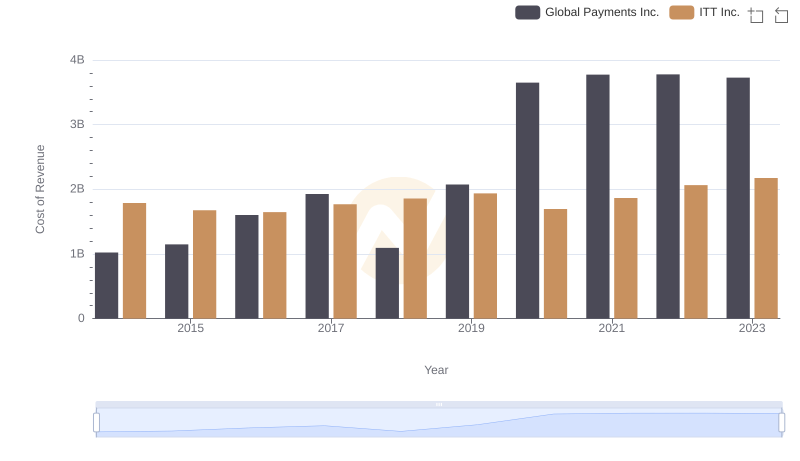

| __timestamp | Global Payments Inc. | ITT Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 519500000 |

