| __timestamp | China Eastern Airlines Corporation Limited | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 4120000000 | 3767000000 |

| Thursday, January 1, 2015 | 3651000000 | 3525000000 |

| Friday, January 1, 2016 | 3133000000 | 3616000000 |

| Sunday, January 1, 2017 | 3294000000 | 4094000000 |

| Monday, January 1, 2018 | 3807000000 | 4567000000 |

| Tuesday, January 1, 2019 | 4134000000 | 3909000000 |

| Wednesday, January 1, 2020 | 1570000000 | 4817000000 |

| Friday, January 1, 2021 | 1128000000 | 4157000000 |

| Saturday, January 1, 2022 | 2933000000 | 4187000000 |

| Sunday, January 1, 2023 | 7254000000 | 5168000000 |

| Monday, January 1, 2024 | 5021000000 |

Infusing magic into the data realm

In the competitive world of aviation, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, The Boeing Company and China Eastern Airlines Corporation Limited have showcased contrasting strategies in this domain. From 2014 to 2023, Boeing's SG&A expenses have shown a steady increase, peaking at approximately 5.2 billion in 2023, reflecting a 37% rise from 2014. In contrast, China Eastern Airlines experienced a more volatile trajectory, with expenses fluctuating significantly, culminating in a dramatic spike in 2023, reaching 7.3 billion, a 76% increase from 2014. This disparity highlights Boeing's consistent approach versus China Eastern's variable strategy, possibly influenced by external economic factors and internal restructuring. As the aviation industry evolves, these trends offer valuable insights into the financial strategies of two of its major players.

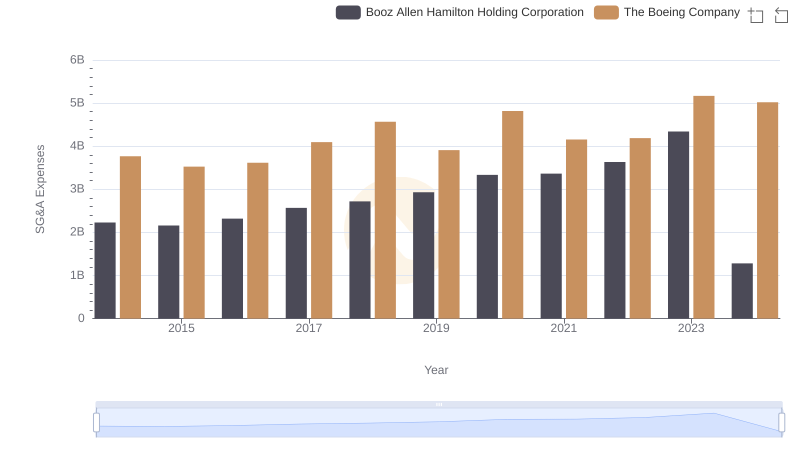

Operational Costs Compared: SG&A Analysis of The Boeing Company and Booz Allen Hamilton Holding Corporation

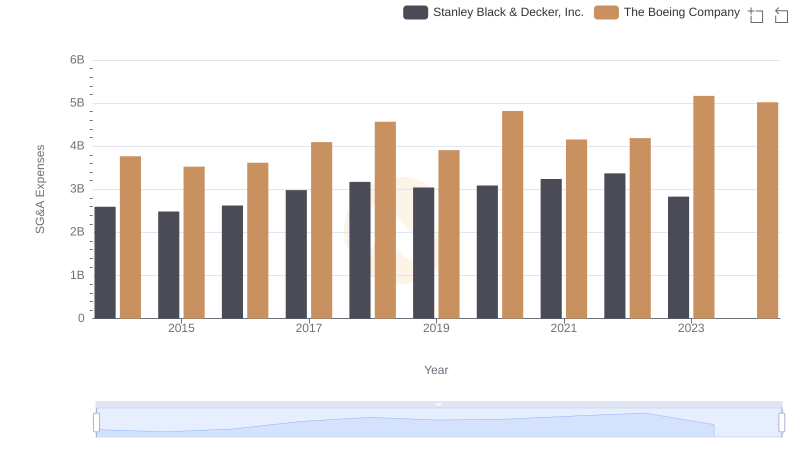

Selling, General, and Administrative Costs: The Boeing Company vs Stanley Black & Decker, Inc.

