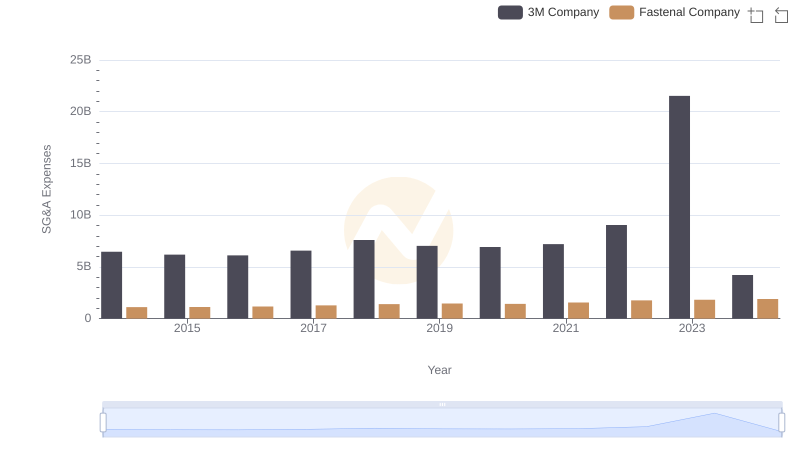

| __timestamp | 3M Company | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 144817000 |

| Thursday, January 1, 2015 | 6182000000 | 153589000 |

| Friday, January 1, 2016 | 6111000000 | 152391000 |

| Sunday, January 1, 2017 | 6572000000 | 177205000 |

| Monday, January 1, 2018 | 7602000000 | 194368000 |

| Tuesday, January 1, 2019 | 7029000000 | 206125000 |

| Wednesday, January 1, 2020 | 6929000000 | 184185000 |

| Friday, January 1, 2021 | 7197000000 | 223757000 |

| Saturday, January 1, 2022 | 9049000000 | 258883000 |

| Sunday, January 1, 2023 | 21526000000 | 281053000 |

| Monday, January 1, 2024 | 4221000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of corporate America, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares the SG&A cost optimization strategies of 3M Company and Old Dominion Freight Line, Inc. over the past decade.

From 2014 to 2023, 3M Company has seen its SG&A expenses fluctuate, peaking in 2023 with a staggering 165% increase from 2014. In contrast, Old Dominion Freight Line, Inc. has maintained a more consistent trajectory, with a modest 94% increase over the same period. This suggests a more stable approach to cost management.

While 3M's expenses surged, Old Dominion's steady rise indicates a potentially more efficient cost structure. However, missing data for 2024 leaves room for speculation on future trends. Investors and analysts should consider these patterns when evaluating corporate efficiency and strategic planning.

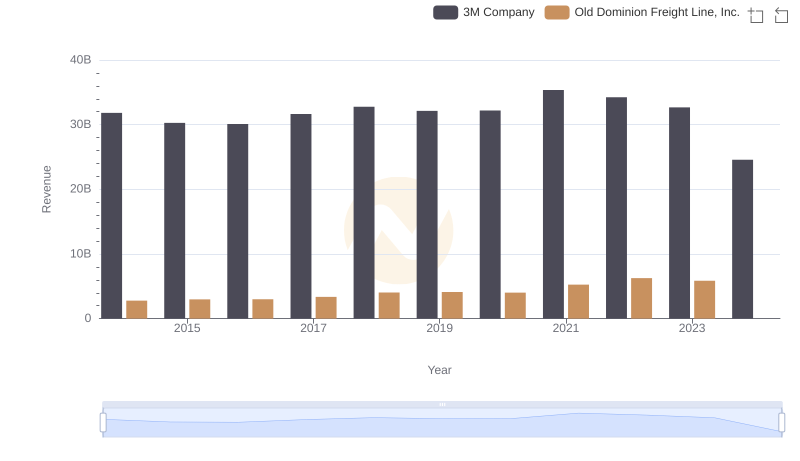

3M Company vs Old Dominion Freight Line, Inc.: Annual Revenue Growth Compared

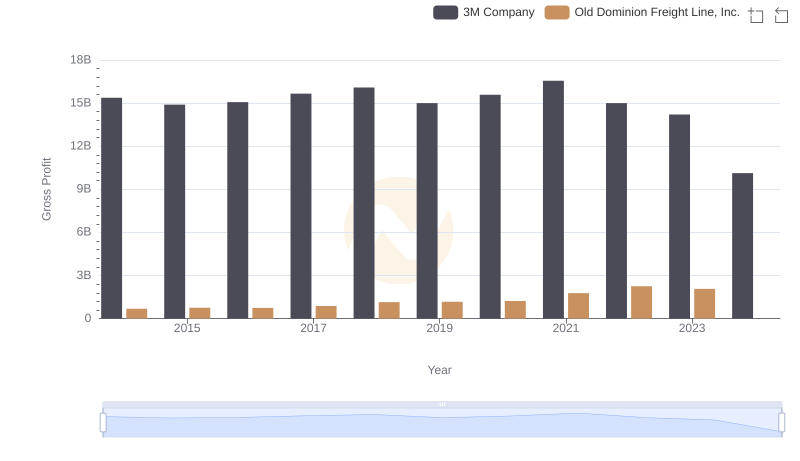

Key Insights on Gross Profit: 3M Company vs Old Dominion Freight Line, Inc.

Breaking Down SG&A Expenses: 3M Company vs Fastenal Company

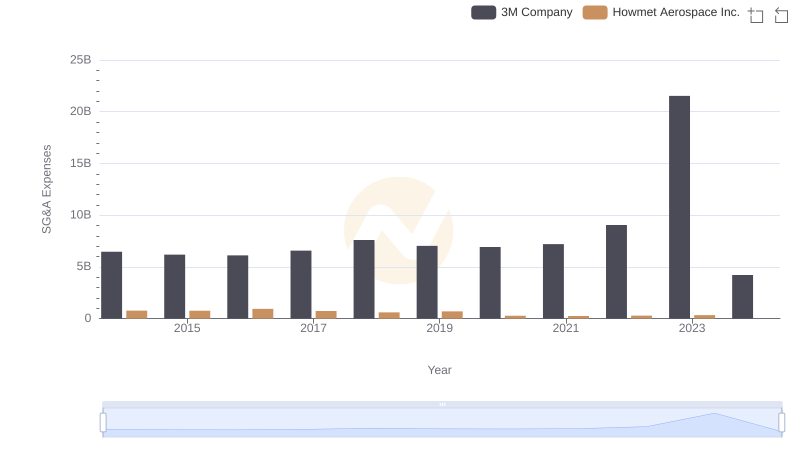

Who Optimizes SG&A Costs Better? 3M Company or Howmet Aerospace Inc.

Operational Costs Compared: SG&A Analysis of 3M Company and Axon Enterprise, Inc.

3M Company or Cummins Inc.: Who Manages SG&A Costs Better?

3M Company vs United Airlines Holdings, Inc.: SG&A Expense Trends