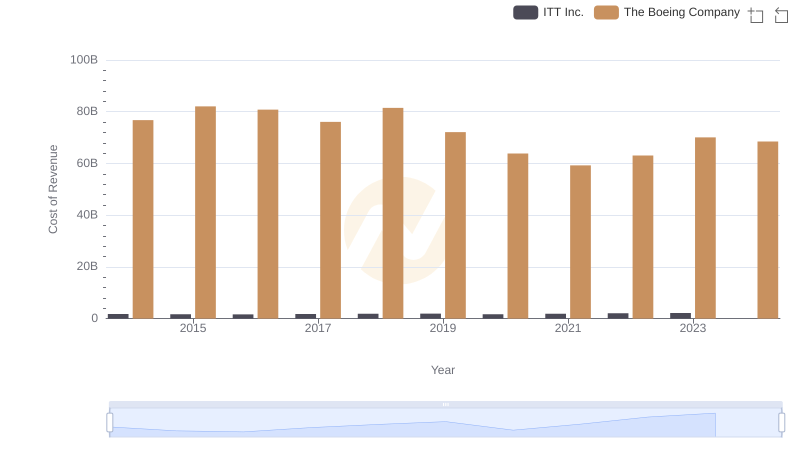

| __timestamp | ITT Inc. | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 519500000 | 3767000000 |

| Thursday, January 1, 2015 | 441500000 | 3525000000 |

| Friday, January 1, 2016 | 444100000 | 3616000000 |

| Sunday, January 1, 2017 | 433700000 | 4094000000 |

| Monday, January 1, 2018 | 427300000 | 4567000000 |

| Tuesday, January 1, 2019 | 420000000 | 3909000000 |

| Wednesday, January 1, 2020 | 347200000 | 4817000000 |

| Friday, January 1, 2021 | 365100000 | 4157000000 |

| Saturday, January 1, 2022 | 368500000 | 4187000000 |

| Sunday, January 1, 2023 | 476600000 | 5168000000 |

| Monday, January 1, 2024 | 502300000 | 5021000000 |

Unlocking the unknown

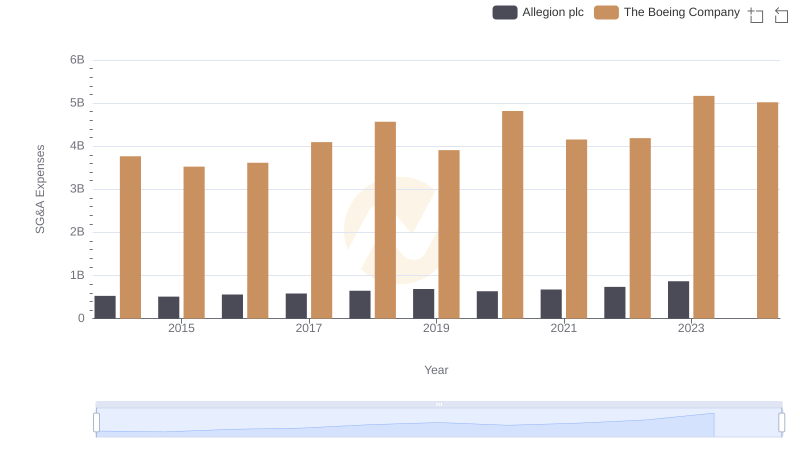

In the competitive world of aerospace and engineering, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, The Boeing Company and ITT Inc. have showcased contrasting strategies in optimizing these costs. From 2014 to 2023, Boeing's SG&A expenses fluctuated, peaking at approximately 5.2 billion in 2023, a 37% increase from its lowest point in 2015. Meanwhile, ITT Inc. demonstrated a more stable approach, with expenses ranging between 347 million and 520 million, showing a 33% decrease from 2014 to 2020, before a slight uptick in 2023. This data highlights Boeing's aggressive spending strategy, possibly reflecting its expansive growth initiatives, while ITT Inc.'s consistent cost management underscores its focus on operational efficiency. As we look to the future, the missing data for ITT in 2024 leaves room for speculation on its strategic direction.

