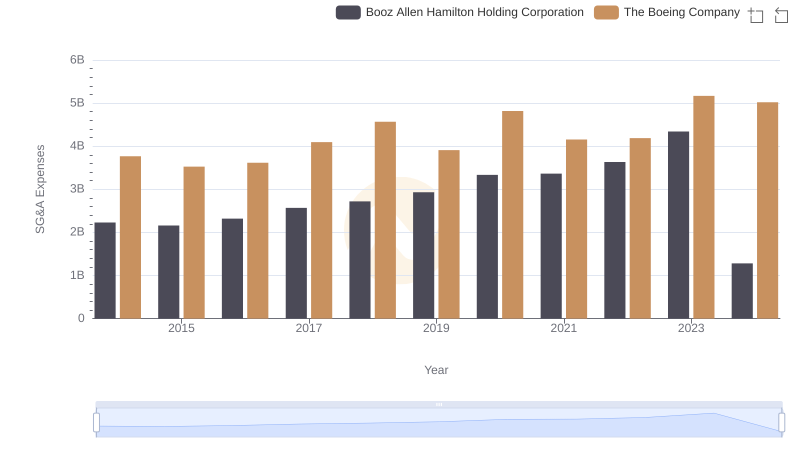

| __timestamp | Carlisle Companies Incorporated | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 379000000 | 3767000000 |

| Thursday, January 1, 2015 | 461900000 | 3525000000 |

| Friday, January 1, 2016 | 532000000 | 3616000000 |

| Sunday, January 1, 2017 | 589400000 | 4094000000 |

| Monday, January 1, 2018 | 625400000 | 4567000000 |

| Tuesday, January 1, 2019 | 667100000 | 3909000000 |

| Wednesday, January 1, 2020 | 603200000 | 4817000000 |

| Friday, January 1, 2021 | 698200000 | 4157000000 |

| Saturday, January 1, 2022 | 811500000 | 4187000000 |

| Sunday, January 1, 2023 | 625200000 | 5168000000 |

| Monday, January 1, 2024 | 722800000 | 5021000000 |

Unleashing the power of data

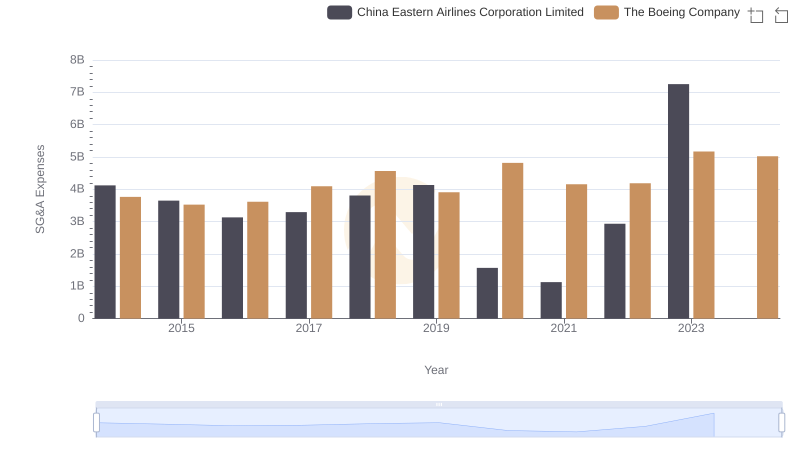

In the competitive world of aerospace and manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, The Boeing Company and Carlisle Companies Incorporated have showcased contrasting strategies in optimizing these costs.

From 2014 to 2023, Boeing's SG&A expenses fluctuated, peaking in 2023 with a 37% increase from 2015. Meanwhile, Carlisle demonstrated a more consistent approach, with a notable 114% rise in SG&A expenses from 2014 to 2022, before a slight dip in 2023.

Boeing's higher SG&A costs, averaging around 4.3 billion annually, reflect its expansive operations and global reach. In contrast, Carlisle's more modest average of 600 million suggests a leaner, more focused strategy.

As we look to the future, understanding these trends offers valuable insights into how these industry leaders balance growth and efficiency.

