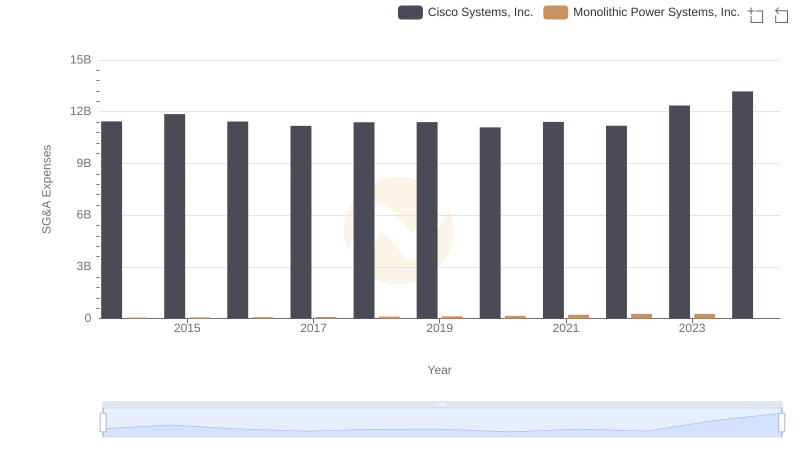

| __timestamp | Cisco Systems, Inc. | Take-Two Interactive Software, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 11437000000 | 402370000 |

| Thursday, January 1, 2015 | 11861000000 | 410434000 |

| Friday, January 1, 2016 | 11433000000 | 390761000 |

| Sunday, January 1, 2017 | 11177000000 | 496862000 |

| Monday, January 1, 2018 | 11386000000 | 503920000 |

| Tuesday, January 1, 2019 | 11398000000 | 672634000 |

| Wednesday, January 1, 2020 | 11094000000 | 776659000 |

| Friday, January 1, 2021 | 11411000000 | 835668000 |

| Saturday, January 1, 2022 | 11186000000 | 1027284000 |

| Sunday, January 1, 2023 | 12358000000 | 2435700000 |

| Monday, January 1, 2024 | 13177000000 | 2266300000 |

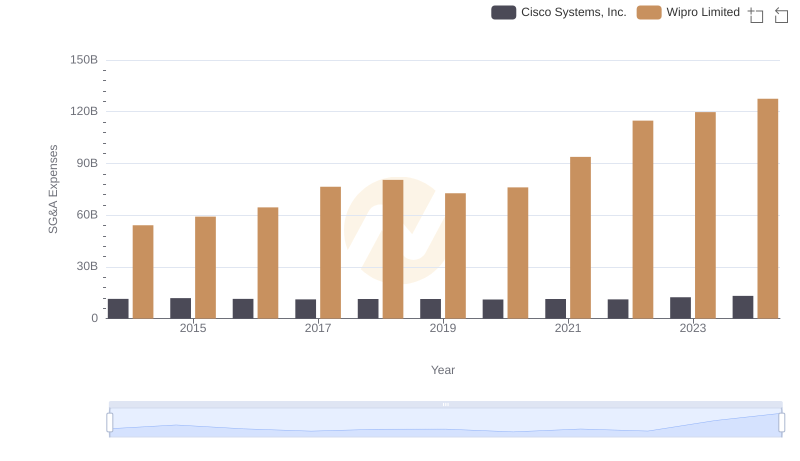

Data in motion

In the competitive world of technology and gaming, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Cisco Systems, Inc., a leader in networking technology, and Take-Two Interactive Software, Inc., a prominent video game publisher, offer a fascinating comparison in cost management from 2014 to 2024.

Cisco's SG&A expenses have shown a steady increase, peaking at approximately $13.2 billion in 2024, reflecting a 15% rise from 2014. This growth suggests a strategic investment in administrative capabilities to support its expansive operations. In contrast, Take-Two Interactive's SG&A expenses surged by over 460% during the same period, reaching around $2.3 billion in 2024. This dramatic increase aligns with the company's aggressive expansion and marketing efforts in the gaming industry.

While Cisco maintains a consistent approach, Take-Two's dynamic growth strategy highlights the diverse paths companies take in optimizing operational costs.

