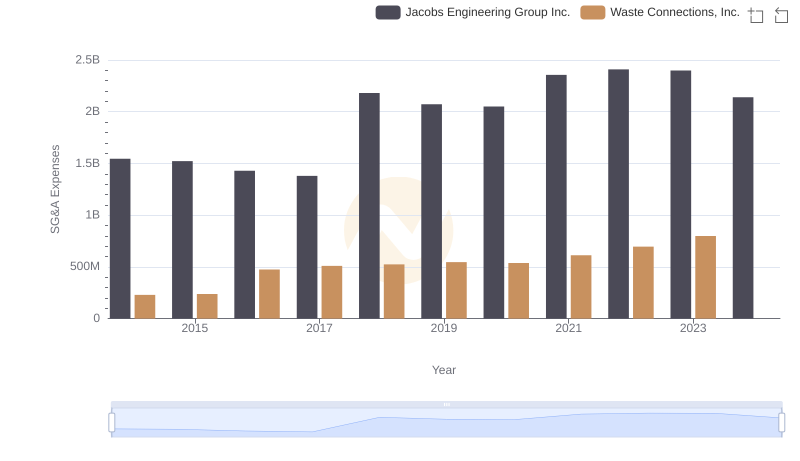

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Jacobs Engineering Group Inc.

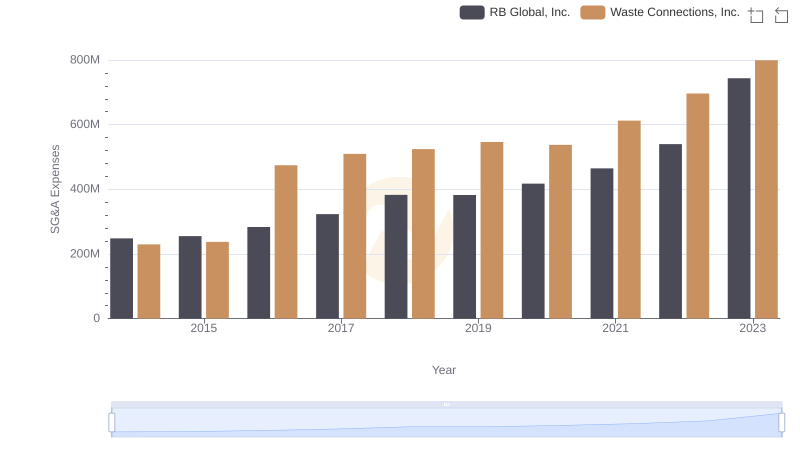

Waste Connections, Inc. vs RB Global, Inc.: SG&A Expense Trends

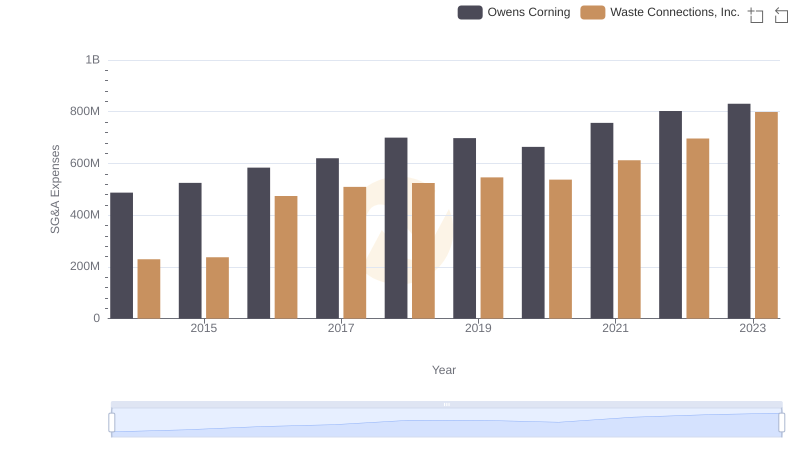

Who Optimizes SG&A Costs Better? Waste Connections, Inc. or Owens Corning

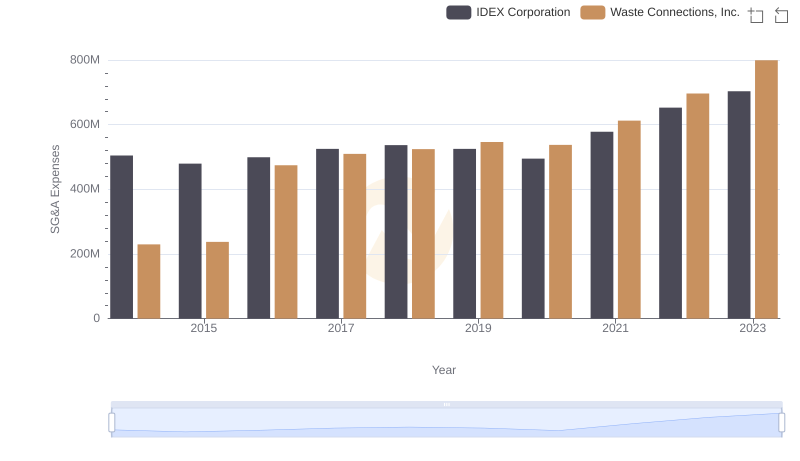

Waste Connections, Inc. and IDEX Corporation: SG&A Spending Patterns Compared

Comprehensive EBITDA Comparison: Waste Connections, Inc. vs Pentair plc

Breaking Down SG&A Expenses: Waste Connections, Inc. vs Textron Inc.