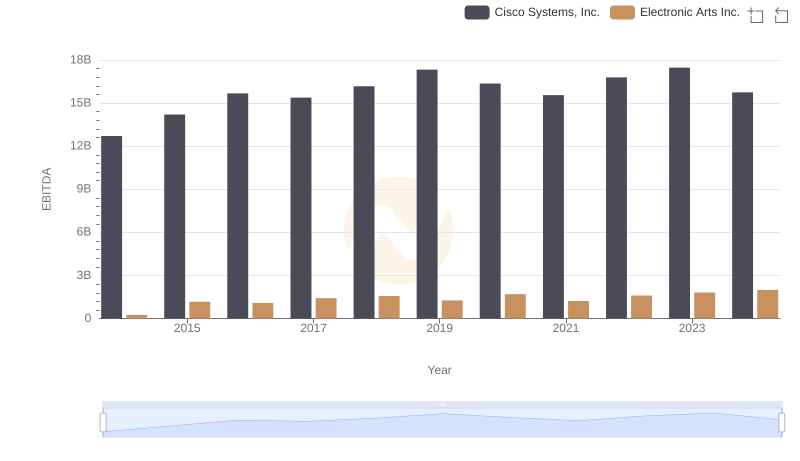

| __timestamp | Cisco Systems, Inc. | Electronic Arts Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 11437000000 | 1090000000 |

| Thursday, January 1, 2015 | 11861000000 | 1033000000 |

| Friday, January 1, 2016 | 11433000000 | 1028000000 |

| Sunday, January 1, 2017 | 11177000000 | 1112000000 |

| Monday, January 1, 2018 | 11386000000 | 1110000000 |

| Tuesday, January 1, 2019 | 11398000000 | 1162000000 |

| Wednesday, January 1, 2020 | 11094000000 | 1137000000 |

| Friday, January 1, 2021 | 11411000000 | 1281000000 |

| Saturday, January 1, 2022 | 11186000000 | 1634000000 |

| Sunday, January 1, 2023 | 12358000000 | 1705000000 |

| Monday, January 1, 2024 | 13177000000 | 1710000000 |

Cracking the code

In the competitive landscape of technology and entertainment, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cisco Systems, Inc. and Electronic Arts Inc. (EA) have been navigating this financial terrain since 2014. Cisco, a leader in networking technology, has consistently maintained SG&A expenses around 11% of its revenue, showcasing a disciplined approach to cost management. In contrast, EA, a titan in the gaming industry, has seen its SG&A expenses rise from 1.1% to 1.7% of revenue over the years, reflecting its investment in marketing and development.

From 2014 to 2024, Cisco's SG&A expenses have shown a steady trend, peaking in 2024. Meanwhile, EA's expenses have gradually increased, indicating a strategic shift towards aggressive market expansion. This comparison highlights the distinct financial strategies of these industry leaders, offering insights into their operational priorities.

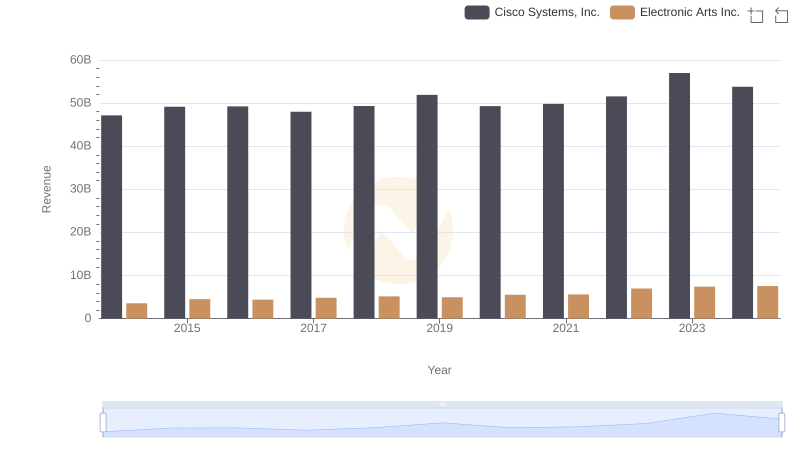

Cisco Systems, Inc. or Electronic Arts Inc.: Who Leads in Yearly Revenue?

