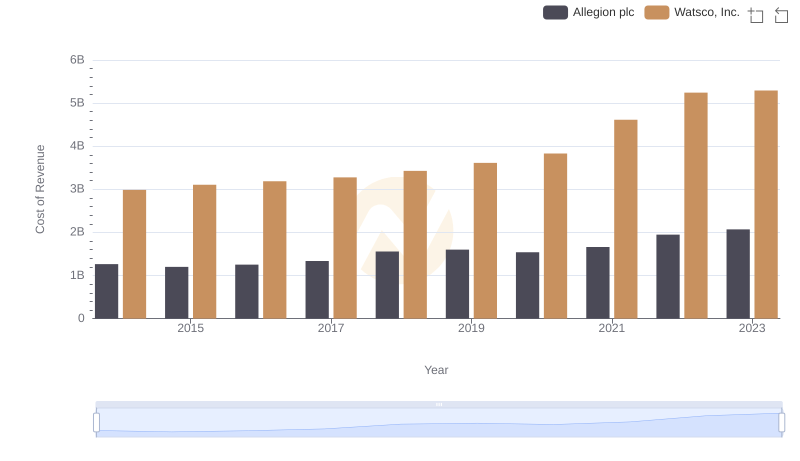

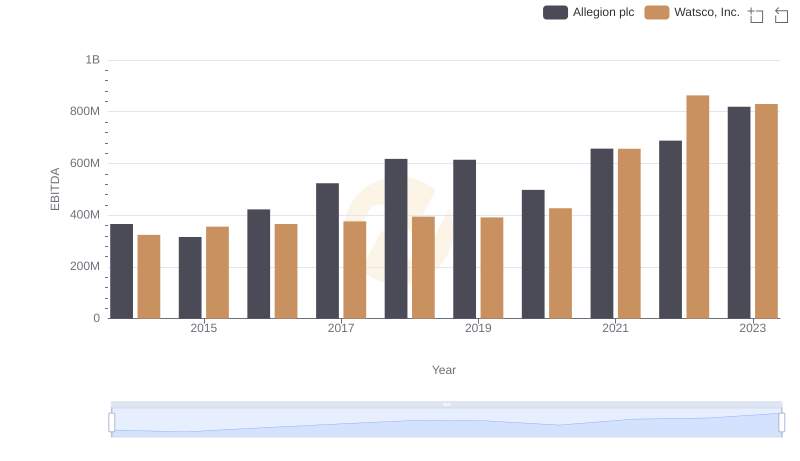

| __timestamp | Allegion plc | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 853700000 | 956402000 |

| Thursday, January 1, 2015 | 869100000 | 1007357000 |

| Friday, January 1, 2016 | 985300000 | 1034584000 |

| Sunday, January 1, 2017 | 1070700000 | 1065659000 |

| Monday, January 1, 2018 | 1173300000 | 1120252000 |

| Tuesday, January 1, 2019 | 1252300000 | 1156956000 |

| Wednesday, January 1, 2020 | 1178800000 | 1222821000 |

| Friday, January 1, 2021 | 1204900000 | 1667545000 |

| Saturday, January 1, 2022 | 1322400000 | 2030289000 |

| Sunday, January 1, 2023 | 1581500000 | 1992140000 |

| Monday, January 1, 2024 | 1668500000 | 2044713000 |

Unlocking the unknown

In the competitive landscape of industrial giants, Watsco, Inc. and Allegion plc have been vying for supremacy in gross profit generation since 2014. Over the past decade, Watsco has consistently outperformed Allegion, boasting a 15% higher average gross profit. Notably, in 2022, Watsco's gross profit surged to nearly 2 billion, marking a 50% increase from 2014, while Allegion's growth was more modest at 55% over the same period. This trend highlights Watsco's robust growth strategy and market adaptability. However, Allegion's recent performance in 2023, with a gross profit of 1.58 billion, indicates a promising upward trajectory. As these two powerhouses continue to innovate and expand, the race for higher profitability remains fierce, captivating investors and industry analysts alike.