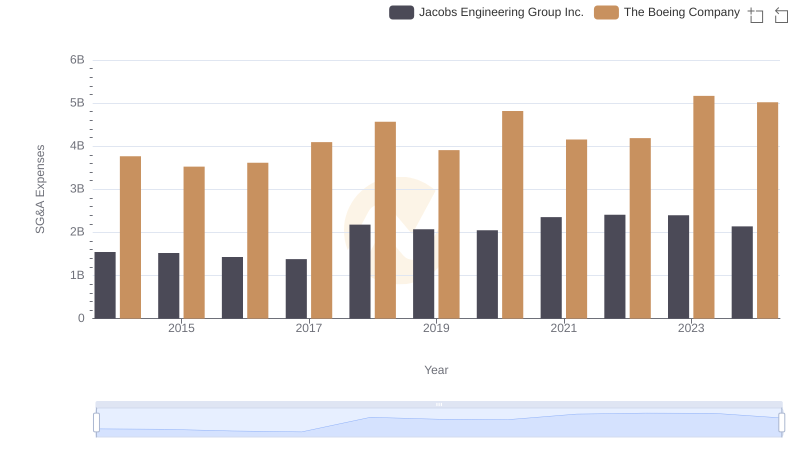

Breaking Down SG&A Expenses: The Boeing Company vs Jacobs Engineering Group Inc.

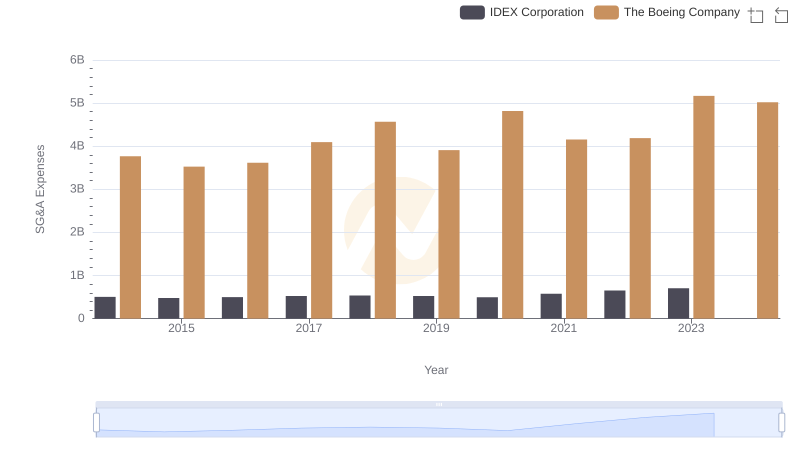

The Boeing Company and IDEX Corporation: SG&A Spending Patterns Compared

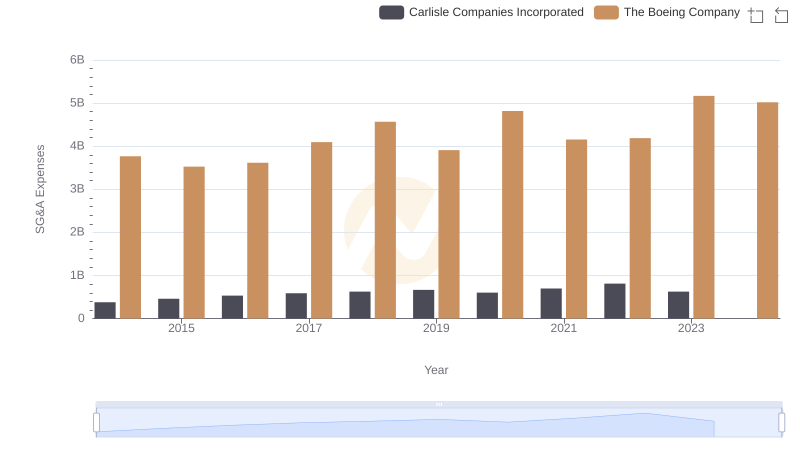

Who Optimizes SG&A Costs Better? The Boeing Company or Carlisle Companies Incorporated