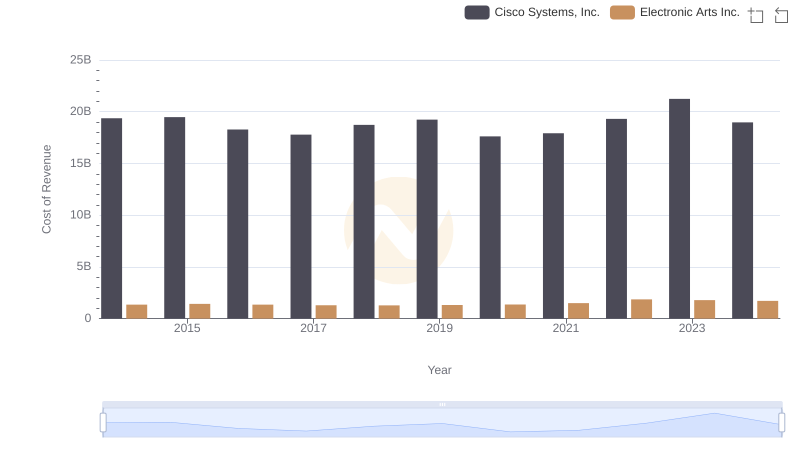

Cost of Revenue: Key Insights for Cisco Systems, Inc. and Electronic Arts Inc.

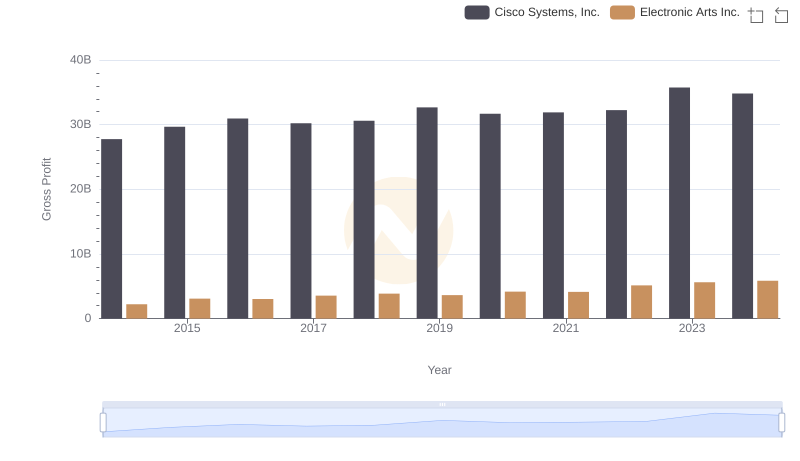

Gross Profit Trends Compared: Cisco Systems, Inc. vs Electronic Arts Inc.

Cost Management Insights: SG&A Expenses for Cisco Systems, Inc. and Garmin Ltd.

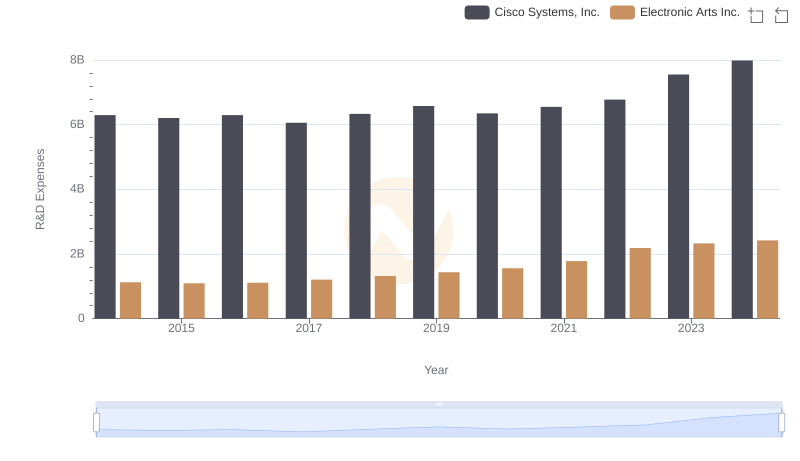

Who Prioritizes Innovation? R&D Spending Compared for Cisco Systems, Inc. and Electronic Arts Inc.