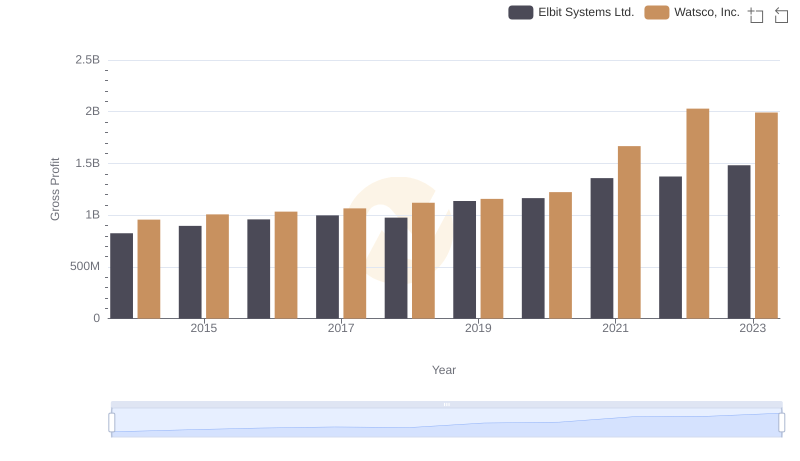

Gross Profit Analysis: Comparing Watsco, Inc. and Elbit Systems Ltd.

Gross Profit Comparison: Watsco, Inc. and Curtiss-Wright Corporation Trends

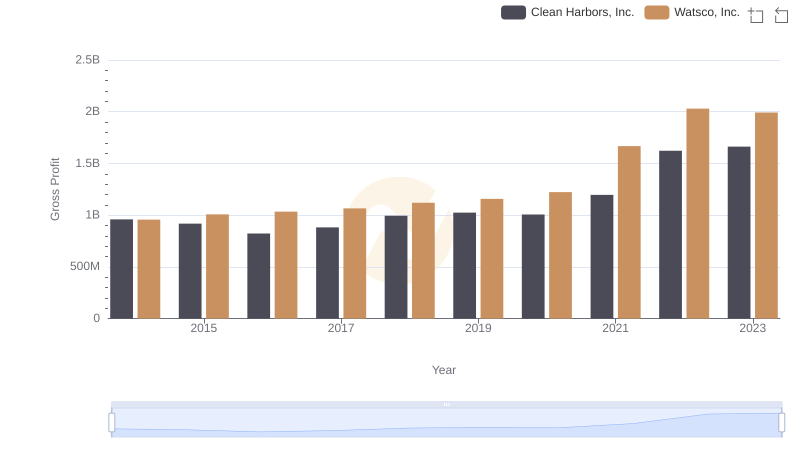

Gross Profit Trends Compared: Watsco, Inc. vs Clean Harbors, Inc.