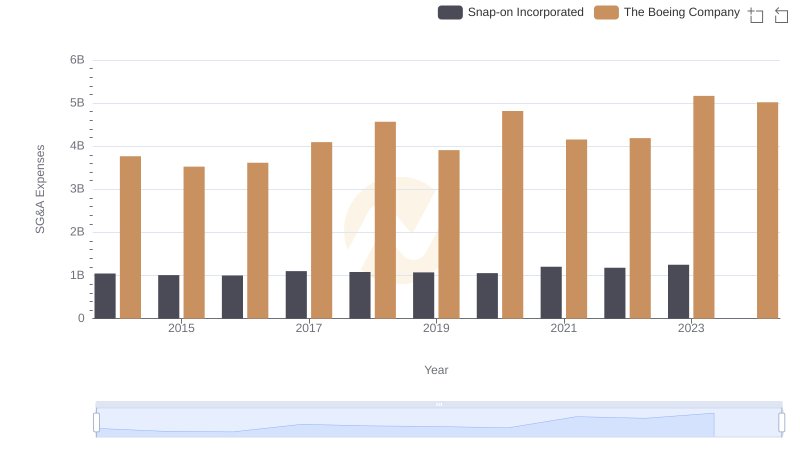

The Boeing Company or Snap-on Incorporated: Who Manages SG&A Costs Better?

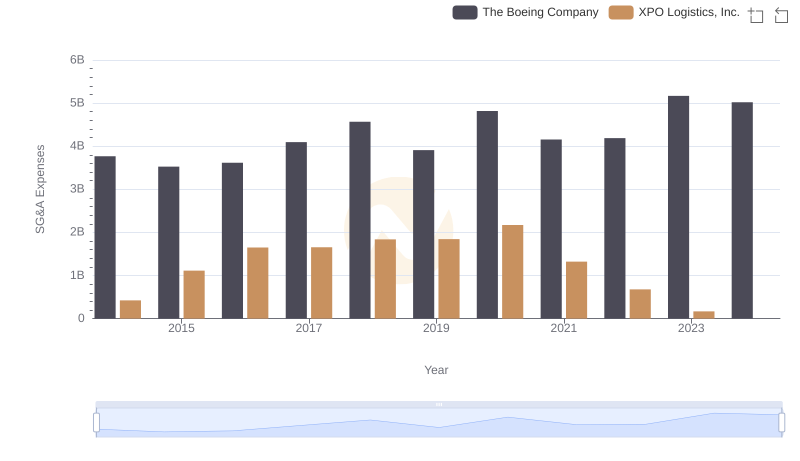

Operational Costs Compared: SG&A Analysis of The Boeing Company and XPO Logistics, Inc.

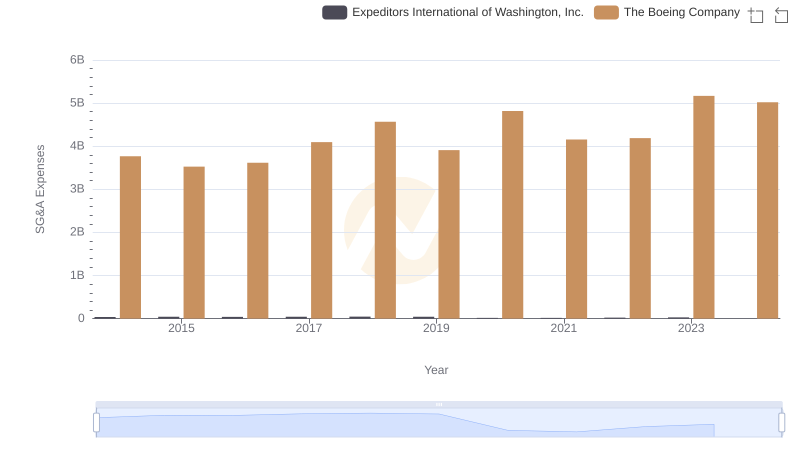

Cost Management Insights: SG&A Expenses for The Boeing Company and Expeditors International of Washington, Inc.