| __timestamp | PACCAR Inc | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 561400000 | 3767000000 |

| Thursday, January 1, 2015 | 541500000 | 3525000000 |

| Friday, January 1, 2016 | 540200000 | 3616000000 |

| Sunday, January 1, 2017 | 555000000 | 4094000000 |

| Monday, January 1, 2018 | 644700000 | 4567000000 |

| Tuesday, January 1, 2019 | 698500000 | 3909000000 |

| Wednesday, January 1, 2020 | 581400000 | 4817000000 |

| Friday, January 1, 2021 | 676800000 | 4157000000 |

| Saturday, January 1, 2022 | 726300000 | 4187000000 |

| Sunday, January 1, 2023 | 784600000 | 5168000000 |

| Monday, January 1, 2024 | 585000000 | 5021000000 |

Unveiling the hidden dimensions of data

In the competitive world of aerospace and automotive manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, The Boeing Company and PACCAR Inc have demonstrated contrasting strategies in optimizing these costs.

From 2014 to 2024, Boeing's SG&A expenses have consistently soared, peaking at approximately $5.17 billion in 2023. This represents a 37% increase from 2015, reflecting the company's expansive operations and complex supply chains.

In contrast, PACCAR Inc has maintained a more stable SG&A trajectory. Despite a 45% increase from 2015 to 2023, their expenses remain significantly lower than Boeing's, highlighting a more conservative approach to cost management.

While Boeing's higher expenses may indicate aggressive growth strategies, PACCAR's steadier costs suggest a focus on efficiency. Investors and industry analysts should consider these trends when evaluating each company's financial health.

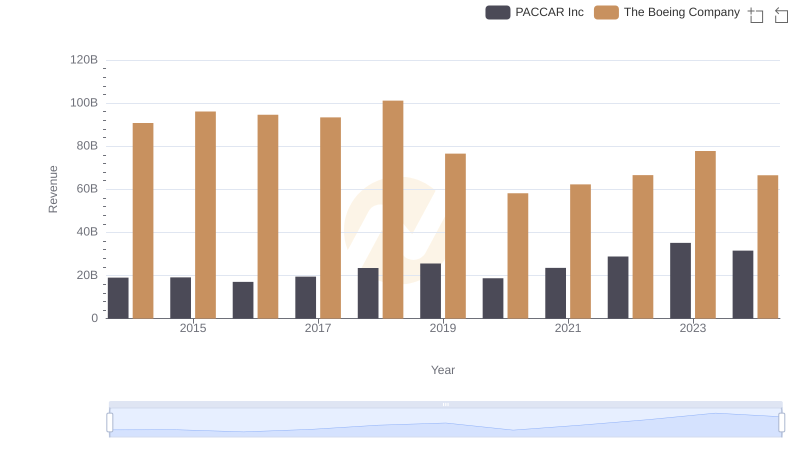

Revenue Insights: The Boeing Company and PACCAR Inc Performance Compared

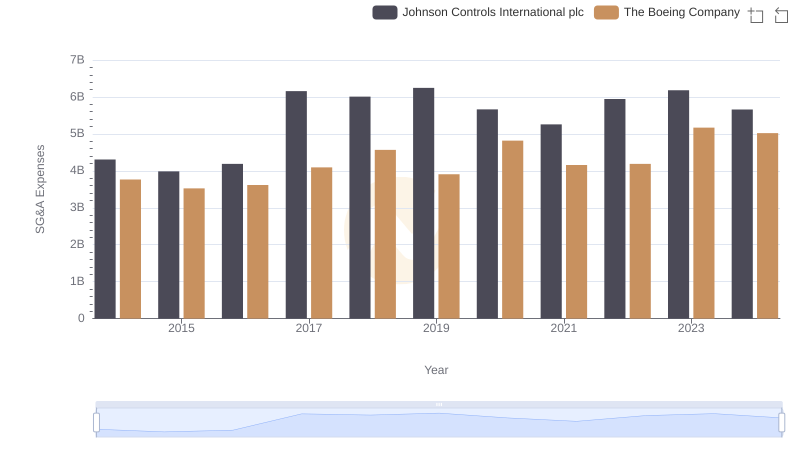

Operational Costs Compared: SG&A Analysis of The Boeing Company and Johnson Controls International plc