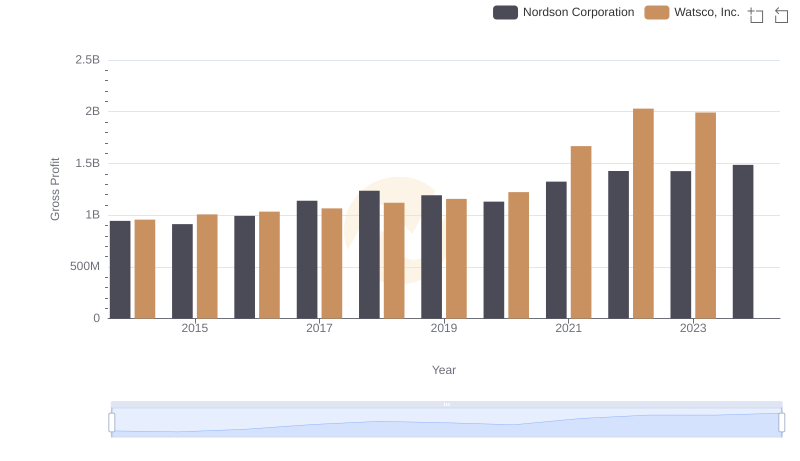

Watsco, Inc. and Nordson Corporation: A Detailed Gross Profit Analysis

Comparing Cost of Revenue Efficiency: Watsco, Inc. vs Allegion plc

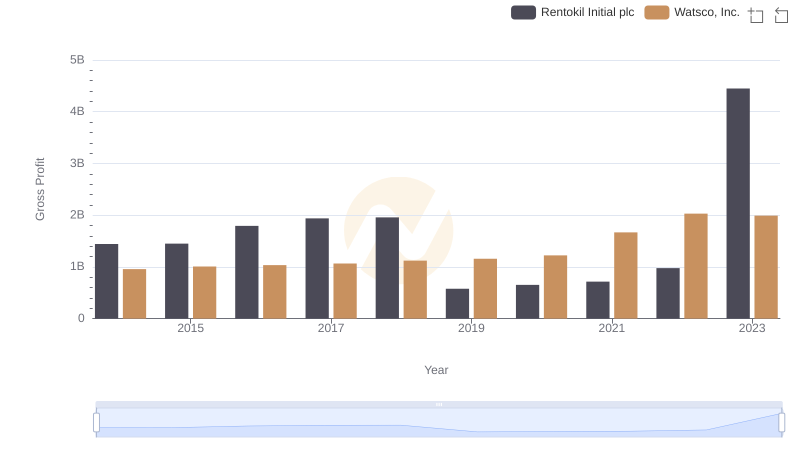

Gross Profit Trends Compared: Watsco, Inc. vs Rentokil Initial plc

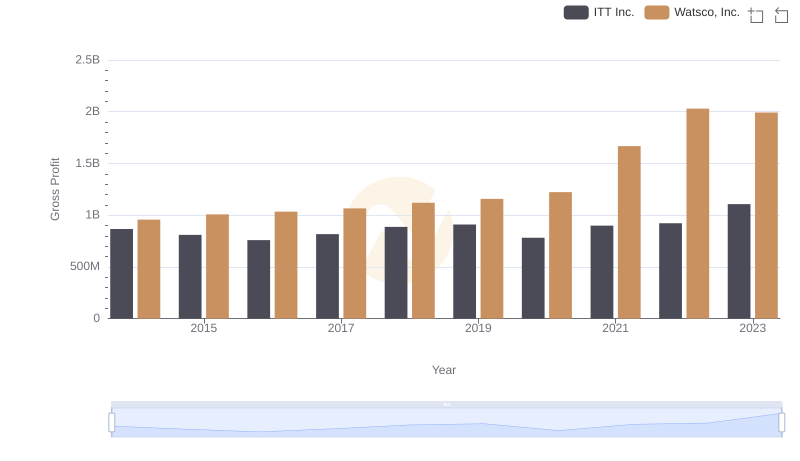

Key Insights on Gross Profit: Watsco, Inc. vs ITT Inc.

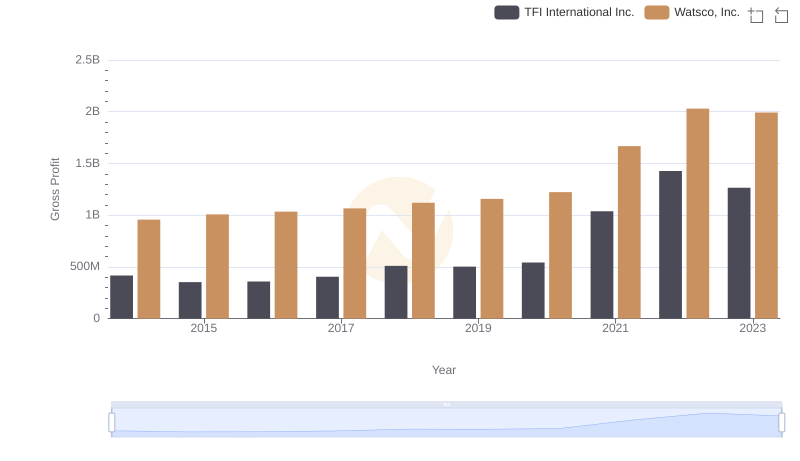

Key Insights on Gross Profit: Watsco, Inc. vs TFI International Inc.

Watsco, Inc. vs Allegion plc: In-Depth EBITDA Performance Comparison