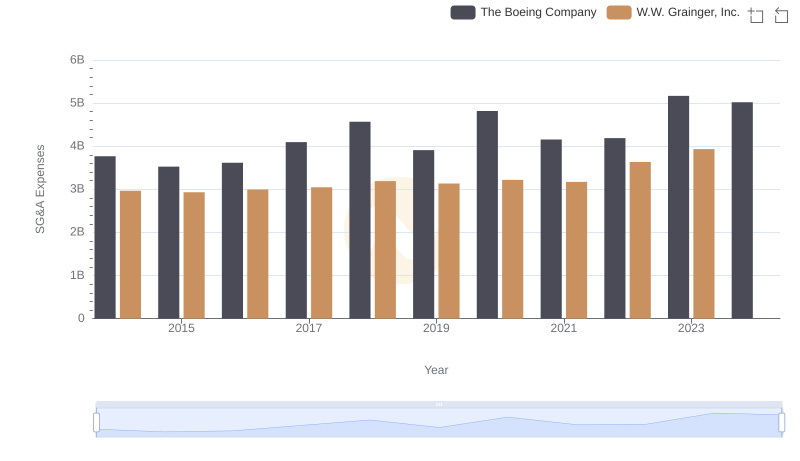

| __timestamp | Fastenal Company | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1110776000 | 3767000000 |

| Thursday, January 1, 2015 | 1121590000 | 3525000000 |

| Friday, January 1, 2016 | 1169470000 | 3616000000 |

| Sunday, January 1, 2017 | 1282800000 | 4094000000 |

| Monday, January 1, 2018 | 1400200000 | 4567000000 |

| Tuesday, January 1, 2019 | 1459400000 | 3909000000 |

| Wednesday, January 1, 2020 | 1427400000 | 4817000000 |

| Friday, January 1, 2021 | 1559800000 | 4157000000 |

| Saturday, January 1, 2022 | 1762200000 | 4187000000 |

| Sunday, January 1, 2023 | 1825800000 | 5168000000 |

| Monday, January 1, 2024 | 1891900000 | 5021000000 |

Unleashing the power of data

In the competitive world of aerospace and industrial supplies, managing Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, The Boeing Company and Fastenal Company have showcased contrasting strategies. From 2014 to 2024, Boeing's SG&A expenses have fluctuated, peaking in 2023 with a 38% increase from 2015. Meanwhile, Fastenal has steadily optimized its costs, achieving a 70% rise over the same period. This trend highlights Fastenal's consistent growth and cost management prowess. Boeing, despite its higher absolute expenses, reflects the challenges of the aerospace sector, especially during economic downturns. As we look to the future, these insights offer valuable lessons in strategic financial management.

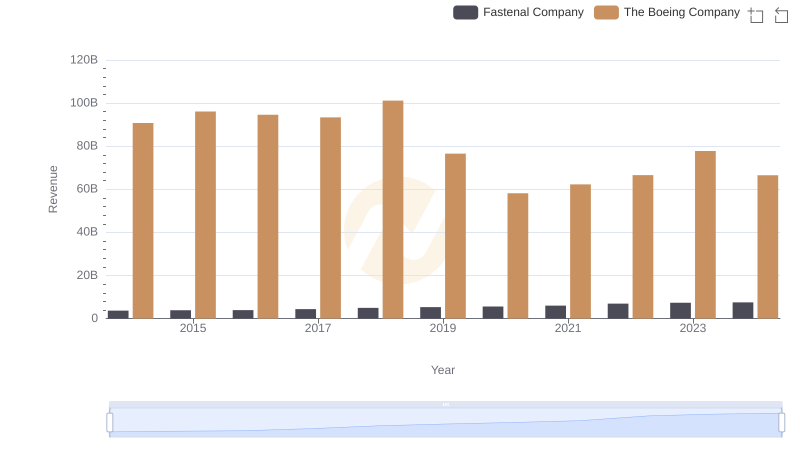

The Boeing Company and Fastenal Company: A Comprehensive Revenue Analysis

Selling, General, and Administrative Costs: The Boeing Company vs W.W. Grainger, Inc.

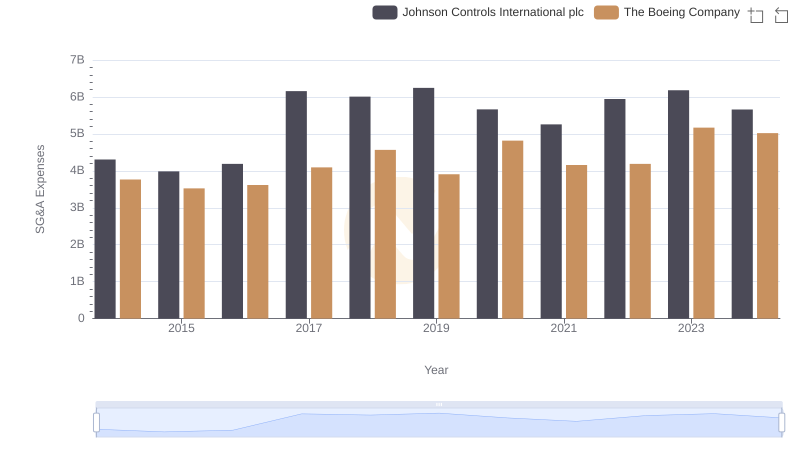

Operational Costs Compared: SG&A Analysis of The Boeing Company and Johnson Controls International plc