| Thursday, January 1, 2015 | 1325567000 | 441500000 |

| Friday, January 1, 2016 | 1411096000 | 444100000 |

| Sunday, January 1, 2017 | 1488258000 | 433700000 |

| Monday, January 1, 2018 | 1534297000 | 427300000 |

| Tuesday, January 1, 2019 | 2046672000 | 420000000 |

| Wednesday, January 1, 2020 | 2878878000 | 347200000 |

| Friday, January 1, 2021 | 3391161000 | 365100000 |

| Saturday, January 1, 2022 | 3524578000 | 368500000 |

| Sunday, January 1, 2023 | 4073768000 | 476600000 |

| Monday, January 1, 2024 | 4285307000 | 502300000 |

In pursuit of knowledge

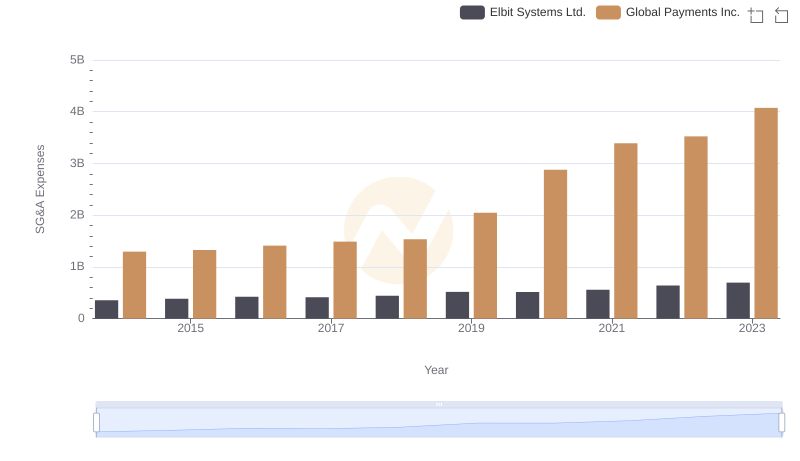

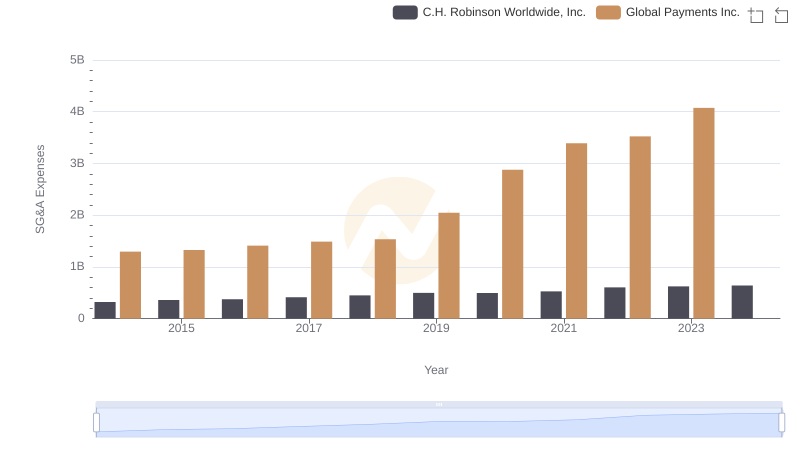

In the competitive landscape of financial management, controlling Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Global Payments Inc. and ITT Inc. have shown contrasting trends in managing these costs. Global Payments Inc. saw a significant increase in SG&A expenses, rising by approximately 215% over the decade, peaking at $4.07 billion in 2023. In contrast, ITT Inc. maintained a more stable trajectory, with expenses fluctuating modestly around $438 million, showcasing a disciplined approach to cost management. This comparison highlights Global Payments Inc.'s aggressive growth strategy, potentially investing heavily in expansion, while ITT Inc. appears to prioritize cost efficiency. Understanding these strategies provides valuable insights into how companies balance growth and operational efficiency in a dynamic market.

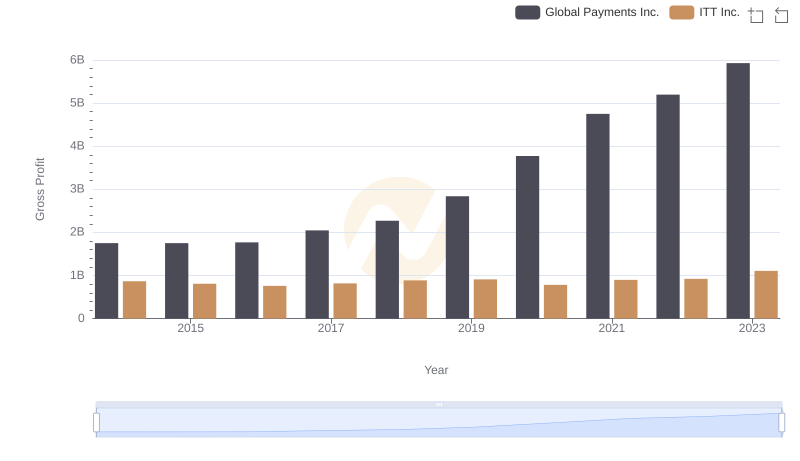

Global Payments Inc. vs ITT Inc.: Examining Key Revenue Metrics

Cost of Revenue: Key Insights for Global Payments Inc. and ITT Inc.

Global Payments Inc. or Elbit Systems Ltd.: Who Manages SG&A Costs Better?

Who Optimizes SG&A Costs Better? Global Payments Inc. or C.H. Robinson Worldwide, Inc.

Who Optimizes SG&A Costs Better? Global Payments Inc. or Clean Harbors, Inc.

Who Generates Higher Gross Profit? Global Payments Inc. or ITT Inc.

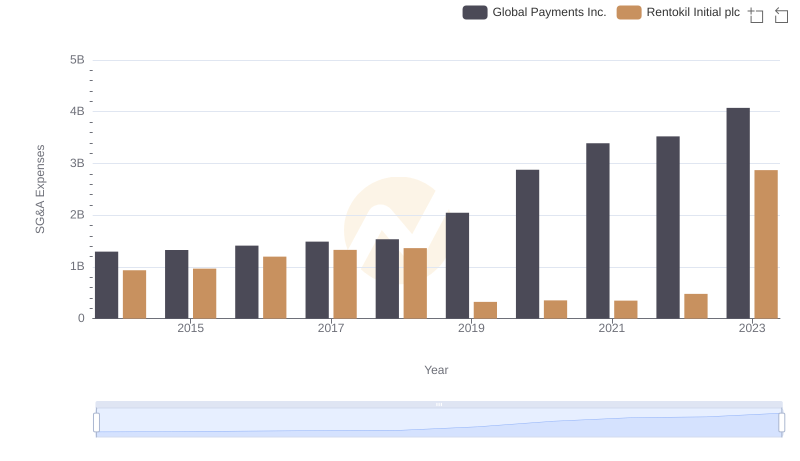

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Rentokil Initial plc