| __timestamp | 3M Company | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 15374000000 | 687488000 |

| Thursday, January 1, 2015 | 14891000000 | 757499000 |

| Friday, January 1, 2016 | 15069000000 | 744627000 |

| Sunday, January 1, 2017 | 15656000000 | 875380000 |

| Monday, January 1, 2018 | 16083000000 | 1144243000 |

| Tuesday, January 1, 2019 | 15000000000 | 1170216000 |

| Wednesday, January 1, 2020 | 15579000000 | 1228598000 |

| Friday, January 1, 2021 | 16560000000 | 1775060000 |

| Saturday, January 1, 2022 | 14997000000 | 2256126000 |

| Sunday, January 1, 2023 | 14204000000 | 2072199000 |

| Monday, January 1, 2024 | 10128000000 |

Unveiling the hidden dimensions of data

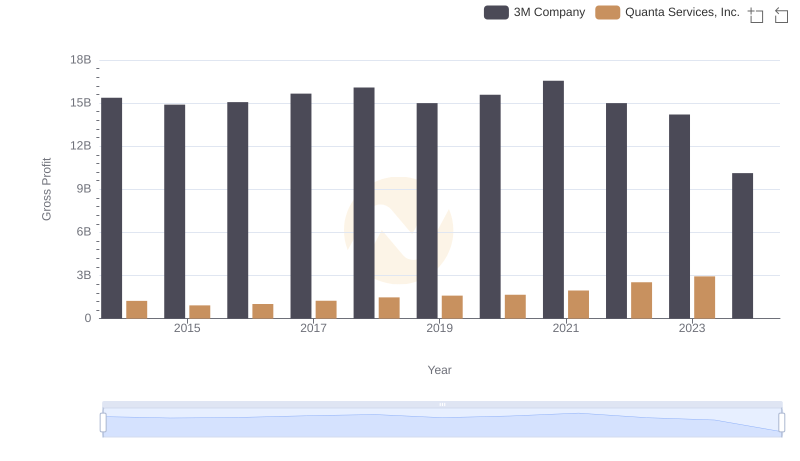

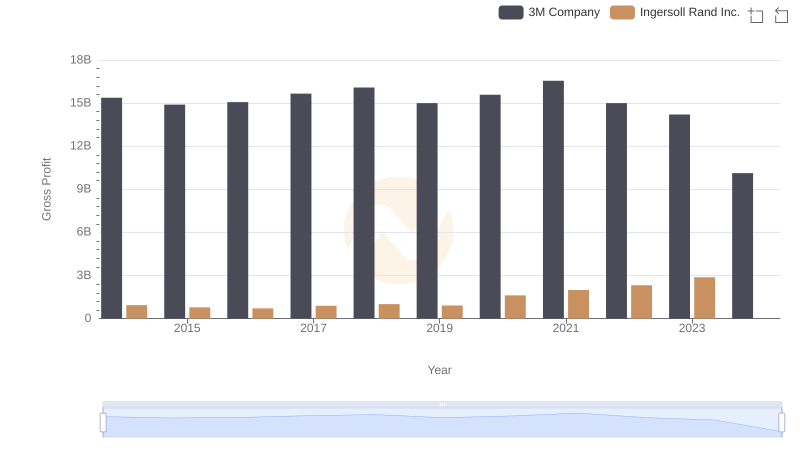

In the ever-evolving landscape of American industry, 3M Company and Old Dominion Freight Line, Inc. stand as titans in their respective fields. From 2014 to 2023, 3M's gross profit showcased a robust yet fluctuating trajectory, peaking in 2021 with a 7% increase from 2014. However, by 2023, it saw a decline of approximately 8% from its peak. In contrast, Old Dominion Freight Line, Inc. demonstrated a remarkable growth story, with its gross profit surging by over 200% from 2014 to 2022. This growth narrative underscores the dynamic nature of the freight industry, driven by increasing demand and operational efficiencies. As we look to 2024, the absence of data for Old Dominion suggests a potential shift or recalibration in its financial reporting. This comparison not only highlights the resilience of these companies but also the broader economic trends shaping their industries.

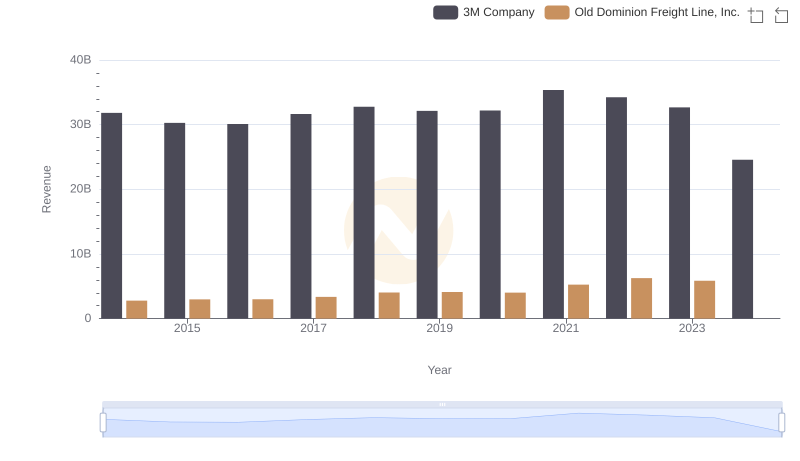

3M Company vs Old Dominion Freight Line, Inc.: Annual Revenue Growth Compared

3M Company and AMETEK, Inc.: A Detailed Gross Profit Analysis

Gross Profit Comparison: 3M Company and Quanta Services, Inc. Trends

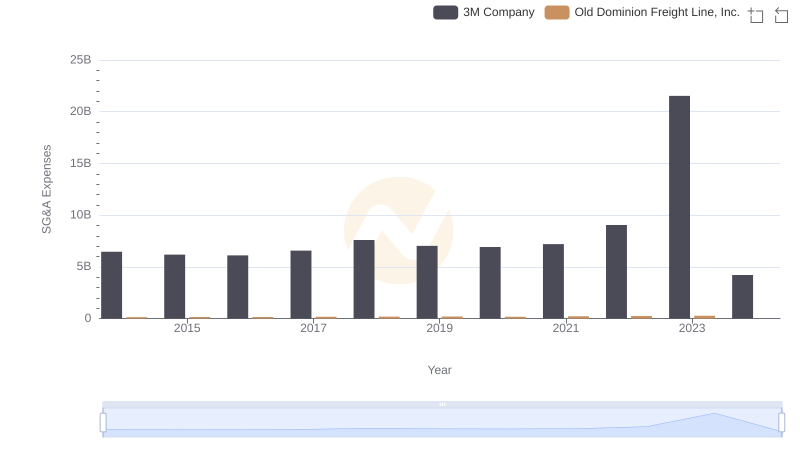

Who Optimizes SG&A Costs Better? 3M Company or Old Dominion Freight Line, Inc.

Gross Profit Comparison: 3M Company and Ingersoll Rand Inc. Trends