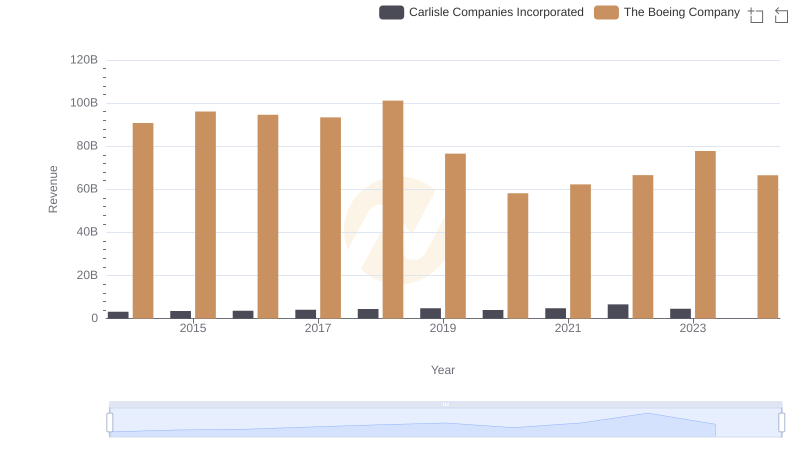

Comparing Revenue Performance: The Boeing Company or Carlisle Companies Incorporated?

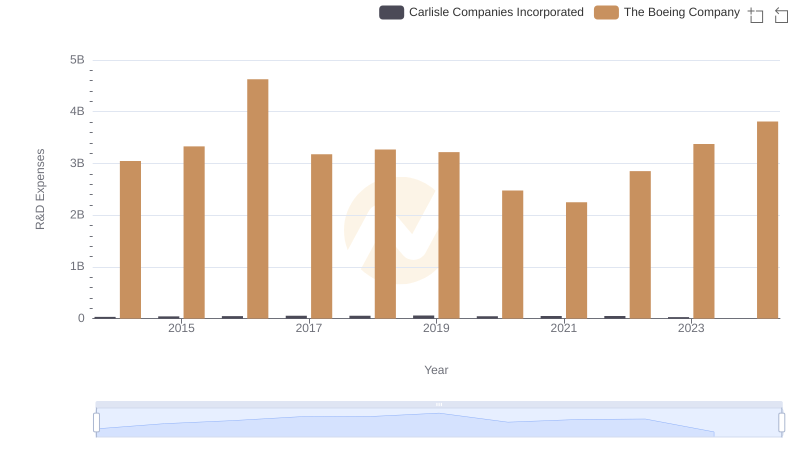

Research and Development Expenses Breakdown: The Boeing Company vs Carlisle Companies Incorporated

Operational Costs Compared: SG&A Analysis of The Boeing Company and Booz Allen Hamilton Holding Corporation

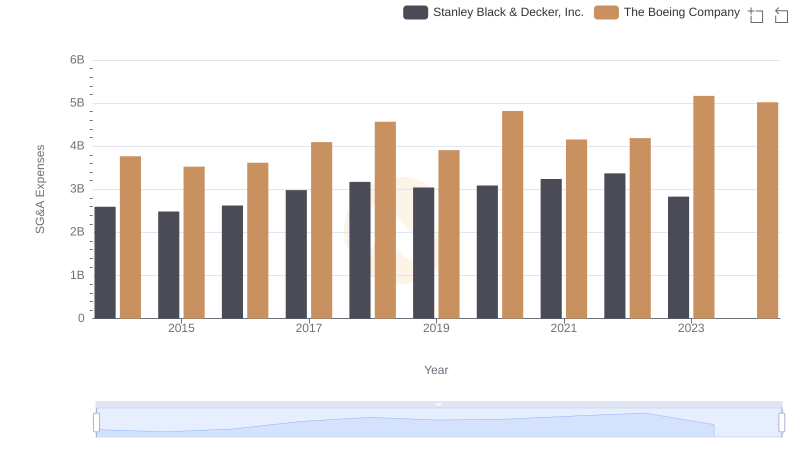

Selling, General, and Administrative Costs: The Boeing Company vs Stanley Black & Decker, Inc.

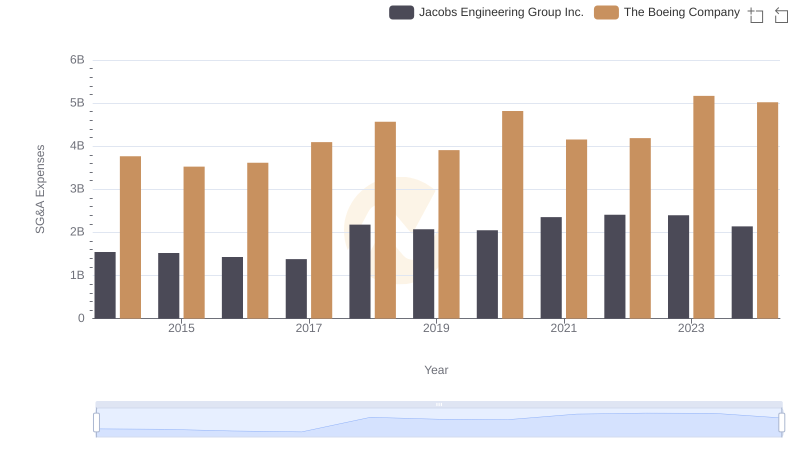

Breaking Down SG&A Expenses: The Boeing Company vs Jacobs Engineering Group Inc.