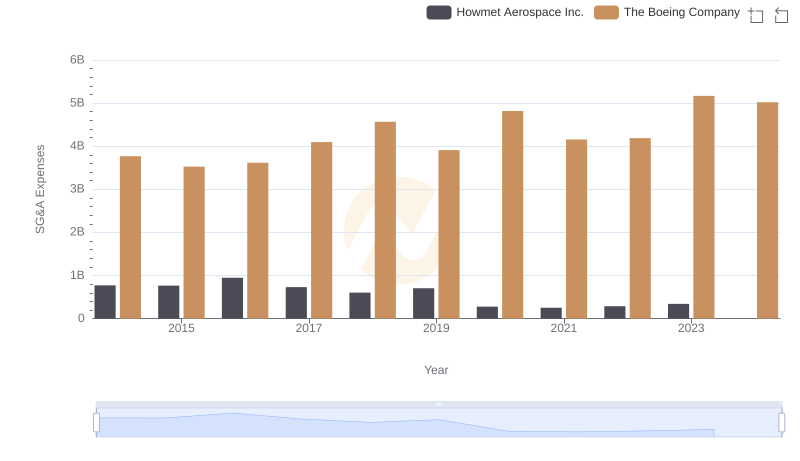

The Boeing Company or Howmet Aerospace Inc.: Who Manages SG&A Costs Better?

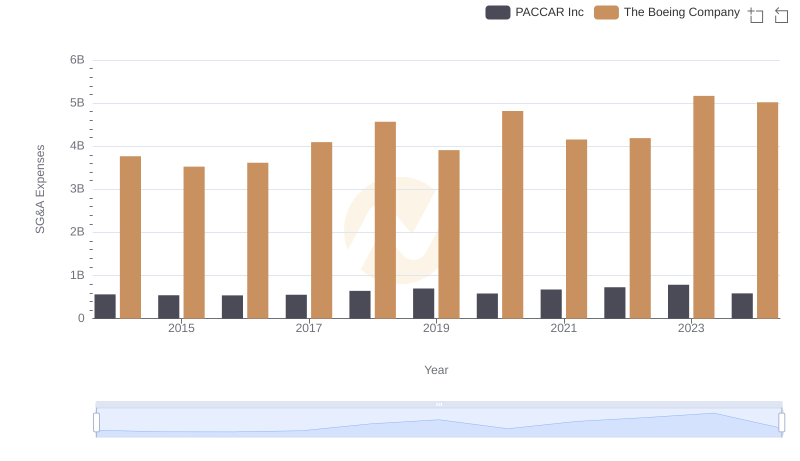

Who Optimizes SG&A Costs Better? The Boeing Company or PACCAR Inc

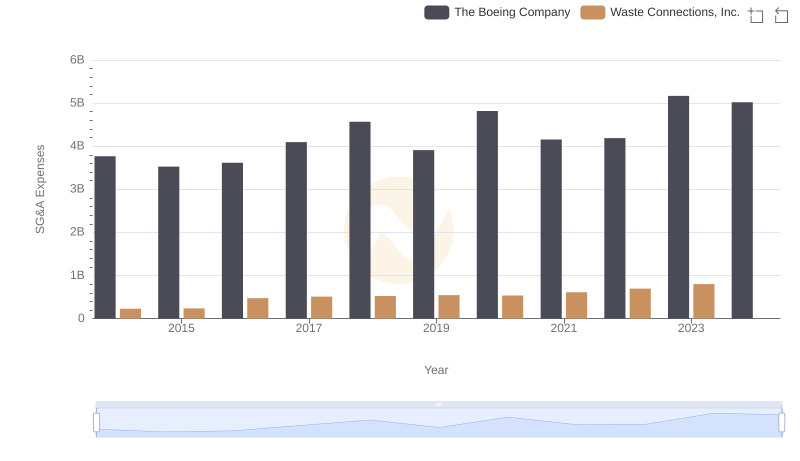

Who Optimizes SG&A Costs Better? The Boeing Company or Waste Connections, Inc.

Comparing SG&A Expenses: The Boeing Company vs Quanta Services, Inc. Trends and Insights

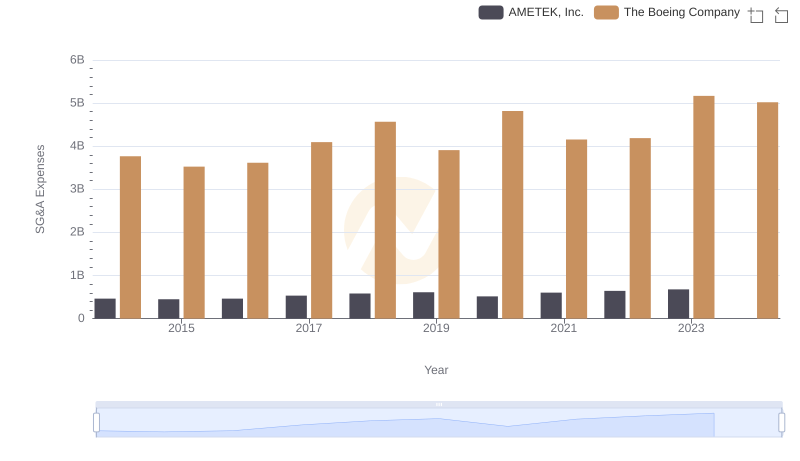

Selling, General, and Administrative Costs: The Boeing Company vs AMETEK, Inc.