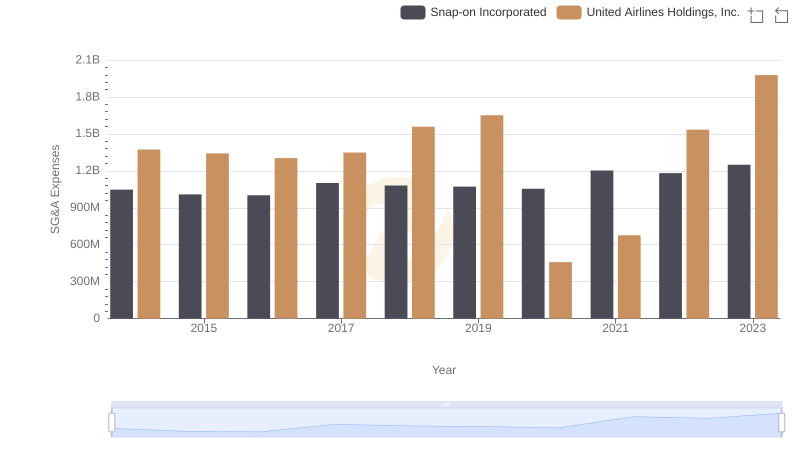

| __timestamp | J.B. Hunt Transport Services, Inc. | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 152469000 | 1373000000 |

| Thursday, January 1, 2015 | 166799000 | 1342000000 |

| Friday, January 1, 2016 | 185436000 | 1303000000 |

| Sunday, January 1, 2017 | 273440000 | 1349000000 |

| Monday, January 1, 2018 | 323587000 | 1558000000 |

| Tuesday, January 1, 2019 | 383981000 | 1651000000 |

| Wednesday, January 1, 2020 | 348076000 | 459000000 |

| Friday, January 1, 2021 | 395533000 | 677000000 |

| Saturday, January 1, 2022 | 570191000 | 1535000000 |

| Sunday, January 1, 2023 | 590242000 | 1977000000 |

| Monday, January 1, 2024 | 2231000000 |

Infusing magic into the data realm

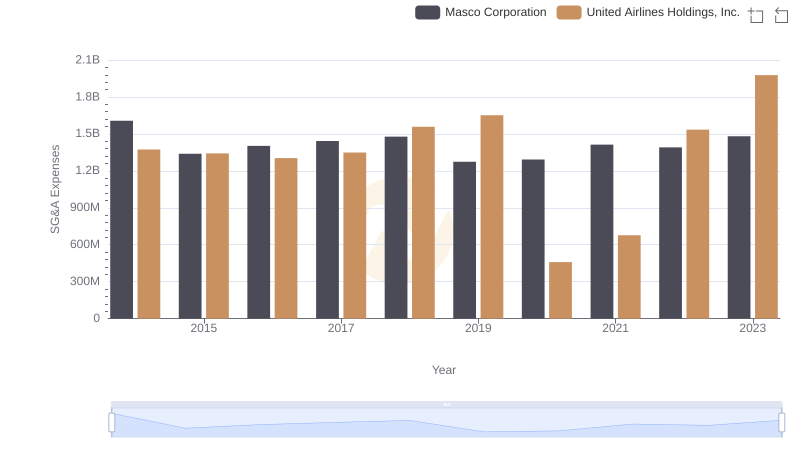

In the competitive world of transportation, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, J.B. Hunt Transport Services, Inc. and United Airlines Holdings, Inc. have showcased contrasting strategies in this domain. From 2014 to 2023, J.B. Hunt's SG&A expenses grew by approximately 287%, reflecting a strategic expansion and investment in operational efficiency. In contrast, United Airlines, despite a 44% increase in SG&A costs, maintained a more stable trajectory, with a notable dip in 2020, likely due to pandemic-related adjustments.

J.B. Hunt's aggressive cost management has allowed it to optimize its SG&A expenses relative to its revenue growth, while United Airlines' approach highlights the challenges faced by the airline industry in balancing operational costs with fluctuating demand. This analysis underscores the importance of strategic financial planning in navigating industry-specific challenges.

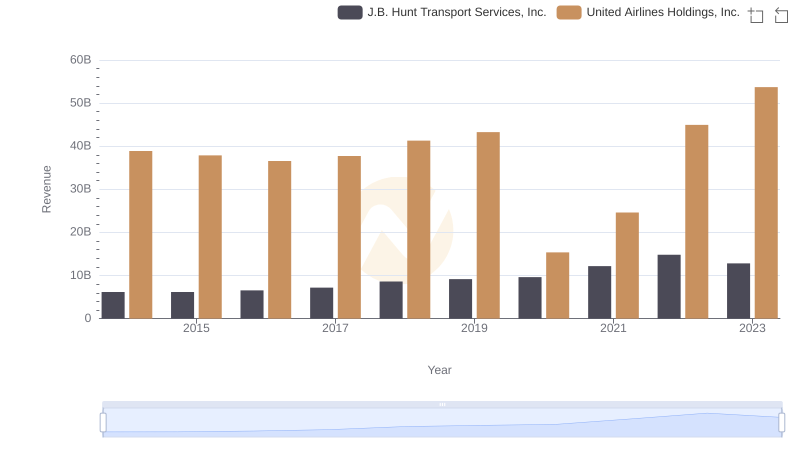

Annual Revenue Comparison: United Airlines Holdings, Inc. vs J.B. Hunt Transport Services, Inc.

