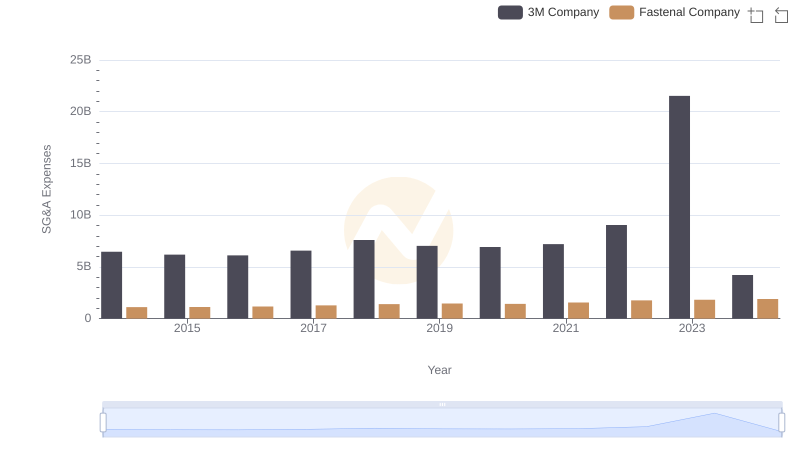

| __timestamp | 3M Company | Howmet Aerospace Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 770000000 |

| Thursday, January 1, 2015 | 6182000000 | 765000000 |

| Friday, January 1, 2016 | 6111000000 | 947000000 |

| Sunday, January 1, 2017 | 6572000000 | 731000000 |

| Monday, January 1, 2018 | 7602000000 | 604000000 |

| Tuesday, January 1, 2019 | 7029000000 | 704000000 |

| Wednesday, January 1, 2020 | 6929000000 | 277000000 |

| Friday, January 1, 2021 | 7197000000 | 251000000 |

| Saturday, January 1, 2022 | 9049000000 | 288000000 |

| Sunday, January 1, 2023 | 21526000000 | 343000000 |

| Monday, January 1, 2024 | 4221000000 | 362000000 |

Data in motion

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, 3M Company and Howmet Aerospace Inc. have showcased contrasting strategies in optimizing these costs. From 2014 to 2023, 3M's SG&A expenses fluctuated, peaking in 2023 with a staggering 165% increase from 2014. In contrast, Howmet Aerospace Inc. demonstrated a more consistent approach, with expenses decreasing by approximately 55% over the same period.

3M's significant spike in 2023 suggests strategic investments or restructuring, while Howmet's steady decline indicates a focus on cost efficiency. Notably, Howmet's expenses in 2023 were just 4% of 3M's, highlighting their lean operational model. As we look to the future, these trends offer valuable insights into how industrial leaders can balance growth and efficiency.

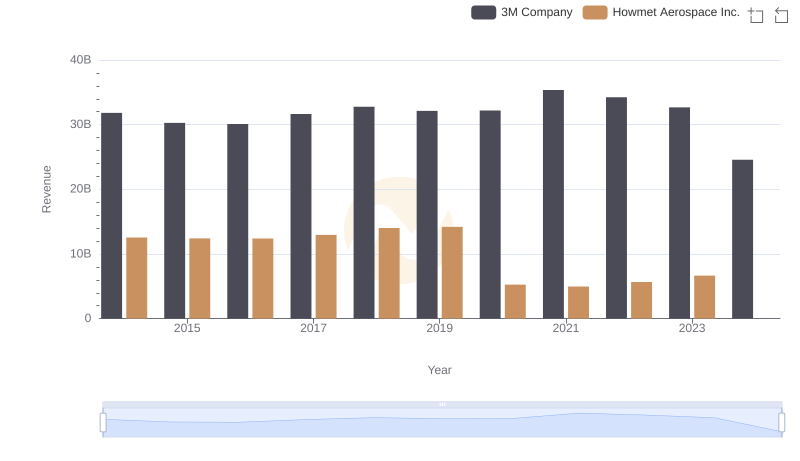

Annual Revenue Comparison: 3M Company vs Howmet Aerospace Inc.

Breaking Down SG&A Expenses: 3M Company vs Fastenal Company

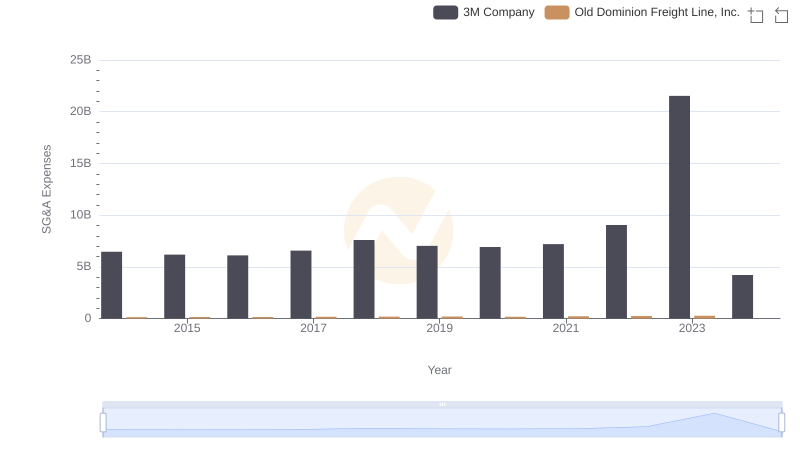

Who Optimizes SG&A Costs Better? 3M Company or Old Dominion Freight Line, Inc.

Operational Costs Compared: SG&A Analysis of 3M Company and Axon Enterprise, Inc.

3M Company or Cummins Inc.: Who Manages SG&A Costs Better?