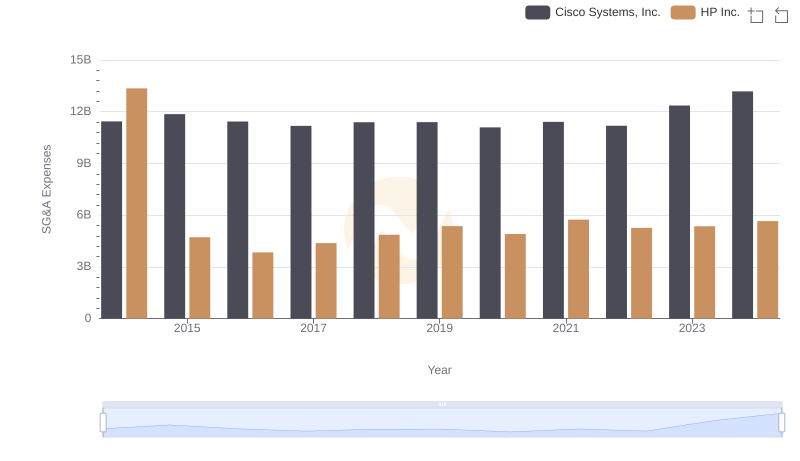

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs HP Inc.

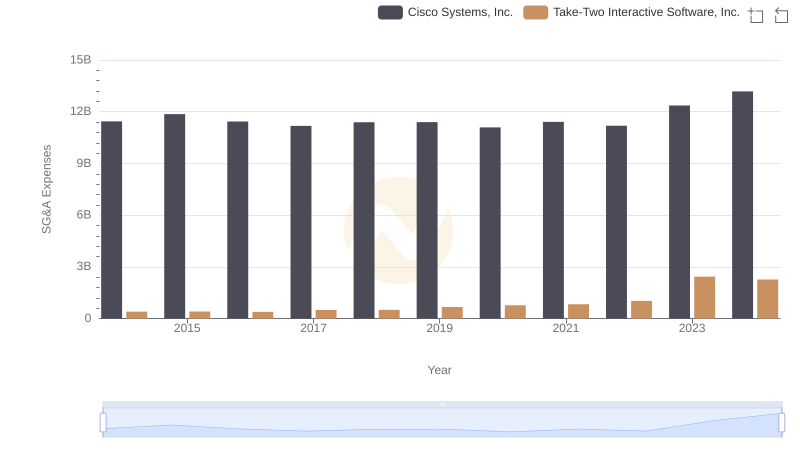

Who Optimizes SG&A Costs Better? Cisco Systems, Inc. or Take-Two Interactive Software, Inc.

Professional EBITDA Benchmarking: Cisco Systems, Inc. vs Electronic Arts Inc.

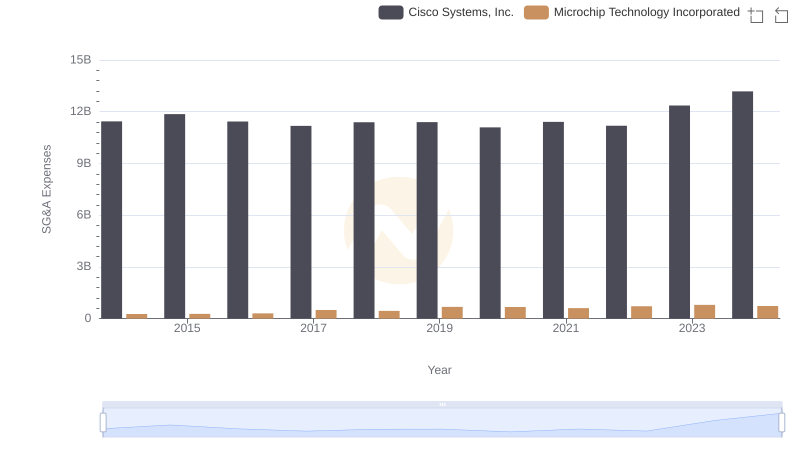

Selling, General, and Administrative Costs: Cisco Systems, Inc. vs Microchip Technology Incorporated