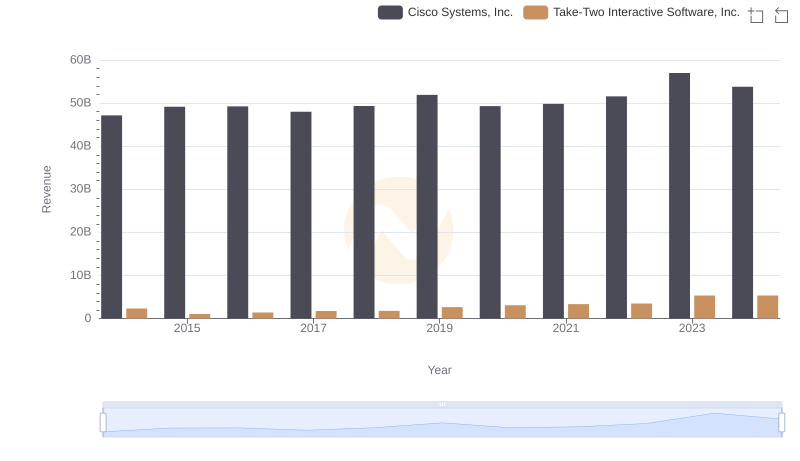

Annual Revenue Comparison: Cisco Systems, Inc. vs Take-Two Interactive Software, Inc.

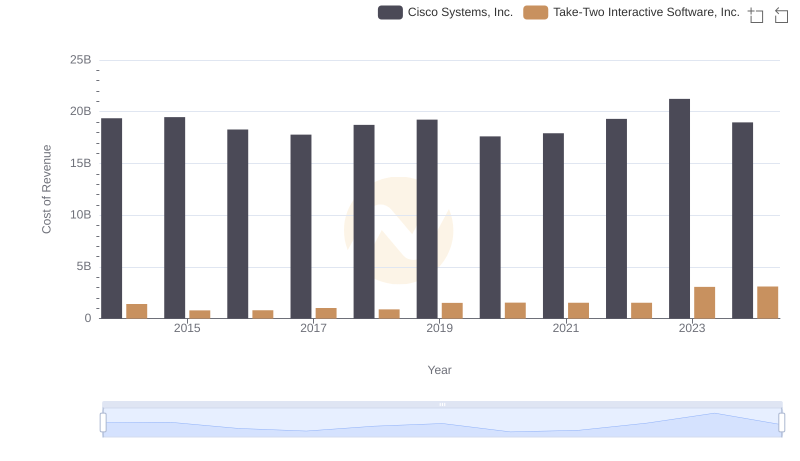

Cisco Systems, Inc. vs Take-Two Interactive Software, Inc.: Efficiency in Cost of Revenue Explored

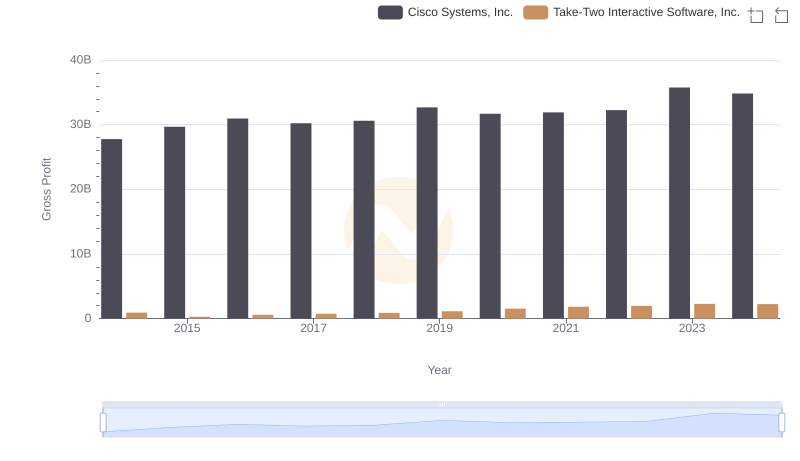

Key Insights on Gross Profit: Cisco Systems, Inc. vs Take-Two Interactive Software, Inc.

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs Wipro Limited

Research and Development Investment: Cisco Systems, Inc. vs Take-Two Interactive Software, Inc.

Cost Management Insights: SG&A Expenses for Cisco Systems, Inc. and HubSpot, Inc.

Cost Management Insights: SG&A Expenses for Cisco Systems, Inc. and Garmin Ltd.

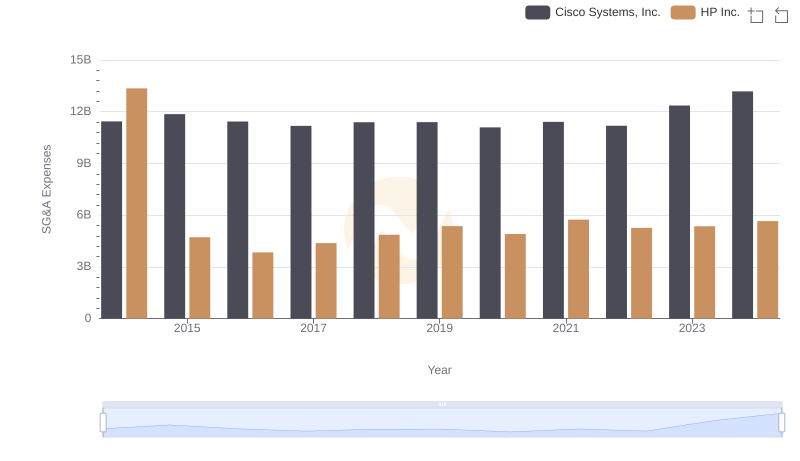

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs HP Inc.