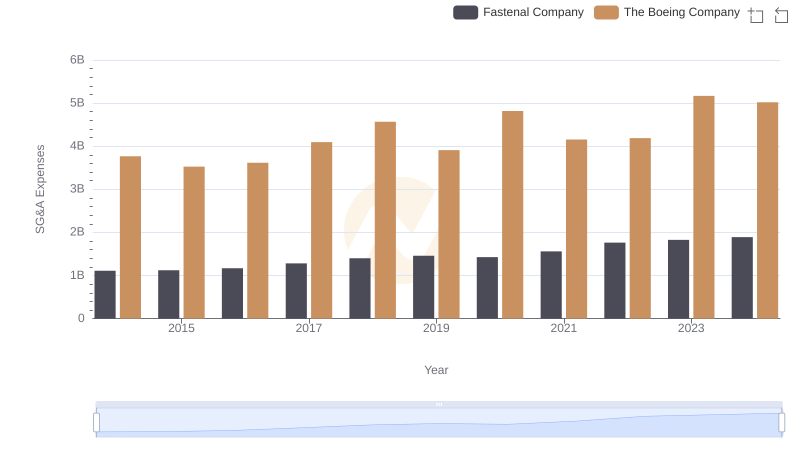

Who Optimizes SG&A Costs Better? The Boeing Company or Fastenal Company

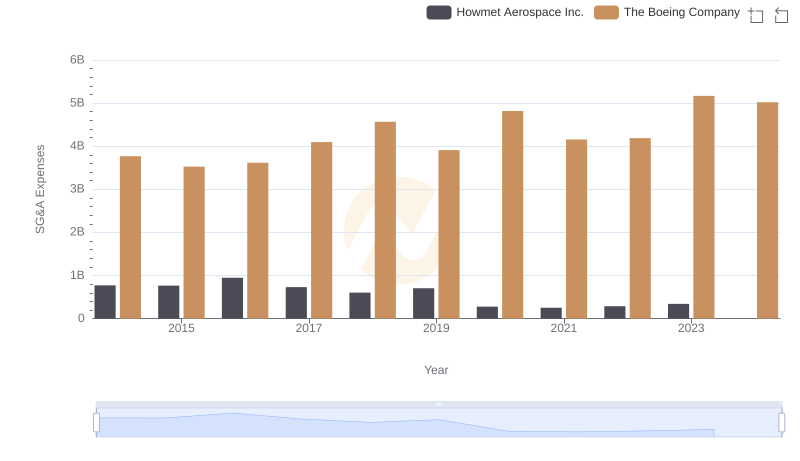

The Boeing Company or Howmet Aerospace Inc.: Who Manages SG&A Costs Better?

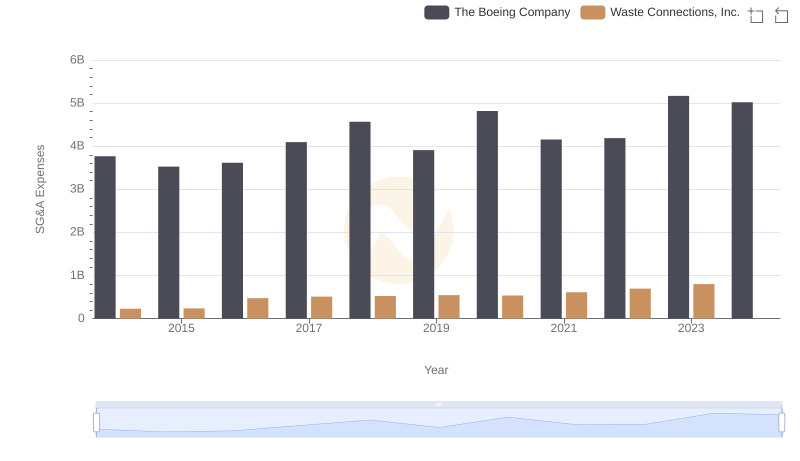

Who Optimizes SG&A Costs Better? The Boeing Company or Waste Connections, Inc.

Comparing SG&A Expenses: The Boeing Company vs Quanta Services, Inc. Trends and Insights

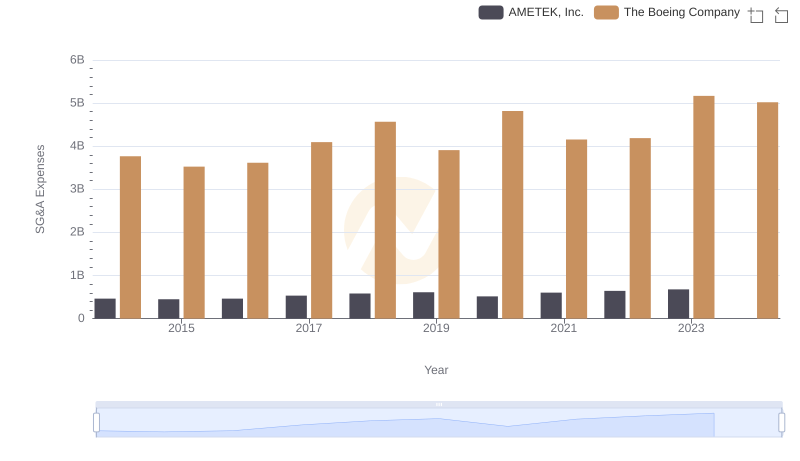

Selling, General, and Administrative Costs: The Boeing Company vs AMETEK, Inc.