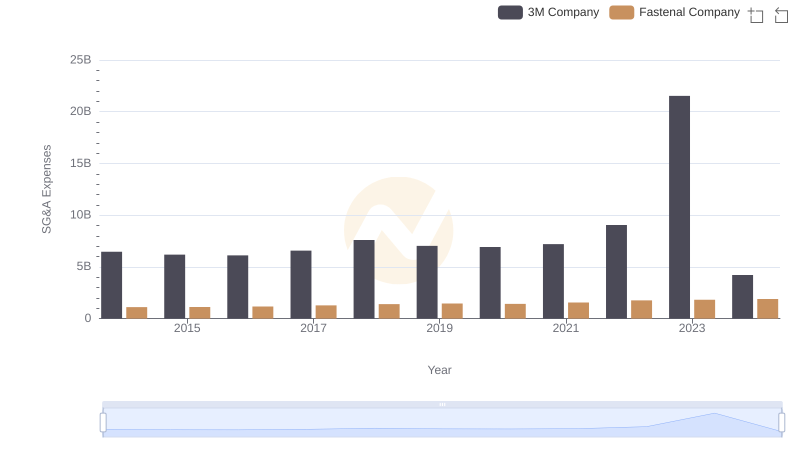

| __timestamp | 3M Company | Cummins Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 2095000000 |

| Thursday, January 1, 2015 | 6182000000 | 2092000000 |

| Friday, January 1, 2016 | 6111000000 | 2046000000 |

| Sunday, January 1, 2017 | 6572000000 | 2390000000 |

| Monday, January 1, 2018 | 7602000000 | 2437000000 |

| Tuesday, January 1, 2019 | 7029000000 | 2454000000 |

| Wednesday, January 1, 2020 | 6929000000 | 2125000000 |

| Friday, January 1, 2021 | 7197000000 | 2374000000 |

| Saturday, January 1, 2022 | 9049000000 | 2687000000 |

| Sunday, January 1, 2023 | 21526000000 | 3208000000 |

| Monday, January 1, 2024 | 4221000000 | 3275000000 |

Infusing magic into the data realm

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, 3M Company and Cummins Inc. have showcased contrasting approaches to SG&A cost management. From 2014 to 2023, 3M's SG&A expenses fluctuated significantly, peaking in 2023 with a staggering 165% increase from 2014. In contrast, Cummins Inc. maintained a more stable trajectory, with expenses rising by only 53% over the same period.

This disparity highlights 3M's challenges in controlling operational costs, while Cummins demonstrates a more consistent approach. Notably, 3M's expenses in 2023 were nearly seven times higher than Cummins', raising questions about strategic priorities and efficiency. As we look to the future, the ability to manage these costs effectively will be pivotal for both companies in sustaining their competitive edge.

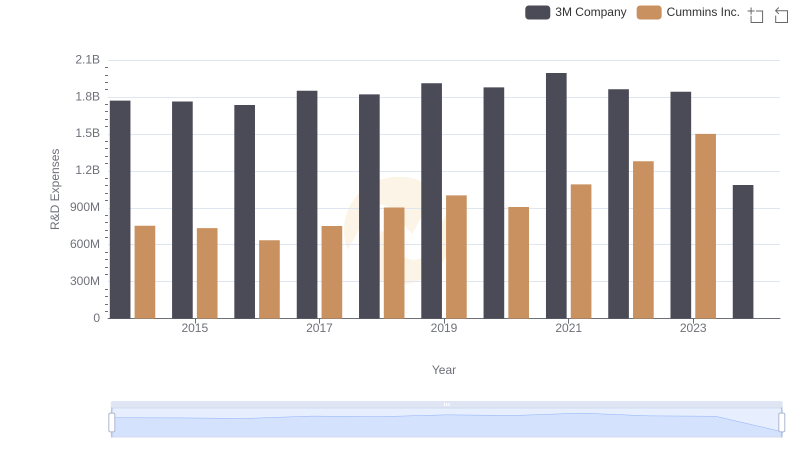

3M Company or Cummins Inc.: Who Invests More in Innovation?

Breaking Down SG&A Expenses: 3M Company vs Fastenal Company

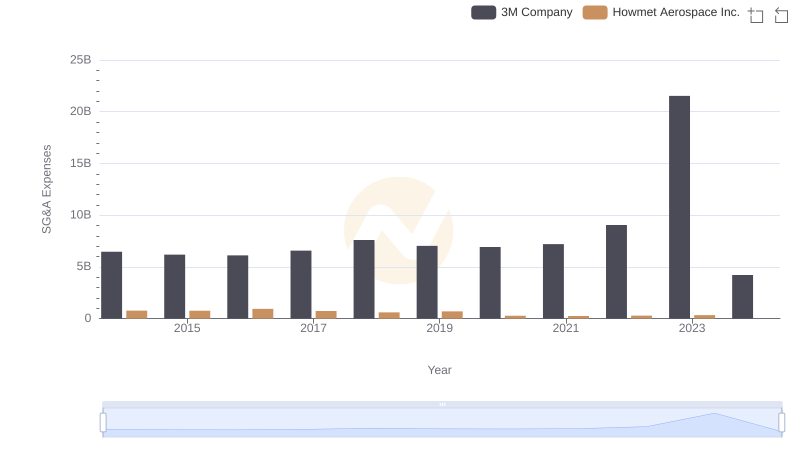

Who Optimizes SG&A Costs Better? 3M Company or Howmet Aerospace Inc.

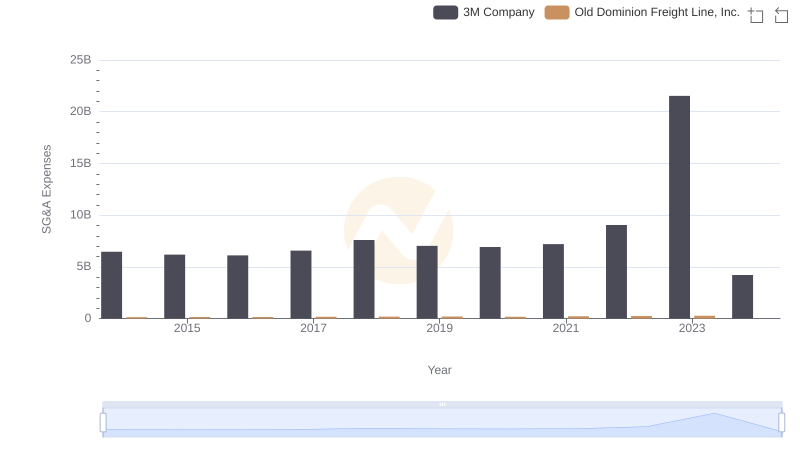

Who Optimizes SG&A Costs Better? 3M Company or Old Dominion Freight Line, Inc.

Operational Costs Compared: SG&A Analysis of 3M Company and Axon Enterprise, Inc.

3M Company vs United Airlines Holdings, Inc.: SG&A Expense Trends