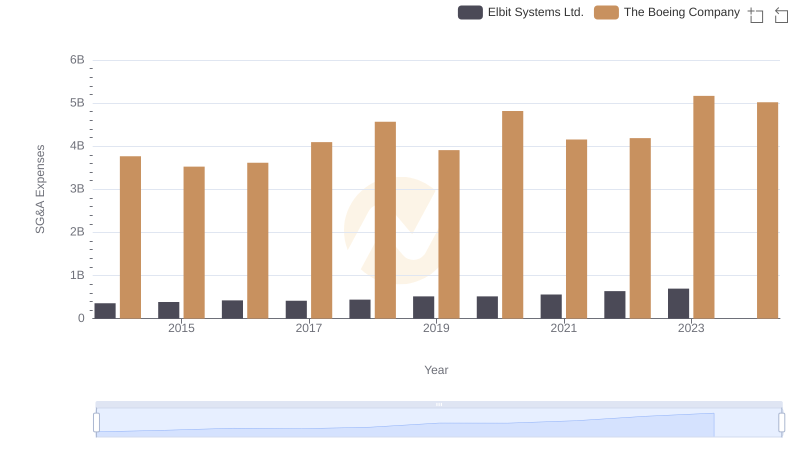

Operational Costs Compared: SG&A Analysis of The Boeing Company and Elbit Systems Ltd.

Cost of Revenue Trends: The Boeing Company vs ITT Inc.

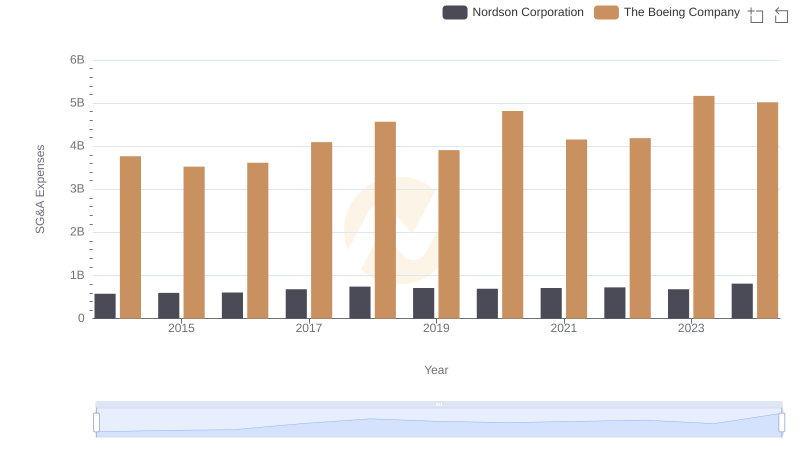

Operational Costs Compared: SG&A Analysis of The Boeing Company and Nordson Corporation

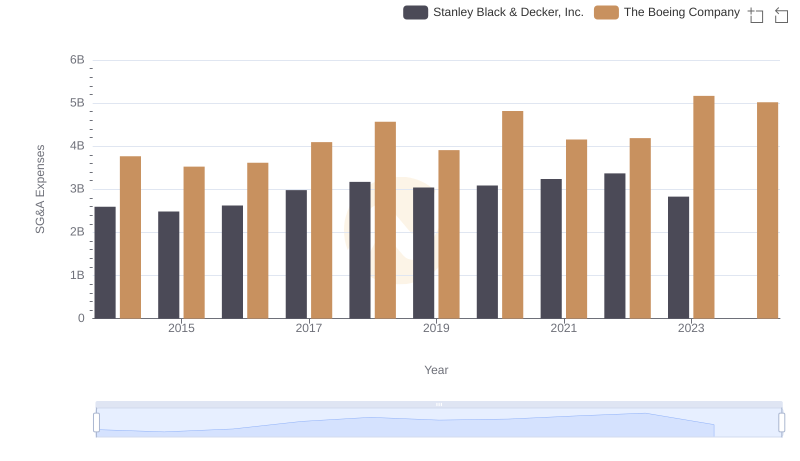

The Boeing Company or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

Who Optimizes SG&A Costs Better? The Boeing Company or Curtiss-Wright Corporation

The Boeing Company and Allegion plc: SG&A Spending Patterns Compared