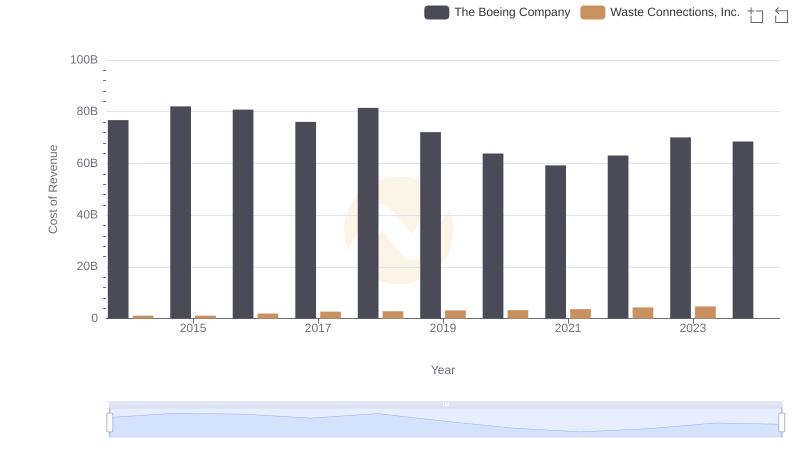

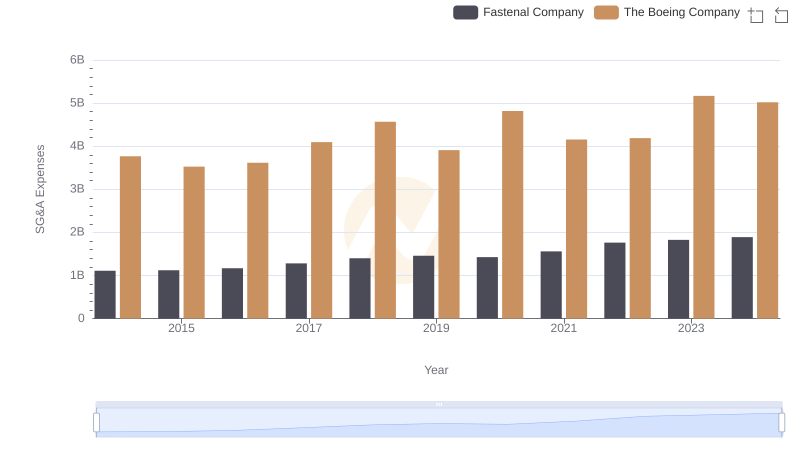

| __timestamp | The Boeing Company | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 3767000000 | 229474000 |

| Thursday, January 1, 2015 | 3525000000 | 237484000 |

| Friday, January 1, 2016 | 3616000000 | 474263000 |

| Sunday, January 1, 2017 | 4094000000 | 509638000 |

| Monday, January 1, 2018 | 4567000000 | 524388000 |

| Tuesday, January 1, 2019 | 3909000000 | 546278000 |

| Wednesday, January 1, 2020 | 4817000000 | 537632000 |

| Friday, January 1, 2021 | 4157000000 | 612337000 |

| Saturday, January 1, 2022 | 4187000000 | 696467000 |

| Sunday, January 1, 2023 | 5168000000 | 799119000 |

| Monday, January 1, 2024 | 5021000000 | 883445000 |

Data in motion

In the competitive world of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, The Boeing Company and Waste Connections, Inc. have taken different paths in optimizing these costs.

From 2014 to 2023, Boeing's SG&A expenses have soared, peaking at approximately $5.2 billion in 2023, a 37% increase from 2014. This trend reflects Boeing's expansive operations and the challenges of managing costs in a volatile aerospace industry.

Conversely, Waste Connections, Inc. has shown a more controlled increase in SG&A expenses, rising from $229 million in 2014 to nearly $799 million in 2023. This 248% growth, while significant, aligns with the company's strategic acquisitions and expansion in the waste management sector.

Both companies face unique challenges, but the data suggests that Waste Connections, Inc. has maintained a more consistent approach to managing SG&A costs.

The Boeing Company and Waste Connections, Inc.: A Comprehensive Revenue Analysis

Cost of Revenue Trends: The Boeing Company vs Waste Connections, Inc.