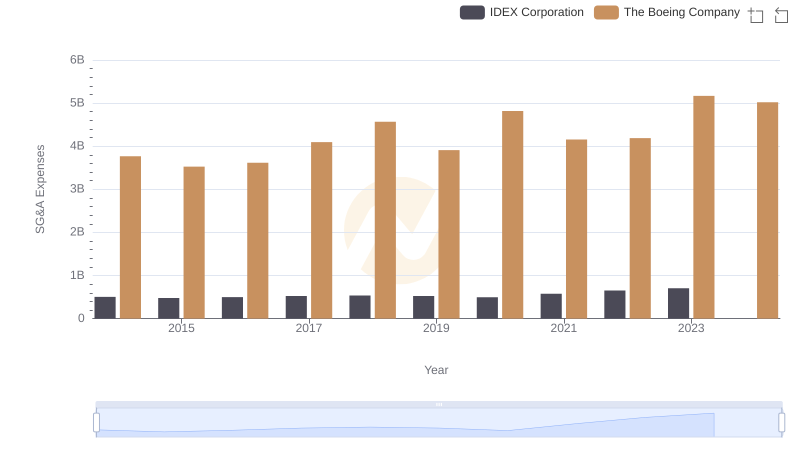

The Boeing Company and IDEX Corporation: SG&A Spending Patterns Compared

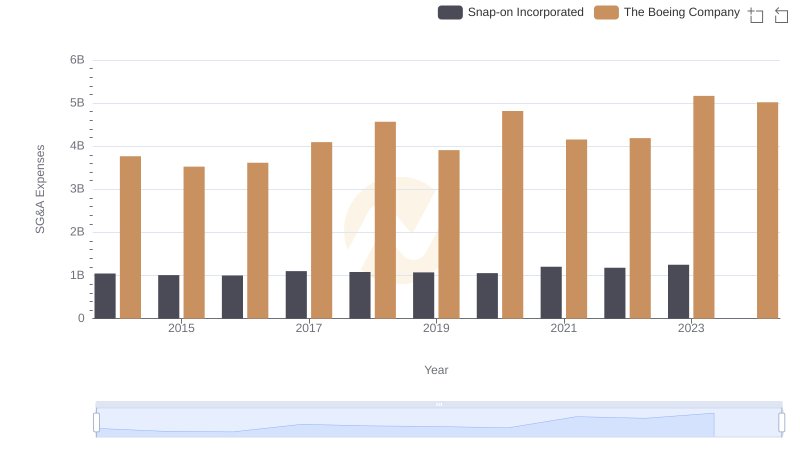

The Boeing Company or Snap-on Incorporated: Who Manages SG&A Costs Better?

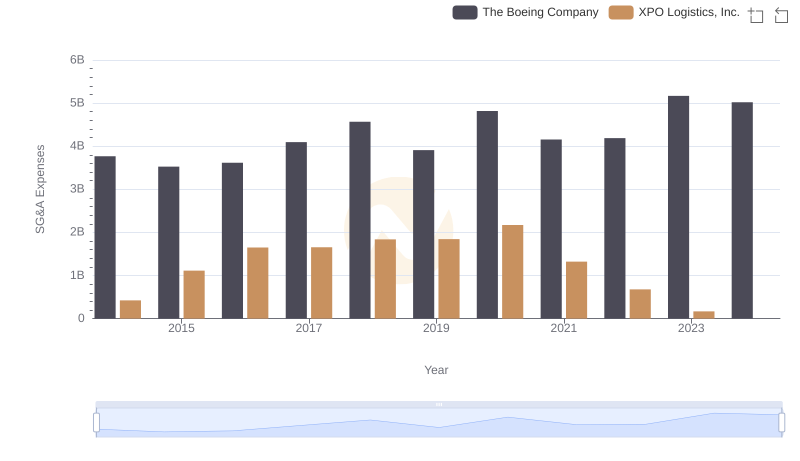

Operational Costs Compared: SG&A Analysis of The Boeing Company and XPO Logistics, Inc.

Who Optimizes SG&A Costs Better? The Boeing Company or China Eastern Airlines Corporation Limited