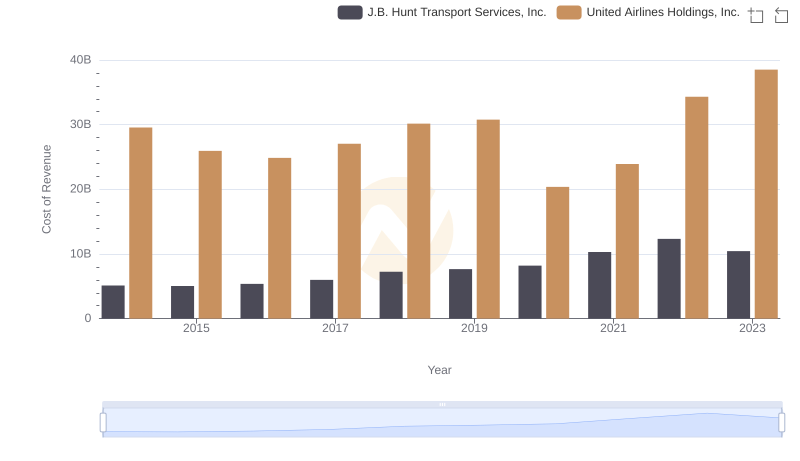

Cost of Revenue Trends: United Airlines Holdings, Inc. vs J.B. Hunt Transport Services, Inc.

Breaking Down SG&A Expenses: United Airlines Holdings, Inc. vs Snap-on Incorporated

United Airlines Holdings, Inc. or Masco Corporation: Who Manages SG&A Costs Better?

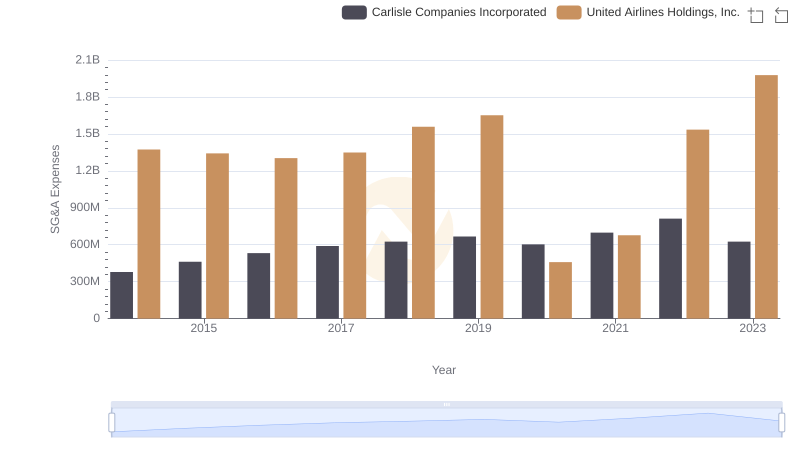

Selling, General, and Administrative Costs: United Airlines Holdings, Inc. vs Carlisle Companies Incorporated

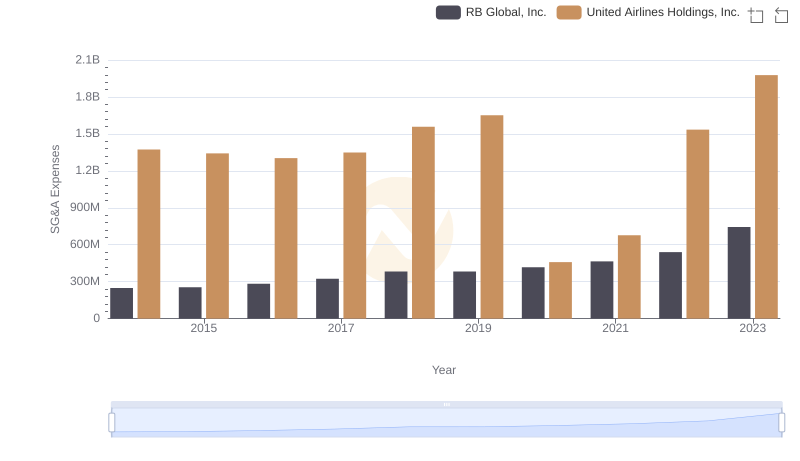

United Airlines Holdings, Inc. vs RB Global, Inc.: SG&A Expense Trends

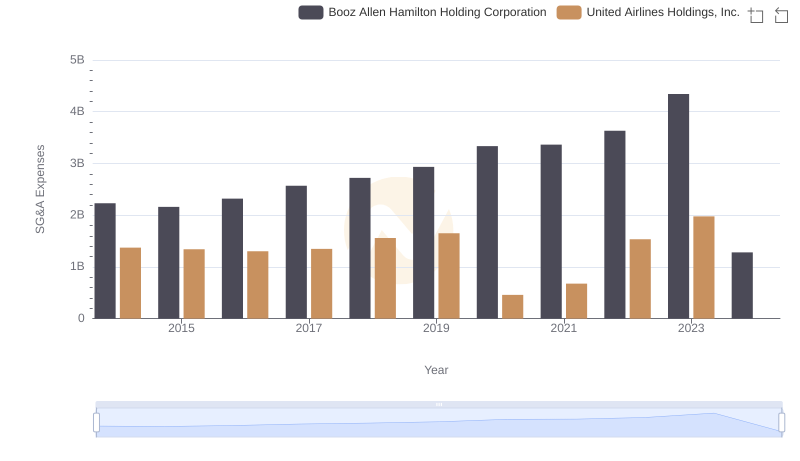

United Airlines Holdings, Inc. or Booz Allen Hamilton Holding Corporation: Who Manages SG&A Costs Better?