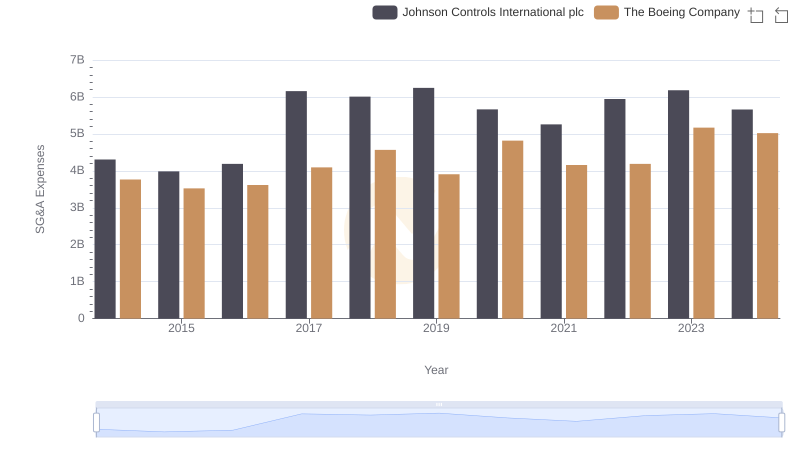

Operational Costs Compared: SG&A Analysis of The Boeing Company and Johnson Controls International plc

Who Optimizes SG&A Costs Better? The Boeing Company or Fastenal Company

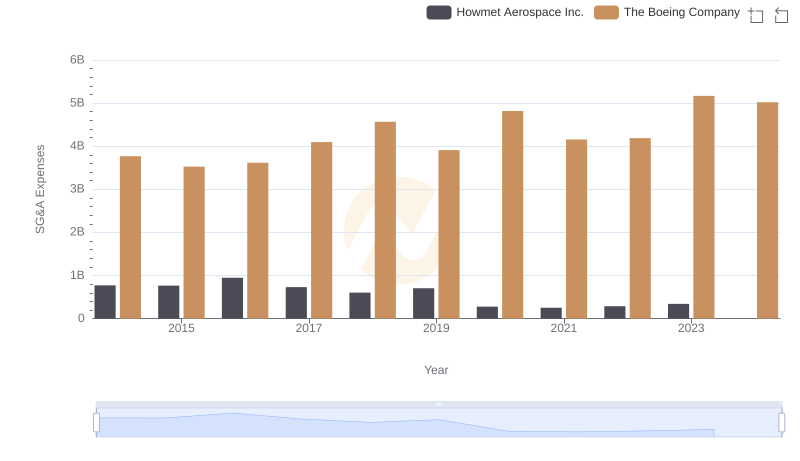

The Boeing Company or Howmet Aerospace Inc.: Who Manages SG&A Costs Better?

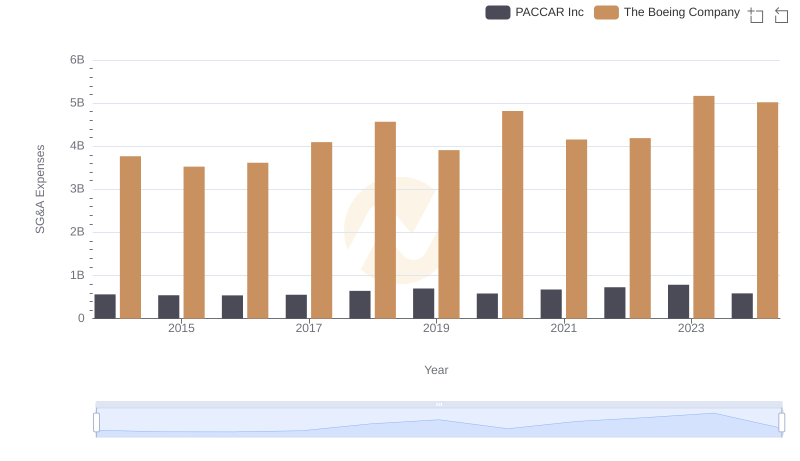

Who Optimizes SG&A Costs Better? The Boeing Company or PACCAR Inc

Comparing SG&A Expenses: The Boeing Company vs Quanta Services, Inc. Trends and Insights

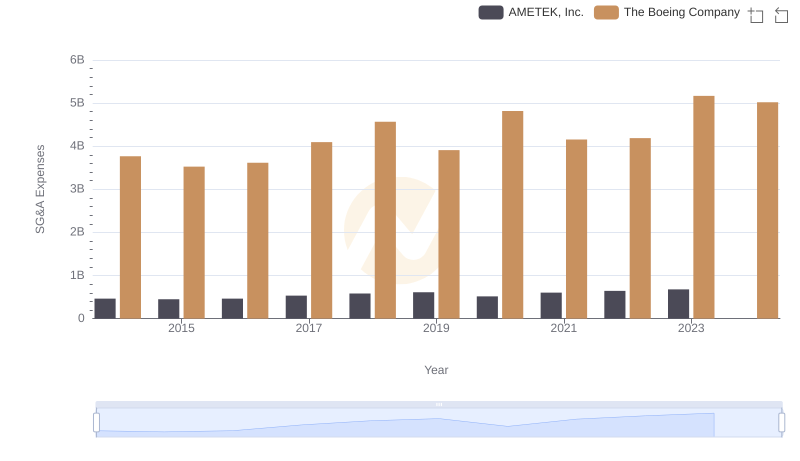

Selling, General, and Administrative Costs: The Boeing Company vs AMETEK, Inc.