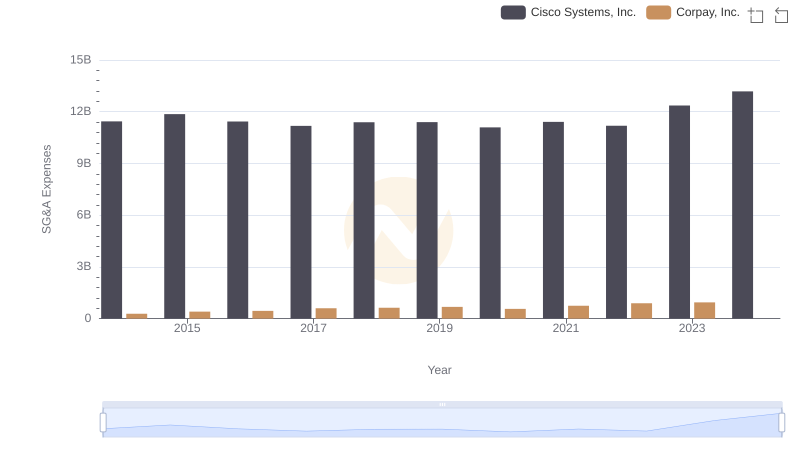

Cisco Systems, Inc. and Corpay, Inc.: SG&A Spending Patterns Compared

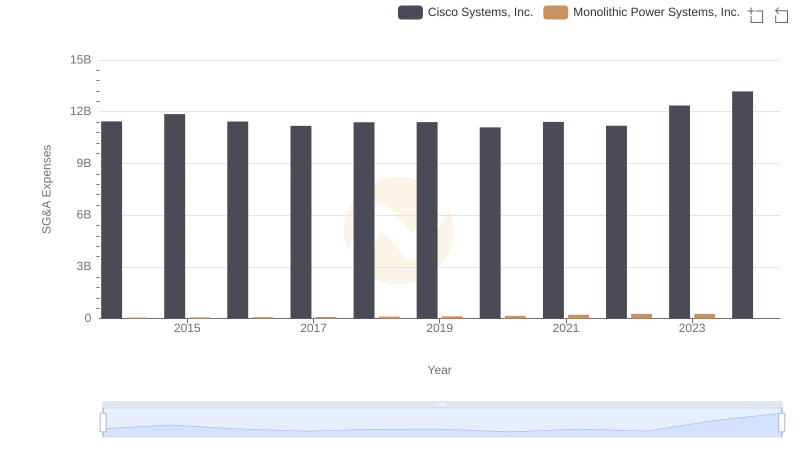

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs Monolithic Power Systems, Inc.

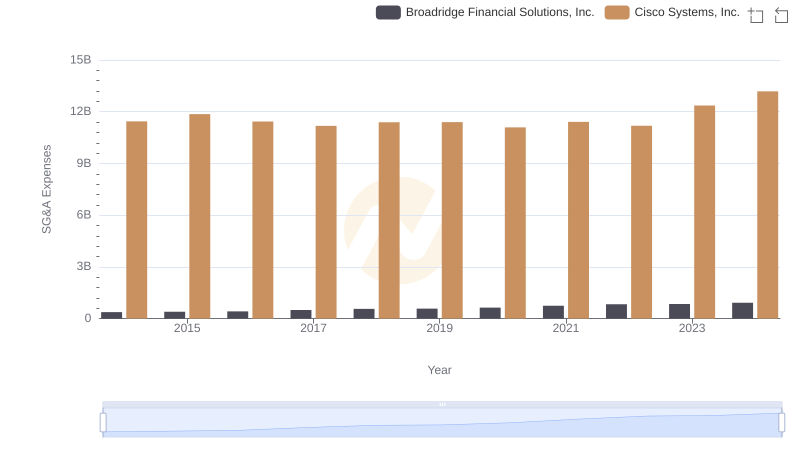

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs Broadridge Financial Solutions, Inc.