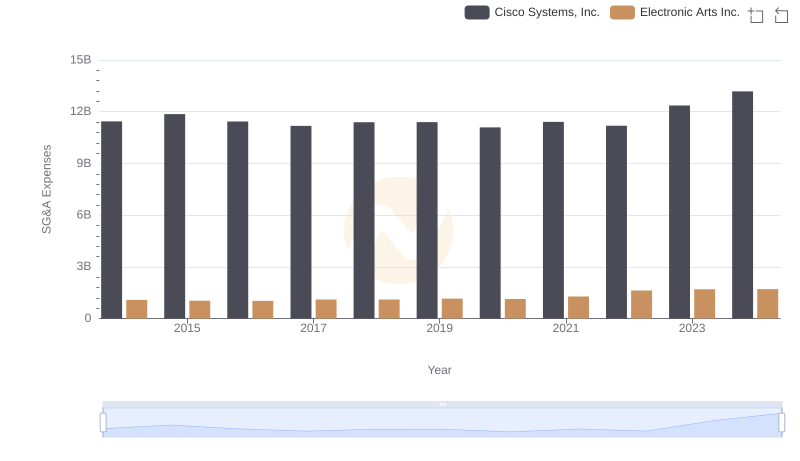

Who Optimizes SG&A Costs Better? Cisco Systems, Inc. or Electronic Arts Inc.

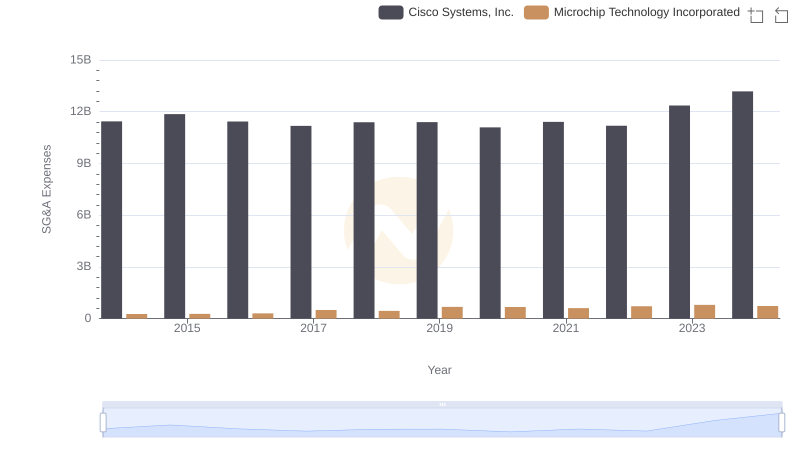

Selling, General, and Administrative Costs: Cisco Systems, Inc. vs Microchip Technology Incorporated

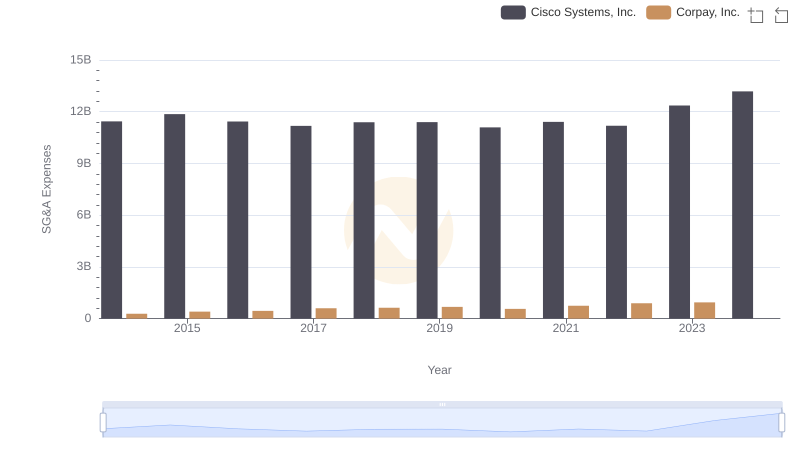

Cisco Systems, Inc. and Corpay, Inc.: SG&A Spending Patterns Compared

Breaking Down SG&A Expenses: Cisco Systems, Inc. vs Monolithic Power Systems, Inc.